Newsletter April-May 2023

We will continue!

Once our well-known board member Natacha Hart quoted the writer Louis Couperus “Of (old) men, and things, that pass away” and not knowing that it would take on a prophetic meaning. Unfortunately, she was forced to resign her position as

Once our well-known board member Natacha Hart quoted the writer Louis Couperus “Of (old) men, and things, that pass away” and not knowing that it would take on a prophetic meaning. Unfortunately, she was forced to resign her position as  treasurer and secretary as of Jan. 1 due to long-term effects of Long Covid. As a result, our service was delayed, for which we apologize.

treasurer and secretary as of Jan. 1 due to long-term effects of Long Covid. As a result, our service was delayed, for which we apologize.

Meanwhile, we got our internal organization back on track where we were inspired by Ramses Shaffy “Wij zal doorgaan”.

It was also a so-called wake-up call for us to focus even more on individual relationship management and to focus partly on Romanian entrepreneurs who want to invest in the Netherlands. It will generate a synergy that adds value for both groups. Of course, networking meetings will also take place again.

In short, you will hear from us starting with this newsletter from now on in a trilingual version.

Education Sector

Blog: Post Craiova – International Students

In the Netherlands, there is currently much ado about international students in higher education. There are too many of them, the workload for teachers is too high, housing is a major problem and the quality of (Dutch-speaking) university education would be at stake. International students are a revenue model for universities, but the government is now considering all kinds of measures to limit the influx. For a different perspective, I would like to take you on a virtual journey to a medium-sized provincial town in Romania.

Our subject is called Camelia. She is 19 and a talented student who finished high school with high grades. Her father works (quite coincidentally) for a large Dutch paint manufacturer as a sales team leader, mothers works in a store in Craiova. Camelia is currently studying literature at the University of Groningen. This is possible, thanks to the efforts of her parents, whose size is hard to imagine in the Netherlands.

Family relationships are just a bit different in Romania, in the sense that it is perfectly normal for parents to sacrifice just about their entire working lives for a better future for their children. It is no different in the case of Camelia. Her parents spend (roughly) over half of their combined disposable income on college tuition, room rent and pocket money. And prove them wrong. With a degree from a Dutch university in her pocket and with the language skills gained in four years abroad, Camelia will soon be able to get a good job and make a pleasant living almost anywhere in the world. Her parents’ investments catapulted her future prospects to stratospheric heights by Romanian standards.

My choice of Romania in this example is related to my own story and knowledge of the situation. However, this will be just as true for any other country on the periphery of Europe, home to people whose children study abroad. Isn’t this also about the pinnacle of the European idea of inclusion? Move freely by opening borders and providing access to superior educational facilities for intelligent fellow Europeans. This undeniably leads to social, geographic and economic mobility with an unprecedented impact on families.

In our raked-in Netherlands, opinions about the large number of international students are somewhat less rosy. I do find that extraordinary, because even if you reason from a purely Dutch perspective, isn’t it precisely these motivated, highly educated employees that our society is crying out for? The sacrifices made by the parents of international students and the impact on many families are underestimated, in my opinion. As are the positive long-term effects of well-educated fellow European citizens on the economy and labor market.

Han in ‘t Veld

Logistics and Transportation Sector

The transport and logistics revolution in Romania: what will change in 2023?

In the context of a constantly developing economy, transportation and logistics are two key areas that have a significant impact on Romania’s economic growth and competitiveness in the international market. In the year 2023, the transportation and logistics sector faces a series of changes and challenges, as well as significant opportunities for growth and innovation.

One of the most important changes in this area is related to the impact of the war in Ukraine on road and rail transport in Romania. The blocking of routes and railroads to Ukraine increased freight traffic on other routes, leading to an increase in demand for transportation and logistics services in Romania. At the same time, it stressed the need to develop road and rail transport infrastructure to meet increasing demand.

Another important aspect relates to maritime transport, where the port of Constanța plays a key role in transporting goods to and from Eastern Europe. In recent years, significant investments have been made to modernize and expand the port to meet the growing demand for transportation and logistics services. Efforts are also being made to develop intermodal transport services, which allow more efficient integration of different modes of transport.

In terms of changes in freight transportation, there is a significant increase in the use of next-generation technologies such as the Internet of Things (IoT), artificial intelligence (AI) and blockchain. These technologies enable more efficient and accurate management of supply chains, leading to a reduction in costs and an improvement in the services provided.

In the year 2022, the transportation and logistics sector in Romania was affected by the COVID-19 pandemic, which had a significant impact on the industry. However, the sector began to recover in 2023 with the gradual return of demand for transportation and logistics services. According to a study by the market research firm Eurostat, road transport remained the most popular mode of goods transport in Romania in the period 2022-2023, with an 82% share. However, rail and sea transport experienced significant growth, with 6.2% and 4.8% growth, respectively, over the previous year.

The use of technology has also increased in the transportation and logistics sector in Romania, a trend that will continue to grow in the coming years. Telematics and fleet tracking systems have become increasingly important to track and optimize the flow of goods and reduce costs.

To cope with these changes and take advantage of growth opportunities in the transportation and logistics sector, companies must be innovative and invest in technology and workforce development. In this sense, the TransLogistica Romania 2023 fair, which will take place from Sept. 19 to 21 at Romexpo, is an important event for everyone working in this sector. The business opportunities, networking and valuable information that can be obtained at this fair are invaluable for development and growth in these areas. We invite all transport, logistics and IT companies to participate in this edition of the TransLogistica Romania fair and take advantage of the benefits offered by this unique event in Romania.

For more information, please contact:

https://romania.translogistica.eu/

.

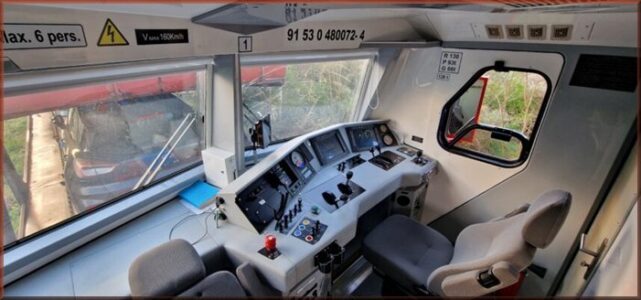

Deutsche Bahn, Europe’s largest carrier, has put into service the locomotives recently purchased from Softronic Craiova

Deutsche Bahn Cargo Romania, the subsidiary of Europe’s largest railroad company – DB Cargo AG, has put into service the locomotives recently purchased from Softronic Craiova. The company currently has more than 30 electric locomotives.

Deutsche Bahn Cargo Romania, the subsidiary of Europe’s largest railroad company – DB Cargo AG, has put into service the locomotives recently purchased from Softronic Craiova. The company currently has more than 30 electric locomotives.

“In 2023, DB Cargo Romania crossed the threshold 30 electric locomotives operated nationally by entering rolling stock of the LEMA 072 locomotive at the end of March. This was followed by LEMA 073, which entered service in the second half of April,” company representatives said.

In February, information appeared that Deutsche Bahn Cargo Romania is buying three more TransMontana locomotives , manufactured by Softronic Craiova. DB Cargo thus reaches a fleet of 30 locomotives purchased over about 10 years from the manufacturer in Oltenia. “The DB Cargo Romania group consolidates its status as the most important Softronic customer in Romania and acquires the TransMontana locomotives (070, 072 and 073),” Romania Feroviara wrote at the time, according to a post on Softronic’s Facebook page.

Financial sector

Steven van Rijswijk, ING Group CEO: We want to continue to grow organically in Romania, the economy and the banking market still have potential and we have the ambition to be in the top 3 banks

In Romania, we have a very balanced business and our model is focused on organic growth

♦ Romania experienced the highest economic growth in Europe and the resilience shown during these crises is remarkable

♦ The economy and market still have growth potential

♦ We are very strong in Bucharest and in the big cities, but now we want to look at the other provinces to see how we can strengthen our presence there as well.

Steven van Rijswijk, CEO of ING Global, was in Romania in early April, one of the Dutch financial group’s most important markets, one of the best known in the world, with assets of nearly 970 billion euros. In an interview with Ziar Financiar, he discussed ING Bank’s position in

Steven van Rijswijk, CEO of ING Global, was in Romania in early April, one of the Dutch financial group’s most important markets, one of the best known in the world, with assets of nearly 970 billion euros. In an interview with Ziar Financiar, he discussed ING Bank’s position in

Steven van Rijswijk, CEO of ING Group

Romania, growth plans and how the Romanian economy is doing, but also on the current global context characterized by geopolitical tensions and banking crises (Credit Suisse).

ING is doing “very well” in Romania as it has grown independently since its founding in 1994, without acquisitions from other banks, and has increased the number of primary customers by about 600,000 over the past seven years, he said. ING could be the third bank in Romania compared to the fourth place it is today.

“We still want to grow. We are currently the fourth player in Romania. We want to reach number three, we have that ambition. Considering our NPS (net promoter score) and the fact that we have been able to grow our core customers over the past seven years, we will continue to grow based on what we measure, and that will not escape us the number three position.” , says Steven van Rijswijk, 53.

For each individual province, ING Bank Romania will analyze plans to further expand its customer base and strengthen its position. “Of course we are very strong in Bucharest, but we will also look to the provinces to see how we can strengthen our presence there as well.”

ING Bank: profit of 1 billion lei in 2022 and revenue up 10% to 2.6 billion lei. Mihaela Bîtu, CEO of ING: Solid financial results facilitate our increased commitment to lending to the real economy, as evidenced by the 10% increase in the loan book

Mihaela Bîtu, CEO of ING Bank Romania: The results achieved in 2022 – a year with many challenges – are further proof of our team’s ability to mobilize and adapt to new economic and social conditions.

