Newsletter August 2025

In this newsletter:

Logistics and Transportation Sector, Agricultural Sector, Shipbuilding Sector, Budget Policy-Correction Period, IT Sector, Financial Sector, Sector Political developments

EU road freight transport increased by 0.6% by 2024 – Eurostat data

Road freight transport in the European Union remained robust in 2024, with a total annual volume of 1,869 billion ton kilometers, up slightly from 1,857 billion ton kilometers in 2023. This represents a marginal annual growth rate of 0.6%, according to data recently published by the European Statistical Office (Eurostat).

Poland remained the leading country in road freight transport in the EU in 2024, with a total of 368 billion ton kilometers, almost 20% of the bloc’s total. It was followed by Germany with 281 billion tonne-kilometers (15%), Spain with 272 billion tonne-kilometers (15%), France with 174 billion tonne-kilometers (9%) and Italy with 153 billion tonne-kilometers (8%). These five countries account for 67% of all road freight transport in the European Union.

Among the smaller economies, significant volumes were recorded in the Czech Republic (70 billion ton kilometers), Romania (67 billion ton kilometers), Lithuania (66 billion ton kilometers) and the Netherlands (63 billion ton kilometers).

In terms of product categories transported in 2024, the top 10 are the same as in 2023. The stability reflects continued demand for transportation in key supply chains such as food, agriculture, building materials and chemicals.

Food, beverages and tobacco remained the most important goods, with 312 billion tonne kilometers in 2024, followed by groupage goods (different goods transported together), with 237 billion tonne kilometers.

In third place are agricultural, hunting and forestry products with 208 billion ton-kilometers, followed by non-metallic mineral products (137 billion ton-kilometers), metal ores and other mining products (132 billion ton-kilometers) and chemical products (116 billion ton-kilometers)

The use of technology has also increased in the transportation and logistics sector in Romania, a trend that will continue to grow in the coming years. Telematics and fleet tracking systems have become increasingly important to track and optimize the flow of goods and reduce costs.

To cope with these changes and take advantage of growth opportunities in the transport and logistics sector, companies need to be innovative and invest in technology and human resource development. In this sense, the trade fair TransLogistica Romania 2025, which will take place from Oct. 14 to 16 at Romexpo, is an important event event for everyone working in this sector. The business opportunities, networking and valuable information that can be obtained at this fair are invaluable for development and growth in these areas. We invite all transport, logistics and IT companies to participate in this edition of the TransLogistica Romania exhibition and take advantage of the benefits offered by this unique event in Romania.

For more information, please contact:https://romania.translogistica.eu

Dutch carrier VOS Logistics Cargo returned to profit in 2024, with sales of 375.7 million lei

VOS Logistics Cargo, the local subsidiary of the Dutch group VOS, reported sales of 375.7 million lei (75.5 million euros) for 2024, down 23.6% from the previous year, when the company had sales of 492.2 million lei (99.5 million euros), according to calculations by ZF based on data from the Ministry of Finance.

The Dutch carrier returned to profit last year with a net profit of 14.5 million lei (2.9 million euros), after a net loss of 3.4 million lei (about 693,000 euros) in the previous year, according to public data. Vos Logistics Cargo reached an average number of 250 employees last year, 11 more than in 2023. VOS Logistics, founded 81 years ago in the Netherlands, entered the Romanian market in 2012 through the company VOS Logistics Romania in Ckuj Napoca, with sales of 15.5 million lei and an average number of 61 employees last year. Subsequently, the Dutch group moved part of its operations to Romania. In addition to VOS Logistics Romania and VOS Logistics Cargo, the Dutch group also owns VOS locally.

Electric trucks, coaches and buses could be exempt from road tax in EU

- The current payment exemption expires in 2025.

- What performance and autonomy does an electric truck have? And what does it cost?

To encourage and support the competitiveness of sustainable road transport, the European Commission (EC) has proposed exempting zero-emission heavy-duty vehicles from tolls and user charges, according to a statement from the Community Executive

The current payment exemption expires in 2025.

The current payment exemption expires in 2025.

As promised in the European Automotive Industrial Action Plan, the Commission is proposing to extend the current derogation period from Dec. 31, 2025, to June 30, 2031. This will provide a significant incentive for companies to invest in zero-emission heavy-duty vehicles.

The initial cost of these vehicles is currently higher than that of conventional vehicles, making them less attractive to buyers. This remains one of the biggest obstacles to their wider use. By eliminating tolls and user fees, the EU aims to make zero-emission trucks, buses and coaches a more attractive option for businesses.

- Iveco could be for sale. The Indians of Tata are interested.

- Volvo launches 100% electric truck with 600-kilometer range

- Amazon buys 200 electric trucks from Mercedes-Benz

“We need to create the right conditions to support European companies and reward those that implement faster solutions for the transition to a low-carbon economy. By extending the exemption period, we give industry a strong economic incentive to invest in zero-emission vehicles and reduce road transport emissions. This is important for our companies, but also for our climate goals,” said Apostolos Tzitzikostas, Commissioner for Sustainable Transport and Tourism.

The proposed exemption will be synchronized with EU CO2 emission standards for new heavy-duty vehicles, which aim for a 43% emission reduction by 2030, the European Commission said.

What performance and autonomy does an electric truck have?

And what does it cost?

Several truck manufacturers, including Mercedes-Benz , have presented zero-emission heavy vehicles in recent years. There are now launches from brands such as Iveco and Volvo, and several companies in the logistics, FMCG and retail sectors in our country have already embraced such models.

However, the market remains small as the cost of a heavy electric vehicle – especially trucks – is higher, especially in terms of purchase price, compared to a traditional diesel variant. Therefore, most long-distance transport is carried out with polluting trucks, also because there is no adequate charging network. Along the A1 highway in Romania, the largest electric vehicle charging station in the country has been opened. At Miercurea Sibiului, at kilometer 288 of the Sibiu-Orăștie section, fuel company OMV Petrom has inaugurated two state-of-the-art charging stations with a total of 34 fast-charging points – 18 of which are dedicated to electric trucks.

At a higher purchase price, however, the electric truck offers performance comparable to that of a diesel truck. The Mercedes-Benz eActros 600, for example, features three battery packs of 207 kWh each. This produces a total installed power of 621 kWh. The electric motors generate continuous power of 400 kW and peak power of 600 kW and provide powerful acceleration.

In addition to CCS charging up to 400 kW, the eActros 600 will later support megawatt charging (MCS). As soon as sales begin, customers can order a version with this charging option installed. The batteries can be charged from 20 to 80 percent in about 30 minutes at a suitable charging station with an output of about one megawatt, and the range can exceed 1,000 kilometers per day.

Agricover Credit receives a 100 million lei loan from EFSE to finance investments by small and medium farmers in sustainable projects.

Agricover Credit IFN, a financial institution specializing in financing farmers and part of the Agricover Group, announces that it has signed a new loan agreement worth 100 million lei with the European Fund for Southeast Europe (EFSE).

The funding is provided for a period of seven years and is intended to support small and medium farmers in Romania in adopting sustainable farming practices and transitioning to environmentally friendly agriculture.

The new agreement allows Agricover Credit to provide farmers and agricultural businesses with targeted long-term financing. This will enable them to adopt sustainable practices, invest in new technologies and increase the productivity and resilience of their farms.

The new agreement allows Agricover Credit to provide farmers and agricultural businesses with targeted long-term financing. This will enable them to adopt sustainable practices, invest in new technologies and increase the productivity and resilience of their farms.

“We have always put farmers at the center of everything we do. We are guided by their real needs, we understand the daily challenges they face and we strongly believe in their potential to transform Romanian agriculture. The lack of access to specific capital for sustainable investments is one of the biggest obstacles to this progress. The agreement with EFSE allows us to provide relevant and accessible financial solutions exactly where they are needed: for farmers who want to evolve, innovate and produce responsibly,” stressed Serhan Hacisuleyman, CEO of Agricover Credit IFN.

