Newsletter July 2025

Romania is off to a flying start!

Presidential elections were held in Romania on May 4 and 18, 2025. A presidential election had already taken place in 2024, but the second round was canceled due to alleged Russian interference in the election after Călin Georgescu received the most votes. Furthermore, in May 2025, Nicuşor Dan  was elected President of Romania without any significant dissenting votes. He immediately showed decisiveness and managed to form a coalition consisting of the parties the PSD, PNL, USR and UDMR/RMDSZ.

was elected President of Romania without any significant dissenting votes. He immediately showed decisiveness and managed to form a coalition consisting of the parties the PSD, PNL, USR and UDMR/RMDSZ.

Liberal Prime Minister Ilie Bolojan has won the confidence of parliament. Now to work with this coalition that wants to reduce the EU’s highest budget deficit to prevent the country from losing its credit rating. In fighting the deficit, the preference is for cuts in government and not in raising taxes which does not rule out more efficiency in public spending. With the swearing in on June 23, the new Romanian government was established.

After that, President Nicuşor Dan had to travel directly to the NATO summit in The Hague where he had a separate meeting with President Trump talking about the tense situation around the Black Sea. Where the US has an American base at Mihail Kogalnicaniceanu located near the Black Sea. The base is set to expand to 50,000 troops. After the NATO summit, the president still went to Brussels where he spoke with Ursula von der Leyen about Romania’s  budget woes. In short, in a relatively short time, he put Romanian interests well on the map.

budget woes. In short, in a relatively short time, he put Romanian interests well on the map.

The DRN wishes the Romanian government much wisdom and to speak in Formula 1 Terms the safety cars are in starting position. And certainly also perseverance because with changes, one cannot make an omelette without breaking eggshells” So give the new coalition a chance to prove itself.

Honorary Consuls – Good relations between two states

To summarize briefly An honorary consul is a person who represents a foreign government in a specific region or country. He/she helps promote bilateral relations, supports citizens of the represented country and facilitates trade and cultural exchanges. In our country, these are Ben Jager as consul general assisted by his colleagues Andrea Teunissen-Oprea, Kees Kuijken and Reinder Schaap. Their motto is service. They are happy to explain it to you on their trilingual website www.consulate-romania.nl

Honorary consuls are an important link between the Netherlands and relevant countries, including by promoting trade and investment and assisting Dutch citizens abroad.

Honorary consuls are an important link between the Netherlands and relevant countries, including by promoting trade and investment and assisting Dutch citizens abroad.

For consular services such as applying for travel documents, visas or residence permits, contact the embassy or through netherlandsworldwide.nl.

Their Dutch counterparts in Romania are: Wouter Reijers in Cluj-Napoca, Marius Popa in Timisoara, DanComan in Constanta and Amalia Georgescu in Iași

Agricultural sector

Highly successful trade mission Dutch goat farming to Romania

For a delegation of 8 leading goat farmers and suppliers from the Netherlands, Agriprogress organized a very successful trade mission to Romania from June 17-21. The mission that started in Bucharest and ended in Cluj-Napoca consisted of an intensive program with daytime visits to dairies, livestock trade, to smaller and larger goat, dairy and sheep farms and to locations in sales. In the evening at dinner there were talks with owners of various farms. This in beautiful locations ranging from the middle of the Carpathians to the heart of downtown Bucharest.

Romania currently has about 1.4 million dairy goats, average production is about 1.5 liters on 210 days. In the EU, Romania is the third country after Spain and Greece in terms of goat numbers. The number of Western-style farms can be counted on one hand, most of them are still farms with less than 50 goats, most of which are now found in the East (due to location near the port of Constanta, goats for the Middle East.) and South of Romania. Production is declining and will continue to decline in the future, due to lack of succession, while demand is growing. There is a severe shortage of goat milk in Romania, especially during the winter period. There is a lack of management knowledge and experience, which has led to several disappointments in developing larger goat farms (diseases). This creates opportunities for Western entrepreneurs who do have this. The fact that there are opportunities for good entrepreneurs was also demonstrated during the trip; a number of successful companies were visited that are successfully marketing their products internationally.

A fascinating trip with the sharing of many experiences (also among themselves): ranging from a bear in the tree to the taste of top products with the table on the feed fence to a visit to the Soviet bar in Cluj…. The plan is to organize a second trip in September given the interest.

Learn more: Agriprogress, e. pieter@agriprogress.com, m. 0653782889.

