Newsletter September 2023

International press: Romania is catching up with richer neighbors, helped by European funds

This year, Romania’s economy is expected to surpass the stagnant economies of neighboring countries, helped by European funds, a stable currency and foreign investment, boosted in part by the relocation of activities from Russia and Ukraine, Reuters reports.

The International Monetary Fund expects Romania’s economy to advance 3.1% this year, and even with the European Commission’s more modest estimate of a 1.8% advance, the country would be ahead of Poland, which would post a 0.7% increase. And % of Hungary, which will face an economic slowdown and accelerating inflation.

This year’s rise follows a decade in which Romania, one of Europe’s poorest countries, narrowed the gap separating it from its neighbors and became Eastern Europe’s second-largest economy after Poland. According to the latest Eurostat data, GDP per capita expressed in standard purchasing power parity (PPP) in Romania in 2021 was 74 percent of the EU average, up 21 percentage points from 2010.

“Provided that all anti-corruption measures provided for in the recovery and resilience mechanism plan are properly implemented, Romania could become an example of good governance in the region,” said a European official who wished to remain anonymous.

S&P, which like other rating agencies gives Romania the lowest rating in the investment grade category in anticipation of the budget deficit reduction, said it expects Romania to make progress on reforms agreed to obtain European funds.

The stability of the Romanian leu is another positive factor, especially compared to the Hungarian forint, which reached several historic lows last year. Higher wages on the other side of the border have already led some Hungarian citizens to accept jobs in the industrialized areas of western Romania.

“This is an entirely new development and I would like to draw the attention of everyone in Hungary to a further depreciation of the forint or failure to raise the minimum wage,” said Sandor Baja, director for the Czech Republic, Hungary and Romania at recruitment agency Randstad.

A recent Reuters poll shows that most economists expect another significant depreciation of the Hungarian forint in 2023, while the exchange rate of the Romanian leu will fall only slightly.

Set designer Zoltan Dio, who lives near Debrecen, Hungary’s second-largest city, has been working for several years in Romania, where he has an account in lei that allowed him to protect his savings from the fluctuations of the Hungarian forint, which persistently lost 8% of its value against the Romanian leu this year. “If, after much negotiation, I could find a job in Hungary, I would have no problem earning about two-thirds of what I earn in Romania,” says Zoltan Dio.

Companies that moved their operations at low cost from Russia and Ukraine to neighboring countries made foreign investments of up to 9.39 billion euros in the January-October period, the highest figure since Romania joined the EU.

A survey conducted in 2022 by the consulting firm Ernst&Young showed that more than half of the 101 foreign companies interviewed were planning to start or expand their operations in Romania, especially in the areas of logistics and supply chains, ranking Romania fourth in Europe in terms of intention to invest.

“We are optimistic that investments will continue to grow in the coming years, encouraged in part by European funds,” said Alex Milcev, partner at E&Y Romania.

Although Romania has no investment promotion agency, officials from the Ministry of Entrepreneurship and Tourism told Reuters that they are monitoring five possible relocation projects from Russia, Belarus and Ukraine with an estimated value of 705 million euros.

One of the companies that decided to relocate to Romania is Finnish tire manufacturer Nokian Tyres, which announced it will invest 650 million euros to build a factory in Oradea, a region in northwestern Romania.

“It was clear that Oradea is the best location for our new plant,” says Päivi Antola, director of investor relations at Nokian Tyres. Päivi Antola said that the Finnish company analyzed more than 40 possible sites, looking mainly at available labor, logistical advantages, renewable energy sources and access to the rail network.

However, there are still some obstacles to the Romanian economy, such as the large current account deficit, an aging population and bureaucracy that has hindered infrastructure development. Reducing the budget deficit before the 2024 elections will be difficult.

Against our habit a long story, but sometimes you have to pause especially with new investments. Even more important is to exchange experiences among themselves, and for that a networking organization such as the DRN provides an opportunity. So in the coming period we are putting the emphasis on you as an entrepreneur, and activities such as a company visit and also the well-known networking activity the Romanian Business Day are on the agenda. You will be hearing from us!

Announcement:

Maritime DRN Network Meeting in November 2023

You can expect a networking organization to organize networking meetings and that includes company visits and they can be sectoral. Therefore, a contact was made with Damen Shipyards, which has a large bevy of suppliers and is of great importance to the Dutch manufacturing industry.

You will be informed of the date at a later date.

The annual well-known Romanian Business Day of interest to all sectors will take place in early 2024.

Company visit |

Annual event |

Sector Shipping & Shipbuilding

Dutch Maritime top trio receives international acclaim!

Everyone remembers the shipwreck of the container ship Fremantle Highway” that struck off Ameland and caught fire fully loaded with cars. Even an environmental disaster threatened.

It may be called a miracle Multraship from Terneuzen, with the help of Smit Salvage(subsidiary of Boskalis) accepted the challenge to turn this serious threat into an opportunity and accomplished it. The ship was then taken to the Botlek to Damen Shiprepair On Sept. 23, the Fremantle Highway arrived in the Port of Rotterdam. There it will be partially dismantled in order to carry out repair work.

Cleanup and inspections are also performed at Damen. The company expects the work to take about four to five months.So it is the finishing touch to the entire operation. What happens to the ship next is still unclear.

Cleanup and inspections are also performed at Damen. The company expects the work to take about four to five months.So it is the finishing touch to the entire operation. What happens to the ship next is still unclear.

Our hats are off to this tremendous achievement.

Hopefully the Romanian principals are convinced that the Netherlands has made its best people available in their field to fulfill their other maritime needs!

Romanian government canceled order to French Naval and opts to reconstitute their fleet

Because discussions on this are ongoing, we are limiting ourselves to the present reporting. However, on the one hand, the name of Damen Shipyards is mentioned again, and on the other hand, the tensions in the Black Sea no longer tolerate a delay.

Fisheries Sector (Fact Sheet Romanian Fisheries and Aquaculture)

Fish and seafood market size in Romania will grow by $191.03 million between 2022 and 2027; Growth driven by increasing awareness about the benefits of seafood consumption

According to a recent market study by the U.S.-based Technavio, it appears that the Romanian fishing market is experiencing strong growth. The seafood market in Romania is estimated to register an incremental growth of $191.03 million between 2022 and 2027, accelerating to a CAGR of 6.38% during the forecast period. The market is driven by increasing awareness of the benefits of seafood consumption. Consumption of fish and seafood products is steadily increasing in Romania.

Essential nutrients

Consumers are becoming increasingly aware of the benefits of seafood consumption. Seafood products contain essential nutrients, such as omega-3 fatty acids, high-quality lean proteins, healthy fats, important vitamins and minerals, including selenium and vitamin D. Omega-3 fatty acids lower blood triglyceride levels and slow plaque formation. Similarly, vitamin D helps maintain calcium and phosphorus levels in the body. It also helps build and maintain strong bones and prevents rickets and osteomalacia. Growing awareness of such health benefits is leading to increased consumption

Romanian situation

Located in southeastern Europe, Romania has a coastline 256 km long, representing 5.3% of the total coastline of the Black Sea and 0.5% of the total coastline of the 23 EU coastal member states. About 900,000 people, or 4.5% of Romania’s total population, live in coastal areas. Sea fishing is possible only in Romanian territorial waters of the Black Sea. The sector employs 757 fishermen. The national fishing fleet is largely small-scale, that is, vessels less than 12 meters in length. Romania had 155 registered vessels in 2017, the vast majority of which (131) were less than 12 meters. Only 5 ships are between 18 and 29 meters. Sea catches and landings totaled 9,553 tons in 2017 due to increased demand for rapana, which totaled 9,244 tons. The fleet targets small pelagic species, such as anchovies ( Engraulis encrasicolus ) and European sprat ( Sprattus sprattus ). In addition, it catches flatfish (turbot ( Psetta maxima )), some shark / dogfish.In fact, by removing the sea snail from the total catch of the sea, the maritime sector catches only 309 tons of other seafood.