“We are pleased to deepen our strategic partnership with Agricover Credit to support the sustainable growth of agribusiness in Romania, combat climate change and increase agricultural productivity. We believe that through our partnership with Agricover Credit we will create significant economic value, support long-term development and business resilience, promote sustainable agriculture, foster innovation and contribute to the country’s transition to a green economy,” said Oxana Bînzaru, regional director of Finance in Motion and co-manager of EFSE.

Funding is available through Agricover Credit IFN. Interested farmers can obtain eligibility information for each sustainable measure directly from the Agricover representative in the region or through www.agricover.ro.

About EFSE

The European Fund for Southeast Europe (EFSE) is an impact investment fund aimed at stimulating economic development and prosperity in Southeast Europe and the Caucasus. Through two sub-funds, the Regional Sub-Fund (RSF) and the Ukrainian Sub-Fund (USF), EFSE provides tailored financial solutions to stimulate entrepreneurship, strengthen financial inclusion and support local economies. EFSE was founded in 2005 by the KfW Development Bank, with financial support from the German Federal Ministry for Economic Cooperation and Development (BMZ) and the European Commission. As the first public-private partnership of its kind, EFSE raises capital from donor organizations, international financial institutions and private institutional investors. Finance in Motion GmbH of Germany is EFSE’s portfolio manager and Hauck & Aufhäuser Fund Services SA of Luxembourg acts as manager.

The European Fund for Southeast Europe (EFSE) is an impact investment fund aimed at stimulating economic development and prosperity in Southeast Europe and the Caucasus. Through two sub-funds, the Regional Sub-Fund (RSF) and the Ukrainian Sub-Fund (USF), EFSE provides tailored financial solutions to stimulate entrepreneurship, strengthen financial inclusion and support local economies. EFSE was founded in 2005 by the KfW Development Bank, with financial support from the German Federal Ministry for Economic Cooperation and Development (BMZ) and the European Commission. As the first public-private partnership of its kind, EFSE raises capital from donor organizations, international financial institutions and private institutional investors. Finance in Motion GmbH of Germany is EFSE’s portfolio manager and Hauck & Aufhäuser Fund Services SA of Luxembourg acts as manager.

About Agricover Credit

Agricover Credit IFN is one of the main players in the Romanian agricultural finance market and is among the top 3 providers of agricultural finance solutions, with a market share of 6.61%. The institution serves more than 4,300 active farmers across the country and has a mobile team of more than 80 specialists dedicated to agriculture. They offer financing products specifically tailored to the needs on the ground, whether for working capital, investments or transitioning to sustainable practices. The company offers a wide range of products, from agricultural inputs to commercial solutions and future digital payment services.

Agricover Credit IFN is one of the main players in the Romanian agricultural finance market and is among the top 3 providers of agricultural finance solutions, with a market share of 6.61%. The institution serves more than 4,300 active farmers across the country and has a mobile team of more than 80 specialists dedicated to agriculture. They offer financing products specifically tailored to the needs on the ground, whether for working capital, investments or transitioning to sustainable practices. The company offers a wide range of products, from agricultural inputs to commercial solutions and future digital payment services.

Agricover Credit IFN is part of the Agricover Group, which has been providing innovative solutions for the development of farms for more than 25 years. In addition to financing agricultural activities and investments, the group also offers agricultural products through its two specialized companies: Agricover Distribution and Agricover Commodities.

The 30 million euro biomethane plant project in Alba takes shape

BSOG ENERGY have signed the development contract. The design phase and obtaining permits are now scheduled.

Mark Beacom and Peter de Boer

DN AGRAR Group (BVB: DN ), one of the main integrated agri-food companies in Romania and the largest producer of cow’s milk in Europe, together with BSOG Energy, an energy company focused on the development of biomethane production units in Romania, owned by Black Sea Oil & Gas, signed the contracts for the next phases of the development of a biomethane production unit in Alba, one of the largest in Romania.

The investment, estimated at 30 million euros, will be fully financed and implemented by BSOG Energy. DN AGRAR will have the opportunity to participate in the project with a capital stake at that time. Design of the unit and obtaining all necessary permits are expected to be completed in the next eight months. The final investment decision is expected in the first half of 2026 and commissioning is expected to take place no later than the first half of 2028, subject to authorities’ approval.

The investment, estimated at 30 million euros, will be fully financed and implemented by BSOG Energy. DN AGRAR will have the opportunity to participate in the project with a capital stake at that time. Design of the unit and obtaining all necessary permits are expected to be completed in the next eight months. The final investment decision is expected in the first half of 2026 and commissioning is expected to take place no later than the first half of 2028, subject to authorities’ approval.

“By converting agricultural waste into clean energy, we aim to reduce CO2 emissions by up to 90% and create a new source of income.  The project has begun and land acquisition has been completed and permits are being obtained thanks to the joint efforts of both partners. Together with our initiatives in composting and solar energy, this project is an essential pillar of our strategy for the period 2025-2030. This strategy aims to double EBITDA and consolidate DN AGRAR’s position as a leader in sustainable agriculture, directly contributing to emission-free milk production,” said Peter de Boer, CEO of DN AGRAR Group.

The project has begun and land acquisition has been completed and permits are being obtained thanks to the joint efforts of both partners. Together with our initiatives in composting and solar energy, this project is an essential pillar of our strategy for the period 2025-2030. This strategy aims to double EBITDA and consolidate DN AGRAR’s position as a leader in sustainable agriculture, directly contributing to emission-free milk production,” said Peter de Boer, CEO of DN AGRAR Group.

Initial production capacity is estimated at a maximum of 15 MW, with the possibility of exceeding 20 MW in later phases.

DN AGRAR will supply the feedstock for biomethane production under a long-term 15-year contract to ensure sustainability. Annual sales are estimated at about 3.5 million euros.

“The signing of these final development and supply agreements with our partner DN AGRAR demonstrates the steady progress made in the realization of the first biomethane project in Romania. We expect this pioneering project with DN AGRAR to be followed by our recently announced combined biomethane/organic fertilizer project and other biomethane projects being launched in the country. By eliminating organic waste from the environment and producing domestic gas with zero CO2 emissions, we believe BSOG Energy will contribute significantly to both Romania’s energy security and the transition to green energy. BSOG Energy’s main shareholders, the Carlyle Group and the European Bank for Reconstruction and Development, fully support this new initiative and the final investment decision is expected in the first half of 2026,” said Mark Beacom, CEO of BSOG Energy.

“The signing of these final development and supply agreements with our partner DN AGRAR demonstrates the steady progress made in the realization of the first biomethane project in Romania. We expect this pioneering project with DN AGRAR to be followed by our recently announced combined biomethane/organic fertilizer project and other biomethane projects being launched in the country. By eliminating organic waste from the environment and producing domestic gas with zero CO2 emissions, we believe BSOG Energy will contribute significantly to both Romania’s energy security and the transition to green energy. BSOG Energy’s main shareholders, the Carlyle Group and the European Bank for Reconstruction and Development, fully support this new initiative and the final investment decision is expected in the first half of 2026,” said Mark Beacom, CEO of BSOG Energy.

DN AGRAR Group is the largest producer of cow’s milk in Europe and one of the most important integrated agri-food companies in Romania. Since 2022, the company has been listed on the Bucharest Stock Exchange.

The group operates an integrated business model based on milk production, crop production, organic composting and green energy to support sustainable and circular agriculture. With five large farms and a herd of more than 16,000 head, the company produces about 70 million liters of milk annually, with a goal of doubling production to 150-200 million liters per year by 2030. DN AGRAR manages more than 10,000 hectares of agricultural land and two composting plants with a capacity of 14,000 tons of organic fertilizer per year, with the goal of expanding it to 40,000 tons by 2030. The group has tripled its operations in just three years since its IPO and aims to double its EBITDA by 2030, while aiming for net zero emission milk production.

The DN AGRAR Group, founded in 2008 as a family business by Jan Gijsbertus de Boer, operates in the heart of Transylvania, in the provinces of Alba, Sibiu and Hunedoara. Since February 2022, the company is listed on the AeRO market of the Bucharest Stock Exchange and is included in the local BETAeRO index, as well as in the international indices MSCI Frontier IMI and MSCI Romania IMI (Small Cap category).