Mihaela Bîtu, CEO of ING Bank Romania: The results achieved in 2022 – a year with many challenges – are further proof of our team’s ability to mobilize and adapt to new economic and social conditions.

Last year, ING Bank increased its gross loan portfolio by 10% over 2021, to 37.3 billion lei. Facilities costs showed a substantial increase in 2022, by 315%, to 76 million lei.

ING Bank, the local branch of the Dutch group of the same name, posted a net profit of 1.06 billion lei in 2022, just 3% higher than the profit in 2021, as the bank’s revenues rose 10% to 2.6 billion lei .

ING Bank’s financial results last year were affected by increases in lending, but also by increases in provisioning costs.

The bank claims to have increased its gross loan portfolio by 10% last year compared to 2021, to 37.3 billion lei. And the cost of facilities showed a significant increase, up 315% by 2022, to 76 million lei.

Source: Ziar Financiar and ING

Focus on: Ralph Hamers, the CEO of UBS, the Swiss bank that announced it was buying Credit Suisse for $3.25 billion, led ING Bank Romania in the early 2000s

Ralph Hamers, 57, chief executive of UBS, the lender that agreed to buy Credit Suisse for $3.25 billion after a hectic weekend of  negotiations, mediated by Swiss regulators to protect its banking system and try to prevent the spread of a crisis in global finance. He worked at ING Bank Romania in the early 2000s. He was appointed CEO of UBS in 2020 after a career spanning nearly three decades at ING Bank.

negotiations, mediated by Swiss regulators to protect its banking system and try to prevent the spread of a crisis in global finance. He worked at ING Bank Romania in the early 2000s. He was appointed CEO of UBS in 2020 after a career spanning nearly three decades at ING Bank.

Between August 1999 and April 2002, Ralph Hamers headed the Romanian branch of the Dutch bank at the age of 33. He was the main CEO leading the operations in Romania and then reached the highest top position in a global company, taking over the management of the Dutch financial group after about a decade.

ING Bank arrived in Romania in 1994 and was the first international bank to open a branch in the local market after 1989.

“Ralph Hamers is CEO of UBS Group AG and Chairman of the Executive Board of UBS AG since November 2020, having joined UBS in September 2020 as a member of the Group Executive Board. Ralph Hamers is committed to ensuring that our company is able to evolve with our clients and the world at large. He led the transformation of our business for the future, with our group-wide strategy and redefined target launched in April 2021. Prior to joining UBS, Hamers was CEO and chairman of the Executive Board of ING Group, where he spent more than 30 years of his career. During his time as CEO of ING, he led the bank to profitability after the financial crisis and supported the company’s digital transformation,” reads the description on the UBS website.

Having taken over Credit Suisse, he has since passed the baton to Sergio Ermotti.

Ralph Hamers was named Honorary Chairman for his achievements after chairing the Dutch Romanian Network

Agricover Credit gets EUR 20 mln loans during parent group’s IPO

Agricover Credit IFN, a major player in the agribusiness financing sector in Romania, has obtained two credit facilities from the European Fund for Southeast Europe (EFSE), worth EUR 10 million and RON 49.2 million, respectively.

The two loans are designed to finance micro, small and medium-sized enterprises (SMEs) and entrepreneurs and have been granted for seven years.

The two loans are designed to finance micro, small and medium-sized enterprises (SMEs) and entrepreneurs and have been granted for seven years.

“We are pleased to have secured two new credit facilities from EFSE, further strengthening our strategic partnership with the fund. The capital will increase the available financing capacity for Romanian farmers, contributing to the development of performing agriculture,” said Serhan Hacisuleyman, CEO of Agricover Credit IFN.

“We recognize that investments in infrastructure, high-quality inputs and modern technology are essential to realize the full potential of the agricultural sector. Through our synergistic business model at Agricover Credit IFN, we understand farmers’ needs and challenges so that we can provide the necessary financing to develop their businesses,” he added.

Romanian agribusiness group Agricover Holding launches EUR 85 mln IPO on Bucharest Stock Exchange

As of December 31, 2022, Agricover Credit IFN recorded a gross book value of loans and advances to customers of approximately RON 2.84 billion, up 42% from the end of 2021.

As of December 31, 2022, Agricover Credit IFN recorded a gross book value of loans and advances to customers of approximately RON 2.84 billion, up 42% from the end of 2021.

Agricover Credit IFN is a subsidiary of Agricover Holding, a leader in the Romanian agribusiness market, which is currently halfway through its initial public offering (IPO) on the Bucharest Stock Exchange. With this IPO, the group aims to raise EUR 27.5 mln, most of which will go to Agricover Credit, according to the listing prospectus.The group’s shareholders are also selling shares worth as much as EUR 56 mln in the IPO.

Mr. Robert Rekkers as Chairman of the Board of Directors of Agricover Credit IFN SA and board member of the Dutch Romanian Network

Agricultural sector

Romania, Netherlands and 6 other EU member states to work on sustainable grazing project

The University of Agricultural Sciences and Veterinary Medicine (USAMV) Cluj-Napoca is representing Romania as a partner in the  Grazing4AgroEcology (G4AE) project, funded by the European Union with about 3 million euros. According to a press release from USAMV Cluj-Napoca, the project supports farmers by promoting innovative solutions to make grazing-based farming systems economically viable.

Grazing4AgroEcology (G4AE) project, funded by the European Union with about 3 million euros. According to a press release from USAMV Cluj-Napoca, the project supports farmers by promoting innovative solutions to make grazing-based farming systems economically viable.

At the same time, the main goal of the project is to produce healthier food with less environmental impact. “Romania is represented in the project by the aforementioned university as coordinator, and they are joined by farmers from the AgroTransilvania Cluster and members of other successful agricultural cooperatives in Transylvania. Such partnerships provide the basis for implementing solutions that have proven their value in partner countries.

Unfortunately, we are currently witnessing a sharp decline in grazing in Romania, which poses a serious threat to the future of these fragile systems on which the survival of one of the most important national assets – biodiversity – depends,” said Prof. Dr. Mugurel Jitea, from the Faculty of Horticulture and Rural Development, USAMV Cluj-Napoca.

The G4AE project, coordinated at the European level by Grünlandzentrum (Germany), will run for 3.5 years, until February 2026. “We see farming systems based on grazing rapidly disappearing in Europe. To reverse these negative trends, we as consumers must support the use of agri-food products from farms where grassland is used in an environmentally friendly way,” said

The G4AE project, coordinated at the European level by Grünlandzentrum (Germany), will run for 3.5 years, until February 2026. “We see farming systems based on grazing rapidly disappearing in Europe. To reverse these negative trends, we as consumers must support the use of agri-food products from farms where grassland is used in an environmentally friendly way,” said project coordinator, Dr. Arno Krause, Grünlandzentrum.

project coordinator, Dr. Arno Krause, Grünlandzentrum.

The project consortium consists of 18 partners from eight EU member states representing different grazing practices: France, Germany, Ireland, Italy,  Netherlands (ZLTO, Aeres), Portugal, Romania and Sweden. The network is based on a “multi-stakeholder” approach, with farmers and representative farmer groups at its core, who will work with academics, consultants, agri-food industry representatives and consumer groups to implement solutions tailored to local needs.

Netherlands (ZLTO, Aeres), Portugal, Romania and Sweden. The network is based on a “multi-stakeholder” approach, with farmers and representative farmer groups at its core, who will work with academics, consultants, agri-food industry representatives and consumer groups to implement solutions tailored to local needs.

Learn more at: https://grazing4agroecology.eu

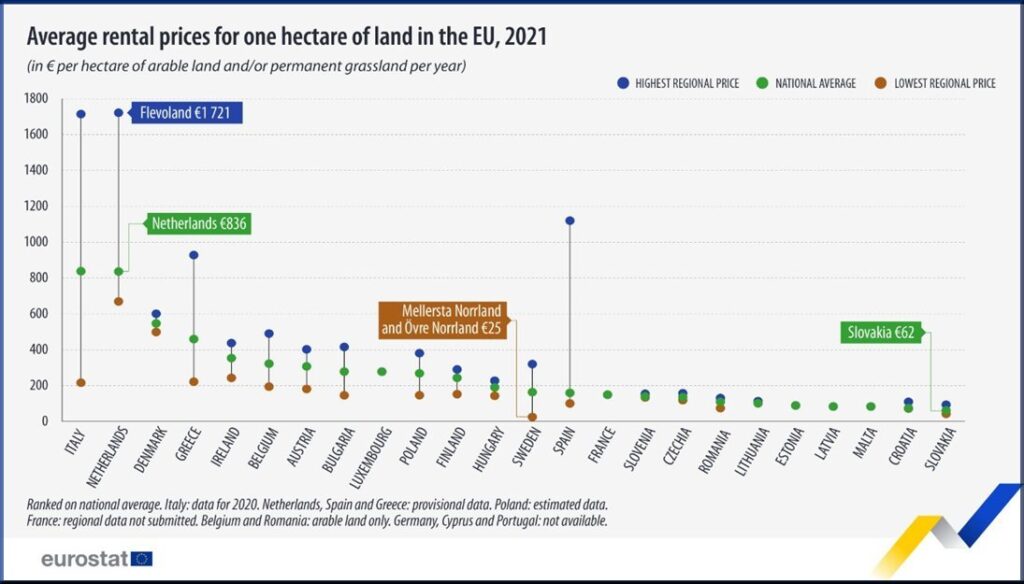

How much does it cost to rent a hectare of land in Romania. We are the seventh cheapest country in the EU

The rent for a hectare of agricultural land costs between 836 euros in the Netherlands and 62 euros per hectare in Slovakia. Romania is one of the cheapest markets for rent, with prices under 200 euros per

acres.