Located in southeastern Europe, Romania has a coastline 256 km long, representing 5.3% of the total coastline of the Black Sea and 0.5% of the total coastline of the 23 EU coastal member states. About 900,000 people, or 4.5% of Romania’s total population, live in coastal areas. Sea fishing is possible only in Romanian territorial waters of the Black Sea. The sector employs 757 fishermen. The national fishing fleet is largely small-scale, that is, vessels less than 12 meters in length. Romania had 155 registered vessels in 2017, the vast majority of which (131) were less than 12 meters. Only 5 ships are between 18 and 29 meters. Sea catches and landings totaled 9,553 tons in 2017 due to increased demand for rapana, which totaled 9,244 tons. The fleet targets small pelagic species, such as anchovies ( Engraulis encrasicolus ) and European sprat ( Sprattus sprattus ). In addition, it catches flatfish (turbot ( Psetta maxima )), some shark / dogfish.In fact, by removing the sea snail from the total catch of the sea, the maritime sector catches only 309 tons of other seafood.

European sprat and turbot are subject to TACs (Total Allowable Catches).In 2019, the quota for sprat was 3 442 tons, while the quota for turbot was 57 tons, but the catches were much lower, only 28 tons for sprat and 43 tons for turbot.Fishing activity is seasonal and depends on weather conditions in the Black Sea, where there are large temperature differences between winter and summer, as well as strong winds.All landed fish are used for human consumption. The main ports used by fishermen to land catches are Mangalia, Olimp, Costineşti, Mamaia and Cape Midia.Fishing and aquaculture are of particular importance in remote areas, where they are the only source of income for the local population.

Inland Fisheries

The total area of inland waters is more than 7 000 km², about 3% of the total area of the country.The Danube River has a total length of 1 074 km in Romania, which corresponds to about 3 430 km² and an average volume of about 2.23 million m³ of water.That is where the main inland fisheries are located.Other areas of importance for inland fisheries are estimated at 500 000 ha of standing water, 66 000 km of running water in the mountains, hills and plains.

The total area of inland waters is more than 7 000 km², about 3% of the total area of the country.The Danube River has a total length of 1 074 km in Romania, which corresponds to about 3 430 km² and an average volume of about 2.23 million m³ of water.That is where the main inland fisheries are located.Other areas of importance for inland fisheries are estimated at 500 000 ha of standing water, 66 000 km of running water in the mountains, hills and plains.

Inland fishing is a full-time occupation practiced mainly by traditional fishermen.In most cases, it is a subsistence activity. Commercial inland fishing takes place in rivers, ponds and reservoirs, including the Danube River, the Danube Delta and the Danube Delta Biosphere Reserve.In 2017, about 2,731 fishing boats and more than 4,103 fishermen were involved in inland fishing, with a total estimated catch of 3,592 tons.Almost all (96%) boats and fishermen (97%) are concentrated on the Danube River and its floodplains, the Delta and some of its former lagoons.

Cyprinid species dominate the catch. Goldfish ( Carassius auratus ) and freshwater bream ( Abramis brama ) represent 41% and 10% of the total, respectively. Of the rest, 13% are pontic shad (Alosa pontica ), a member of the herring family.

Aquaculture

Aquaculture is predominantly freshwater, and the country’s land resources and the availability of inland waters provide excellent conditions for fish farming.The main fish species farmed are members of the cyprinids, especially common carp.Other species include trout, pikeperch and pike.In total, the aquaculture sector produced 12 209 tons in 2017. The growth of aquaculture production can be attributed to the extensive production of common carp in polyculture, extensive or semi-intensive. In 2015, there were about 635 production facilities in the country. Almost all companies produced freshwater fish. Organic carp were produced on 29 farms in 2016. Production of new species, such as sturgeon, is still low. Recently, extensive fish farms have become multifunctional, providing services such as ecological tourism, recreational fishing and educational activities related to aquatic biodiversity knowledge and protection. There is a trend to diversify and expand the current range of aquaculture activities.

Processing and trade

In 2016, there were 31 registered fish processing companies, which employed 1 343 people.The processing industry had a production value of €88.7 million with an added value of €10.2 million.In 2017, 20,170 tons were produced, of which preserved/prepared and frozen whole sea fish were the main product types. The native species commonly used for processing are carp, silver carp, bighead carp, bream, catfish, perch, pike and trout.The most common imported marine species used for processing are salmon, herring, sprat and mackerel.There is a wide variety of value-added products such as salads, smoked fish and marinades, as well as primary processed fish (headless, gutted or portioned).

Romania imports large quantities of fishery and aquaculture products. Imports have increased steadily since 2011, reaching a value of €286 million and a volume of 110,000 tons in 2017. More than four-fifths of all imports come from other EU member states with the Netherlands (13%), Poland (10% ), Italy (8%), Spain (8%) and Germany (8%) being the main suppliers. Mackerel, hake and herring are the main import species. In recent years, sea bass, sea bream, trout and salmon have emerged as important imports.Among non-EU countries, Turkey is the main source of raw materials. Imports from it were worth 9.9 million euros and amounted to 3 089 tons.

Romania imports large quantities of fishery and aquaculture products. Imports have increased steadily since 2011, reaching a value of €286 million and a volume of 110,000 tons in 2017. More than four-fifths of all imports come from other EU member states with the Netherlands (13%), Poland (10% ), Italy (8%), Spain (8%) and Germany (8%) being the main suppliers. Mackerel, hake and herring are the main import species. In recent years, sea bass, sea bream, trout and salmon have emerged as important imports.Among non-EU countries, Turkey is the main source of raw materials. Imports from it were worth 9.9 million euros and amounted to 3 089 tons.

Romanian export levels fluctuated in recent years.In 2017, Romania exported 24 428 tons (including 17 822 tons of fishmeal) of fishery and aquaculture products worth €40 million.The main export market was the EU (92%), where France, Italy, Bulgaria and Greece were the main destinations.Moldova was the largest non-EU destination, receiving half of all non-EU exports. Salmon was the largest commodity group exported to Moldova. So Romania is a net fish-importing country.

Dayseaday – Oceanis

Is a Dutch importer and supplier of frozen foods for the catering and retail industry in Romania

DayseaDay have long been active in former Eastern Bloc countries such as Ukraine, Russia, Hungary, the Czech Republic and Poland. Since 2012, Romania-based Oceanis Seafood Europa SRL (OSE) has been a subsidiary of Dayseaday. To which the Russian Federation must be temporarily excluded.

Within fourteen years, Oceanis Seafood Europe has become a major player. With a wide range of one hundred and sixty products, good quality, reliability, continuity, flexibility and competitive prices, they have an excellent reputation in Romania and surrounding countries.

Within fourteen years, Oceanis Seafood Europe has become a major player. With a wide range of one hundred and sixty products, good quality, reliability, continuity, flexibility and competitive prices, they have an excellent reputation in Romania and surrounding countries.

The fish is brought in by container ship via the port city of Constanta and by truck from Urk and other parts of Europe. Oceanis Seafood also imports fish from Turkey and Bulgaria.

Their storage capacity is a thousand pallets.