How we grow the Romanian food industry

The “restaurant” on the first floor of the building is increasing its sales. Ready-to-eat products, a market that has tripled over the past decade, continue to attract consumers. “The growth opportunities for this segment are great.”

Ready-to-eat meals, or meals that can only be reheated and consumed, saw a 5% increase in volume last year, after stagnating in 2023, according to retail audit data from NielsenIQ. At the same time, products such as salads, meatballs, sandwiches and hummus rose only 8% in price in 2024, compared with the 15% price increase of these products the year before, the same source said.

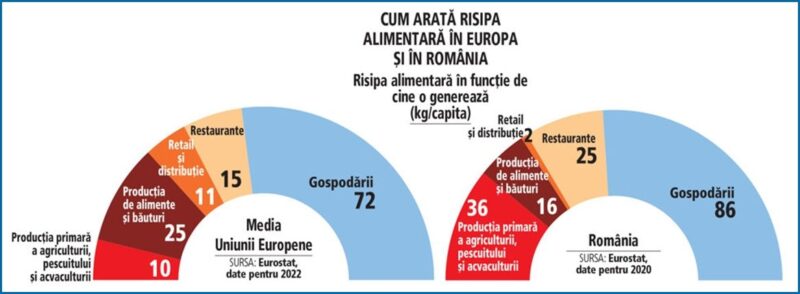

How Romania’s food industry can grow. Food waste and loss, a business opportunity, especially for small entrepreneurs. How can food waste be used efficiently, for example in the form of compost, snacks or thermal insulation panels?

How Romania’s food industry can grow. Food waste and loss, a business opportunity, especially for small entrepreneurs. How can food waste be used efficiently, for example in the form of compost, snacks or thermal insulation panels?

According to the latest Eurostat data, Romania wastes about 166 kilograms per capita annually, higher than the European Union average of 132 kilograms per capita.

The product that is causing a furor in Romania; more and more Romanians are buying it to save time and solve the food problem quickly.

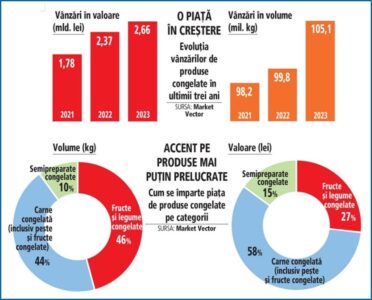

Last year, each Romanian bought an average of 6 kilograms of frozen foods, whether meat, vegetables, fruits or semi-finished products. This market segment has experienced a positive development in recent years, in line with general food consumption.

Last year, each Romanian bought an average of 6 kilograms of frozen foods, whether meat, vegetables, fruits or semi-finished products. This market segment has experienced a positive development in recent years, in line with general food consumption.

How can we grow Romania’s food industry? An X-ray of the fish market, a category looking for more consumption: Romania is at the bottom of the ranking of largest fish producers in Europe, leaving us with an annual deficit of 300 million euros.

Fish consumption in Romania is almost three times lower than the European average. This makes the sector less attractive than meat or semi-finished products. This, combined with a lack of organization in the sector, leads you to find fish on the market from Bulgaria rather than Romania.

How the Romanian food industry can grow. The food industry is drifting without a clear strategy. In the land of “support” and “we will invest,” an industry with at least twice the potential is going nowhere. What should a real plan look like?”

Romania will ensure its food security and become a major player in European and international trade in agricultural products and foodstuffs.” This is one of the objectives of a 2020-2030 strategy developed by the Ministry of Agriculture, which can be found on the institution’s website.

How Romania’s food industry can grow. Germany, the Netherlands and France dominate food exports to the EU. Is the Middle East an opportunity for Romania? “As of 2020, we have no export strategy.”

How Romania’s food industry can grow. Germany, the Netherlands and France dominate food exports to the EU. Is the Middle East an opportunity for Romania? “As of 2020, we have no export strategy.”

Romania is not among the “elite” of food exporters in the European Union, but it manages to maintain its agri-food trade balance through grain exports.

