Business organizations are concerned that the debate on economic recovery focusing on tax increases.

As part of the debates on economic recovery measures and addressing the budget deficit, eleven(+DRN) business associations and organizations, including AHK, AmCham, AOAR, Concordia and FIC, are asking the parties to also listen to the voice of the business community. Including the Dutch Romanian Network (DRN)wishing the important “Cotroceni Group” much wisdom and success.

In the context of the current debates on economic recovery measures and addressing the budget deficit, business organizations are calling on the group chairs of the parties participating in the ongoing consultations, asking them to also listen to the business community.

“We are aware that the decisions and measures in this period will have a profound and lasting impact on the population, on businesses, on the economy, on investor confidence and on Romania’s international positioning. It is precisely for this reason that we need a real dialogue so that the measures taken are aimed both at correcting imbalances and at protecting the economic capacity to perform in the medium and long term,” said the organizations signing the document.

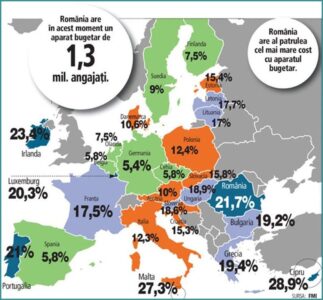

“We also ask political parties to listen to the voice of business, which has supported and continues to support the economy. We are concerned that the current debate seems to focus predominantly on tax increases, while there is no public vision to reduce excessive public spending or modernize the state apparatus. Without a real commitment to internal reform, fiscal measures risk only taxing the economic engine needed for recovery,” said the call by the 11 organizations.

Businessmen recognize that the risks of blocking European funds and lowering the country’s rating, which is disastrous for Romania’s future, require a comprehensive and responsible response from the government, with a combination of measures aimed at both reducing spending and increasing revenues. They believe that the future package of measures should include policies to stimulate investment and economic activity.

In this context, the organizations signing the document consider it necessary for any package of measures to be based on: to preserve Romania’s main competitive advantages, such as the flat rate, and to avoid discouraging investment, but also to allow us to develop in the long term.

- maintaining the uniform and fair tax rate, with the elimination of all exceptions, a simple and efficient mechanism for both taxpayers and authorities – essential for supporting economic growth, reducing distortions and combating tax evasion;

- reducing nonessential government spending, including excessive administrative costs, redundant agencies and discretionary political spending;

- sweeping reforms in public sector management, prioritizing performance, efficiency, real reduction of bureaucratic burdens and transparency;

- eliminating wasteful budget allocations, such as unjustified grants and excessive funding of election campaigns from public funds;

Protecting and prioritizing essential public investments in infrastructure, education and innovation – foundations of long-term growth;

- ensuring tax fairness by abolishing exemptions, sales taxes and the tax on special constructions;

- efficient tax collection by reducing the VAT gap and prioritizing efforts to combat large-scale tax evasion;

- accelerating digitization, administrative simplification and reducing bureaucracy;

- maximizing the absorption of European funds by simplifying procedures and removing bureaucratic bottlenecks.

The state must set the first example. A credible response to this fiscal challenge begins with a clear message that the government is willing to optimize the use of public money and reform itself.

Improving collection and voluntary compliance – through smart enforcement, digitization and addressing systematic tax evasion, as well as increasing the transparency and predictability of tax policy and the spending of public money – is an essential part of the solution. However, this should not be confused with introducing new taxes or increasing existing ones, or unfairly punishing the same honest taxpayers by the relevant authorities.

Improving collection and voluntary compliance – through smart enforcement, digitization and addressing systematic tax evasion, as well as increasing the transparency and predictability of tax policy and the spending of public money – is an essential part of the solution. However, this should not be confused with introducing new taxes or increasing existing ones, or unfairly punishing the same honest taxpayers by the relevant authorities.

The private sector is already under considerable pressure, caused by unpredictability and administrative burdens. The current discussions, leaked to the public, in the absence of impact analyses in which the business community would also participate, further reinforce the degree of instability and economic gridlock, especially since the state is not fulfilling its own obligations to repay what is owed to a large proportion of honest and well-paying taxpayers in the private sector. Solidarity cannot function without a minimum of reciprocity, nor in a fiscal context that permanently creates inequality and privileged categories. Honest businesses should not have to pay to cover the deficit caused by the irresponsible management of public finances. Efficient and responsible economic activity, as well as high-performing and adequately paid labor, should not be discouraged by tax mechanisms that impede growth.

The European Commission’s Spring 2025 package highlights Romania’s excessive spending growth and fiscal slowdown. Ignoring these signals will only increase the imbalance. What is needed now is not another fiscal round, but a responsible medium-term fiscal plan anchored in spending reforms, institutional efficiency and economic predictability.

As always, even this time, the private sector understands the gravity of the situation and the urgency and is willing to be part of the solution. We need transparency and dialogue, and perceived solidarity with the private sector must be demonstrated at all levels of government – not by implicitly passing on the sacrifices to the private sector, but by actual ownership of the reforms and discipline in the management of public finances.

The call was signed by the Romanian-German Chamber of Commerce and Industry – AHK, the American Chamber of Commerce in Romania – AMCHAM ROMANIA, the Romanian Entrepreneurs Association – AOAR, the Belgian-Luxembourg – Romanian-Moldovan Chamber of Commerce – BEROCC, the British-Romanian Chamber of Commerce – BRCC, the French Chamber of Commerce, Industry and Agriculture in Romania – CCIFER, the Italian Chamber of Commerce in Romania – CCIPR, the Dutch Chamber of Commerce in Romania – NRCC, the CONCORDIA Employers Association, the Council for Foreign Investors – FIC and the Romanian Foundation for Business Leaders – RBL.