From a coldstore, manager Bogdan Manoliu and his enthusiastic team serve wholesale and foodservice customers throughout Romania on a daily basis. They also supply directly and indirectly to star hotels such as Marriott, Sheraton and Novotel. The company is a reliable cooperation partner.

For further information: www.dayseaday.com and www.technavio.com

Investment of 2 million euros in a fish farm on the Transalpina.

On Oașa, the largest reservoir on Sebeș, the Pastravul Șara Ta Cooperative will complete this year an investment of about 2 million euros, European money, in a farm that will produce 620 tons of rainbow trout annually. Most of the goods will arrive in the stores of the Carrefour retailer, which works with more than 25 Romanian fish suppliers, starting in the second half of the year.

Pastrăvul dinn Țara Ta , an association founded in 2020. The 6,430-square-meter farm, accessed through the courtyard of the Oaşa Monastery, will eventually produce 620 tons of rainbow trout per year in 32 ponds, according to the presentation memorandum. To begin with, expected annual production will be about 345 tons of rainbow trout.

The value of the shrimp market in Romania has reached 25 million euros. From 2020 to 2022, the volume of imports doubled

Romanian shrimp consumption has grown steadily since the start of the pandemic, with market players reporting a 20% increase in the first half of 2023 compared to the same period the year before. Fish and seafood distributor and processor Alfredo Seafood estimates the shrimp market at 25 million euros.

Consumption data shows that Romanians value shrimp, which accounts for more than 50% of the total local fish market, which has grown steadily as a result of the pandemic estimates the value of the shrimp market in Romania at some 25 million euros. The segment increased 20% in the first half of 2023 compared to the same period of the previous year. The increasing demand for shrimp is also reflected in the volume and value of imports, which doubled between 2020 and 2022, according to analysis by representatives of Alfredo Seafood, based on data from the National Institute of Statistics.Shrimp consumption, however, remains at modest levels. The annual average of fish and seafood consumption in Romania is 8-9 kilograms per capita, of which shrimp represents only 3%. Shrimp consumption in Romania is constantly evolving, starting in 2020. The pandemic has made Romanians more careful about what they eat and more interested in adopting a healthy lifestyle. And according to nutritionists, shrimp is one of the most valuable foods

Consumption data shows that Romanians value shrimp, which accounts for more than 50% of the total local fish market, which has grown steadily as a result of the pandemic estimates the value of the shrimp market in Romania at some 25 million euros. The segment increased 20% in the first half of 2023 compared to the same period of the previous year. The increasing demand for shrimp is also reflected in the volume and value of imports, which doubled between 2020 and 2022, according to analysis by representatives of Alfredo Seafood, based on data from the National Institute of Statistics.Shrimp consumption, however, remains at modest levels. The annual average of fish and seafood consumption in Romania is 8-9 kilograms per capita, of which shrimp represents only 3%. Shrimp consumption in Romania is constantly evolving, starting in 2020. The pandemic has made Romanians more careful about what they eat and more interested in adopting a healthy lifestyle. And according to nutritionists, shrimp is one of the most valuable foods

“The nutritional benefits make shrimp a superfood. They contain optimal amounts of vitamin B12 and folic acid, with an anti-anemic effect, iron, and in just 100 grams they contain 20 grams of protein and 50% of the body’s daily selenium requirement. When it comes to protein sources, shrimp are just as valuable as meat and fish. But in terms of minerals, they are clearly superior because they get the best from the sea: iodine is essential for accelerating metabolism and optimal thyroid function, and zinc boosts immunity. Moreover, shrimp have a low calorie intake, so they do not make you fat, and after the egg, they are the food with the highest level of good cholesterol, LDL: 200 milligrams, per 100 grams of product, that is, 70% of the recommended daily dose, explains Mihaela Bilic, specialist in nutrition and metabolic diseases.

Release market study: ornamental plants and cut flowers in Romania

The agriculture team of the Dutch Embassy in Bucharest commissioned an update of a market study on the ornamental plants and cut flowers sector presented in 2019. The study, using comparative data from 2020 and 2021, highlights interesting opportunities within the Romanian market for ornamental plants and cut flowers.

According to the summary, local production in this sector currently remains remarkably modest and is mainly concentrated in selected regions throughout the country. Although Romanian export figures remain relatively limited, there has been a consistent upward trajectory in imports of cut flowers and ornamental plants in recent years. This trend indicates an escalating demand for these botanical varieties, a demand that native production is struggling to meet. A main supplier of particular importance is the continuing dominance of the Netherlands as the main supplier of ornamental plants and cut flowers to Romania. In the year 2021 alone, imports from the Netherlands reached the highest market value in Romania, around 40 million euros. According to the report, as in 2015, public sector entities remain the main consumers of ornamental flora.

According to the summary, local production in this sector currently remains remarkably modest and is mainly concentrated in selected regions throughout the country. Although Romanian export figures remain relatively limited, there has been a consistent upward trajectory in imports of cut flowers and ornamental plants in recent years. This trend indicates an escalating demand for these botanical varieties, a demand that native production is struggling to meet. A main supplier of particular importance is the continuing dominance of the Netherlands as the main supplier of ornamental plants and cut flowers to Romania. In the year 2021 alone, imports from the Netherlands reached the highest market value in Romania, around 40 million euros. According to the report, as in 2015, public sector entities remain the main consumers of ornamental flora.

Romania’s efforts to improve and preserve green spaces across the landscape have continued since 2007. However, achieving optimal green space per capita in many urban centers remains uncertain. This is underscored by the inclusion of specific funding measures for green infrastructure in each Regional Development Plan for the period 2021-2027. The room for progress is considerable. Challenges that arise in implementing pioneering projects within this sector, such as sometimes suboptimal equipment, training and expertise, simultaneously provide opportunities for engagement at different levels. Opportunities include equipment exchange, educational initiatives and consulting services.

Financing for Green Projects Moreover, a range of financing options for green projects is accessible to SMEs, NGOs, the research and development sector, as well as industrial and agricultural entities. These funding opportunities cover a spectrum that ranges from comprehensive project implementation to initiatives that raise public awareness The Netherlands has already cemented its position as a pioneer in the market and holds the lion’s share of ornamental and cut flower imports. Notable is the established reputation for innovation within the industry. Against the backdrop of an evolving cultural institution that increasingly values urban green spaces and with the diverse range of funding prospects, coupled with previous triumphant collaborations involving foreign partners, Romania emerges as an enticing and fertile ground for expanding Dutch ventures. The underlying ambition of this report is to boost those interested in strengthening their presence in Romania and position them at the forefront of a new era of growth within the floriculture sector.

Are you a Dutch entrepreneur/company interested in the ornamental or cut flower sector in Romania and might this research provide you with useful information? Contact us at bkr-lnv@minbuza.nl to receive a copy.

Logistics and Transportation & Electrification

KLG Installs photovoltaic panels in Romania

Logistics company KLG Europe Logistics has had 888 photovoltaic panels installed at its warehouse in Bolintin Deal, Giurgiu district, which will cover about 40% of the energy consumed annually

Renovatio Solar, a company in the Renovatio Group, one of the main players in solar energy and green technology in Romania, recently completed a 400 kWp photovoltaic project for the logistics and transport company KLG Europe Logistics Romania.

“The project included the installation, as said, of a number of 888 photovoltaic panels, with a capacity of 400 kWp, capable of generating an annual quantity of electricity estimated at 500 MWh. The company’s headquarters is also located there,” said Horatiu Regneală, CEO of Renovatio Solar.

