Page 6 - KPMG Tax in Romania

P. 6

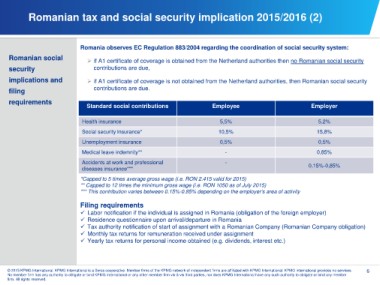

Romanian tax and social security implication 2015/2016 (2)

Romanian social Romania observes EC Regulation 883/2004 regarding the coordination of social security system:

security

implications and if A1 certificate of coverage is obtained from the Netherland authorities then no Romanian social security

filing contributions are due,

requirements

if A1 certificate of coverage is not obtained from the Netherland authorities, then Romanian social security

contributions are due.

Standard social contributions Employee Employer

Health insurance 5,5% 5,2%

15,8%

Social security insurance* 10,5% 0,5%

0,85%

Unemployment insurance 0,5%

0,15%-0,85%

Medical leave indemnity** -

Accidents at work and professional -

diseases insurance***

*Capped to 5 times average gross wage (i.e. RON 2.415 valid for 2015)

** Capped to 12 times the minimum gross wage (i.e. RON 1050 as of July 2015)

*** This contribution varies between 0.15%-0.85% depending on the employer’s area of activity

Filing requirements

Labor notification if the individual is assigned in Romania (obligation of the foreign employer)

Residence questionnaire upon arrival/departure in Romania

Tax authority notification of start of assignment with a Romanian Company (Romanian Company obligation)

Monthly tax returns for remuneration received under assignment

Yearly tax returns for personal income obtained (e.g. dividends, interest etc.)

© 2015 KPMG International. KPMG International is a Swiss cooperative. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG international provides no services. 6

No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member

firm. All rights reserved.