BSOG Energy is a Romanian energy company focused on the development of green energy projects, with the primary goal of increasing national biomethane production capacity. BSOG Energy is 100% owned by Black Sea Oil & Gas SA, the developer and majority owner of the Midia Natural Gas Development Project (MGD), the first new offshore gas infrastructure and production project in the Romanian Black Sea region in the last 30 years, covering 12% of Romania’s gas needs.

Romanian dairy farming: challenges and opportunities

Two experts from the Agrosilvic Biodiversity Study & Research Center, “Acad. David Davidescu,” associate professor Gabriel Popescu and PhD Eng. Ioana Corina Moga, recently published an interesting article in the journal Business Press Agricol, analyzing the competitiveness of Romanian dairy farmers compared to their fellow EU dairy farmers.

Importance of livestock production

The authors describe livestock farming as playing an essential role in ensuring food security in the EU, maintaining economic balance in rural areas and providing value-added food products. According to Eurostat data (2023), livestock production accounts for about 40% of the total value of agricultural production in the EU-27, and dairy cattle are a central pillar of this ecosystem, with more than 20 million head raised on commercial farms.

Countries such as Germany, France, the Netherlands and Poland stand out for their high efficiency, superior yields per animal and advanced agricultural technology. For example, average milk production in Germany and the Netherlands exceeds 9,000 liters per animal per year, while the European Union average is around 7,300 liters per animal per year (European Milk Market Observatory, 2023). These results are due to continuous investments in genetics, nutrition, automation and digitalization.

Lagging behind in competitiveness

In contrast, Romania, although endowed with significant natural resources, is struggling to become more competitive and achieve similar results. Although the cattle sector has stabilized in recent years, it is still characterized by low levels of economic concentration and  low technological efficiency. Data from the National Institute of Statistics (INS, 2023) show a decline in the cattle population from 2.5 million head in 2007 to about 1.85 million in 2023, of which only about 20% are kept on commercial farms. Average milk production per animal is between 4,000 and 5,500 liters per year – significantly lower than the European average. Technical gap

low technological efficiency. Data from the National Institute of Statistics (INS, 2023) show a decline in the cattle population from 2.5 million head in 2007 to about 1.85 million in 2023, of which only about 20% are kept on commercial farms. Average milk production per animal is between 4,000 and 5,500 liters per year – significantly lower than the European average. Technical gap

Unfortunately, one of the most visible differences between Romania and Western European countries is the level of technical equipment. According to a report by the Ministry of Agriculture and Rural Development (MADR, 2022), only 15-18% of commercial dairy farms in Romania use automated milking systems and less than 10% have microclimate monitoring equipment. In contrast, in Germany, the Netherlands and Denmark, digitization of all processes – including herd management, automated ventilation and feed monitoring – is already common practice on medium and large farms.

Competitive Advantages

However, according to the authors, Romania has competitive advantages that, with a coherent valorization strategy, can be turned into sources of progress. These include: the availability of large fodder resources (13 million hectares of arable land), relatively low labor costs, access to European funds and the growing demand for local dairy products with guaranteed traceability. To convert these advantages into real economic benefits, the process of technological modernization must be accelerated. Structural challenges

If we dig deeper into the challenges Romanian farmers face, they are multiple and structural in nature. The small size of farms, low capitalization rates, insufficient use of technology and limited access to digital innovations significantly limit their competitiveness.

Romania represents about 33.5% of the total number of farms in the EU, but most of these are small, with an average size of 4.4 ha/farm, compared to the EU average of 15 ha/farm (Eurostat, 2023). This fragmentation reduces economic efficiency and makes it difficult to attract significant investment. For example, an average farm in France or Germany has more than 100 dairy cows and uses automated equipment, while Romania has more than 134,000 small dairy farms (less than 10 head), many of which are below the profitability threshold (MADR, 2022).

A comparison with the EU

Overall economic performance confirms these differences. A study published in the journal “Sustainability” (2023) compared key indicators between EU countries and showed that Romanian farms have a Farm Economic Sustainability Index (FESI) of €29,262, compared to the EU average of €41,529. Regarding the Farm Capitalization Index (FCI), Romania stands at 13.8, while the European average is 18.96 – indicating significant differences in technical equipment. Similarly, the Profitability and Cash Flow Index (PCFI) in Romania ranges between 118% and 136%, lower than the level in other countries (137%-157%), indicating lower liquidity and limited self-financing capacity.

Digitization

The level of digitalization is also a critical factor. Only 15-18% of commercial cattle farms in Romania use automated milking equipment and less than 10% have microclimate monitoring systems, while in countries such as Germany or the Netherlands these technologies are present on more than 60% of farms. In addition, tractor density is another relevant indicator: in Romania, there is 1 tractor per 54 ha, compared to 1 tractor per 13 ha in Western European countries, indicating low productivity and high dependence on manual labor (European Commission, 2022).

The digitization process is also delayed by cultural and institutional factors. Research highlights the main obstacles faced by small farms in Romania in implementing Agricultural Digital Solutions (ADS): high initial costs, lack of digital skills and insufficient institutional support. Studies show that Romanian farmers’ reluctance to implement smart technologies is influenced by low levels of technical education, but also by the lack of functional local examples that drive change. Market position of farmers

Moreover, market positioning is often unfavorable. Large farms in Western Europe are integrated into efficient processing and distribution networks, while most farmers in Romania sell milk as a commodity at low prices, with no processing capacity of their own. This dependence limits the added value farmers achieve and increases their vulnerability to market fluctuations.

Financial position

In terms of financial support, Romania is also not in a favorable position. The ratio of subsidies to income is 107%, lower than the EU average of 121%. In fact, less than 30% of European funds are converted into productive investments, compared to more than 45% in farms in developed countries.

Conclusion: the only way is up!

The authors conclude that all these structural, technological and differences lead to unequal competition within the EU market. Without a coherent modernization plan, Romanian farmers risk being stuck in an uncompetitive economic model vulnerable to external shocks and unable to meet increasingly stringent quality, safety and sustainability standards. For the new Romanian government, the livestock sector is a priority. We continue to monitor and examine developments in this and other promising sectors, and identify opportunities for cooperation between NL and RO.

Curious about the opportunities on the Romanian market? See also: Agrifood Trade Mission to Romania (Initiative Romanian Embassy Bucharest (ask for Sophie Neeve)and ‘Dutch Day at Indagra Fair’ and maybe you will manage to speak there the experience experts Peter and Jan de Boer of DN Argrar

FrieslandCampina leaves Romania

FrieslandCampina is selling its operations in Romania to Bonafarm Group. The deal includes the Napolact brand and plants in Cluj-Napoca and Târgu Mureș.  Earlier this year it already became clear that FrieslandCampina wanted to get rid of the Romanian branch. Local media reported then that Bonafarm, but possibly also Danone were in the race as potential buyers.

Earlier this year it already became clear that FrieslandCampina wanted to get rid of the Romanian branch. Local media reported then that Bonafarm, but possibly also Danone were in the race as potential buyers.

According to Friesland Campina, the decision to sell was taken after a strategic evaluation of the activities on site and is in line with the strategy of the Europe business group. This is to focus on core markets and growth segments with high added value and on markets where milk from member farmers can be optimally processed.

While the Romanian operating company has a leading position in the local dairy market, its activities offer limited synergy with the European portfolio and do not contribute to the valorization of Friesland Campina’s member milk. “With Bonafarm Group as the new owner, the Romanian company is in capable hands,” states FrieslandCampina.  The Hungarian Bonafarm Group is headed by OPT Bank President Sandor Csany, who also maintains professional contacts with the Russian Federation.

The Hungarian Bonafarm Group is headed by OPT Bank President Sandor Csany, who also maintains professional contacts with the Russian Federation.

The two production sites in Cluj-Napoca and Târgu Mureș employ about 400 people. The transaction is subject to the usual regulatory approvals, including approval from the Romanian Competition Authority, and is expected to be completed by the end of December 2025.