KLG Europe Romania offers road, sea and air transport services, warehousing, value-added services, e-fulfilment and courier services for bulky products.

“Recently we have invested over 1 million euros in digitalization and sustainable initiatives, considering that in both areas the benefits that the company will book are clear: more independence in carrying out operational processes and significant cost savings. As for the investments in photovoltaic panels, they cover about 40% of annual energy consumption and correspond to the planting of 1,600 trees,” said Răzvan Marinescu, Managing Director of KLG Europe Logistics Romania.

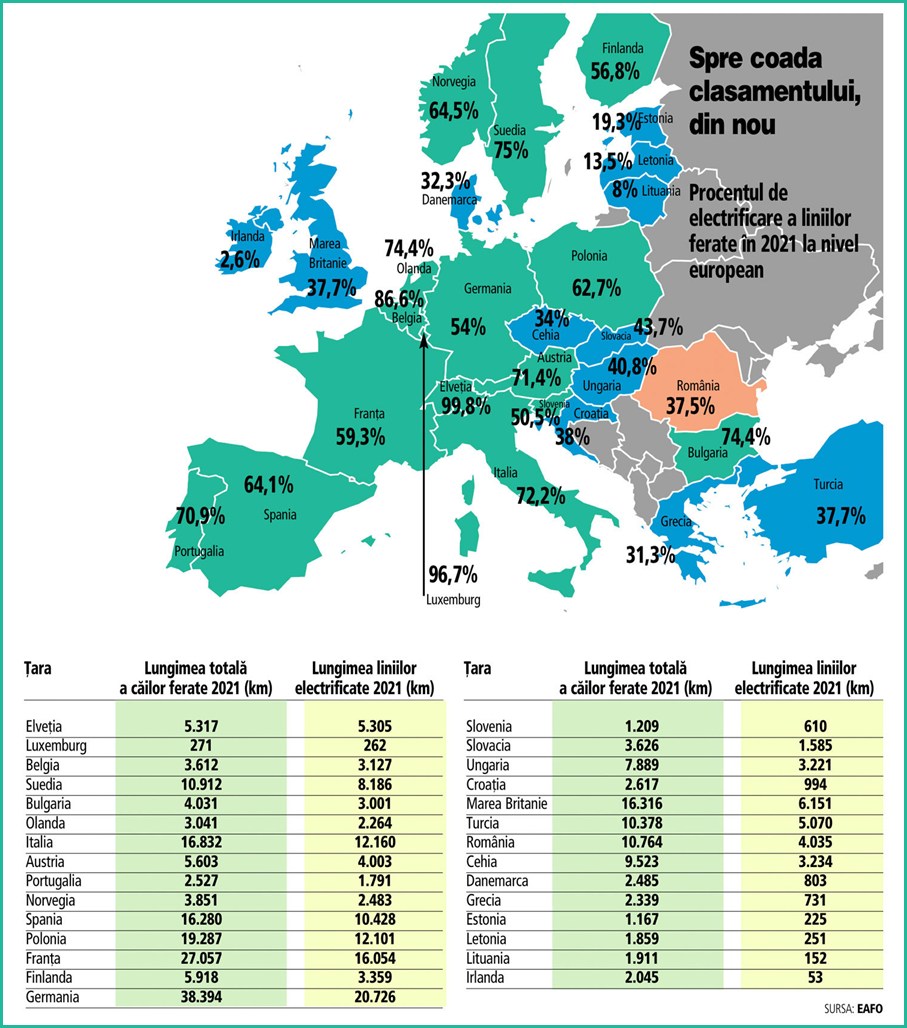

Electrification of the economy: In what areas can a shift to electricity consumption take place and what are the challenges?

The electrification of transportation and the transition to heating solutions that use electricity, in both cases through the use of green energy, represent the main directions towards the electrification of economies and thus the transition from fossil fuels to emission-free consumption. In the latest episode of the series Energy from A to Z, ZF’s editorial campaign supported by PPC (PUBLIC POWER CORPORATION), we see how long the road Romania has to travel in this direction.

The electrification of transportation and the transition to heating solutions that use electricity, in both cases through the use of green energy, represent the main directions towards the electrification of economies and thus the transition from fossil fuels to emission-free consumption. In the latest episode of the series Energy from A to Z, ZF’s editorial campaign supported by PPC (PUBLIC POWER CORPORATION), we see how long the road Romania has to travel in this direction.

ZF calculations based on Eurostat data show that only 25% of the EU’s final energy consumption was supplied by electricity in 2021. Again, the Scandinavian states do well in this regard, with Norway having an electrification rate of over 51% of its economy, while Romania has a rate of only 16%. This low percentage in the case of Romania actually represents the way the country still has to go on the path of decarbonization by transitioning some industries from the area of fossil fuel consumption to that of electricity from green sources.

“Electrification involves replacing technologies or processes that use fossil fuels, such as internal combustion engines or gas boilers, with equivalent technologies powered by electricity, such as electric cars or heat pumps. These alternatives are typically more efficient and have an impact on the emissions area in the context where the energy used is produced from non-CO2 sources,” the IEA (International Energy Agency) website states.

The biggest challenges, including for Romania, will be the transportation and heating segments.

Sources: Ziarul Financiar, Eurostat

The Dutch at Photon Energy have connected two photovoltaic power plants in Făget and Săhăteni to the grid, with a combined production capacity of 10.3 MWp. The company expects the two units to generate sales of over 2 million euros by 2024

Photon Energy Engineering Romania, the Romanian branch of the Dutch Photon Energy group, which focuses on technological, procurement and construction (EPC) services, has completed and connected to the electricity grid two photovoltaic (PV) power plants near Făget (Timiş County) and Săhăteni (Timiş County). Timiş district) Buzau), with a combined production capacity of 10.3 MWp.

The units, wholly owned by Photon Energy Group, cover 4.8 and 10 acres of vacant land, respectively, and are equipped with a total of 18,300 solar panels.

Company officials estimate that the total annual output of the power plants will be about 4.7 GWh and 10.9 GWh, respectively. The solar panels will provide clean energy to the networks operated by E-Distribuţie Banat (Făget) and Distribuţie Energie Electrică Romania (Săhăteni)

Company officials estimate that the total annual output of the power plants will be about 4.7 GWh and 10.9 GWh, respectively. The solar panels will provide clean energy to the networks operated by E-Distribuţie Banat (Făget) and Distribuţie Energie Electrică Romania (Săhăteni)

“The electricity produced will be sold on the energy market on a commercial basis, without any government support and without a power purchase agreement with a power distributor,” said representatives of Photon Energy.

The company expects the plants to generate revenues of about €2.25 million in 2024 based on current forward prices for baseload electricity in Romania.

“Following the commissioning of our first six power plants in Romania early this year, the commissioning of the Făget and Săhăteni plants represents a new important phase for Photon Energy in the Romanian renewable energy market, where we have an additional capacity of about 20 MWp at five different sites in an advanced stage of construction,” said Georg Hotar, CEO of Photon Energy Group.

The company’s Independent Power Producer (IPP) portfolio now includes 96 solar power plants with a combined generating capacity of 123.4 MWp.

Currently, a total capacity of over 100 MWp is sold as clean electricity directly on the energy market.

The company is currently developing utility-scale solar PV projects with a combined capacity of over 1.2 GWp MWp in Australia and core markets in Central and Eastern Europe, including 223 MWp in Romania, with a total capacity of 20.1 MWp in advanced stages of construction.

Is the photovoltaic energy phenomenon going out of control?

ANRE (Romanian Energy Regulatory Authority) suggests limiting the capacity a prosumer can install.