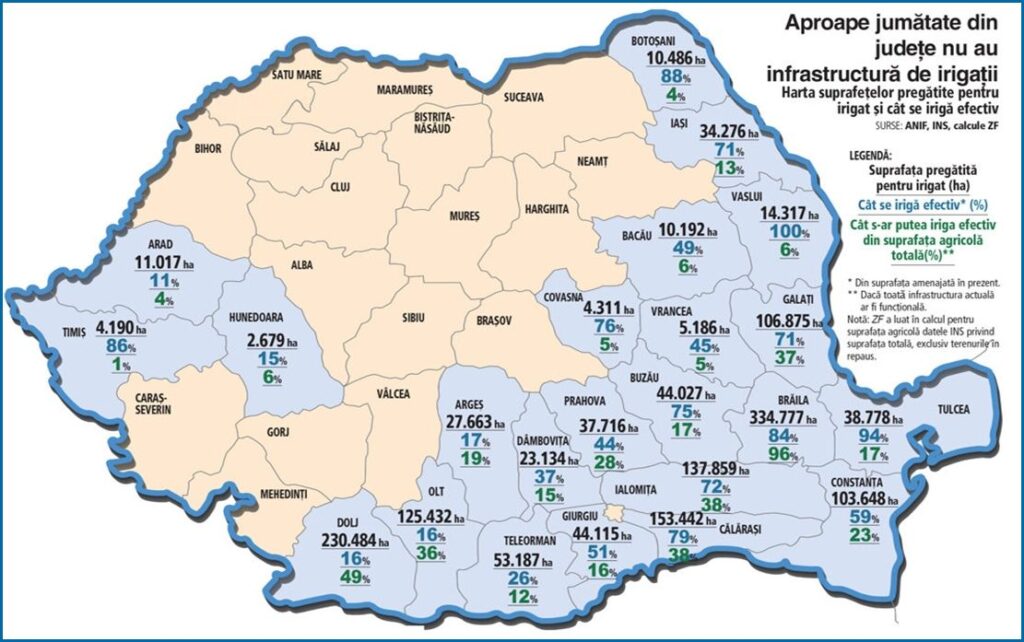

How we grow Romania’s food industry. The reality behind the numbers in a year of record temperatures: nearly half of the provinces do not have irrigation infrastructure, and in others it does not even cover a quarter of needs. “Without irrigation, agriculture is at risk,” he said.

The year 2024 brought drought, but also prolonged record temperatures, making Romania’s production of cereals, vegetables, potatoes, as well as fodder, once again dependent on the weather and many farmers once again waiting for compensation from the state. This is because almost 20 districts of the country lack irrigation infrastructure and in many areas where it does function, it is not sufficient to cover all farms.

How can we grow the Romanian food industry or when can we finally see Romania as a driving force in the European food industry? We already see holdings, but we need to build integrated companies to push the boundaries.

The Romanian food industry is taking tentative steps toward new horizons, as evidenced by several local companies that have established holdings and are looking to conquer new markets. The best example in the region is Poland, which today has a food industry that generates four times as much revenue as the Romanian one, with twice as many employees.

Transportation and Logistics Sector

E. van Wijk Group acquires Steenbergen Transport

Steenbergen Transport has been acquired by the E. van Wijk Group. The acquisition means substantial growth for Van Wijk to a total of 1,200 people and a fleet of 550 vehicles.

E.van Wijk (l) and J.W. Quist continue together. Photo: E. van Wijk

Steenbergen in Bodegraven will continue to operate as a separate entity with the existing management team, led by Jaap Quist. The company has 300 employees and a fleet of 180 vehicles, spread across locations in the Netherlands and Belgium. The acquisition guarantees “optimal delivery in the Benelux,” Van Wijk said. No acquisition amount was disclosed.

Scale

According to CEO Ewout van Wijk, the “addition of Steenbergen is a means to remain future-proof in a market that calls for economies of scale and network strengthening. The cultures of both companies also fit well together, according to Van Wijk. Steenbergen is a family business, as is Van Wijk, where “continuity and stewardship” are key, according to the company.

E.van Wijk has acquired several transport companies in recent years, including Exalto of Brakel earlier this year. The acquisition of Steenbergen is expected to be completed in the third quarter, following approval from the Authority Consumer and Market.

Sector IT and Automotive

Romania, leader in automotive innovation

Indian IT giant TCS, part of Tata Group, is expanding with an engineering center in our country.

Romania is at the forefront of Tata Consultancy Services’ (TCS) European expansion with the opening of a new engineering center specifically for the software-defined vehicle (SDV) sector. In addition to this strategic investment in Romania, TCS has opened two automotive distribution centers in Germany, in Munich and Villingen-Schwenningen.

Romania is at the forefront of Tata Consultancy Services’ (TCS) European expansion with the opening of a new engineering center specifically for the software-defined vehicle (SDV) sector. In addition to this strategic investment in Romania, TCS has opened two automotive distribution centers in Germany, in Munich and Villingen-Schwenningen.