Arable land rents continue to rise, both in Europe and in Romania, the seventh cheapest country with the cheapest land in the EU, according to the latest Eurostat data, with respect to 2021. The trend comes in the context where in the period 2011- In 2020, we saw purchase prices in Romania and the Czech Republic increase fivefold, the highest in the EU.For example, according to data from 2021, the rent for one hectare in Romania costs on average about 200 euros.

Among EU regions, the most expensive lease in 2021 was in the Dutch region of Flevoland (€1,721 per ha), followed by the Spanish Canary Islands (€1,119 per ha) and Greek Attiki (€927 per ha). In 2021, Venezia Giulia in Italy (€1,714 per ha) was among the regions with the highest rental prices for arable land.

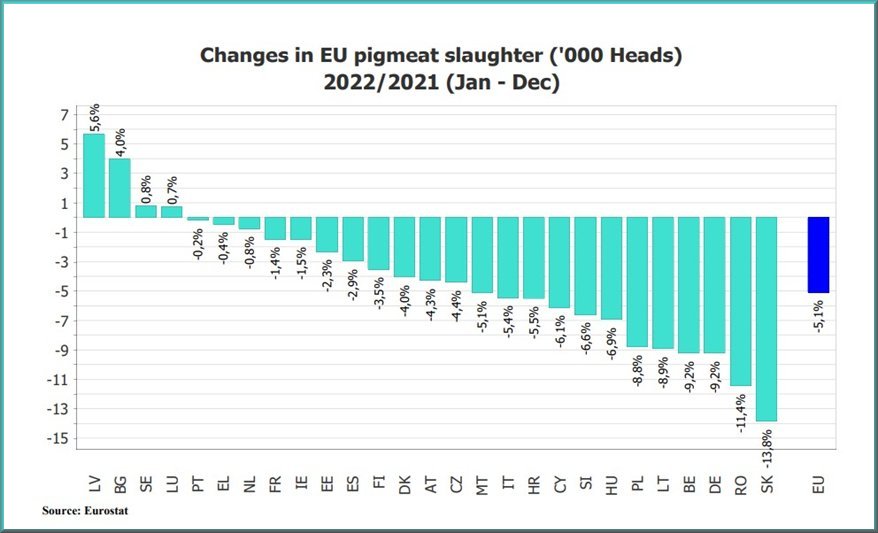

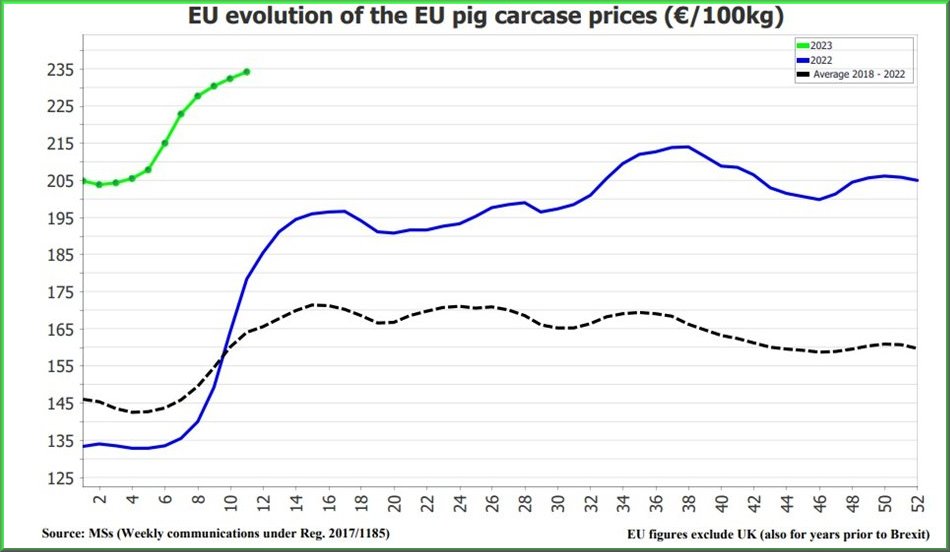

Romania has the smallest pig herd in the past nine years. The price of meat continues to rise

At the end of last year, Romania had only 3.4 million pigs, the lowest number since 2013. In the past 2 years alone, the number has decreased by 5%. The trend is reflected in the quantities of meat placed on the market, but also in prices, which have increased by more than 21% compared to the same period last year.

At the end of last year, Romania had only 3.4 million pigs, the lowest number since 2013. In the past 2 years alone, the number has decreased by 5%. The trend is reflected in the quantities of meat placed on the market, but also in prices, which have increased by more than 21% compared to the same period last year.

Romania, a country with a tradition of raising pigs, reports a steady decline in the number of herds, so that at the end of last year there were only 3.4 million head, 5.8% less than a year ago, according to the latest preliminary data from Eurostat .

It is the lowest level since 2013, as there were more than 5.1 million pigs in Romania nine years ago. Only in 2017, when the first outbreak of swine fever appeared in Romania, the number of herds decreased by 6.4% compared to 4.4%, while in 2016 herds decreased compared to 2015. In practice, the number of effective from 2017 to 2022 fell by about 1 million heads.

The trend recorded by the animal population is also reflected in the amount of goods on the market, making Romania the second country in the EU in terms of the decrease in the number of animals slaughtered.

Livestock decline across Europe

At the EU level, there were 134 million pigs in November/December 2022, 5% less than in 2021. More than half of the decline in EU herds is due to the situation in Germany, the second largest producer in the EU, and Denmark, the fourth largest EU producer, which lost 10% (2.4 million head) and 12% of their herds (1.6 million head), respectively

At the EU level, there were 134 million pigs in November/December 2022, 5% less than in 2021. More than half of the decline in EU herds is due to the situation in Germany, the second largest producer in the EU, and Denmark, the fourth largest EU producer, which lost 10% (2.4 million head) and 12% of their herds (1.6 million head), respectively

Specifically, the reduction in Germany was equal to 33% of the total EU reduction, while the reduction in Denmark was equal to 22% of the total EU reduction. Bulgaria and Malta (both -26%) recorded the largest relative declines.

The declines were part of a general trend. All EU member states with more than three million pigs reported decreases. There were also two exceptions: Italy (+330 thousand units, +4% compared to 2021) and Sweden (+50 thousand units, +3%).

Over the past decade, livestock numbers have declined for all species. The goat population experienced the steepest decline during this period (-9 index points in 2022 compared to 2012). Until 2020, the pig population was an exception to this trend. But since then, notable declines have been reported over the past two years.

The impact on prices

Currently (data updated on March 23), European Commission data show that the price of the 100-kg carcass of pork reaches an average of 234.2 euros. It is 5.1% higher than last month and 31.2% higher than the same period in 2021. For type S carcass, the price is 235.8 euros 100 kilograms, 31.4% higher than the same period last year.

In Romania, the 100 kg carcass of category S pork sold to the farm for 233.9 euros, or 13.8% more expensive than the previous month and 21.5% more than last year. However, it did drop 1% from the previous week.

By comparison, meat is 52.8% more expensive in France than in previous years and 16.8% in Sweden.

Over the past decade, livestock numbers have declined for all species. The goat population experienced the steepest decline during this period (-9 index points in 2022 compared to 2012). Until 2020, the pig population was an exception to this trend; since then, however, it has overtaken the rest of the species, with notable declines in each of the past two years.

Romanian state aid of 3 million lei to reduce excise tax on diesel fuel used by aquaculture SMEs

Small and medium-sized enterprises active in aquaculture will receive state aid totaling 3 million lei for the period 2023 – 2025 for the reduction of excise duty on used diesel from the budget of the Ministry of Agriculture. The scheme is applicable throughout Romania and amounts will be paid no later than December 31, 2023. For the year 2023, 1,529 lei/liter will be given as state aid in the form of reimbursement.

According to MADR (Romanian Ministry of Agriculture) data, a number of 246 units operating an area of more than 6,000 ha are currently licensed for the production of fry. 750 units with an area of over 65,653 ha are licensed for the production of consumer fish.

In 2021, domestic fish production was 11,714 tons, accounting for about 10% of fish consumption.

The scheme applies throughout Romania and amounts are paid until Dec. 31, 2023. The National Agency for Fisheries and Aquaculture, an institution under MADR, is the competent authority responsible for implementing the scheme.

FrieslandCampina Romania milk price agreement to be implemented as soon as possible in May

FrieslandCampina Romania, part of the Dutch company Royal FrieslandCampina and owner of the Napolact, Campina and Oke brands, started bilateral negotiations with retailers before May 1 on reducing the price of milk costing more than 7 lei, as part of a voluntary agreement mediated by the Competition Council.

The company says it uses only raw milk from Romania, meaning the voluntary agreement could apply to any milk it markets.

Nearly 40 percent of agricultural businesses in certain regions are understaffed.

However, only one-third of agricultural high school students have taken the practice in the past 10 years.

However, only one-third of agricultural high school students have taken the practice in the past 10 years.

Nearly 60% of farms say they need skilled labor and 42% talk about unskilled labor, but only 400 of the 20,000 farms operating in this sector have organized internships for agricultural high school students in the past 10 years.

However, not all companies have the potential to practically train apprentices. Thus, only 30% of those who could do it get involved in this way, according to a study conducted by the company Kynetec, world leader in agricultural and veterinary market research, commissioned by the Romanian Center for European Policy (CRPE).

