Page 53 - CEE Tax Guide 2025

P. 53

VAT and other indirect taxes lists (IC report) are obligatory in Slovenia and

should be submitted by the 20th day of the month

The general tax rate is 22%; a reduced rate of 9.5% following the taxable period. Mandatory submission

applies to some goods, e.g. foodstuffs, water of records of VAT charged and VAT deduction records

supply, carriage of passengers and their personal by the deadline for submitting the VAT return

luggage, and a reduced rate of 5% applies to books (as of July, 1, 2025).

and newspapers, regardless of whether they are Other indirect tax types in Slovenia include excise

delivered on physical media or electronic forms. VAT- duty, insurance tax, tax on financial services, motor

vehicle tax, customs, etc.

VAT options in Slovenia Applicable / limits

Personal income tax /

Distance selling EUR 10,000/year The OSS

system is applicable from Social security system

July 1, 2021.

Call-off stock Personal income tax rates are progressive (16%, 26%,

33%, 39%, and 50%), and apply on active income

VAT group registration

sources. Capital and rental income is taxed at a flat

Cash accounting – yearly 400.000 rate (dividends at 25%, interest at 25%, capital gains

amount in EUR (approx.)

from 0% to 25%), depending on the holding period;

Import VAT deferment Yes, special treatment for rental income is taxed at 25%.

tax non-residents who use

a Slovenian VAT ID number. Social security contributions are applicable

on income from employment and are 16.10% for

Local reverse charge Certain ares. the employer and 22.10% for the employee. From

Option for taxation January 2024 onwards there is also a separate flat

monthly fee for mandatory medical insurance.

letting of real estate

Self-employed individuals (business income) pay

supply of used real estate

their own social security contributions depending

VAT registration EUR 60,000/year on the circumstances of the case. The examples

threshold below show the cost of the employer and the

employee in case of the minimum wage level and

exempt services include services of public interest, the average wage in the private sector. There

as well as banking services, insurance, investment- are a number of personal allowances that apply

related services, gambling, certain services provided individually depending on the personal status

by medical doctors and dentists, etc. EC Sales of the individual.

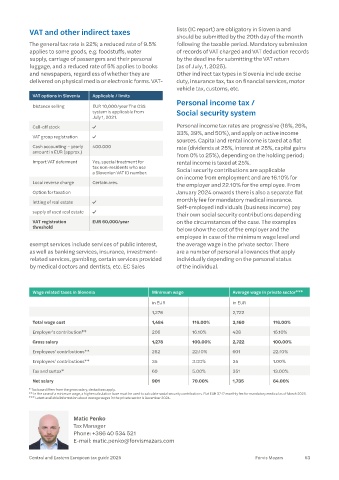

Wage related taxes in Slovenia Minimum wage Average wage in private sector***

in EUR in EUR

1,278 2,722

Total wage cost 1,484 116.00% 3,160 116.00%

Employer’s contribution** 206 16.10% 438 16.10%

Gross salary 1,278 100.00% 2,722 100.00%

Employees’ contributions** 282 22.10% 601 22.10%

Employees’ contributions** 35 3.00% 35 1.00%

Tax and surtax* 60 5.00% 351 13.00%

Net salary 901 70.00% 1,735 64.00%

* Tax base differs from the gross salary, deductions apply.

** In the case of a minimum wage, a higher calculation base must be used to calculate social security contributions. Flat EUR 37.17 monthly fee for mandatory medical as of March 2025.

*** Latest available information about average wages in the private sector is December 2024.

Matic Penko

Tax Manager

Phone: +386 40 534 521

E-mail: matic.penko@forvismazars.com

Central and Eastern European tax guide 2025 Forvis Mazars 53