According to the Indian IT giant, founded in 1968, these new facilities represent a strategic effort to support its international automotive customers in developing next-generation mobility solutions.

TCS is part of the Tata Group, an Indian conglomerate with nearly 100 companies in sectors such as automobiles, steel, energy, retail, tourism, telecommunications and media. In the automotive sector, it owns global brands such as Jaguar Land Rover and Tata Motors. TCS generated consolidated revenue of $30 billion in the fiscal year ending March 31, 2025 and has more than 600,000 employees worldwide

Financial Economic Developments

What foreign investors with exposure to Romania are saying about the budget package.

Kathleen Brooks, XTB London: It poses a political risk, it could be unpopular, for example, and challenge the coalition government, but from an economic and financial perspective this is good news and Romania is on the right track.

Kathleen Brooks, XTB London: It poses a political risk, it could be unpopular, for example, and challenge the coalition government, but from an economic and financial perspective this is good news and Romania is on the right track.

Kathleen Brooks, research director, XTB

- The government wants to adopt a budget quickly to reduce the deficit and maintain creditworthiness, ZF writes.

- Raising VAT and taxes will reduce bond yields and prevent credit downgrades.

- The measures may create political tensions but are necessary for economic stability and control of public spending.

To avoid a credit downgrade, the government must take measures such as increasing VAT and certain taxes. This has led to a decline in government bond yields, despite market expectations, ZF said .

If the budget is passed and the measures are implemented quickly, Romania has a chance to avoid relegation this year.

What does Kathleen Brooks, research director at XTB, say?

The Romanian government is trying to quickly pass a budget through parliament to reduce the budget deficit. This is necessary to comply with EU deficit rules and to protect the country’s investment-grade credit rating. Maintaining this rating is essential for the government because it allows access to a wider range of investors and keeps borrowing costs as low as possible. If the government wants to avoid a downgrade of its credit rating, measures such as raising VAT and some taxes are crucial. Bond yields have fallen as a result of this plan, as investors open up to the prospect of a lower budget deficit.

The market has been waiting for these revenue-generating measures for a long time, causing Romanian government bonds to hit a months-long high and interest rates to fall. If this budget is passed and the measures are implemented quickly, Romania could have a chance to avoid a credit rating downgrade later this year. In 2025, there is a new focus on highly indebted countries, such as the US and the UK, which should follow Romania’s example and cut government spending. Now is not a good time to be a highly indebted country with a large budget deficit. Romania is aware of the problem and if it wants to avoid a sudden increase in borrowing costs or a fiscal crisis, it should control public spending, ” she said.

Agrifood Trade Mission to Romania and “Dutch Day at Indraga Fair”

We as LAN Team of the Dutch Embassy in Bucharest invite you as a potential candidate to participate in our Agrifood Trade Mission to Romania from October 30 to 31, 2025 on the sidelines of the largest agrifood fair in the country: called INDRAGA. As Dutch companies, you have the opportunity to enter and/or expand your position on the Romanian market.

Livestock and horticulture (covered crops/greenhouses) are among the most promising sectors. With its large agricultural area, Romania needs proper fertilization on the one hand, and on the other hand, it wants to make better use of its arable crops by developing a stronger livestock sector. Also, given the demand for year-round fruits and vegetables in Romania – which is currently met by high imports – the development of a professional efficient and resilient cover crop sector has become a priority.

We strongly believe that the Dutch agri-food complex is well positioned to contribute to these

Mission objectives

- Provide Dutch companies with first-hand information about opportunities and market developments in this region with great potential in the EU.

- Promote Dutch technological innovations suitable for the Romanian context. Main focus areas are livestock and protected horticulture

Programma

- Wednesday, Oct. 29 Arrival in Bucharest

- Thursday, October 30

Breakfast Meeting

Conference / Visit Indraga Fair

Matchmaking/Networking event (Dutch business in Romania, Romanian companies,organizations and governments - Friday, Oct. 31, field visits (2 separate program,s: livestock development andProtected horticulture).

- Saturday, November 1 tRETURN

Option 1: Departure at 06:00 a.m. Arrival 07:50 a.m.

Option 2: Two later flights also available

The mission is accompanied by representative(s) from the Ministry of LVVN

Cost

Only the first 10 registered companies can take advantage of the participation package free of charge. The package includes matchmaking,a conference, a networking event and joint working visits. From 11 companies onwards, costs will be charged. Participants are responsible for their own costs, with the exception of those mentioned above.