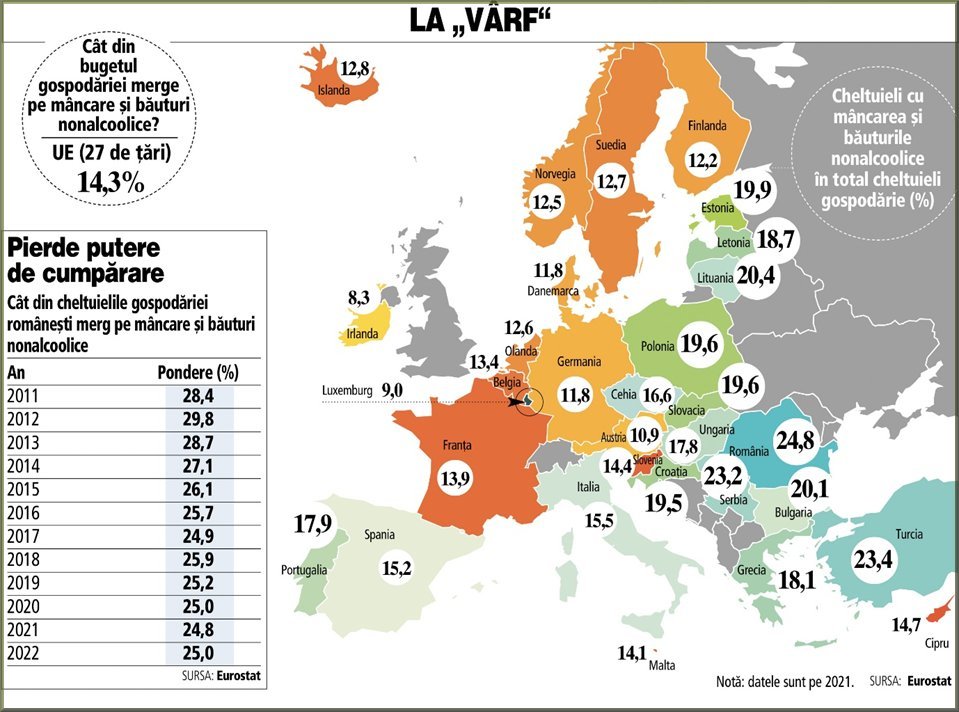

Purchasing power fell in 2022 for the first time since 2011. One in four lei spent by a family in Romania goes on food and non-alcoholic beverages

Romania is the EU country that spends the most on food and non-alcoholic beverages as a percentage of the total household spending budget. By comparison, the EU average is 14.3% . Record high prices in 2022 led Romanians to spend even more budget on food, evidence of declining purchasing power and less money left for other aspects such as education, culture and health.

In 2022, a year marked by record inflation and basic food prices up to 30-50%, a family in Romania had to allocate a quarter of its spending budget to ensure its daily food. Its share of the total spending budget increased to 25% last year for the first time since 2011, up from 24.8% in 2021, data from the European Statistical Office Eurostat show.

Romania is one of four countries for which data are already available for 2022, along with Iceland, Norway and Malta. It is interesting to note that in these last three countries, also affected by inflation, like much of the entire world, the share of food spending in the total spending budget fell, a sign that price increases did not affect the purchasing power of their citizens. In Malta, for example, the share fell from 14.1% to 13.5%, and in Norway from 12.5% to 11.4%.

This can happen even if each household adjusts consumption – people buy less or cheaper – as well as if the total spending budget increases due to wage increases or incomes in general. More accurately, people’s spending budgets increased faster (they had more money) than prices increased.

A kilo of tomatoes is up to three times more expensive than a kilo of chicken meat

A kilo of grilled chicken starts at 12.99 lei/kg and reaches 27.99 lei/kg in a Mega Image store (Ahold Delhaize). The chicken is raised in Romania and the price varies by brand, the cheapest being Mega and the most expensive being Libertan (Transavia). In the same place, a kilo of tomatoes of the San Marzano variety (oblong tomatoes) costs 39.99 lei/kg and they come from Belgium, because in Romania it is not yet their production season. For example, a kilo of tomatoes is up to three times more expensive than a kilo of chicken meat. Why?

A kilo of grilled chicken starts at 12.99 lei/kg and reaches 27.99 lei/kg in a Mega Image store (Ahold Delhaize). The chicken is raised in Romania and the price varies by brand, the cheapest being Mega and the most expensive being Libertan (Transavia). In the same place, a kilo of tomatoes of the San Marzano variety (oblong tomatoes) costs 39.99 lei/kg and they come from Belgium, because in Romania it is not yet their production season. For example, a kilo of tomatoes is up to three times more expensive than a kilo of chicken meat. Why?

“A chicken weighs 1.5-2 kg in 45 days, while tomatoes take 155 days to grow and vegetables cannot be genetically modified to give better yields. Moreover, sustaining the growth of a vegetable for 155 days is incomparable to sustaining the growth of a chicken for 45 days. And I don’t even want to think about what the energy costs during winter were for growing in greenhouses and solariums,” said Vlad Gheorghe, president of the Interprofessional Organization of the Fruit and Vegetable Industry (OIPA).

Producers and economists estimate that vegetable prices will fall, this situation is temporary. Both, however, say it is “almost mission impossible” to be vegetarian or fast by 2023 at current vegetable prices.

Romania imports tomatoes worth over 100 million euros and 65% of the quantity comes from Turkey

Shari Romania imported some 90,000 tons of tomatoes in 2021, accounting for over 11% of consumption, according to ZF’s calculations based on data from Eurostat, the European statistics office. The largest amount of tomatoes entering Romania, over 65%, comes from Turkey. Why do we import tomatoes from Turkey when we produce hundreds of thousands of tons?

Shari Romania imported some 90,000 tons of tomatoes in 2021, accounting for over 11% of consumption, according to ZF’s calculations based on data from Eurostat, the European statistics office. The largest amount of tomatoes entering Romania, over 65%, comes from Turkey. Why do we import tomatoes from Turkey when we produce hundreds of thousands of tons?

By value, Romania imported tomatoes worth 113 million euros and exported 1.12 million euros. According to Eurostat data, imports are 100 times higher than exports. The largest exporter of tomatoes for Romania is Turkey. In 2021, nearly 60,000 tons of tomatoes came from this country, meaning that 7 Romanians out of every 100 ate a tomato from Turkey. The next positions are Germany (11,900 tons), Spain (6,100 tons) and the Netherlands (5,200 tons).

Romania’s EU funds for milking robots and farm automation

Milking robots, feeding robots and other agricultural automation systems are equipment that farmers can buy using EU digitization funds. The Minister for European Investment and Projects (MIPE), Marcel Bolos, through the National Resilience and Recovery Program (NRRP), announced which financial instruments will benefit farmers this year. Agricultural producers and livestock farmers who want to invest in farm automation will receive funds from a budget of €150 million, with a maximum of €3 million/project.

Agriculture will also be one of the sectors to benefit from financial instruments worth €400 million for private equity investment, i.e., holding shares in private companies. The Minister for European Investment and Projects explained that the guide for the €150 million budget is in public debate and will most likely be officially launched in June. He also explained that the money would go to farmers in the form of co-financing, through subsidies of up to 70%. “Co-financing we can give within the limits of state aid subsidies, which are available everywhere in the European Union. Of course, if it’s a small or medium enterprise, the subsidy goes up to 70% and the difference is co-financing So this would be, let’s say, a first line of financing,” the minister explained. The second funding line MIPE is preparing concerns agricultural financial instruments. The financial allocation will be €400 million and the money will be provided in the form of private equity investments.

“The second line of funding would be financial instruments. It may sound strange to some people, and they wonder what financial instruments have to do with agriculture? There is 400 million euros that we can allocate in the form of private equity investments. We are in the process of selecting investment funds,” Marcel Bolos told TVR 1’s Agrostrategia program. The Minister for European Investment and Projects explained in detail what private equity means and how this form of financing will help Romanian farmers. “Private equity is buying shares in companies that are not yet listed, that’s important. So it does not have to be, for example, a sale of shares where the fund becomes the majority shareholder, but only a part of it and with that money you can finance the development of the company, the farm. But it is money that stays, there is no interest on it. There are 20 investment funds that must be selected according to the NRRP, but we put on them that these areas related to agriculture and the agri-food industry are mandatory, to look for those companies in the economy that are either already profitable or have a very high market potential […]. There are many areas for which it will be applied, from production, from industry, but agriculture cannot be excluded. We will probably have the whole portfolio of investment funds selected starting in the fall,” the minister added.

“The second line of funding would be financial instruments. It may sound strange to some people, and they wonder what financial instruments have to do with agriculture? There is 400 million euros that we can allocate in the form of private equity investments. We are in the process of selecting investment funds,” Marcel Bolos told TVR 1’s Agrostrategia program. The Minister for European Investment and Projects explained in detail what private equity means and how this form of financing will help Romanian farmers. “Private equity is buying shares in companies that are not yet listed, that’s important. So it does not have to be, for example, a sale of shares where the fund becomes the majority shareholder, but only a part of it and with that money you can finance the development of the company, the farm. But it is money that stays, there is no interest on it. There are 20 investment funds that must be selected according to the NRRP, but we put on them that these areas related to agriculture and the agri-food industry are mandatory, to look for those companies in the economy that are either already profitable or have a very high market potential […]. There are many areas for which it will be applied, from production, from industry, but agriculture cannot be excluded. We will probably have the whole portfolio of investment funds selected starting in the fall,” the minister added.

Shipbuilding Sector

Order for electric ferry and loading pontoon for Royal Van der Leun

Dutch Romanian Network member Royal Van der Leun is pleased to announce it has received the order for the complete engineering, integration and delivery of the electrical package for an electric ferry.

Dutch Romanian Network member Royal Van der Leun is pleased to announce it has received the order for the complete engineering, integration and delivery of the electrical package for an electric ferry.

This includes everything from system integration and main switchboards to energy management systems, alarm monitoring systems and e-motors.

German ferry company AG Reederei Norden-Frisia is making great strides in sustainability with its newest addition to the fleet. The company is working with Damen Shipyards to design and deliver an all-electric 32-meter ferry that can carry 150 passengers and have a speed

of 16 knots can offer. To further support the ship’s sustainability, AG Reederei Norden-Frisia has also invested in a jetty loading pontoon, which will be responsible for providing charging power to the ferry. Royal Van der Leun was also awarded the contract for the complete engineering, integration and delivery of the electrical package for the scaffold loading pontoon. The new ferry will be classified by Lloyds Register (LR).