A transaction sum was not disclosed. Earlier this year it was reported that Friesland Campina was estimated to raise between €60 million and €70 million from the sale.

A transaction sum was not disclosed. Earlier this year it was reported that Friesland Campina was estimated to raise between €60 million and €70 million from the sale.

Incidentally, Friesland Campina announced as early as 2023 that it would lay off 1,800 employees worldwide over the next few years as part of measures to reduce costs and improve profitability.

The company said the layoffs will result in savings of 200 million euros. These savings are part of a program to reduce annual costs by 400-500 million euros starting in 2026.

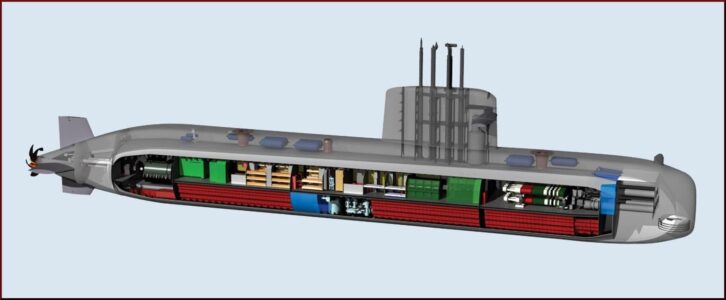

Shipbuilding’s best-kept secret revealed

For 90 years, Alblasserdam-based Nevesbu has been providing advanced solutions for submarines, naval vessels and (floating) offshore energy. Their mission? To contribute to safety and energy security at sea. Nevesbu does this with precision, technical depth and silence. It is not for nothing that the company is sometimes called the best kept secret in shipbuilding. As Nevesbu celebrates its 90th anniversary this year, Managing Director Bart van Rijssen and Commercial Director Albert Jurgens thought it was time to reveal that secret.

Nevesbu was founded in 1935 by four major Dutch shipyards and the Machinefabriek Werkspoor. Its mission was clear: to design submarines and naval vessels. Today, Nevesbu has grown into an international knowledge partner in two markets: naval (submarines and naval vessels) and offshore energy. With 117 people, the company works on high-profile projects worldwide.

Marine engineering and offshore energy

Nevesbu now does much more than designing submarines and naval vessels. The DUKC is a specialist working group of the Netherlands Naval Construction Cluster (NMC) and has a coordinating role in pooling all Dutch knowledge, skill and experience in the field of underwater technology. Only NMC participants can participate in this platform. Albert: “We are no longer just the engineering firm that works out drawings – we have become a major player in the field of marine engineering and offshore energy.” After almost 90 years, the company has the wind in its sails in both sectors. But it has been different at times. “In recent decades, we found our work mostly abroad,” Bart explains. “When the Dutch defense market became smaller, we were forced to broaden our view

Nevesbu now does much more than designing submarines and naval vessels. The DUKC is a specialist working group of the Netherlands Naval Construction Cluster (NMC) and has a coordinating role in pooling all Dutch knowledge, skill and experience in the field of underwater technology. Only NMC participants can participate in this platform. Albert: “We are no longer just the engineering firm that works out drawings – we have become a major player in the field of marine engineering and offshore energy.” After almost 90 years, the company has the wind in its sails in both sectors. But it has been different at times. “In recent decades, we found our work mostly abroad,” Bart explains. “When the Dutch defense market became smaller, we were forced to broaden our view

.”

That turned out to be a golden move. Bart: “We built strong relationships with foreign navies and offshore companies. Like in Malaysia, where we are now carrying out a special project for maintaining and modernizing submarines.” It is no coincidence that Bart mentions this very project – in fact, it is one of his favorites. “We were competing against large, international parties in that tender,” he says. “But the client chose us because we have proven knowledge of building

project for maintaining and modernizing submarines.” It is no coincidence that Bart mentions this very project – in fact, it is one of his favorites. “We were competing against large, international parties in that tender,” he says. “But the client chose us because we have proven knowledge of building

submarines. That a relatively small country like the Netherlands is seen as an expert in this makes me proud. They also see us that way in Spain and Southeast Asia and other countries.”

Hired by navies all over the world

Typically, Nevesbu is a relatively unknown company in the Netherlands. Albert: “We have always been better at doing our work than talking about it. And that has never been a problem – clients and stakeholders knew where to find us anyway. Besides, we often can’t share much content about our work, for example for safety reasons.”

Nevertheless, Nevesbu is now increasingly choosing to go public. Over a year ago, that need became painfully clear when the Minister of Defense said in the media that the Netherlands can do little in the field of submarines. “An extraordinary statement,” Bart said. “We are hired by navies all over the world. We have built up a wealth of knowledge in 90 years. Our customers abroad were surprised when they heard about these statements. But it got us thinking. Since then, we have deliberately let ourselves be heard more in the media.”

Nevertheless, Nevesbu is now increasingly choosing to go public. Over a year ago, that need became painfully clear when the Minister of Defense said in the media that the Netherlands can do little in the field of submarines. “An extraordinary statement,” Bart said. “We are hired by navies all over the world. We have built up a wealth of knowledge in 90 years. Our customers abroad were surprised when they heard about these statements. But it got us thinking. Since then, we have deliberately let ourselves be heard more in the media.”

Friendship and trust

Bart, with his love of marine engineering, sailed on a submarine himself for many years. “So I know how important it is that such a boat is well designed,” he says. “That every little button and switch is where you expect it to be, that everything works intuitively. It’s not just about technical perfection, it’s also about user experience. Can you do your job well on board? For a resounding ‘yes’ to that question, we need to work closely with the customer.” Albert also emphasizes the importance of cooperation: “The relationship with our customers can almost be called friendly. Of course everything is neatly laid down in contracts, but in the end it’s all about trust. Customers must dare to trust us with their work. And we get that trust because we deliver, think with them and are always nearby. Not only during the drawing phase, but also once the product has been put into use.”

he says. “That every little button and switch is where you expect it to be, that everything works intuitively. It’s not just about technical perfection, it’s also about user experience. Can you do your job well on board? For a resounding ‘yes’ to that question, we need to work closely with the customer.” Albert also emphasizes the importance of cooperation: “The relationship with our customers can almost be called friendly. Of course everything is neatly laid down in contracts, but in the end it’s all about trust. Customers must dare to trust us with their work. And we get that trust because we deliver, think with them and are always nearby. Not only during the drawing phase, but also once the product has been put into use.”

Stock building strategy Damen enables fast delivery of Fast Ferry 4212

Damen Shipyards Group has signed a contract with South Korea’s Starline Co. Ltd. for the delivery of a new Damen Fast Ferry 4212. Available directly from Damen Song Cam Shipyard in Vietnam, the shipbuilder expects to deliver the vessel just seven weeks after signing the contract on May 12.

Starline purchased the vessel for the route between Busan on the mainland and the Japanese island of Tsushima. Currently operating a Damen Fast Ferry 4010, the company wanted a slightly larger vessel, suitable for the sometimes harsh open sea conditions on this route.

Ready for the season

Because Damen builds standard ships in series for stock, the company already had the Fast Ferry 4212 available. In addition, Damen had already equipped the vessel to ensure it would be ready for delivery in time for the summer season. Damen continues to build and equip vessels, such as the Fast Ferry 4212’s design, to give customers worldwide quick access to their next vessel.

Preparing the ferry in this way reduces the already fast delivery time from six months to just a few weeks. The success of the Fast Ferry 4212 – Damen has sold 18 such vessels to date – has given Damen a clear picture of market needs, allowing them to almost finalize the vessel before purchase. In the coming weeks, the shipbuilder will finalize the vessel and make minor modifications to meet Starline’s requirements.

Suitable for South Korea

The Fast Ferry 4212 is an aluminum catamaran designed to provide optimal passenger comfort with high fuel efficiency and low maintenance requirements. The 42.2-meter vessel can carry up to 439 passengers at speeds of up to 40 knots.

