Page 37 - CEE Tax Guide 2025

P. 37

calendar year in 2025. PIT at the rate of 20%

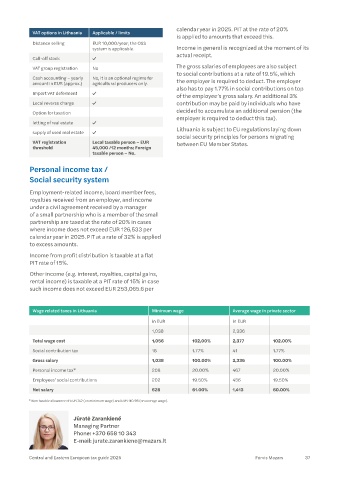

VAT options in Lithuania Applicable / limits

is applied to amounts that exceed this.

Distance selling EUR 10,000/year; the OSS

system is applicable. Income in general is recognized at the moment of its

actual receipt.

Call-off stock

VAT group registration No The gross salaries of employees are also subject

to social contributions at a rate of 19.5%, which

Cash accounting – yearly No, it is an optional regime for

amount in EUR (approx.) agricultural producers only. the employer is required to deduct. The employer

also has to pay 1.77% in social contributions on top

Import VAT deferment

of the employee’s gross salary. An additional 3%

Local reverse charge contribution may be paid by individuals who have

Option for taxation decided to accumulate an additional pension (the

employer is required to deduct this tax).

letting of real estate

Lithuania is subject to EU regulations laying down

supply of used real estate

social security principles for persons migrating

VAT registration Local taxable person – EUR between EU Member States.

threshold 45,000 /12 months; Foreign

taxable person – No.

Personal income tax /

Social security system

Employment-related income, board member fees,

royalties received from an employer, and income

under a civil agreement received by a manager

of a small partnership who is a member of the small

partnership are taxed at the rate of 20% in cases

where income does not exceed EUR 126,533 per

calendar year in 2025. PIT at a rate of 32% is applied

to excess amounts.

Income from profit distribution is taxable at a flat

PIT rate of 15%.

Other income (e.g. interest, royalties, capital gains,

rental income) is taxable at a PIT rate of 15% in case

such income does not exceed EUR 253,065.6 per

Wage related taxes in Lithuania Minimum wage Average wage in private sector

Exchange rate KGS/EUR 97 in EUR in EUR

1,038 2,336

Total wage cost 1,056 102,00% 2,377 102.00%

Social contribution tax 18 1.77% 41 1.77%

Gross salary 1,038 100.00% 2,336 100.00%

Personal income tax* 208 20.00% 467 20.00%

Employees’ social contributions 202 19.50% 456 19.50%

Net salary 628 61.00% 1,413 60.00%

* Non taxable allowance of EUR 747 (on minimum wage) and EUR 110.98 (on average wage).

Jūratė Zarankiené

Managing Partner

Phone: +370 658 10 343

E-mail: jurate.zarankiene@mazars.lt

Central and Eastern European tax guide 2025 Forvis Mazars 37