For a proper definition: Prosumers are consumers who generate (part of) their own energy through solar panels, CHP plants, wind turbines, etc.. They are both producers and consumers.

Prosumers have begun installing more photovoltaic panels than they consume, with the idea of making a business out of selling the excess energy. But this creates problems with imbalances throughout the grid, says ANRE’s president, who suggests putting a limit on the capacity people can install on rooftops.

The role of prosumers is to make us energy efficient, to lower our bill at a time of high energy and gas prices, not to make money out of it, said George Niculescu, ANRE’s president, during the launch conference of Good Code practices. in the renewable energy sector.

The role of prosumers is to make us energy efficient, to lower our bill at a time of high energy and gas prices, not to make money out of it, said George Niculescu, ANRE’s president, during the launch conference of Good Code practices. in the renewable energy sector.

“I have encouraged and continue to believe in the role of prosumers as a measure of energy efficiency. I still believe that to lower our energy bills, we should turn to photovoltaic panels on the roofs of homes, just like household consumers. However, I do not believe in oversizing the production facilities to monetize this excess energy they produce excessively,” Niculescu said.

He stated that there are situations where a consumer, although he has a technical approval to connect only for 5 kW, installs 20 kW because the roof allows it, but in this way unbalances the distribution network.

“We get into a situation where the tenth neighbor down the street can no longer connect, and if they do connect, we get problems with low-voltage distribution. Therefore, I think there should be a threshold for these capacities, a percentage of what you consume. We don’t want to discourage this process, but we want it to be a measure of energy efficiency, not monetizing a situation,” the ANRE president stressed.

Recently, Gabriel Andronache, the vice president of ANRE, stated that photovoltaic panels are currently being installed so fast that next year we could have an installed capacity of 2,000 MW, almost as much as three Cernavodă nuclear reactors.

Agri & Food Sector

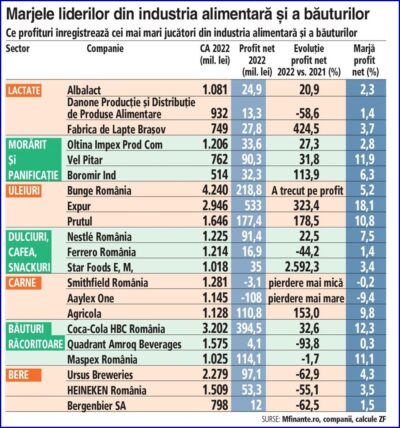

Food industry leaders’ profit margins

In dairy, Danone and Lactalis are “struggling” under 2-3%, in meat Agricola is heading toward 10% and (Bakery Bread) Vel Pitar is reaching 12%. In terms of value, the fresh meat market increased on average by over 15%, the dairy market by over 20%, the oil market by over 35% and the cookie market by over 20%.

In dairy, Danone and Lactalis are “struggling” under 2-3%, in meat Agricola is heading toward 10% and (Bakery Bread) Vel Pitar is reaching 12%. In terms of value, the fresh meat market increased on average by over 15%, the dairy market by over 20%, the oil market by over 35% and the cookie market by over 20%.

The largest profit margin among the largest players in key food and beverage industry subsectors was recorded by oil producer Expur in 2022 in the year when vegetable oil reached a record price. Thus, Expur achieved a net profit margin of 18%, according to ZF’s calculations based on data from the Ministry of Finance. Another major player in this field, Prutul, is doing no worse in terms of profit margin, with an increase of over 10%. Moreover, Bunge, the largest player in the market in terms of revenue, was turning a profit.

On the other hand, the top most profitable company-leader in the sector is completed by bakery products manufacturer Vel Pitar (11.9%) and soft drink bottler Coca-Cola HBC (12.3%). Traditionally there was also a brewer at the top, but recent years have been difficult for the market in a context where consumption stagnated and then declined.

Financial and Economic Developments

Fitch reaffirms Romania’s sovereign rating and maintains stable outlook for economy

According to the agency, the Romanian economy will grow 2.9% in 2023 and 3.2% in 2024. Illustrative image.

On Sept. 8, 2023, the rating agency Fitch affirmed Romania’s sovereign debt rating at BBB-/F3 for long-term and short-term foreign currency debt, as well as the country’s stable outlook, the Ministry of Finance reported in a press release.

The decision to reaffirm the sovereign rating and maintain a stable outlook is supported, in the agency’s view, by the country’s membership status in the European Union and capital flows from the European Union that support investment and the country’s macro-economic stability, as well as by the positive evolution of GDP per capita and governance and human development indicators, which, according to the agency’s assessment, are at a higher level than countries in the same rating group (BBB), the statement said.

‘Fitch’s announcement is a recognition of our ongoing efforts to control the fiscal deficit, support the business environment and promote sustainable economic growth. The rating agencies’ confidence provides us with a solid framework to continue developing and implementing responsible fiscal policies and infrastructure projects that support long-term growth. The priorities of the Ministry of Finance remain the implementation of the measures that ensure fiscal consolidation and those necessary to ensure sustainable economic growth of Romania. We are determined to stay on the path of reform and continue to improve our rating and economic outlook in the future,” said Finance Minister Marcel Boloș.

In the assessment conducted, Fitch cites both the economic resilience that Romania has shown in the recent period (2022 and the first half of 2023) and the political stability that our country has enjoyed since the end of 2021. At the same time, the agency highlights Romania’s debt-stable public sector, as well as the downward trend of inflation in our country.

According to the agency, the Romanian economy will show growth of 2.9% in 2023 and 3.2% in 2024, given that our country will benefit from important European funds from both the Multiannual Financial Framework 2021-2027 and the Recovery and Development Fund. Resilience Mechanism (PNRR), says the Treasury Department.

According to the agency, the Romanian economy will show growth of 2.9% in 2023 and 3.2% in 2024, given that our country will benefit from important European funds from both the Multiannual Financial Framework 2021-2027 and the Recovery and Development Fund. Resilience Mechanism (PNRR), says the Treasury Department.

The main factors that could individually or collectively lead to an improvement in a country’s rating or outlook are the continued reduction in the budget deficit, which would also support a solid decline in public debt as a percentage of gross domestic product over the medium term. As well as the structural improvement in the current account position by reducing external debt and external financing risks.

On the other hand, continued large budget deficits that would lead to an upward trajectory of the share of public debt in GDP in the medium term, as well as the significant deterioration of external liquidity reserves, due to the persistence of large current account deficits and the reduction of foreign capital income, will be mentioned as factors that could lead to a deterioration of the country’s rating, the press release said.

