Page 62 - CEE Tax Guide 2025

P. 62

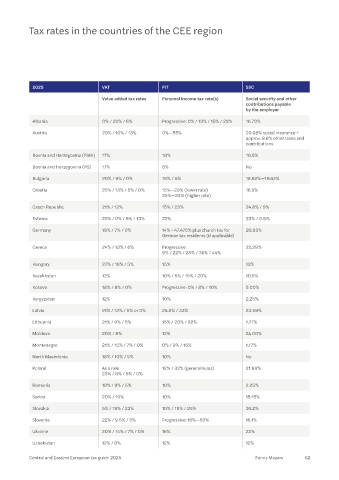

Tax rates in the countries of the CEE region

2025 VAT PIT SSC

Value added tax rates Personal income tax rate(s) Social security and other

contributions payable

by the employer

Albania 0% / 20% / 6% Progressive: 0% / 13% / 15% / 23% 16.70%

Austria 20% / 10% / 13% 0%—55% 20.98% social insurance +

approx. 8.6% other taxes and

contributions

Bosnia and Herzegovina (FBiH) 17% 10% 10.5%

Bosnia and Herzegovina (RS) 17% 8% No

Bulgaria 20% / 9% / 0% 10% / 5% 18.92%—19.62%

Croatia 25% / 13% / 5% / 0% 15%—23% (lower rate) 16.5%

25%—33% (higher rate)

Czech Republic 21% / 12% 15% / 23% 24.8% / 9%

Estonia 22% / 0% / 9% / 13% 22% 33% / 0.8%

Germany 19% / 7% / 0% 14%—47.475% plus church tax for 20.95%

German tax residents (if applicable)

Greece 24% / 13% / 6% Progressive: 22.29%

9% / 22% / 28% / 36% / 44%

Hungary 27% / 18% / 5% 15% 13%

Kazakhstan 12% 10% / 5% / 15% / 20% 10.5%

Kosovo 18% / 8% / 0% Progressive: 0% / 8% / 10% 5.00%

Kyrgyzstan 12% 10% 2.25%

Latvia 21% / 12% / 5% or 0% 25.5% / 33% 23.59%

Lithuania 21% / 9% / 5% 15% / 20% / 32% 1.77%

Moldova 20% / 8% 12% 24.00%

Montenegro 21% / 15% / 7% / 0% 0% / 9% / 15% 1.17%

North Macedonia 18% / 10% / 5% 10% No

Poland As a rule 12% / 32% (general rules) 21.98%

23% / 8% / 5% / 0%

Romania 19% / 9% / 5% 10% 2.25%

Serbia 20% / 10% 10% 15.15%

Slovakia 5% / 19% / 23% 10% / 19% / 25% 36.2%

Slovenia 22% / 9.5% / 5% Progressive: 16%—50% 16.1%

Ukraine 20% / 14% / 7% / 0% 18% 22%

Uzbekistan 12% / 0% 12% 12%

Central and Eastern European tax guide 2025 Forvis Mazars 62