Page 49 - CEE Tax Guide 2025

P. 49

insurance (0.75%). Contributions payable

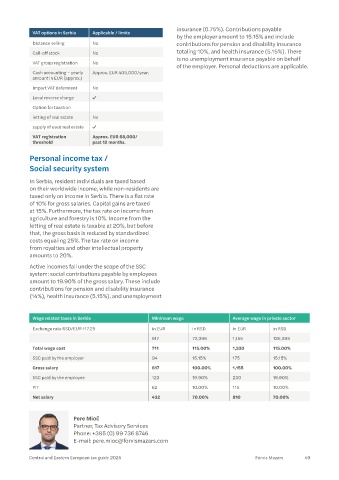

VAT options in Serbia Applicable / limits

by the employer amount to 15.15% and include

Distance selling No contributions for pension and disability insurance

Call-off stock No totaling 10%, and health insurance (5.15%). There

is no unemployment insurance payable on behalf

VAT group registration No

of the employer. Personal deductions are applicable.

Cash accounting – yearly Approx. EUR 405,000/year.

amount in EUR (approx.)

Import VAT deferment No

Local reverse charge

Option for taxation

letting of real estate No

supply of used real estate

VAT registration Approx. EUR 68,000/

threshold past 12 months.

Personal income tax /

Social security system

In Serbia, resident individuals are taxed based

on their worldwide income, while non-residents are

taxed only on income in Serbia. There is a flat rate

of 10% for gross salaries. Capital gains are taxed

at 15%. Furthermore, the tax rate on income from

agriculture and forestry is 10%. Income from the

letting of real estate is taxable at 20%, but before

that, the gross basis is reduced by standardized

costs equaling 25%. The tax rate on income

from royalties and other intellectual property

amounts to 20%.

Active incomes fall under the scope of the SSC

system: social contributions payable by employees

amount to 19.90% of the gross salary. These include

contributions for pension and disability insurance

(14%), health insurance (5.15%), and unemployment

Wage related taxes in Serbia Minimum wage Average wage in private sector

Exchange rate RSD/EUR 117.25 in EUR in RSD in EUR in RSD

617 72,396 1,155 135,395

Total wage cost 711 115.00% 1,330 115.00%

SSC paid by the employer 94 15.15% 175 15.15%

Gross salary 617 100.00% 1,155 100.00%

SSC paid by the employee 123 19.90% 230 19.90%

PIT 62 10.00% 115 10.00%

Net salary 432 70.00% 810 70.00%

Pere Mioč

Partner, Tax Advisory Services

Phone: +385 (0) 99 736 8746

E-mail: pere.mioc@forvismazars.com

Central and Eastern European tax guide 2025 Forvis Mazars 49