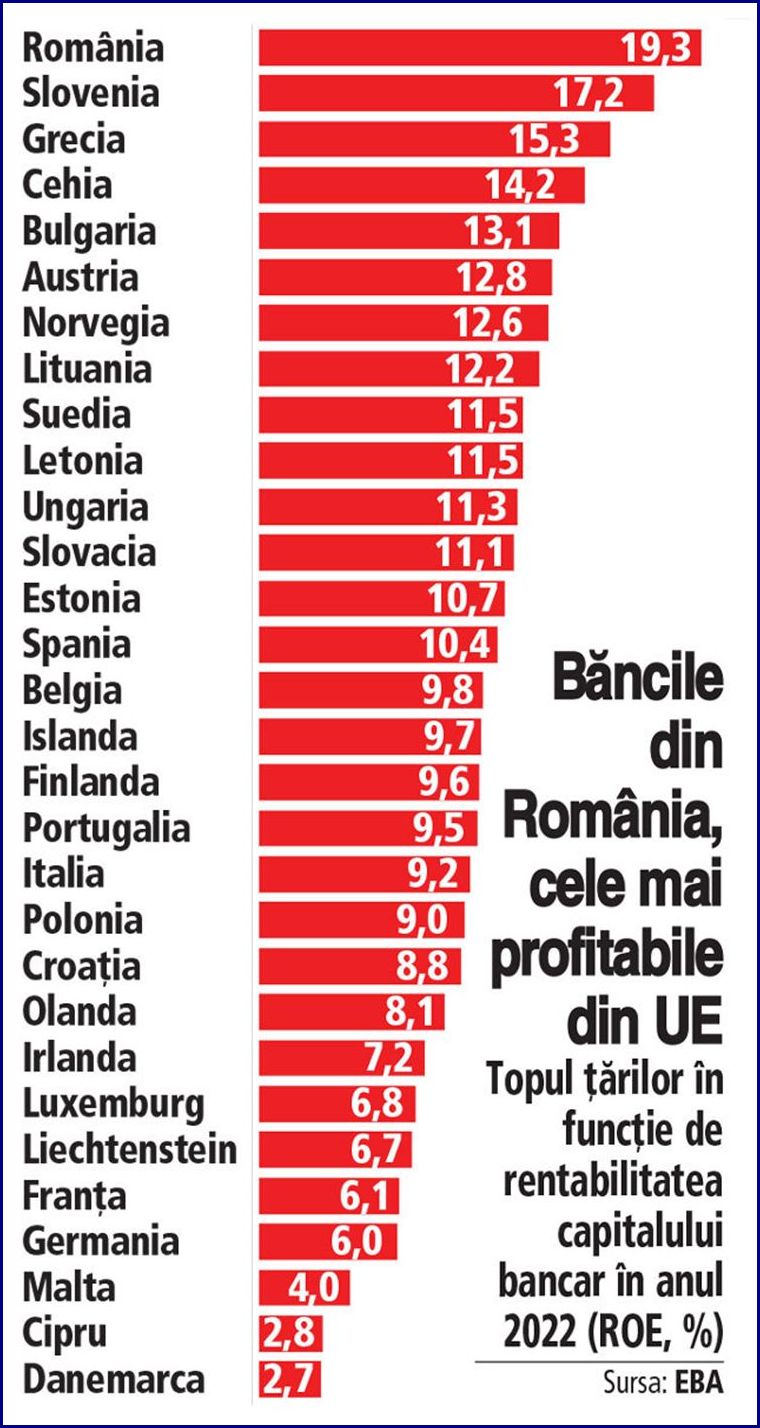

Banks’ return on capital (ROE) in Romania according to the ROE indicator (return on capital)

The return in 2023 rose to a record of the past 15 years, to over 21%. Romanian banks are the most profitable in the EU, with a return on equity double the EU average. But if we analyze at the sectoral level, the profitability of banks in Romania was below the average profitability of other sectors

Banks rose to a record 21.3% in March 2023, keeping it above 21% (21.1%) at the end of June. The top The five countries with the highest ROE levels at banks in 2022 include Romania (19.3%), Slovenia (17.2%), Greece (15.3%), the Czech Republic (14.2%) and Bulgaria (13.1%), according to data from the European Banking Authority.

In the first semester (H1) of this year, the Romanian banking system had an ROE (return on capital) indicator of over 21%, marking the historical maximum for the past 15 years, since the NBR has been publishing such data. ROE at banks rose to a record 21.3% in March 2023, remaining above 21% (21.1%) at the end of June.

After 2009, due to the international financial crisis, the level of ROE also declined in Romania, even reaching the negative level in some years.

High interest rates and an increase in lending brought the banking system’s profit in S1/2023 to nearly 7 billion lei, a new record, up more than 40% compared to S1/2022. In the full year 2022, banks made a historic profit of 10.2 billion lei.

At the European Union (EU) level, Romanian banks have led the top profitability league in recent years, with the highest return on bank capital ROE in 2022, of over 19%, more than double the EU average of 8%, according to European Banking Authority (EBA) data.

The effects of inflation in Romania

A third of Romanians save less. Investments in financial products and material goods, dropped from the priority list.As a result of price increases, 29% of Romanians are saving less or not at all, and a quarter of them say they have changed the way they put money aside or invest, according to a recent survey by Ipsos for ING Bank.

Valentin Tataru, chief economist of ING BankPhoto: ING Bank

These figures are also confirmed by ING’s internal assessments, conducted between January and June 2023, which show that 39% of those who enter into a relationship with ING’s Banometer program do not have a savings fund or do not save at all.

On the other hand, investing in financial products and material goods is not a priority for many Romanians: 58% of respondents said they very rarely or not at all invest in stocks/bonds/investment funds, as well as real estate or valuables.

‘The impact of rising inflation on consumption behavior is complex and usually manifests itself with a certain inertia. So it usually takes several good quarters before consumers really notice the change in their disposable income and start adjusting their consumption,” explained Valentin Tătaru, chief economist at ING Bank Romania.

In turn, consumption is also strongly influenced by rising interest rates that encourage saving on the one hand and increase interest rates on loans on the other, which also causes an adjustment in consumption behavior, the chief economist said.

“To the extent that this situation lasts longer, there may even be quasi-permanent changes in consumption and savings behavior. So when inflation and interest rates begin to fall, consumers may extend their cautious behavior for a longer period of time after periods of high inflation, and it will take a relatively long period of consistent real wage growth to return to pre-inflation consumption behavior.” concludes Valentin Tătaru.

Romanians spend less on clothes, restaurants and travel to cover price hike

Over 70% of Romanians spend a larger portion of their income on food/daily groceries and energy than they did five years ago, and over 65% expect to still be doing so in five years, Ipsos research shows.

To cope with inflation, 50% say they have cut back on clothing and restaurants/bars, while 48% allocate a smaller budget for travel.

The Banometer evaluation shows that the inability to maintain the same lifestyle due to inflation also has an emotional impact. As a result, there is a growing sense of frustration, but also a significant increase in consumption, especially for those with higher incomes.

According to the cited study, 48% of Romanians can no longer afford to save because of inflation, and only 11% are setting aside more money to face a more expensive future, which is already reflected in the numerous price increases.

What does Mihaela Bîtu, CEO of ING Bank, think about the current times: We have to be careful

The economy is slowing, which is also being felt in the banking sector, but there will be no recession this year, said Mihaela Bîtu, head of ING Bank. The bank does, however, she said, remain cautious and constantly alert to both local and international developments. Against the backdrop of inflation and high interest rates, credit demand moderated. Mihaela Bîtu speaks in an interview about the current challenges, as well as the maturation and financial responsibility of Romanians and the financial system as a whole, claiming that “many lessons have been learned from the past,” which helps us adapt more quickly to the new set of economic conditions characterized by a slowdown in GDP, high inflation, high interest rates and credit moderation.

Overall, we see resilience in economic activity, but also a continuation of general trends. Probably the main areas of concern are in the area of industrial production, which has been on a declining trend for years, although not all industries are underperforming. Then, of course, agriculture is a relatively volatile sector, especially during this period. The construction, real estate and related economic sectors are affected to some extent by the current context, but access to European funds and related public investment are smoothing out the slowdown trends somewhat. On the other hand, the services sector is going through a good period, especially in the IT field,” is how ING Bank CEO Mihaela Bîtu sees Romania’s current economic picture.