Damen sales at 2.5 billion euros for the first time

In 2022, Damen Shipyards Group’s turnover reached 2.5 billion euros for the first time. This despite the effects of the war in Ukraine, which had and continues to have a significant impact on business operations. The order backlog matched the company record of 8.8 billion euros at the end of 2021. EBITDA (earnings before interest, taxes, depreciation and amortization. In Dutch, EBITDA is earnings before interest,taxes,depreciation and amortization) rose slightly to about 85 million euros (81.5 million in 2021); net profit increased from 1 to 15 million euros.

“Overall, we are content with 2022,” said CEO Arnout Damen. “Naturally, this does not apply to the situation in Ukraine, where we have had to close our branches in Cherson and Mykolayiv. We still sympathize intensely with our colleagues there and support them wherever we can.”

“Overall, we are content with 2022,” said CEO Arnout Damen. “Naturally, this does not apply to the situation in Ukraine, where we have had to close our branches in Cherson and Mykolayiv. We still sympathize intensely with our colleagues there and support them wherever we can.”

“We see that our focus on making our vessels more sustainable is gaining traction and recognition,” Damen continued. “Last year, we delivered the world’s first full-electric harbor tug ‘Sparky’ to the Port of Auckland in New Zealand. This RSD-E Tug 2513 was immediately voted ‘Tug of the Year’ at the International Tug & Salvage Awards 2022 as well as appearing on TIME Magazine’s Best Inventions List. Our revolutionary Fast Crew Supplier 7011 ‘Aqua Helix’ was awarded Offshore Energy Vessel of the Year 2022 by Offshore Support Journal.”

Steps in strategy

“Our mission is still to become the most sustainable shipbuilder in the world. We are therefore active with major innovation projects, for example in the field of methanol as fuel, battery capacity and alternative energy storage systems on board. But we also made good strides in other areas of our strategy last year, such as with the start of the expansion of our yard in Gorinchem, the opening of our eleventh service hub in Panama City and the introduction of a completely new range of cutter suction dredgers.”

From Cape Town to Den Helder

Despite the fact that, partly due to the sanctions against Russia, the number of ships delivered fell to 104, production value reached a record 2.5 billion euros. In 2021, this was still 2.4 billion euros. Among the completed vessels are the first 11 of a major order for LNG-powered barges by Concordia Damen and a patrol vessel built by Damen Shipyards Cape Town for the South African Navy. Substantial progress was made on such large orders as four F126 frigates for the German Navy and the Combat Support Ship ‘Den Helder’ for the Royal Navy. The volume of repair and conversion orders increased slightly to 1,127.

The order book remains well filled, thanks to strong order intake across all divisions. Notable is the growth of the segment of vessels for offshore wind applications; for which five divisions received orders. These include two vessels of the new generation of “service operation vessels” developed by Damen for this sector, which are partly powered by hydrogen. “But the sale of sixteen coasters of our new type 3850 should also not go unmentioned. The fact that these vessels save 25 percent fuel compared to conventional vessels certainly contributes to that success.”

Arnout Damen: “We therefore look to the future with great confidence. Demand remains strong in virtually all the markets where we operate. The upward trend in terms of financial results that we started in 2020, we expect to continue in 2023.”

Alewijnse completes electrical system integration of first two Amels 60 Limited Editions superyachts

Alewijnse has successfully completed the electrical system integration of the first two vessels in the Amels 60 Limited Editions series. In doing so, the systems integrator builds on its more than 130 years of experience in innovative and sustainable electrical and automation solutions aboard superyachts and  other large advanced vessels.In the process, Alewijnse installed all electrical systems aboard the first Amels 60 https://cdn.jachtbouwactueel.nl/wp-content/uploads/2021/07/21135916/Amels-6004_LR_1-scaled.jpgjacht COME TOGETHER and part of the electrical installation of the second Amels 60 ENTOURAGE, with the exception of the AV/IT system. One of the key systems Alewijnse has designed is a state-of-the-art hybrid drive system, equipped with special features for energy storage and peak smoothing. Other essential systems are the installations for navigation, communications, lighting, alarms and accommodation.

other large advanced vessels.In the process, Alewijnse installed all electrical systems aboard the first Amels 60 https://cdn.jachtbouwactueel.nl/wp-content/uploads/2021/07/21135916/Amels-6004_LR_1-scaled.jpgjacht COME TOGETHER and part of the electrical installation of the second Amels 60 ENTOURAGE, with the exception of the AV/IT system. One of the key systems Alewijnse has designed is a state-of-the-art hybrid drive system, equipped with special features for energy storage and peak smoothing. Other essential systems are the installations for navigation, communications, lighting, alarms and accommodation.

“It is important for Amels to work with a partner who can supply, install and retrofit the complete electrical package,” Alewijnse project manager William Bouman explains about the cooperation with the yard. “With a select group of partners, the construction process of a yacht goes much more smoothly. At Amels, the choice quickly fell on Alewijnse, as there are few electrical integrators who can offer a complete package. “With challenging targets for each yacht, there is no room for error,” William continues. “Long lead times for equipment and delays in getting supplies https://cdn.jachtbouwactueel.nl/wp-content/uploads/2021/07/21135916/Amels-6004_LR_1-scaled.jpgvan materials impacts everyone. But because Alewijnse and Amels have worked together for many years, we effectively operate as one team. Should problems arise, we address them immediately and resolve them successfully as a team. ”

Arie Midavaine, project manager at Damen Yachting, confirms the good cooperation with Alewijnse: “We have a long and very fruitful cooperation with Alewijnse. We work well together. Their flexible, no-nonsense approach means they always find a solution to any problem that arises. Personally, I have been working with them for more than 20 years and greatly appreciate their professionalism and in-depth knowledge and experience.”

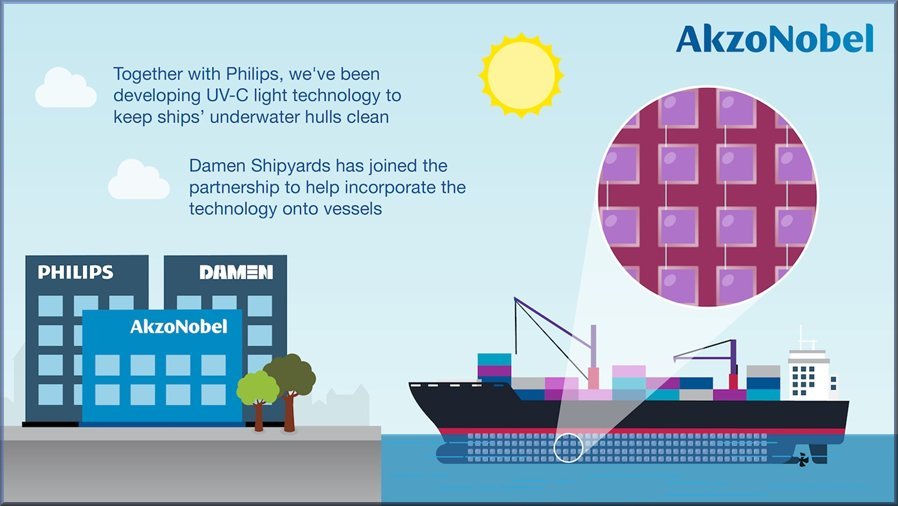

AkzoNobel and Philips welcome Damen in pioneering antifouling collaboration

Damen Shipyards Group collaborates with AkzoNobel and Philips to further develop a groundbreaking solution for antifouling (antifouling) control

This uses UV-C light technology to keep the underwater hulls of ships clean. The technology used integrates UV-C light-emitting diodes (LEDs) into a coating scheme that emits just enough light to completely prevent accumulation of biological contaminants on the protected area. Although successful small-scale trials have already taken place, bringing Damen Shipyards on board will add essential expertise in areas such as ship integration – a perfect complement to AkzoNobel’s know-how in surface protection and adhesion and Philips’ unmatched capabilities in UV-C LED applications and electronics.

Essential knowledge and experience “We are both delighted and excited to welcome Damen to the consortium,” said Menno van der Zalm, director of the AkzoNobel Incubator. “As a leading international shipbuilder, they bring essential knowledge and experience and significantly increase our chances of success.” All three parties will now work together to build on the progress AkzoNobel and Philips have made since establishing the RunWell consortium in 2017. The goal is to create a completely biocide-free solution for fouling control that will deliver breakthrough performance and lead to substantial economic and environmental benefits.” Positive impact on the environment As a leading global innovator, Philips is continuously developing and expanding its extensive catalog of technologies that provide opportunities for growth and innovation in many business areas,” explained Jako Eleveld, Head of IP Licensing at Philips. “By offering access to our technologies through our technology licensing programs, we encourage collaboration with partners who share our commitment to delivering impactful innovations. It’s great to see that Philips’ UV-C technology has found its way into this innovative antifouling solution, which will benefit shipping while having a positive impact on the environment.” Jasper Schuringa, Head of Corporate Venturing at Damen Shipyards Group, added: “This is a very exciting project and fits perfectly into our own strategy to become the most sustainable shipbuilder in the world. There is still some way to go, but the solution being developed clearly has the potential to reshape the way the industry has traditionally thought about antifouling systems.

” In 2014, Philips first began experimenting with UV-C LED technology – known for its use in water treatment and sterilization applications – but it had never been used in open water. Since working with AkzoNobel, promising progress has been made to the point where trials have taken place on commercial commercial vessels. An important next step for the consortium is not only continuing to improve the technology, but also ship integration. All three partners will now work to create a commercially viable solution in the near future. Dutch companies “It is a challenging project, but it is also a fantastic example of the benefits of collaborative innovation,” Van der Zalm continued. “Working together as a strong partnership of three complementary Dutch companies, we are confident that we can combine our capabilities to provide a sustainable solution that can completely revolutionize the fouling control industry.”