Registration

Would you like to participate in this trade mission? Please contact us atBKR=LVVN@minbuza.nl

Please note registration does not guarantee participation

We hope to welcome you!

Sophie Neve has served as LVVN Council from the Dutch Embassy in Bucharest since August 2023.

Her working area includes Romania, Bulgaria and Moldova.

Romanian wellness sector experiences increasing growth

The wellness sector is a broad market that focuses on improving people’s health and well-being through various products and services. This sector includes everything from traditional saunas and spas to fitness, nutrition, stress management, relaxation and beauty treatments. The sector has grown significantly in recent years and includes a wide range of companies and professionals dealing with physical, mental and emotional health.

The wellness sector is a broad market that focuses on improving people’s health and well-being through various products and services. This sector includes everything from traditional saunas and spas to fitness, nutrition, stress management, relaxation and beauty treatments. The sector has grown significantly in recent years and includes a wide range of companies and professionals dealing with physical, mental and emotional health.

Until recently in the Netherlands it fell into the category of “unknown makes unloved” But now that the new government is faced with a large budget deficit, people are aware that tourism activities are a welcome source of income they are seeing activities aimed at foreign tourism everywhere. Our country has hardly discovered Romania in this sense. New hotel chains appear everywhere and golf courses are also being built.

But the wellness sector in particular stands out because the country has the most more than one-third (160) of the mineral and thermal springs in Europe. The natural thermal baths give relief from many medical discomforts and diseases including rheumatism, endocrine, kidney, liver, respiratory, heart, stomach and nerve diseases as well as metabolic, metabolic and  gynecological discomforts. The natural factors are supplemented – under constant medical supervision – with physiotherapy, acupuncture, electrotherapy and medicines. Romania’s main spas are: Mangalia , Neptun, Eforie Nord , Covasna, Slanic Moldova, Vatra Dornei, Borsec, Herculane,Oradea, Bucharest, Buzias, Sovata , Bazna , Ocna Sibiului, Baile Felix , Tusnad, Calimanesti and Govora.

gynecological discomforts. The natural factors are supplemented – under constant medical supervision – with physiotherapy, acupuncture, electrotherapy and medicines. Romania’s main spas are: Mangalia , Neptun, Eforie Nord , Covasna, Slanic Moldova, Vatra Dornei, Borsec, Herculane,Oradea, Bucharest, Buzias, Sovata , Bazna , Ocna Sibiului, Baile Felix , Tusnad, Calimanesti and Govora.

Finally, we would like to draw your attention to the product GEROVITAL H3 ANTI-AGING. The Gerovital brand was developed in 1952 by world-renowned Romanian rejuvenation professor Prof. Dr. Ana Aslan. She was director of the National Institute of Gerontology and Geriatrics in Romania. She was the first to use procaine as an ingredient in anti-aging products and developed a preparation to inhibit the natural aging process of the body’s cells as much as possible.

Michelle Obama is coming to Romania on Sept. 17 and 18.

Michelle Obama, former first lady of the United States and one of the most influential women in the world,

is coming to Romania on Sept. 17 and 18.

She is participating in an event on business and technology. The agenda includes topics related to defense and cybersecurity, green transformation, digitalization, the future of cities, global economy, health and leadership. Michelle Obama is a best-selling author and podcaster, as well as a television program producer.

Barack Hussein Obama II was the 44th president of the United States and the first African-American elected to the position.

He held the position for two consecutive terms, between 2009 and 2017.

To participate: contact@impactbucharest.com

Purchasing power analysis

Romania was the second cheapest country in the EU by 2024

Romania was the second cheapest country in the EU by consumer price level in 2024, but purchasing power remained low compared to the European average.

Romania ranked penultimate within the European Union in terms of the price level of consumer goods and services for the population in 2024, according to data published by Eurostat and communicated Friday by the National Institute of Statistics (INS).

Romania ranked penultimate within the European Union in terms of the price level of consumer goods and services for the population in 2024, according to data published by Eurostat and communicated Friday by the National Institute of Statistics (INS).

The analysis shows that the overall price level for consumer goods and services in final household consumption in Romania is 36% below the EU average. This puts the country in second place in the ranking of cheapest countries within the EU bloc, after Bulgaria, where prices were 40% lower than the European average.

According to Eurostat’s methodology, price indices indicate how many units of the same currency are needed to buy an identical volume of goods and services in different countries. For example, if the European average is 100 euros, the same basket costs 143 euros in Denmark – the country with the highest prices – and only 60 euros in Bulgaria.

