Page 11 - KPMG Tax in Romania

P. 11

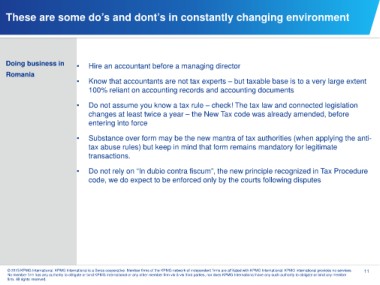

These are some do’s and dont’s in constantly changing environment

Doing business in • Hire an accountant before a managing director

Romania

• Know that accountants are not tax experts – but taxable base is to a very large extent

100% reliant on accounting records and accounting documents

• Do not assume you know a tax rule – check! The tax law and connected legislation

changes at least twice a year – the New Tax code was already amended, before

entering into force

• Substance over form may be the new mantra of tax authorities (when applying the anti-

tax abuse rules) but keep in mind that form remains mandatory for legitimate

transactions.

• Do not rely on “In dubio contra fiscum”, the new principle recognized in Tax Procedure

code, we do expect to be enforced only by the courts following disputes

© 2015 KPMG International. KPMG International is a Swiss cooperative. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG international provides no services. 11

No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member

firm. All rights reserved.