Page 3 - KPMG Tax in Romania

P. 3

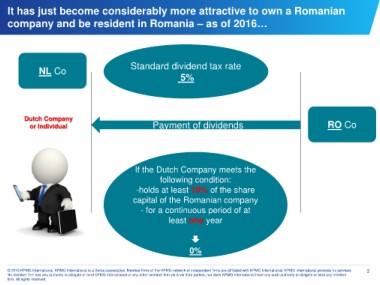

It has just become considerably more attractive to own a Romanian

company and be resident in Romania – as of 2016…

NL Co Standard dividend tax rate

5%

Dutch Company Payment of dividends RO Co

or Individual

If the Dutch Company meets the

following condition:

-holds at least 10% of the share

capital of the Romanian company

- for a continuous period of at

least one year

0%

© 2015 KPMG International. KPMG International is a Swiss cooperative. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG international provides no services. 3

No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member

firm. All rights reserved.