Page 15 - CEE Tax Guide 2025

P. 15

– a wide range of other fees (such as tourist tax; Services exempt from VAT are exhaustively listed,

tax on the carriage of passengers by taxi; refuse such as financial and insurance services, transfer

collection fee) or other fees usually imposed of buildings, educational services, medical and social

for specific services, such as social services, services, etc.

technical, and other.

VAT payers are required to submit monthly VAT

VAT and other indirect taxes returns, sales and purchase registers, VIES, and

Intrastat returns.

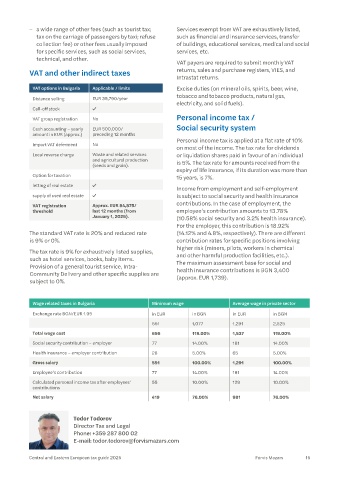

VAT options in Bulgaria Applicable / limits Excise duties (on mineral oils, spirits, beer, wine,

tobacco and tobacco products, natural gas,

Distance selling EUR 35,790/year

electricity, and solid fuels).

Call-off stock

VAT group registration No Personal income tax /

Cash accounting – yearly EUR 500,000/ Social security system

amount in EUR (approx.) preceding 12 months

Personal income tax is applied at a flat rate of 10%

Import VAT deferment No

on most of the income. The tax rate for dividends

Local reverse charge Waste and related services or liquidation shares paid in favour of an individual

and agricultural production

(seeds and grain). is 5%. The tax rate for amounts received from the

expiry of life insurance, if its duration was more than

Option for taxation 15 years, is 7%.

letting of real estate

Income from employment and self-employment

supply of used real estate is subject to social security and health insurance

VAT registration Approx. EUR 84,875/ contributions. In the case of employment, the

threshold last 12 months (from employee’s contribution amounts to 13.78%

January 1, 2025). (10.58% social security and 3.2% health insurance).

For the employer, this contribution is 18.92%

The standard VAT rate is 20% and reduced rate (14.12% and 4.8%, respectively). There are different

is 9% or 0%. contribution rates for specific positions involving

higher risk (miners, pilots, workers in chemical

The tax rate is 9% for exhaustively listed supplies, and other harmful production facilities, etc.).

such as hotel services, books, baby items. The maximum assessment base for social and

Provision of a general tourist service, Intra- health insurance contributions is BGN 3,400

Community Delivery and other specific supplies are (approx. EUR 1,739).

subject to 0%.

Wage related taxes in Bulgaria Minimum wage Average wage in private sector

Exchange rate BGN/EUR 1.95 in EUR in BGN in EUR in BGN

551 1,077 1,291 2,525

Total wage cost 656 119.00% 1,537 119.00%

Social security contribution – employer 77 14.00% 181 14.00%

Health insurance – employer contribution 28 5.00% 65 5.00%

Gross salary 551 100.00% 1,291 100.00%

Employee’s contribution 77 14.00% 181 14.00%

Calculated personal income tax after employees’ 55 10.00% 129 10.00%

contributions

Net salary 419 76.00% 981 76.00%

Todor Todorov

Director Tax and Legal

Phone: +359 287 800 02

E-mail: todor.todorov@forvismazars.com

Central and Eastern European tax guide 2025 Forvis Mazars 15