The Damen Fast Ferry has proven to be a very suitable vessel for the South Korean market. To date, the company has sold eight vessels in the series to the country, including six of the Fast Ferry 4212 design. Following the order, Damen assisted Starline in the sale of their existing vessel, the Fast Ferry 4010, through their own brokerage service Damen Trading.

Mr. Choo, Starline representative, said, “When we decided to invest in a new ferry, we knew where to go. Damen has an excellent track record in the public transport sector in South Korea. Moreover, since we have already been operating the Damen Fast Ferry 4010 since 2016, we were aware of the high quality of the series. We were impressed that Damen was able to deliver the vessel we were looking for in such a short time. In addition, we greatly appreciate the support provided by Damen in selling our current vessel.”

Ready for the season

Support for Damen Shipyards

The Ministry of Economic Affairs (EZ) is allocating €270 mln in a supplementary budget to support shipbuilder Damen Shipyards, which has run into money problems. In documents to the Lower House, the ministry does not name the company, but sources confirm a report in the AD that this shipyard is involved.

The Chamber is meeting in an emergency session to discuss the aid package, which is quite exceptional in the first week of the summer recess. The ministry has devised a legal route to allow the money to be disbursed without a prior vote by parliament, but the chamber has yet to say it considers itself “well informed.

Outgoing EZ Minister Vincent Karremans (VVD) writes that the support must be provided “soon. According to the minister, the Chamber has been informed confidentially of the need for the support. A spokesman for Damen would not comment.

Damen has run into acute money problems due to delays in the construction of F126 frigates for the German Navy. The German government does not want to transfer money to Damen because of missed deadlines. The Dutch shipbuilder is said to be facing intractable software problems in the design of the frigates, as well as complex negotiations with banks, real estate parties and governments.

Interest of Dutch government

The Dutch government has an interest in ensuring that Damen can build the German frigates and stay afloat. After all, the concern is going to build four frigates for the Dutch Navy. According to a source with knowledge of the matter, the technology for the German frigates will also be applied in the yet-to-be-built Dutch naval vessels. The Dutch order involves an amount of €5 bln.

In addition, given geopolitical tensions, the Dutch government wants yard capacity for defense orders. Recently, therefore, a guarantee facility was also issued in favor of shipbuilder IHC. Sources indicate that the intended support for Damen will also benefit other smaller companies. Damen relies on several dozen suppliers when building ships.

Bridging credit

Documents to the House indicate that the cabinet intends to provide the support to Damen in the form of a €270 mln bridge loan. According to Minister Karremans, the support agreement will be fleshed out in the coming weeks. ‘It is expected that parliament can be informed about this further elaboration in the second half of July,’ Karremans writes.

This is not the first time Damen has faced financial problems. Due to the economic sanctions against Russia, the concern was unable to deliver a number of ordered ships. Damen therefore wanted to file a lawsuit against the Dutch State, but ultimately refrained from doing so. The company had to make new financing arrangements with the banks. Part of this included the sale of real estate.

Tough legal battle

For 2023 – the most recent year for which an annual report is available – Damen had revenues of €3 bln and profits of €43 bln. The company had a total of 9400 employees at home and abroad in that year.

In addition to financial problems, the family concern is facing an uphill legal battle. In late April, it was announced that the Public Prosecutor’s Office will prosecute the shipbuilder on suspicion of bribery, forgery, money laundering and violating sanctions against Russia. The criminal prosecution of Damen Shipyards will not affect current or future contracts with the Department of Defense for the time being, this ministry announced earlier. However, suspicion is not a synonym for determination!!!

Submarine order awarded to European Competition Authority

As DRN, we continue to wonder why the Dutch state chose a (French) state-owned company over a private company like Damen when awarding a submarine order. Here a level playing field was knowingly sinned against. Not to mention the fact that Australia and Romania have had bad experiences with French Naval.

In any case, the DRN is considering raising the matter with the European Competition Authority.

Damen builds 4 freighters for German shipowner

Damen has received the order from the German Shipping Company Bernd Sibum which is in fact a green upgrade of the existing cargo vessel Combi Freighter 3850.

We will spare you the technical details except that these cargo vessels are being built yard of Damen in Yichang in South China.

Romanian government must make cuts, not taxpayers

Prime Minister Ilie Bolojan: State-owned companies to be controlled. Companies that have been making losses for years should simply be closed down.

” Money is like muck, not good except it be spread” .

Ilie Bolojan declared Tuesday night that all large state-owned companies will be controlled. The prime minister added that companies that have been making losses for years will have to be closed or put under private management so that they are no longer “at the mercy of people who have been ridiculing them for years.”

New revelations about scandalous ministries Another day of protests by civil servants. “The increase in harmful conditions is not a privilege.” Government considers new measures. Tax lawyer: Budget deficit not caused by taxpayers

Companies that are clearly visible in economic analyses, have large assets, do not generate revenue, have negative capital, have been making losses for years, should simply be closed down because they are in fact nothing more than a black hole for the state.

Wave of price hikes from Aug. 1:

How much will a decent life cost in Romania? The new fiscal measures adopted by the government will put direct pressure on household budgets. Economists warn that the impact will be significant for all categories of consumers, but especially for low- and middle-income families. Starting August 1, 2025, VAT will change as follows: the standard rate will rise from 19% to 21%, and the only reduced rate will be 11%. This applies to medicine, food, textbooks, firewood, water and sewage, as well as admission to museums or other cultural institutions. Starting next month, fuel and alcoholic beverages will also become more expensive, following a 10% excise tax increase. It is also facing an increase in electricity prices following liberalization last July 1. Rates are now almost twice the maximum prices. Economist Adrian Negrescu estimates that given the wave of price increases, a family with two children will need at least 12,000 lei net per month to live decently. “Until now, the National Institute of Statistics told us that a family with two children needs about 10,000 lei net per month for a decent income, this amount is likely to rise to 12,000 lei, as everything around us becomes more expensive, from the electricity bill to food, transportation, clothing, shoes… everything is getting more expensive every day.” The limited price increases are inevitable, but the Romanian government’s rather drastic budget cuts will positively affect the increases. Economists do need to consider the prices in light of the unacceptable budget deficit, and thus we are talking about a temporary situation.

What did the president say?

- President Nicuşor Dan stated that Romania has a concrete future right after the correction period is over.

- “I want to convey to you my conviction that Romania has a future, not in 20 to 30 years, but in two to three years, once we get past this correction period. Romania has a dynamic, competitive private sector, Romania has the chance to join the OECD and thus attract much more foreign investment by the end of next year. So Romania has a concrete future”,

Download speeds in Europe

Romania is among the European countries that have seen an increase in 5G speeds, but with a more modest increase compared to Poland (57%), the Netherlands (40%), Slovakia (21%), Hungary (19%), Bulgaria (12%) and Italy (11%). The country is on par with Switzerland, Greece and Ireland (all at 3%), and below Austria (7%), Spain (5%) and Portugal (5%).

Countries with declining download speeds for 5G include Finland (-1%), France (-3%), Belgium (-4%), Croatia (-5%), Czech Republic (-6%), Germany (-7%), Norway (-9%), the United Kingdom (-14%) and Denmark (-23%).

Countries with declining download speeds for 5G include Finland (-1%), France (-3%), Belgium (-4%), Croatia (-5%), Czech Republic (-6%), Germany (-7%), Norway (-9%), the United Kingdom (-14%) and Denmark (-23%).

In contrast, Romania managed to increase its share of 3.5 GHz band usage by 14 percentage points. This is the third highest increase in Europe, after Poland (33 pp) and Belgium (21 pp), but ahead of Greece (10 pp) and Belgium (10 pp).

According to the source cited, the 3.5 GHz band is considered ideal for 5G because it offers a good balance between capacity and coverage – making it suitable for enhanced mobile broadband services. Open Signal’s analysis shows a strong correlation between increasing use of the 3.5 GHz band and higher average 5G download speeds.

Is AI a kind of sword of Damocles?