Antifouling is the collective term for measures taken to prevent microorganisms, mussels and algae from attaching to a ship’s hull below the water’s surface. The deposits formed by the accumulation of the organic material are called biological deposits.

Multraship christens two tugs in port of Terneuzen

Multraship Towage & Salvage on Friday, May 12, christened two tugs built by Damen Shipyards Group during a special ceremony at Multraship’s home port in Terneuzen.

The MULTRATUG 5, a Damen Stan Tug 1205 was christened by Sabine Kamerling, office management assistant at Multraship. Operations & Crewing manager Bianca Pielaat christened the MULTRATUG 6, a Damen ASD Tug 2810. Both ships are deployed in the Scheldt area.

Although Damen builds its vessels based on proven standard designs, it is able to customize these vessels to meet the specific requirements of its customers. In the case of the MULTRATUG 6, this included winterizing the tug, a FiFi-1 class rating and the installation of a winch on the aft deck, among several other amenities.

What makes the MULTRATUG 6 special is the fact that it is the last ASD Tug 2810 built by Damen. Having sold more than 200 vessels, the ASD Tug 2810 is Damen’s most successful design to date. This type of tug can be found on the water in ports in all parts of the world.

Leendert Muller, managing director of Multraship, said the following at the ceremony, “We work hard to ensure that our fleet reflects the wishes and needs of our customers and that we have the best credentials to provide them with fast, reliable and safe towing and salvage services at all times. To do this, we need high-quality tugs with a wide range of operational capabilities. We know we can rely on Damen to deliver vessels that meet our specifications and the highest standards. It gives us great pleasure to officially welcome the MULTRATUG 5 and MULTRATUG 6 within our fleet.”

Vincent Maes, Damen’s Benelux sales manager: “It is a real pleasure to witness this special event. And what makes it even more special is the fact that the MULTRATUG 6 is the last ASD Tug 2810 that will ever be delivered. The design of this tug, like all the other vessels in our portfolio, was developed based on a wealth of valuable input from our customers. Multraship is a long-time customer of ours and has provided us with numerous useful insights that have found their way into the development of our tugs. We are grateful for this reciprocal relationship and look forward to continuing our collaboration in the years to come.”

The vessels were delivered to Multraship as part of the expansion of its fleet. The company last year added the two emergency response tugs (ERTVs) MULTRASHIP COMMANDER and MULTRASHIP PROTECTOR to its fleet, as well as the MULTRASALVOR 6, a Multi Cat salvage support vessel, and the MULTRATUG 9, another of Damen’s port tugs.

Both Damen(Galati and Mangalia) and Multraship(Constanta and Bucharest) have all been active in Romania for many years and may be called pioneers without exaggeration

Automotive

Dacia Duster included in list of best 4×4 and off-road vehicles of 2023

The Dacia Duster SUV, produced in the Romanian city of Mioveni, has been included by British car magazine Autocar in a ranking of the best 4×4 and off-road vehicles of 2023. Its low price and off-road capabilities make the Duster the tenth best 4×4 and off-road vehicle and road car of the year.

The Duster was placed alongside heavyweight names in the off-road industry such as the Land Rover Defender, Jeep Wrangler, Toyota Land Cruiser, Mercedes-Benz G Class and the recently launched Ineos Grenadier. Although these vehicles are known to be the best equipped for off-road driving on rough terrain, and because of their advanced technology have high prices, the Duster is considered more of a road-oriented SUV, and few consider its off-road as an SUV. Importantly, only all-wheel drive (AWD) models are capable of navigating difficult terrain.

“It’s not as cheap as it was (there is now no entry-level Access version with all-wheel drive), but a whisker under £21,000 for the Expression dCi 115 4×4 is still top value, regardless of vehicle type (you’ll struggle to buy nowadays for that amount a similarly specified supermini),” says Autocar in describing the Duster.

“The smart all-wheel drive system lets you choose front-wheel drive for the road, an Auto mode that quickly engages the rear axle when wheel spin is detected or Lock that sets the torque distribution to 50:50 for the best off-road traction. There is also a shorter first gear for climbing steep slopes and hill descent control to scramble down the other side. Oh, and the infotainment system features a compass and altimeter, so you know where you’re going and if you’re about to fall,” according to the entry.

What’s more, “the Duster’s best off-road features are decent ground clearance and a relatively low empty weight, allowing it to tiptoe over some obstacles that would sink heavyweight rivals,” the ranking adds.

The Duster is “much more modern and controlled than its predecessor,” with precise steering, good body control and more than enough grip. Bumps and potholes can be overcome with a Duster “with rare confidence,” the article says, and while it handles itself off-road, the car feels right at home on the road.

According to Autocar, the best 4×4 car of 2023 is the Land Rover Defender, the latest generation of a model that has represented the symbol of off-road vehicles for decades. In second place is another symbol, the American Jeep Wrangler, a car designed for rugged terrain. The Toyota Land Cruiser is in third place, followed by the Merceds-Benz G-Class and the Land Rover Discovery.

Last on the list, Dacia Duster can be considered the most suitable choice for those who do not have a significant budget, as is the case with the cars in the first part of the ranking.

Real estate sector

Romania, the promised real estate country for rich and risk-loving Belgians?

Fifteen years after the financial crisis, Belgian property developers are once again finding their way to Romania. The growing economy and rising purchasing power make the Eastern European country attractive to those who like some risk and have enough money. ‘For bargains, don’t get involved.’

Many Belgian real estate entrepreneurs are finding their way to the Black Sea country. The Huyzentruyt Group recently announced the purchase of a first project land of 10,000 square meters in Voluntari, an emerging suburb of the capital Bucharest. The Waregem property developer wants to start building 120 apartments for the upper middle class next year.

According to a listing by Flemish business newspaper De Tijd, at least 20 Belgian real estate companies are active in Romania, often with local partners. Together, Belgians own or develop about a hundred business parks, residential complexes, office buildings, shopping centers and parking garages, totaling several thousand hectares.

According to a listing by Flemish business newspaper De Tijd, at least 20 Belgian real estate companies are active in Romania, often with local partners. Together, Belgians own or develop about a hundred business parks, residential complexes, office buildings, shopping centers and parking garages, totaling several thousand hectares.

Sometimes a project’s Belgian roots are obvious. The complex of 270 flats being built by Atenor in Bucharest bears the same name as the residential tower the listed developer erected on the canal in Brussels: Up-Site. In 2018, a group around Kortrijk entrepreneur Christian Dumolin (Koramic) sold Flanders Residences, a project with 200 apartments.

After the fall of communism in 1989, many Belgian property developers, following in the footsteps of Ghelamco owner Paul Gheysens, went to try their luck primarily in Poland. Those who were more daring looked to Romania. With nearly 20 million inhabitants, slightly less than half the population of Poland, Romania is the sixth largest country in the European Union. It has long been luring Western businessmen who seek higher returns (at higher risk), but find Poland too mature or mature and Oekr ain too risky). Group Huyzentruyt also wants to repeat its Polish success in Romania. ‘If we had started in Poland five years earlier, we could have built a much larger pipeline at lower prices,’ says CEO Thomas Van Poucke.

ain too risky). Group Huyzentruyt also wants to repeat its Polish success in Romania. ‘If we had started in Poland five years earlier, we could have built a much larger pipeline at lower prices,’ says CEO Thomas Van Poucke.

Apartments

All Belgian real estate players in Romania combined have a pipeline of over 15,000 apartments to be built.

Balcaen founded Speedwell in 2015 with architect Jan Demeyere. The Flemings, active in Eastern Europe for more than 20 years, are developing major projects in Romania with financial support from wealthy West and East Flemish families. Together with Baltisse, the holding company of businessman Filip Balcaen, Speedwell has two mixed-use projects in the cities of Timisoara and Cluj-Napoca. Baltisse is also the sponsor of WellOne, the fund that Speedwell established in 2019 for its residential projects in Romania. WellOne is home to some 20 Belgian entrepreneurs, including French fries king Jan Clarebout and interior design specialist Jan Ollevier. Businessmen such as Pascal Vanhalst, Willy Naessens and the Vandermarliere and Stadsbader families invest directly in Speedwell projects.

Housing

Speedwell has nearly 6,000 apartments in the pipeline in several Romanian cities. The company is carpentry with Straco, the investment holding company of the De Raedt-Verheyden lab couple, and Ghent promoter Immogra on The Ivy, an 800-home project in Bucharest. In 2021, Speedwell bought an old factory site in central Bucharest, similar to Tour & Taxis in Brussels. Among other things, the company wants to build 3,000 apartments there, good for an investment of half a billion euros. ‘In terms of large projects, in Flanders you only have Nieuw-Zuid in Antwerp and the Arsenaal site in Ghent,’ Demeyere said. ‘In Romania, you can still develop many large, old industrial sites in cities. We have already bought a shoe factory, a hat factory and a lingerie factory.’

Speedwell has nearly 6,000 apartments in the pipeline in several Romanian cities. The company is carpentry with Straco, the investment holding company of the De Raedt-Verheyden lab couple, and Ghent promoter Immogra on The Ivy, an 800-home project in Bucharest. In 2021, Speedwell bought an old factory site in central Bucharest, similar to Tour & Taxis in Brussels. Among other things, the company wants to build 3,000 apartments there, good for an investment of half a billion euros. ‘In terms of large projects, in Flanders you only have Nieuw-Zuid in Antwerp and the Arsenaal site in Ghent,’ Demeyere said. ‘In Romania, you can still develop many large, old industrial sites in cities. We have already bought a shoe factory, a hat factory and a lingerie factory.’

