Page 5 - KPMG Tax in Romania

P. 5

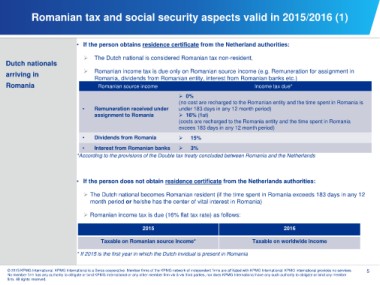

Romanian tax and social security aspects valid in 2015/2016 (1)

• If the person obtains residence certificate from the Netherland authorities:

Dutch nationals The Dutch national is considered Romanian tax non-resident,

arriving in

Romania Romanian income tax is due only on Romanian source income (e.g. Remuneration for assignment in

Romania, dividends from Romanian entity, interest from Romanian banks etc.)

Romanian source income Income tax due*

0%

(no cost are recharged to the Romanian entity and the time spent in Romania is

• Remuneration received under under 183 days in any 12 month period)

assignment to Romania 16% (flat)

(costs are recharged to the Romania entity and the time spent in Romania

excees 183 days in any 12 month period)

• Dividends from Romania 15%

• Interest from Romanian banks 3%

*According to the provisions of the Double tax treaty concluded between Romania and the Netherlands

• If the person does not obtain residence certificate from the Netherlands authorities:

The Dutch national becomes Romanian resident (if the time spent in Romania exceeds 183 days in any 12

month period or he/she has the center of vital interest in Romania)

Romanian income tax is due (16% flat tax rate) as follows:

2015 2016

Taxable on Romanian source income* Taxable on worldwide income

* If 2015 is the first year in which the Dutch invidual is present in Romania

© 2015 KPMG International. KPMG International is a Swiss cooperative. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG international provides no services. 5

No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member

firm. All rights reserved.