Overall, we see resilience in economic activity, but also a continuation of general trends. Probably the main areas of concern are in the area of industrial production, which has been on a declining trend for years, although not all industries are underperforming. Then, of course, agriculture is a relatively volatile sector, especially during this period. The construction, real estate and related economic sectors are affected to some extent by the current context, but access to European funds and related public investment are smoothing out the slowdown trends somewhat. On the other hand, the services sector is going through a good period, especially in the IT field,” is how ING Bank CEO Mihaela Bîtu sees Romania’s current economic picture.

She believes that “many lessons have been learned from the past” that will allow us to adapt more quickly to the new economic conditions characterized by slowing GDP, high inflation, high interest rates and credit moderation. For Romania, ING expects gross domestic product growth to slow from 4.7% in 2022 to about 2.5% in 2023, probably one of the highest economic growth rates in Europe this year. ‘Overall, it seems that we are witnessing a slight rebalancing of the economic growth model from consumption to investment, a phenomenon that can only be sustained in the medium term through the efficient absorption of European funds.

Gerke Witteveen is the new CEO of NN Pensii, the largest private pension fund in Romania

Gerke Witteveen will be the new CEO of NN Pensii as of October 9, 2023. Gerke replaces Andreea Pipernea, who has led NN Pensii for the past six years and will pursue new professional and entrepreneurial opportunities outside NN, according to the company.

Gerke Witteveen will be the new CEO of NN Pensii as of October 9, 2023. Gerke replaces Andreea Pipernea, who has led NN Pensii for the past six years and will pursue new professional and entrepreneurial opportunities outside NN, according to the company.

NN is the administrator managing the mandatory private pension fund (Pillar II) with the most contributors in Romania, reaching a number of over 2 million Romanians.

Gerke Witteveen has nearly 20 years of experience in the financial field. For the past seven years, he held the role of CFO of NN Asigurări de Viață and has been a member of NN Asigurări’s board of directors since 2020. At the same time, he held the role of vice president of the National Union of Insurance and Reinsurance Companies of Romania (UNSAR) from 2017 to the present and is a board member of the Romanian-Netherlands Chamber of Commerce (NRCC).

Since joining NN, Gerke Witteveen has strengthened the company’s finance domain and contributed to NN’s digital transformation as part of its strategy to become the digital insurer of the future. Over time, he has been involved in several projects, the most notable of which was the implementation of the financial reporting standard IFRS17.

Since joining NN, Gerke Witteveen has strengthened the company’s finance domain and contributed to NN’s digital transformation as part of its strategy to become the digital insurer of the future. Over time, he has been involved in several projects, the most notable of which was the implementation of the financial reporting standard IFRS17.

“Moreover, in the role of CEO of NN Pensii, I will continue to develop the company’s operational excellence and consolidate the investment strategy through which, through Pillar II, we support more than 2 million Romanians in saving for their retirement. In the coming years, the focus will be on sustainable investment policies in line with ESG standards: Environmental, Social, Governance. A key priority will also be to accelerate digitalization to provide participants with a simple and fast experience in interacting with their mandatory private pension,” said Gerke Witteveen.

Source photo: NN Pensii

Presentation of credentials of Dutch ambassador

Recent H.E. Willemijn van Haaften presented her credentials to President Klaus Iohannis, who accredited her as ambassador of the Kingdom of the Netherlands to Romania.

Education Sector

Ten students spent the summer at Philips learning about state-of-the-art medical equipment

During the summer, a group of ten students from the Faculty of Medical Technology at Bucharest Polytechnic University went on a study tour to Philips.

The goal was to acquire the essential knowledge needed to become the next generation of engineers who will play a role in efforts to modernize the health care system in Romania.

In May this year, Philips Romania signed a partnership with the Faculty of Medical Technology at the Polytechnic University in Bucharest to support students entering the medical field. For example, during the summer, ten third-year students learned what medical technology means, the digitization of medical systems and the constant focus on innovation; these are the key elements that form the basis of training healthcare professionals.

In May this year, Philips Romania signed a partnership with the Faculty of Medical Technology at the Polytechnic University in Bucharest to support students entering the medical field. For example, during the summer, ten third-year students learned what medical technology means, the digitization of medical systems and the constant focus on innovation; these are the key elements that form the basis of training healthcare professionals.

The goal of the program was to give students the opportunity to identify the right roles for them as graduates, understand how a medical technology company works, participate in workshops to discover new professional skills, learn their craft in practice and apply their theoretical knowledge.

“Engineers specialized in this field play a crucial role in the transformation of the healthcare system in Romania to one that is as modern, as digital and as patient-centered as possible. The ten students who spent the summer at Philips had the opportunity to work side by side with our technical team, participated in workshops and learning sessions, and witnessed the installation of equipment in hospitals in different parts of the country. Giving these young people a chance to see what the future means in the medical industry is an important step in forming the next generation of engineers, anchored in a future that is not as far away as we think. This is a modern, sustainable future where the needs of the patient come first!

Based on the agreement, Philips Romania committed to support students in preparing them to use state-of-the-art medical equipment, put their theoretical knowledge into practice and cultivate interest and curiosity for medical innovation for the benefit of patients. According to the students, this interaction was very meaningful to them.

“After participating in the workshops and activities organized by Philips, I can say that I have formed a solid foundation from which I can later deepen my internship. Activities played an extremely important role in the whole learning process. Work in the field is indispensable because only in this way can we actually cope with various contingencies and observe the approach engineers take in such cases. The Philips experience was unexpected. Everyone was involved and eager to contribute to our learning process” , says Maria Dumitrașcu, a third-year student at the Faculty of Medical Technology of the Politehnca University of Bucharest, majoring in “Biomaterials and Medical Devices.”

“Philips workshops and activities became the backbone of my development. They were not only complementary to the theoretical knowledge, but a real bridge to the in-depth understanding and concrete application of the concepts studied. Having the opportunity to work in multidisciplinary teams, develop solutions to real problems and explore different areas, such as Field Service, Clinical Application and US Commercial, had an invaluable impact in shaping my professional vision. During my time at Philips, one aspect that particularly fascinated me was the sincere and in-depth interaction with mentors, such as Mihail Stoica, who not only shared knowledge, but also made me feel that theory and practice come together in a concrete and meaningful way.”, says Mădălina Pană, a third-year student at the Faculty of Medical Technology of the Politehnca University of Bucharest, majoring in “Biomaterials and Medical Devices.

“I must admit that I like hard feedback so that the person asking for it can improve and get into the best shape possible, but for me the Philips workshops and activities were beyond expectations! Theory and practice flowed together more harmoniously than ever, and each coordinator showed interest and willingness to share as much as possible with us within the allotted time. I feel that I have come a long way, I feel that I have evolved and that I am a big step forward towards entering the job market in this field,” explained Bade Ozgul, third-year student at the Faculty of Medical Technology of the Politehnca University of Bucharest, specialization “Biomaterials and Medical Devices”.

“I must admit that I like hard feedback so that the person asking for it can improve and get into the best shape possible, but for me the Philips workshops and activities were beyond expectations! Theory and practice flowed together more harmoniously than ever, and each coordinator showed interest and willingness to share as much as possible with us within the allotted time. I feel that I have come a long way, I feel that I have evolved and that I am a big step forward towards entering the job market in this field,” explained Bade Ozgul, third-year student at the Faculty of Medical Technology of the Politehnca University of Bucharest, specialization “Biomaterials and Medical Devices”.