Logistics

Belgians also have a strong presence in logistics real estate. WDP’s Romanian portfolio is worth €1.1 billion. The listed company is the market leader in Romania based on square meters of rentable area, according to its annual report. WDP can lease 1.5 million  square meters (150 hectares) of warehouses in Romania. WDP acquired a lot of interesting land in 2007. But when WDP wanted to broach that one, the financial crisis hit in full force. Only in the second run-up did the company achieve success. Romania is today WDP’s third most important market after the Netherlands and Belgium, accounting for a 17 percent stake in the total portfolio.

square meters (150 hectares) of warehouses in Romania. WDP acquired a lot of interesting land in 2007. But when WDP wanted to broach that one, the financial crisis hit in full force. Only in the second run-up did the company achieve success. Romania is today WDP’s third most important market after the Netherlands and Belgium, accounting for a 17 percent stake in the total portfolio.

WDP CEO Joost Uwents underlines Romania’s excellent location. “It is a large country in a strategic location with the EU’s only port on the Black Sea and with access to the Danube River, which runs deep into Europe. Moreover, according to WDP, Romania will also benefit from the phenomenon of reshoring. Retail chains and manufacturers want their supplies closer to the end customer after the bad experience with supply during the corona pandemic and because of the uncertain geopolitical situation.

Alinso and VGP

With an area of 300 hectares, Alinso’s PWP is one of the largest business parks in Eastern Europe.  Listed sector peer VGP is also in Romania. VGP’s Romanian portfolio is worth 207 million euros. The company still owned a land bank of more than 700,000 square meters there at the end of 2022.

Listed sector peer VGP is also in Romania. VGP’s Romanian portfolio is worth 207 million euros. The company still owned a land bank of more than 700,000 square meters there at the end of 2022.

Alinso, the company of DOMO family Jan De Clerck, bought the Ploiestie West Park (PWP) in northern Bucharest in 2008, just before the onset of the financial crisis. With an area of 300 hectares, PWP is one of the largest business parks in Eastern Europe. Last year, Alinso signed for the largest industrial real estate transaction of the year in Romania. It bought its second business park (Metav) for 36 million euros.

Stores

In early April, the Geuten family’s retail specialist Mitiska opened its new retail park in the city of Giurgiu on the Bulgarian border. With a local partner, Mitiska already developed 25 shopping complexes, accounting for a leasable area of 134,000 square meters. Already the Belgian company, which did not respond to inquiries, is considering selling its portfolio in the country, according to the Romanian press.

Mitiska already developed 25 retail parks in Romania with a local partner.

Mitiska is one of the few real estate companies operating in all corners of Romania. Most Belgians confine themselves to the region around the Bucharest metropolis. According to the statistical office Eurostat, the capital accounts for 27 percent of Romania’s gross domestic product. More than 2 million people live in the spacious Bucharest region. Other large cities are a lot smaller, but growing due to rural exodus. In Cluj-Napoca, “the Silicon Valley of Transylvania,” housing prices are higher than in the capital.

Mitiska is one of the few real estate companies operating in all corners of Romania. Most Belgians confine themselves to the region around the Bucharest metropolis. According to the statistical office Eurostat, the capital accounts for 27 percent of Romania’s gross domestic product. More than 2 million people live in the spacious Bucharest region. Other large cities are a lot smaller, but growing due to rural exodus. In Cluj-Napoca, “the Silicon Valley of Transylvania,” housing prices are higher than in the capital.

Capital-intensive

Many Romanians move to the cities for work. Romania’s gross domestic product per capita has increased by more than half since 2015. According to Eurostat, Romania dangles at the bottom of the list of member states with an average annual wage of the equivalent of €13,000. But wages have more than doubled since 2015. Workers in IT or project managers are paid extremely well.

Several Belgian businessmen warn against seeing Romania as a cheap country. ‘Romania was long called the China of the EU because wages were so low. Meanwhile, wages have gone up,’ said Uwents (WDP). “The net wages of executives, especially in Bucharest, are at the level of Belgium,” said Ivan Lokere, Alinso’s CEO. ‘For the cheap you shouldn’t start it.’

Growing purchasing power increases the demand for quality housing. “80 percent of our buyers pay cash,” says Balcaen (Speedwell). ‘That’s why we feel the rise in interest rates less.’ Still, financing real estate projects is a tough sell for developers. Romanian banks finance a maximum of 60 percent of a project, requiring the developer to put at least 40 percent of their own money on the table. In addition, promoters must provide utilities. Liebrecht & Wood put 5 million euros a few years ago into the construction of a highway exit and a 4-kilometer lane to a large residential project.

That capital intensity is why Triple Living’s Romanian mega-project is progressing slowly. The Antwerp developer can build more than 2,000 homes on a patch of land west of Bucharest. But Triple Living is developing Riverside Residence in tranches of 50 units. “Bank financing is difficult or expensive in Romania,” said top executive Jeff Cavens. ‘Moreover, in Romania there is no framework such as the Breyne Law for sale on plan. The deed is not passed until completion. Therefore, as a developer, we have to finance everything ourselves.’

Challenges

Romania is still struggling with some problems. The administration is unwieldy. Because Romania did not have a cadastre in communist times, there is often ambiguity about the ownership structure. This leads to legal uncertainty. No Belgian entrepreneur contacted speaks of corruption. But in Bucharest, when he took office, the new mayor put a moratorium on all spatial implementation plans in the capital because of too much corruption. As a result, entrepreneurs, such as Group Huyzentruyt, are also diverting to the rich north just outside Bucharest.

Romania has long lagged behind. But the country has enormous potential.

Once the permit for a project is in, things can move fast in Romania. “We charge two years for permitting and three years for construction of a project,” Balcaen said. ‘Construction is faster here because workers work six days a week and 12 hours a day. There is no construction leave in either summer or winter. There is continuous work. And the quality we build in Romania is as good or even better than in Belgium.’ Nepalese, Pakistani and Indian construction workers also toil on the sites because many Romanians have moved to Western European countries, including Belgium.

While the Belgian real estate market slowed in recent months, the market in Romania continues to turn. Speedwell already bought four new projects this year. ‘The economy continues to grow,’ Balcaen said. ‘We are spared high peaks here, but also deep valleys. Romania is finally investing in infrastructure, public transportation and new roads. That gives an extra boost. But a gigantic catch-up operation is needed.’ Uwents agrees. “Romania is experiencing now what Poland or the Czech Republic experienced 30 years ago,” says WDP’s top executive. ‘The country had been lagging behind for a long time. But Romania has tremendous potential.’

What is it about?After the tough economic crisis years, Belgian real estate developers are returning to Romania. Belgian companies own or are developing thousands of hectares of projects there.

Why is Romania attractive?

Romania is, after Poland, the most populous country in Eastern Europe. Purchasing power and wages are on the rise, increasing demand for stores, warehouses and quality housing.

What is the challenge?Real estate companies have to finance projects in Romania largely on their own. As a result, a lot of their own money is needed. Moreover, the administration does not run smoothly and there are regular discussions about the ownership of land.

Source: The Time

Energy Sector

Kazakh crude starts arriving at Petromidia refinery, ignoring Russia

Kazakh national oil company KazMunayGas (KMG) has begun shipping Kazakh oil to Romania from the Turkish port of Ceyhan to Romania, while until now most deliveries were made from the Russian port of Novorosiisk, the eastern end of the CPC Caspian pipeline.  KMG head Magzum Mirzagaliev visited the Turkish port of Ceyhan and was briefed on the process of shipping Kazakh oil to the Petromidia refinery, which is owned by KMG, according to a press release from the Kazakh company .

KMG head Magzum Mirzagaliev visited the Turkish port of Ceyhan and was briefed on the process of shipping Kazakh oil to the Petromidia refinery, which is owned by KMG, according to a press release from the Kazakh company .

“Today we are attending an important event for the national oil and gas industry. It is no coincidence that the head of state pays so much attention to the development of new supply routes for Kazakh oil. In that context, it is good that our agreements with the Azerbaijani company Socar have now become a reality. This indicates good prospects for further expansion of our cooperation,” Mirzagaliev said at the ceremony of starting the transport.

The first cargo of 80,000 tons of oil from the Ceyhan terminal will be transported by the Kazakh oil tanker Alatau, owned by Kazmortransflot (KMG’s transport company), and headed to Constanța with discharge for the Petromidia refinery.

Late last year, a five-year oil transit agreement on the Aktau-Baku-Ceyhan route, with an annual volume of 1.5 million tons, was signed between KMG and SOCAR of Azerbaijan. In March this year, shipments of Kazakh oil began along the Aktau-Baku route.Until April 20, 86,000 tons were shipped from the port of Aktau.

In Ceyhan, the head of KMZ thanked the management of the Tengizchevroil joint company for a series of successful negotiations on transportation conditions through the Baku-Tbilisi-Ceyhan pipeline.

Kazakh oil is not subject to Western sanctions, unlike Russian crude, although sanctions have caused problems for some Kazakh products.