One’s own conclusion is that this is a sum of special circumstances, listed below in more or less random order

- Corona led to a gigantic boom in automation, as companies wanted to be less dependent on staff who were no longer allowed on the

shop floor. This spike is normalizing in recent years, and companies are scaling back their IT investments to more regular levels.

shop floor. This spike is normalizing in recent years, and companies are scaling back their IT investments to more regular levels. - Uncertain geopolitical and economic conditions. War between Russia and in Ukraine, Israel and Palestine, higher interest rates, inflation and more recently that orange narcissist in the US, etc, etc.

- Specific to the Dach region (Germany, Austria, Switzerland) is an ailing automotive industry. Partly due to the energy transition and associated uncertainties. We looked at dozens of IT companies there in the context of desired international expansion, almost all struggling with difficult market conditions. Automotive is sort of a top-of-the-foodchain there, and they are pulling down a huge SME supply industry with them.

- AI is something of a sword of Damocles hanging over the IT industry, not only there for that matter. It is still unclear exactly how big the impact will be; as so often, developments are not linear. What is certain is that repetitive development and testing work will disappear as a human activity, the question is what will take its place.

With that, by the way, we do not believe in the end of the IT industry.

That exceptions that confirm the “rule” is correct because the Dutch company NetRom in Craiova is still growing despite the challenging conditions and with double digits, All in all, there is also just a kind of normalization of international and Romanian market conditions, we can also see this in the labor market where the availability of resources is returning to reasonable standards.

Banca Transilvania notes one these days at the BVB its first bond issue in lei

Banca Transilvania notes one these days at the BVB its first bond issue in lei, worth 1.5 billion lei, with a maturity until 2032 and an annual interest rate of 8.8%. Banca Transilvania, the largest credit institution and the most traded stock on the Bucharest Stock Exchange, issues a sustainable bond issue worth 1.5 billion lei, with a maturity until 2032 and an annual interest rate of 8.87%.

This is the bank’s first lei issue, listed on the stock exchange, and includes 2,500 durable eligible (as per MREL requirements) non-preferential corporate bonds with a face value of 600,000 lei.

The problem is listed under the symbol TLV32.

“With this bond issue, we are diversifying investment opportunities for local investors through the stock exchange. Those who choose to invest support both BT’s growth and sustainable initiatives, with direct impact on the community and the economy. We are happy to contribute to the development of the capital market and set an example for companies that choose BVB to finance their operations and prosper,” said Ӧmer Tetik, general manager of Banca Transilvania.

“With this bond issue, we are diversifying investment opportunities for local investors through the stock exchange. Those who choose to invest support both BT’s growth and sustainable initiatives, with direct impact on the community and the economy. We are happy to contribute to the development of the capital market and set an example for companies that choose BVB to finance their operations and prosper,” said Ӧmer Tetik, general manager of Banca Transilvania.

Banca Transilvania listed two other Eurobond issues on the BVB. The first in 2018, worth 285 million euros, under the exchange symbol TLV28E, maturing in 2028. The second issue was listed in 2023, worth 200 million euros, under the exchange symbol TLV33E, with a maturity until 2033.

“This issue was received with remarkable enthusiasm by local and international investors, confirming that the Romanian capital market is gaining visibility and credibility in the international financial market. The issue received an Investment Grade rating from Fitch, putting these bonds in the safe investment category, at the same level as the Romanian sovereign rating,” said Remus Vulpescu, CEO of the Bucharest Stock Exchange.

“This issue was received with remarkable enthusiasm by local and international investors, confirming that the Romanian capital market is gaining visibility and credibility in the international financial market. The issue received an Investment Grade rating from Fitch, putting these bonds in the safe investment category, at the same level as the Romanian sovereign rating,” said Remus Vulpescu, CEO of the Bucharest Stock Exchange.

The bond issue was conducted through BT Capital Partners, a Banca Transilvania Financial Group company.

In its 28 years on the local stock exchange, the bank’s market capitalization has grown nearly a thousand times, to more than 30 billion lei, a historic maximum. At the same time, Banca Transilvania has paid a gross dividend of 8.3 billion lei since its IPO.

During this period, the main BVB index, the BET index, in which Banca Transilvania has the largest share (20%), rose 19.4 times.

Focus on elections Sept. 28 in Moldova

Things began so well after Maia Sandu with her center-liberal party PAS (Action and Solidarity Party) won the presidential election. Support also came from Europe and through the President of the European Council Antonio Costa and the President of the European Commission Ursula von der Leyen were offered candidate membership in the European Union. The Netherlands also made a positive contribution by opening an embassy led by Ambassador Fred Duijn.

Things began so well after Maia Sandu with her center-liberal party PAS (Action and Solidarity Party) won the presidential election. Support also came from Europe and through the President of the European Council Antonio Costa and the President of the European Commission Ursula von der Leyen were offered candidate membership in the European Union. The Netherlands also made a positive contribution by opening an embassy led by Ambassador Fred Duijn.

Considering these positive developments, the business community also showed interest mainly consisting of Dutch and Belgian entrepreneurs. The neighboring country Romania showed assistance in many areas such as infrastructure, energy facilities and the like. In addition, Romania took over the free port of Giurgiulesti located on the Danube; this port is 133 km from the Black Sea. Together with the port of Constanta, they will be able to become the market leader in Central and Southeastern Europe via transformation.

energy facilities and the like. In addition, Romania took over the free port of Giurgiulesti located on the Danube; this port is 133 km from the Black Sea. Together with the port of Constanta, they will be able to become the market leader in Central and Southeastern Europe via transformation.

So far, so good you might think.

However, in sight of the elections, the Republic of Moldova, appears to be a testing ground for the Russian disinformation machine and these elections will be decisive in the hybrid war.

The current mayor of Chisinau Ion Ceban has been banned from entering Romania and all other Schengen countries  because he and his alternative movement MAN pose a risk to Romania’s national security. Incidentally, another exiled tycoon Ilan Șhor has fled Moldova and currently resides in his native Israel. He was convicted of a case related to the theft of $1 billion in bank deposits, money laundering and fraud. In addition, voter bribery took place during the 2023 Gagauzian gubernatorial election.

because he and his alternative movement MAN pose a risk to Romania’s national security. Incidentally, another exiled tycoon Ilan Șhor has fled Moldova and currently resides in his native Israel. He was convicted of a case related to the theft of $1 billion in bank deposits, money laundering and fraud. In addition, voter bribery took place during the 2023 Gagauzian gubernatorial election.

Gagauzia is an autonomous region in southern Moldova. The region is inhabited by Gagausians, a Turkic people of southeastern Europe. The region has had autonomous status since 1994. The capital of Gagauzia is Comrat. The governor of Gagauzia is Evghenia Gutul.These are oriented toward the Russian Federation.

In the unrecognized state of Transnistria bordering Moldova, 430 Russian servicemen are stationed in Transnistria as part of the Joint Peacekeeping Forces , while another 1,500 serve in the Operational Group of Russian Troops, according to Moldova’s Reintegration Agency.Jun 5, 2025

Hungary is Russian Trojan Horse

Informal visit by Hungarian Prime Minister Viktor Orbán to Romania.

