Page 13 - CEE Tax Guide 2025

P. 13

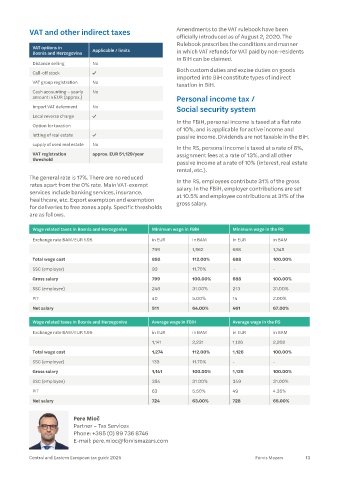

VAT and other indirect taxes Amendments to the VAT rulebook have been

officially introduced as of August 2, 2020. The

Rulebook prescribes the conditions and manner

VAT options in

Bosnia and Herzegovina Applicable / limits in which VAT refunds for VAT paid by non-residents

in BiH can be claimed.

Distance selling No

Both custom duties and excise duties on goods

Call-off stock

imported into BiH constitute types of indirect

VAT group registration No taxation in BiH.

Cash accounting – yearly No

amount in EUR (approx.) Personal income tax /

Import VAT deferment No Social security system

Local reverse charge

In the FBiH, personal income is taxed at a flat rate

Option for taxation

of 10%, and is applicable for active income and

letting of real estate passive income. Dividends are not taxable in the BiH.

supply of used real estate No

In the RS, personal income is taxed at a rate of 8%,

VAT registration approx. EUR 51,129/year assignment fees at a rate of 13%, and all other

threshold

passive income at a rate of 10% (interest, real estate

rental, etc.).

The general rate is 17%. There are no reduced In the RS, employees contribute 31% of the gross

rates apart from the 0% rate. Main VAT-exempt salary. In the FBiH, employer contributions are set

services include banking services, insurance, at 10.5% and employee contributions at 31% of the

healthcare, etc. Export exemption and exemption gross salary.

for deliveries to free zones apply. Specific thresholds

are as follows.

Wage related taxes in Bosnia and Herzegoniva Minimum wage in FBiH Minimum wage in the RS

Exchange rate BAM/EUR 1.95 in EUR in BAM in EUR in BAM

799 1,562 688 1,345

Total wage cost 892 112.00% 688 100.00%

SSC (employer) 93 11.70% - -

Gross salary 799 100.00% 688 100.00%

SSC (employee) 248 31.00% 213 31.00%

PIT 40 5.00% 14 2.00%

Net salary 511 64.00% 461 67.00%

Wage related taxes in Bosnia and Herzegoniva Average wage in FBiH Average wage in the RS

Exchange rate BAM/EUR 1.95 in EUR in BAM in EUR in BAM

1,141 2,231 1,126 2,202

Total wage cost 1,274 112.00% 1,126 100.00%

SSC (employer) 133 11.70% - -

Gross salary 1,141 100.00% 1,126 100.00%

SSC (employee) 354 31.00% 349 31.00%

PIT 63 5.50% 49 4.35%

Net salary 724 63.00% 728 65.00%

Pere Mioč

Partner – Tax Services

Phone: +385 (0) 99 736 8746

E-mail: pere.mioc@forvismazars.com

Central and Eastern European tax guide 2025 Forvis Mazars 13