Page 10 - CEE Tax Guide 2025

P. 10

Austria

Forvis Mazars

Business Services GmbH

Kärntner Ring 5–7 1010 Vienna

Phone: +43 1 531 74-0

www.forvismazars.com/at

Corporate taxes and other direct taxes There is a yearly minimum CIT amounting to EUR

3,500 for public companies (AG) and EUR 500 for

Under domestic tax laws, corporations are limited liability companies (GmbH). Any unused

deemed to be tax resident in Austria if they have minimum amounts can be offset against future CIT

either their registered seat or their effective payment obligations.

place of management in Austria. In this case, the

global income of the corporation is generally Tax losses can be carried forward indefinitely (but

subject to Austrian corporate income tax. Other only 75% of the profit of a single year can be offset).

corporations are subject to Austrian corporate Thin capitalization rules (TCR) are in place

income tax only on the basis of income generated in accordance with the EU-ATAD (Anti-Tax

from Austrian sources. Partnerships are not subject Avoidance Directive). Further restrictions relate

to CIT. The corporate income tax rate is 23%. to the deduction of interest paid to intercompany

The tax base is generally determined based on the recipients. CFC rules were introduced in accordance

result of the income statement under commercial with the EU-ATAD.

law, which is then amended insofar as the tax

law contains deviating rules (e.g. tax exemptions, Some 100 double tax treaties are in place.

restrictions of deductions, or tax-specific Withholding tax can be reduced at source to treaty

valuation rules). rates or under the EU-Parent-Subsidiary Directive,

if formal requirements are met.

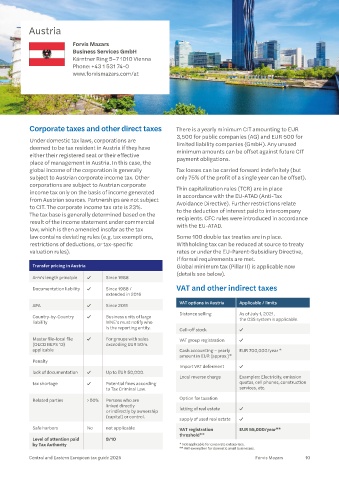

Transfer pricing in Austria Global minimum tax (Pillar II) is applicable now

(details see below).

Arm’s length principle Since 1988

Documentation liability Since 1988 / VAT and other indirect taxes

extended in 2016

VAT options in Austria Applicable / limits

APA Since 2011

Distance selling As of July 1, 2021,

Country-by-Country Business units of large the OSS system is applicable.

liability MNE’s must notify who

is the reporting entity. Call-off stock

Master file-local file For groups with sales VAT group registration

(OECD BEPS 13) exceeding EUR 50m.

applicable Cash accounting – yearly EUR 700,000/year *

amount in EUR (approx.)*

Penalty

Import VAT deferment

lack of documentation Up to EUR 50,000.

Local reverse charge Examples: Electricity, emission

tax shortage Potential fines according quotas, cell phones, construction

to Tax Criminal Law. services, etc.

Related parties > 50% Persons who are Option for taxation

linked directly

or indirectly by ownership letting of real estate

(capital) or control.

supply of used real estate

Safe harbors No not applicable VAT registration EUR 55,000/year**

threshold**

Level of attention paid 8/10

by Tax Authority * Not applicable for corporate enterprises.

** VAT exemption for domestic small businesses.

Central and Eastern European tax guide 2025 Forvis Mazars 10