The success of this collaboration between the Faculty of Medical Technology at Bucharest Polytechnic University is all the more important because the data collected in the various literatures of the Philips Future Health Index survey show that young physicians face discrepancies in terms of alignment with global healthcare standards. Moreover, a significant majority of emerging physicians in Romania consider the digitization of the healthcare system as a crucial means of improving patient outcomes. Accordingly, Philips contributes to the academic environment by providing internship opportunities within the organization, promoting a rapid and natural learning process for the use and maintenance of medical technology.

About Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leader in medical technology with the goal of improving people’s health and well-being through medical innovation. Patient-centered innovation uses advanced technologies and clinical knowledge to deliver personalized healthcare solutions for consumers and professional healthcare solutions for healthcare providers and their patients, in the hospital and at home. The company, based in the Netherlands, is a leader in medical imaging, ultrasound, diagnostics, monitoring and medical informatics, as well as personal care. Philips generated sales of €17.8 billion in 2022 and employs about 74,000 people with sales and services in more than 100 countries.

European developments

Measures to make it easier for Europeans to stay, work and travel abroad

The European Commission has proposed a series of measures to make it easier for Europeans to stay, work and travel abroad. On Wednesday, Sept. 6, the European Commission proposed a package of measures to further digitalize the coordination of social security systems in Europe.

Thus, it will be easier for European citizens to live, work and travel abroad, it will be easier for companies to operate in other EU countries and for national governments to coordinate their social security systems across borders.

Key proposed actions:

- accelerate the implementation at the national level of the Electronic Exchange of Social Security Information (EESSI ) , so that it will be fully operational across Europe by the end of 2024. EESSI digitizes exchanges between national social security institutions to eliminate paper procedures, which are time-consuming and cumbersome.

- offer fully online procedures for increased coordination of social security systems, further facilitate citizens’ travel and work abroad, and ensure their quick access to eligible benefits. Member states can rely on the Regulation on the Single Digital Portal RO— , which provides for the full online delivery of important administrative procedures to citizens and businesses until December 12, 2023 at the latest.

- To be fully involved in the pilot activities related to the European Social Security Passport ( ESSPASS ), which explores ways to simplify the issuance and verification of citizens’ social security rights at the cross-border level.

- work to introduce EU digital identity wallets ( EUDI RO— ), which will allow EU citizens to keep digital versions of documents evidencing entitlement to benefits, such as the European Health Insurance Card (CEASS) , allowing immediate verification of these documents by social security institutions, labor inspectorates and medical service providers.

The Commission will support EU member states in implementing these actions by providing technical assistance and making EU funds available.

Austria also threatens to become a European problem

Italy is currently preparing proceedings in the European Court against Austria for restrictions imposed on Italian trucks in the Brenner Pass. The announcement was made this week by Italian Deputy Prime Minister and Transport Minister Matteo Salvini, the leader of the right-wing League party – according to reports by Italian news agency ANSA.

President of the European Commission (EC) Ursula von der Leyen speaks out about welcoming migrants, but does nothing to end the Austrian blockade of Italian trucks in the Brenner Pass, said Salvini, who accused the EC head of not signing the start of the action. Infringement proceedings against Vienna.

‘Right now we are relying on the justice of the European Court. You cannot pontificate on behalf of Italy and demand the reception and integration (of migrants) on Lampedusa, while blocking the border at the Brenner Pass. This government will put an end to this disgrace,” Salvini said Wednesday during Question Time in the Chamber of Deputies.

In the Brenner case, “after four years of inactivity on the part of the European Commission, the government decided to activate the procedure provided for in the EU Treaty, to bring a case before the European Court of Justice against another (member) state for violation of the rules of the EU Treaty. EU law. This is a powerful but necessary gesture. The offices of my ministry and the Chigi Palace (government) are preparing the file,” the minister explained, despite the fact that “this activity is usually the responsibility of the Commission.”

In the Brenner case, “after four years of inactivity on the part of the European Commission, the government decided to activate the procedure provided for in the EU Treaty, to bring a case before the European Court of Justice against another (member) state for violation of the rules of the EU Treaty. EU law. This is a powerful but necessary gesture. The offices of my ministry and the Chigi Palace (government) are preparing the file,” the minister explained, despite the fact that “this activity is usually the responsibility of the Commission.”

“We are facing an act of violence and political arrogance on the part of a government of an EU member state, which we must put an end to,” Salvini said. “The restrictions were introduced by Austria on paper for environmental reasons, but the environment has nothing to do with it. It is simply unfair Austrian competition against contractors and carriers from Italy, Germany and the entire European continent.”

The European Commission has so far received no notification of a complaint from Italy against Austria over Vienna’s unilateral traffic restrictions on the Brenner Pass, an EC spokesman said a day later.

“This is a problem we have been working on with the member states for a long time. We have initiated and organized meetings with the transport ministers of Germany, Austria and Italy,” the spokesman recalled, stressing that “it depends mainly on these three countries to find a solution.”

In October, Deputy Prime Minister and Minister Matteo Salvini will travel to the Brenner Pass to monitor the situation, especially after Vienna’s announcement on strengthening border controls.

“Italy cannot be punished by other European partners: without a return to a condition of loyal cooperation, Salvini is ready to propose a tightening of controls for Austrian vehicles,” said Italian Transport Ministry sources.

Romania changes attitude toward Austria

After numerous diplomatic attempts by the Romanian side to reach a settlement with Austria, Austria continues to abuse the veto right by raising non-Schengen related objections.

After numerous diplomatic attempts by the Romanian side to reach a settlement with Austria, Austria continues to abuse the veto right by raising non-Schengen related objections.

In effect, Austria is blackmailing the entire European Union with this.

Seeing no movement from the Austrian side, Romania makes an emergency move to break the deadlock.

Although Austria is not a member of NATO, it is entrenched in the Alliance through the “Partnership for Peace” and NATO-led operations mandated by the UN Security Council.

Austrian press: Romania blocks Austria’s entry into NATO in revenge for veto on Schengen.

Romanian Prime Minister Marcel Ciolacu recently stepped up pressure on Austria, demanding that the country authorize Romania’s accession to the Schengen area by December. If Austria opposes this, it will appeal the decision to the Court of Justice of the European Union (CJEU) at one of two meetings of EU interior and justice ministers

that the country authorize Romania’s accession to the Schengen area by December. If Austria opposes this, it will appeal the decision to the Court of Justice of the European Union (CJEU) at one of two meetings of EU interior and justice ministers

Another important issue is that the OMV-controlled oil company, which together with Romgaz will invest some 4 billion euros in the development of the field and the infrastructure that will bring the first gas to the country in 2027, has s request to amend or clarify a single request. aof the offshore law, according to sources close to the situation.

Another important issue is that the OMV-controlled oil company, which together with Romgaz will invest some 4 billion euros in the development of the field and the infrastructure that will bring the first gas to the country in 2027, has s request to amend or clarify a single request. aof the offshore law, according to sources close to the situation.

According to our sources, during yesterday’s meeting with the OMV delegation, Prime Minister Ciolacu said that he understands the concerns of the oil company and would not have disputed the fears of the company’s representatives, but he said that at this time no change will be made to offshore legislation, at least in the context in which Austria is still opposed to joining Schengen.

“We will continue to support the Neptun Deep project and move forward based on the current form of offshore legislation, just as Romania will continue to support its arguments regarding accession to the Schengen area, including before the European courts, if Austria does not change its position,” Marcel Ciolacu said.

Disclaimer

The newsletter of the Dutch Romanian Network is compiled with great care. The Dutch Romanian Network cannot accept any liability for a possible inaccuracy and/or incompleteness of the information provided herein, nor can any rights be derived from the content of the newsletter. The articles do not necessarily reflect the opinion of the board.