Petromidia Năvodari has a capacity of nearly six million tons per year and is the largest in Romania and one of the most modern refineries in the Black Sea region, providing about 40% of the national refining capacity.The Năvodari refinery benefits from a steady supply of raw materials, mainly from Kazakhstan, with the support of the national oil and gas company KazMunayGas

Economical developments

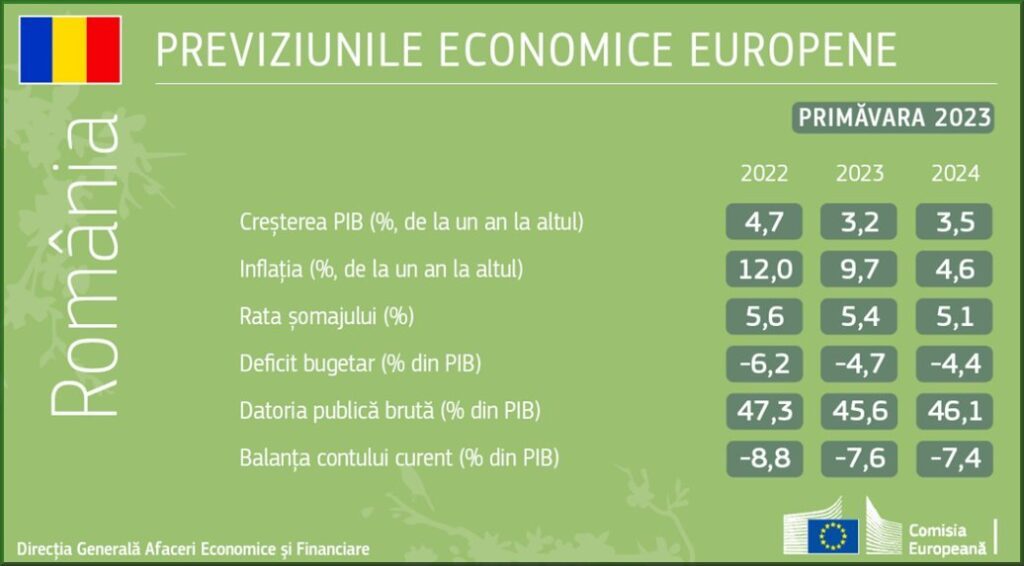

European Commission becomes more optimistic about Romanian economy

One raises the economic growth forecast from 2.5% to 3.2% in 2023. Inflation falls below 10% and budget deficit reaches 4.7% of GDP

The European Commission believes the Romanian economy will grow more strongly than previously expected and has raised its forecast for real GDP growth from 2.5% to 3.2% in 2023.

“Economic growth will continue, albeit at a slower pace than in 2022, due to persistent inflation, tight financing conditions and low growth in trading partners. Core inflation is expected to peak in 2023 and overall inflation will remain above the inflation target over the forecast period. Unemployment is estimated to decline only marginally, keeping the labor market relatively tight and wage growth high,” European Commission economists summarized the forecast.

What the European Commission says about Romania in the spring 2023 economic forecast:

Resilient growth despite headwinds

Growth reached 4.7% in 2022, driven by strong private consumption and robust investment. High-frequency indicators point to a reasonably resilient economy in 2023-Q1, with rising retail sales sentiment and sales and signs of improvement in industrial production. Employment expectations remained at a relatively high level.

Going forward, high inflation, tight financing conditions and lower growth in trading partners will all slow real growth. Despite these headwinds, private consumption growth is expected to remain positive thanks to higher wages and pensions and the extension of the energy price ceiling until 2025. Government support schemes and a resilient labor market will also support economic activity.

Monetary policy should remain tight, with monetary policy rates at 7%, affecting the flow of credit to the economy and investment. However, planned investments under the National Recovery and Resilience Plan (PNRR) and inflows from other EU funds can cushion the impact of tight credit conditions. Investment is expected to strongly support real growth in 2023 and 2024.

It is estimated that net exports will not contribute to GDP growth. Despite lower energy prices and improved terms of trade, strong domestic demand will keep the trade balance negative. The current account deficit is projected to remain around [8%] of GDP over the forecast period, posing medium-term external sustainability risks.

All in all, real GDP is estimated to grow 3.2% in 2023 and 3.5% in 2024. Risks to the forecast are downside, as delays in NRDP implementation may reduce investment.

“Sticky” unemployment and wage pressure

Despite solid GDP growth, employment prospects remain modest, as an aging population and mass migration pose serious obstacles to job creation. However, labor market integration of people fleeing the war in Ukraine and visas for non-EU workers may be mitigating factors. The unemployment rate is expected to fall slightly, to 5.4% in 2023 and 5.1% in 2024. Wage growth was strong, especially in the private sector, but for the economy as a whole, overall CPI inflation lags. The tight labor market, the need to compensate for purchasing power losses and high inflation should contribute to substantial wage increases in 2023 and 2024.

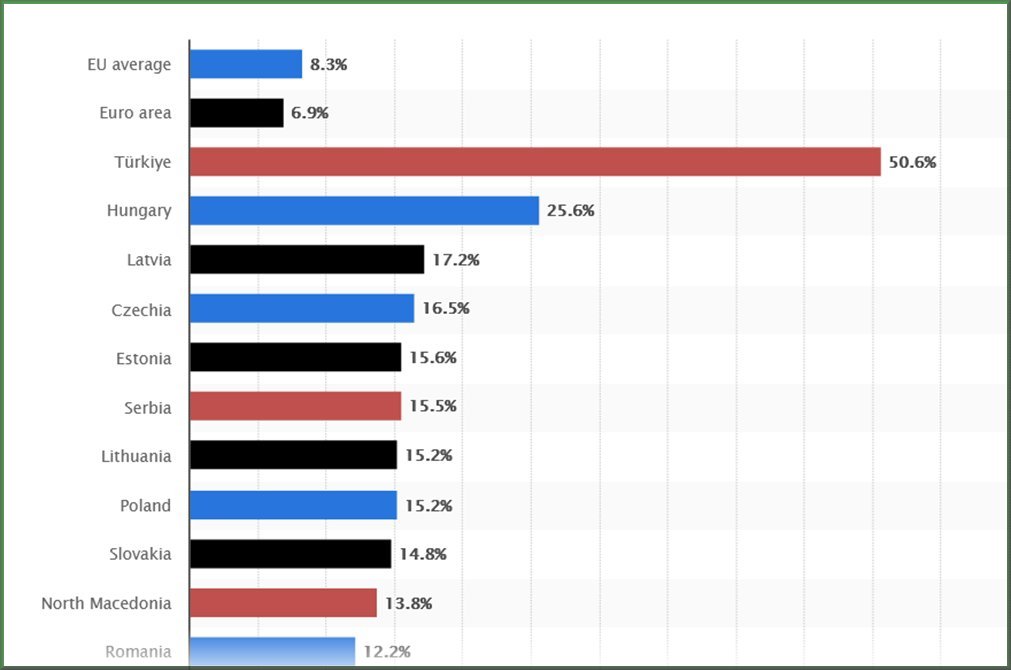

Core inflation remains high

Overall HICP inflation (according to the EU Harmonized Index 0 n.ed.) peaked in November and then fell to 12.2% in March due to lower energy prices. Because of the energy price cap scheme, almost no change is expected for this component, largely driven by movements in fuel and energy distribution prices. However, core inflation continued to rise due to increases in processed food and services. After peaking in the first quarter, inflation is expected to remain above headline inflation this year. All in all, average HICP inflation will fall to 9.7% in 2023 and 4.6% in 2024, but the risks are to the upside as upward wage pressures are high.

Romanian government deficit expected to decrease

Romania’s public deficit is estimated to fall from 6.2% in 2022 to 4.7% of GDP in 2023 (in ESA terms, according to the European methodology – ed.). Robust nominal GDP growth and high energy taxes will boost government revenues in 2023. Current spending is expected to grow less than nominal GDP, due to government wage moderation. Public investment as a percentage of GDP is expected to increase due to ambitious domestic fiscal targets and a large inflow of EU funds. Additional payments to pensioners, changes in the tax code, the compensation scheme to cope with rising energy prices and credibly announced legislation to reduce government spending by 2023 are all included in the forecast.

The deficit is expected to narrow to about 4.4 percent of GDP in 2024, as current spending as a percentage of GDP declines due to the discontinuation of some measures implemented in 2022/2023 that amount to about 0.3 percentage points. Nominal economic growth is expected to remain substantial. Growth in capital spending is expected to slow down due to the base effect caused by the large residual of the 2014-2020 EU budget cycle expected in 2023. The Commission currently assumes a complete phase-out of energy support measures by 2024.

Public debt is expected to fall to 45.6% of GDP in 2023 as a result of deficit reduction before rising to 46.1% in 2024. Risks to the fiscal outlook are downside. Lower GDP growth, the upcoming election cycle, possible upward pressure on government wages due to negative real growth rates in 2021, pension indexation that will deal with the high inflation of 2022 in 2024 may lead to budget deficits.

U.S. rating agency Fitch upgraded its outlook for Romania’s country rating from “negative” to “stable.”

The first positive change since 2020. However, Romania remains at the last recommended step for investment. The reaction of Finance Minister Adrian Câciu

U.S. rating agency Fitch upgraded its outlook for Romania’s country rating from “negative” to “stable.” This is the first positive change in outlook by the rating agency.

“The Fitch Ratings decision is proof of international recognition of the Romanian government’s agenda to ensure fiscal consolidation and confirmation that the measures already taken were the right ones, necessary for our country and highly expected by all our external partners. At the same time, we should also note the agency’s positive estimates regarding Romania’s medium-term economic growth potential,” said Finance Minister Adrian Câciu.

What Fitch says: the public debt to GDP ratio is stabilized at 49% in 2021-2022 and the budget deficit will decrease, but less than the government expects. Romania’s economy will grow 2.3% in 2023

Geopolitical developments

Politicians and entrepreneurs speak a different language

Almost daily you can read about politicians causing geopolitical turmoil that they substantiate with familiar fallacies that they must weigh all factors and not limit themselves only to the economic actors which in most cases creates an incorrect cause-and-effect relationship.

For an entrepreneur looking to invest in a country, one of the main concerns is political stability.

Looking at the current geopolitical situation in Central and Eastern Europe, one cannot escape the impression that there are a number of dissonant countries whose nationalistic attitudes undermine the necessary clout of the European Union. For that reason, we try to reflect the most important developments.

Romania

In short, a Roman island of tranquility surrounded by a troubled Slavic ocean.

In short, a Roman island of tranquility surrounded by a troubled Slavic ocean.