Page 4 - KPMG Tax in Romania

P. 4

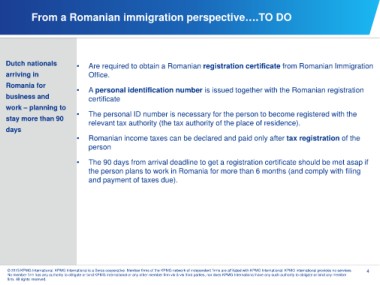

From a Romanian immigration perspective….TO DO

Dutch nationals • Are required to obtain a Romanian registration certificate from Romanian Immigration

arriving in Office.

Romania for • A personal identification number is issued together with the Romanian registration

business and certificate

work – planning to

stay more than 90 • The personal ID number is necessary for the person to become registered with the

relevant tax authority (the tax authority of the place of residence).

days

• Romanian income taxes can be declared and paid only after tax registration of the

person

• The 90 days from arrival deadline to get a registration certificate should be met asap if

the person plans to work in Romania for more than 6 months (and comply with filing

and payment of taxes due).

© 2015 KPMG International. KPMG International is a Swiss cooperative. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG international provides no services. 4

No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member

firm. All rights reserved.