Hungarian Prime Minister Viktor Orbán recently attended the funeral of lawyer Előd Kincses, who died of a medical condition a week ago at the age of 84. Előd Kincses, former leader of the Front for National Salvation in Mureş in the early 1990s, is recognized as a lawyer of  former MEP László Tőkés, as well as of several persons convicted following the inter-ethnic conflict in Târgu Mureş on March 19 and 20, 1990. On this occasion, Orbán gave a video interview to the Hungarian publication Kronika Online. Orban’s statement: what was said and what it means During his speech in Transylvania, Orbán emphasized Hungary’s strong commitment to ethnic Hungarians abroad and the need to preserve their identity, language and autonomy. Orbán criticized attempts to “assimilate” Hungarian minorities in neighboring countries and called for “historical reconciliation” through “self-determination” and cultural autonomy. Although phrased in soft-powered language, these messages are not new. Orbán has long pursued a pan-Hungarian policy promoting ethnic Hungarian identity beyond Hungarian borders, offering dual citizenship and political representation through diaspora organizations aligned with Fidesz,” IRL writes. “The context in which this message was delivered in Romania – a NATO and EU partner increasingly at odds with Orbán’s pro-Russian orientation – adds a geopolitical dimension. His reference to Hungarian communities in Transylvania is a direct allusion to Szeklerland, an area with historical claims to autonomy,” IRL said. The territorial sentiment of Székely Land and Hungary Székely Land is a culturally unique area in Harghita, Covasna and parts of the Mureș districts, with a Székely (Hungarian) majority. Although Hungary officially recognizes Romania’s borders, Budapest’s actions suggest a parallel policy of informal ethnic patronage and moderate irredentism: Funding Hungarian-speaking schools and cultural institutions in Transylvania. Granting Hungarian citizenship and

former MEP László Tőkés, as well as of several persons convicted following the inter-ethnic conflict in Târgu Mureş on March 19 and 20, 1990. On this occasion, Orbán gave a video interview to the Hungarian publication Kronika Online. Orban’s statement: what was said and what it means During his speech in Transylvania, Orbán emphasized Hungary’s strong commitment to ethnic Hungarians abroad and the need to preserve their identity, language and autonomy. Orbán criticized attempts to “assimilate” Hungarian minorities in neighboring countries and called for “historical reconciliation” through “self-determination” and cultural autonomy. Although phrased in soft-powered language, these messages are not new. Orbán has long pursued a pan-Hungarian policy promoting ethnic Hungarian identity beyond Hungarian borders, offering dual citizenship and political representation through diaspora organizations aligned with Fidesz,” IRL writes. “The context in which this message was delivered in Romania – a NATO and EU partner increasingly at odds with Orbán’s pro-Russian orientation – adds a geopolitical dimension. His reference to Hungarian communities in Transylvania is a direct allusion to Szeklerland, an area with historical claims to autonomy,” IRL said. The territorial sentiment of Székely Land and Hungary Székely Land is a culturally unique area in Harghita, Covasna and parts of the Mureș districts, with a Székely (Hungarian) majority. Although Hungary officially recognizes Romania’s borders, Budapest’s actions suggest a parallel policy of informal ethnic patronage and moderate irredentism: Funding Hungarian-speaking schools and cultural institutions in Transylvania. Granting Hungarian citizenship and voting rights to ethnic Hungarians in Romania. Political support for Szekler’s autonomy movements, often presented as “minority rights.

voting rights to ethnic Hungarians in Romania. Political support for Szekler’s autonomy movements, often presented as “minority rights.

In particular, to Transylvania, a region with a significant ethnic Hungarian population – was marked by controversial rhetoric, in which he affirmed Budapest’s support for Hungarian minorities abroad. Although Orbán presented his statement as a gesture related to culture and identity, the tone of his message sounded like a familiar irredentist narrative. Irredentist means a political desire to recapture and/or annex territories that a particular group or state believes belong to their nation but are currently under the control of another country. It is often based on shared ethnicity, language or historical ties.

In the context of growing regional instability and Russia’s interest in fragmenting NATO and the EU from within, Orbán’s remark deserves further analysis, according to the Robert Lansing Institute .

The statements referred to by the Robert Lansing Institute were made in Romania Orbán’s speech reinforces the suspicion that Hungary is subtly reasserting its claims to former territories it lost in 1920 with the Treaty of Trianon, without formal revisionism. It reflects a strategic ambiguity that keeps the nationalist base mobilized at home while undermining the sovereignty of neighboring countries at home. Possible indicators of future Hungarian hybrid activity in Romania Orbán’s rhetoric is not merely symbolic – it could foreshadow a broader hybrid campaign, which could include the following:

strategic ambiguity that keeps the nationalist base mobilized at home while undermining the sovereignty of neighboring countries at home. Possible indicators of future Hungarian hybrid activity in Romania Orbán’s rhetoric is not merely symbolic – it could foreshadow a broader hybrid campaign, which could include the following:

Information operations:

strengthening stories of discrimination against Hungarian minorities in the Romanian media and in international forums.

Economic penetration:

channeling money through Hungarian consulates or organizations to strengthen loyalty among ethnic Hungarians and encourage economic dependency.

Cyber/propaganda war:

promoting irredentist and nationalist content through social media, similar to Russia’s tactics in Crimea and the Donbas.

Education and cultural diplomacy:

the intensification of soft power through Hungarian-funded institutions and historical revisionism in schools in Transylvania. Scenarios of increasing tensions between Hungary and Romania

Pressure for autonomy:

the UDMR, encouraged by Orban’s support, renews bills for autonomy for Szekler. Bucharest responds briskly, leading to diplomatic tensions.

Citizenship crisis:

Hungary quickly increases issuance of Hungarian passports to Hungarians in Transylvania. Romania protests, in protest of violation of sovereignty and fear of dual loyalty.

Interference in elections:

Budapest secretly supports Romanian politicians who support the Hungarian agenda, which could undermine Romania’s national cohesion.

Border symbolism:

Hungarian officials openly commemorate Trianon near the border or in Transylvania, leading to nationalist protests in Romania.

Security incident:

Provocative actions, such as the hanging of Hungarian flags at Romanian institutions or the alleged harassment of Hungarian speakers, could be used to justify Hungarian rhetoric about increased “protection.

Russia’s influence:

exploiting divisions to undermine NATO and EU unity Moscow benefits enormously from the deterioration of relations between Hungary and Romania, according to the Robert Lansing Institute’s analysis:

Divisions and weakening NATO. Both countries are important members of NATO on its eastern flank. Increasing bilateral hostility would disrupt joint defense planning and regional military coordination, especially with regard to security in the Black Sea and Ukraine.

Distraction and EU fragmentation:

Hungary can act as a Trojan horse for Russia in EU policymaking. By challenging Romania, Budapest can block collective action on sanctions, defense coordination or energy policy.

A domino effect in the Balkans:

Russia could use Hungarian irredentism as a model to encourage similar separatist sentiments in Moldova (Gagauzia, Transnistria), Serbia (Republika Srpska in Bosnia) and even Slovakia, leading to further destabilization of Central and Eastern Europe.

Imitating Hybrid Warfare:

Hungary could copy aspects of Russia’s strategy in Crimea – dividing citizenship, manipulating the media and exploiting cultural grievances – normalizing “gray zone” strategies within NATO borders.

Conclusions and Strategic Recommendations:

Viktor Orbán’s speech in Transylvania is more than just an ethnic rant – it may well be the first salvo in a protracted hybrid campaign. Romania and its allies should recognize this pattern and prepare accordingly, the Robert Lansing Institute believes:

Strengthening internal resilience:

strengthening citizenship education, minority integration and media literacy in Transylvania.

Diplomatic engagement:

increasing bilateral pressure and monitoring at the European level on minority policy and Hungary’s cross-border influence.

Monitoring Hybrid Indicators:

intelligence services should monitor Hungarian funding, dual nationality trends and possible disinformation campaigns.

NATO Awareness:

encourage joint threat assessments by NATO, Hungary and Romania to prevent mutual suspicions from escalating into a crisis.

Countering Russian exploitation:

ensure that Russia cannot exploit dissent within NATO through cyber, diplomatic or proxy channels.

Orbán’s statements in Romania reflect an evolving strategy that combines nationalism, identity politics and geopolitical maneuvering. Although  this development is still within the realm of soft power, it rings alarm bells for regional stability. It is essential that Romania – and the Euro-Atlantic community as a whole – view Orbán’s cultural diplomacy not as a harmless declaration of identity, but as a potentially destabilizing factor on a multipolar, hybrid battlefield.

this development is still within the realm of soft power, it rings alarm bells for regional stability. It is essential that Romania – and the Euro-Atlantic community as a whole – view Orbán’s cultural diplomacy not as a harmless declaration of identity, but as a potentially destabilizing factor on a multipolar, hybrid battlefield.