In Romania, the average cost of a volume of goods and services was 64 euros.

Besides Denmark, Ireland (38% above the EU average), Luxembourg (33% above the EU average) and Finland (24% above the EU average) are the EU countries where the cost of living is significantly higher.

While the low price level may suggest that the city is more accessible, in reality it also reflects lower purchasing power, due to lower average incomes compared to those in Western Europe.

The INS data also show that Romania is the Member State with the lowest prices for the “Food and non-alcoholic beverages” category, with only 76% of the EU average. Also for products and services in the “Recreation and culture” category, Romania records the lowest price level in the entire Union (67%), followed by Bulgaria (68%).

In other areas, such as clothing, housing and transportation, Romania is not the cheapest country, but it is still at the bottom of the rankings.

On the other side is Denmark, the most expensive country in the Union, with prices 43% above the EU average for final consumption, followed by Ireland (plus 38%), Luxembourg (plus 33%) and Finland (plus 24%).

Ireland ranks first in terms of costs for alcoholic beverages and tobacco (205%) and home maintenance (187%).

In terms of GDP per capita adjusted for purchasing power parity, Romania has a value of 78% of the European Union average, slightly higher than Hungary and Croatia (both at 77%). Bulgaria is still at the bottom of the ranking, with a GDP per capita of only 66% of the EU average.

78% of the European Union average, slightly higher than Hungary and Croatia (both at 77%). Bulgaria is still at the bottom of the ranking, with a GDP per capita of only 66% of the EU average.

In contrast, Luxembourg continues to lead the top European position, with a GDP per capita more than 2.4 times higher than the EU average (242%). This situation is partly explained by the fact that a large number of foreign citizens have an increasing share of the country’s total labor force and contribute to the realization of GDP, but are not part of the local population.

Data on price and final consumption comparability were calculated by Eurostat in June 2025 and are based on a detailed analysis of prices in 36 European countries.

If you see a gap as an opportunity

Recently I read a column by Peter Middendorp about a supposed gap between urban and rural areas in the Netherlands. Research by the Netherlands Bureau for Economic Policy Analysis allegedly showed that there is little or no such gap.

Nevertheless, I think the coming decades will show major shifts. For example, as an entrepreneur under the current circumstances, I would not invest quickly in intensive livestock and intensive dairy farming in the Netherlands. It seems fairly clear to me that there will be climate-related blows there. There is too little space.

In my never ending need to compare Holland and Romania, I see very big changes in the countryside in Romania as well. The distance between city and countryside in Romania feels more like a ravine than a chasm. Whereas the cities are rapidly developing culturally and financially – toward being equal to or more enjoyable than many Western European cities – the situation in the countryside is just the opposite.

Rural Romania is depopulating. Young people are moving away, the level of services is declining, and the average age of those left behind is rising. Basic services such as sewage, water supply and gas are often lacking. People still burn wood. But: internet is top notch.

In some places, this leads to curious price trends. For example, there is a lot of vacancy and property prices are dramatically low. A house deep in the countryside costs €2000 and in some villages the price of land within the built-up area is around €0.50 per m² – much lower than the price of land outside it.

At the same time, you see that farmers in the Netherlands are shrinking, while in Romania 9 million hectares of fertile land await knowledge and investment. You could almost say that the space in Romania compensates for our shrinkage. With a little buyout money you stomp out a beautiful farm in Romania, which would benefit local employment. After all, there is plenty of space.

Somewhat less visible, but at least as important: the same development is also taking place in the labor market. Young Romanians are flocking to the cities en masse, where they attend training courses, gain modern work experience and develop into highly qualified professionals. Especially in cities such as Cluj, Iași and Craiova, a new generation of tech specialists is emerging who, in terms of talent, work ethic and ambition, can match – and in some cases even surpass – Western colleagues.

It is extraordinary to see how within Europe such opposing developments can reinforce each other. Whereas in the Netherlands space and availability are becoming increasingly limited – both physically and in the labor market – in Romania momentum is being created. Those who look beyond clichés do not see a gap, but an opportunity. For farmers and for companies.

Disclaimer

The newsletter of the Dutch Romanian Network is compiled with great care. The Dutch Romanian Network cannot accept any liability for a possible inaccuracy and/or incompleteness of the information provided herein, nor can any rights be derived from the content of the newsletter. The articles do not necessarily reflect the opinion of the board.