According to the Robert Lansing Institute. Robert Lansing was an American lawyer and diplomat who was an adviser to the State Department at the outbreak of World War I and then Secretary of State under President Woodrow Wilson from 1915 to 1920. A conservative, pro-business Democrat, he was a staunch supporter of democracy and the role of the United States in establishing international law. He was an outspoken opponent of German autocracy and Russian Bolshevism. The institute that bears his name promotes an informed understanding of global challenges that pose threats to democratic societies, political affairs and diplomacy through reliable research, trusted analysis and innovative teaching. “We are committed to enhancing Euro-Atlantic capacity to counter hybrid operations and respond to emerging threats to achieve strategic goals.

President Nicuşor Dan comes up with paradigm shift

“Unfortunately, the economic aspect of our foreign activities is extremely weak right now. I have already spoken several times with the minister (of foreign affairs, ed.) about how to address this aspect,” the president said recently at his first press conference after the government announced the financial package to restore the budget deficit.

President Nicuşor Dan comes with a paradigm shift: my foreign visits will have a strong economic component. President Nicuşor Dan left on July 18 for an official visit to Germany, followed, a few days later, by another visit to Austria.

Chisinau

Before his visits mentioned above, he made his first official visit to Chisinau in Moldova which was more symbolic in nature because there was an aid effort and he wanted to indicate to Maia Sandu that it was permanent.

Berlin

Furthermore, President Nicuşor Dan arrived in Berlin on July 18, where he was received with all official honors by Bundespresident Frans Walter Steinmeijer and Bundeskanzler Merz, among others.

The big news to get straight to the point was that in the context of the present meeting, it was announced that German arms manufacturer Rheinmetall has announced that it will produce Lynx armored vehicles in Romania, at Automecanica Mediaș. The company is thus expanding its

The big news to get straight to the point was that in the context of the present meeting, it was announced that German arms manufacturer Rheinmetall has announced that it will produce Lynx armored vehicles in Romania, at Automecanica Mediaș. The company is thus expanding its

presence in the country and its role as a manufacturer and supplier to the Romanian military from. A new Rheinmetall Center of Excellence in Romania will focus on transferring technical know-how to the local workforce. Equipped with advanced simulators and practical training programs, the center will provide expertise in the operation and support of systems such as the Lynx vehicle. Rheinmetall had already established an extensive local production network in Romania, which includes both its own companies in the country and new partnerships with Romanian companies. This expands both the technology company’s presence in Romania and its status as a leading manufacturer and service provider for the Romanian armed forces. Providing advanced turnkey solutions for the production of infantry combat vehicles, ammunition and powder, as well as state-of-the-art training services, should strengthen Romania’s defense industry in the long term. The network includes Rheinmetall Automecanica, other local Rheinmetall activities and a new center of expertise for training and continuing education. A cornerstone of Rheinmetall’s localization efforts is cooperation with key Romanian companies, including Uzina Automecanica Moreni, Interactive Software SRL and MarcTel-SIT. These partnerships will promote local sourcing and assembly processes and foster the integration of Romanian expertise into the production chain. The initiative focuses on the local production of the Lynx infantry fighting vehicle at Rheinmetall Automecanica (Mediaș, ed.), with a robust supply chain and reduced reliance on  external suppliers. Rheinmetall Munitions Romania will produce medium-caliber ammunition for infantry combat vehicles and air defense, while Victoria Explosive Powder Factory (Pirochim Victoria, ed.) will produce propellants, for which Rheinmetall is providing expertise and technology for a propylene plant. Local service facilities will be responsible for ongoing maintenance and support of the military equipment, ensuring operational availability at all times. Rheinmetall’s Center of Excellence in Romania ensures the transfer of crucial knowledge to the local workforce. Equipped with state-of-the-art simulators and extensive training programs, the center will provide Romanian employees with practical experience and technical expertise in the operation, maintenance and development of advanced defense technologies, particularly with regard to the Lynx infantry combat vehicle. Rheinmetall’s investment in local production will contribute significantly to the Romanian economy and create hundreds of jobs in various sectors, including manufacturing, engineering and technical services. Cooperation with Romanian companies will also boost local supply chains, create additional business opportunities and promote industrial growth. “With this strategic initiative, Rheinmetall

external suppliers. Rheinmetall Munitions Romania will produce medium-caliber ammunition for infantry combat vehicles and air defense, while Victoria Explosive Powder Factory (Pirochim Victoria, ed.) will produce propellants, for which Rheinmetall is providing expertise and technology for a propylene plant. Local service facilities will be responsible for ongoing maintenance and support of the military equipment, ensuring operational availability at all times. Rheinmetall’s Center of Excellence in Romania ensures the transfer of crucial knowledge to the local workforce. Equipped with state-of-the-art simulators and extensive training programs, the center will provide Romanian employees with practical experience and technical expertise in the operation, maintenance and development of advanced defense technologies, particularly with regard to the Lynx infantry combat vehicle. Rheinmetall’s investment in local production will contribute significantly to the Romanian economy and create hundreds of jobs in various sectors, including manufacturing, engineering and technical services. Cooperation with Romanian companies will also boost local supply chains, create additional business opportunities and promote industrial growth. “With this strategic initiative, Rheinmetall  Automecanica not only improves Romania’s defense capabilities, but also lays the foundation for a sustainable and independent defense industry. By integrating advanced technologies and professional training, Rheinmetall ensures the future viability of the Romanian defense sector while expanding its own global production network,” the press release said. Nicușor Dan: We are at the stage of exploring the partnerships we can enter into. President Nicușor Dan, during his visit to Berlin this month, announced advanced negotiations between German arms manufacturer Rheinmetall and Romarm’s Mediaș factory on a joint venture in the field of ammunition. He added that Romania is at the stage of exploring what partnerships it can enter into. “Moreover, for the SAFE program, we are still in the phase where European Union member states propose joint projects. There is a first deadline at the end of this month when the countries can somehow propose the financial part and, by the middle of next year, enter into concrete partnerships. So we are in the phase where we are exploring the possible other partnerships,” Nicușor Dan added.

Automecanica not only improves Romania’s defense capabilities, but also lays the foundation for a sustainable and independent defense industry. By integrating advanced technologies and professional training, Rheinmetall ensures the future viability of the Romanian defense sector while expanding its own global production network,” the press release said. Nicușor Dan: We are at the stage of exploring the partnerships we can enter into. President Nicușor Dan, during his visit to Berlin this month, announced advanced negotiations between German arms manufacturer Rheinmetall and Romarm’s Mediaș factory on a joint venture in the field of ammunition. He added that Romania is at the stage of exploring what partnerships it can enter into. “Moreover, for the SAFE program, we are still in the phase where European Union member states propose joint projects. There is a first deadline at the end of this month when the countries can somehow propose the financial part and, by the middle of next year, enter into concrete partnerships. So we are in the phase where we are exploring the possible other partnerships,” Nicușor Dan added.

Vienna and Salzburg

The President of Romania paid an official visit to Austria on July 25-26, in Vienna and Salzburg, at the invitation of Federal President Alexander Van der Bellen. Nicușor Dan was accompanied by his wife and two children, who participated in several official meetings.

Worth mentioning is the son Antim 2 years old of Nicușor Dan (did not follow protocol) and started a conversation with the journalists present about their photographic equipment because he also owned it at home.

Worth mentioning is the son Antim 2 years old of Nicușor Dan (did not follow protocol) and started a conversation with the journalists present about their photographic equipment because he also owned it at home.

Whether the Austrian president is a Dutchman given his name is also a recurring question. Yes, but then you have to go back to 1701.

The business part of this meeting revolves around the almost rhetorical question” Will Romania soon become the EU’s largest natural gas producer?”

After a long battle, Austrian energy group OMV has given the green light for a billion-dollar project in the Black Sea. The company is investing four billion euros over the next few years in the development of the deep-water project, together with Romanian state gas producer Romgaz. The costs will be shared equally, OMV and its Romanian subsidiary Petrom announced today.

The project, known as “Neptun Deep,” is one of the most important natural gas reserves in the European Union (EU) and should make Romania, Austria and also Moldova less dependent on Russian gas supplies. The first gas delivery is expected in 2027.