Newsletter 21 February 2022

DRN greets Alewijnse Marine Galati as a new member

If we have to describe Alewijnse very briefly, we are talking about an electrical system integrator aimed at the maritime sector.

After more than 130 years of existence, they have proven themselves as a reliable partner. The head office is located in Nijmegen, and they also have two Dutch offices in Rotterdam and Drachten. Also worldwide such as in Romania, Vietnam and France. However, if we add Alewijnse Marine Galati (AMG) to the list, the pioneer and current general manager Pieter Smit should not be left unmentioned, who settled in Galati in 1992 and started a small electrical company there under the name Retec (The Romanian Electro Trade & engineering company).

Photo: Alewijnse CEO Dick Alewijnse (left) and Pieter Smit, General Manager of AMG (right), shaking hands on completing the full integration of AMG into the Alewijnse Group.

Damen Shipyards also appeared in Galati in the 1990s, initially outsourcing the construction of cargoes for ships, but then decided to establish itself and Retec was then taken over by Alewijnse, including Pieter Smit. In short, during this period a successful collaboration was established between Alewijnse and Damen Shipyards. Other Dutch companies followed in Galati, such as Den Breejen, Eekels, Helmers. Heinen and Hopman, Den Haan and DMT. In short: a traditional Dutch ship cluster near the Black Sea.

For more information: https://www.alewijnse.com/markets/naval-governmental#

DRN welcomes Legal2practice from Arnhem as a new member

Legal2Practice is a specialist in the field of legal services, which distinguishes itself in particular in the variety of their services with various disciplines. They work largely online and spread throughout Europe for their customers. They are strong in the pragmatic translation of complex issues to the needs and wishes of their customers. They combine the high-end (practice) expertise with the short lines of communication and the personal contact of a close-knit multidisciplinary team. They work largely online and spread throughout Europe for their customers

Legal2Practice is a specialist in the field of legal services, which distinguishes itself in particular in the variety of their services with various disciplines. They work largely online and spread throughout Europe for their customers. They are strong in the pragmatic translation of complex issues to the needs and wishes of their customers. They combine the high-end (practice) expertise with the short lines of communication and the personal contact of a close-knit multidisciplinary team. They work largely online and spread throughout Europe for their customers

The hub L2P Academy is special, which organizes a multitude of courses, training courses and theme meetings. This L2P Academy offers many of its open training courses through Outvie. In addition, the L2P Academy also provides all its training courses as in-company (online) training.

For further information: https://www.legal2practice.nl

Their social involvement is particularly important. They use green energy and actively support vulnerable groups in society. In addition, Legal2Practice supports the Ronald McDonald Children’s Fund Arnhem and Kika children cancer free.

Dutch source of information for Romanian diaspora

We are regularly approached by personnel departments of companies, educational institutions and local authorities about various matters such as registration and internships for Romanian students, documents such as identity documents when registering in the population register, notarial powers of attorney, Dutch social legislation, and the like.

We are regularly approached by personnel departments of companies, educational institutions and local authorities about various matters such as registration and internships for Romanian students, documents such as identity documents when registering in the population register, notarial powers of attorney, Dutch social legislation, and the like.

The Romanian government has set up an excellent digitized system for this, so that those involved can use it.

For most questions, you can consult the trilingual website www.consulate-romania.nl , which is regularly updated. This site also provides a global insight into the Romanian legal system.

Save the Date – Program under construction

Agri & Food sector

Romania failed the food self-sufficiency test

According to the latest data from Eurostat, Romania is the fifth largest country in Europe in terms of agricultural area with 13.5 million hectares. However, a recent survey by the National Institute of Statistics (INS) only covers the consumption needs of the inhabitants of six agri-food products.

These are grains (155.6%), wheat and rye (165.2% self-sufficiency), maize (151.2%). ) and sheep and goat meat (112.2% self-sufficiency).

In virtually all other subsectors, they depend to varying degrees on imports and are vital to the economy.

Pork consumption

According to INS data, Romania produces only 55.3% of the necessary pork consumption, as there have been outbreaks of African swine fever in the country since 2017. For example, in 2015, production covered more than 70% of consumption needs averaging 31.3 kg per capita per year.

According to INS data, Romania produces only 55.3% of the necessary pork consumption, as there have been outbreaks of African swine fever in the country since 2017. For example, in 2015, production covered more than 70% of consumption needs averaging 31.3 kg per capita per year.

In 2020, Romania consumed an average of 37.3 kg of meat and pork products per capita, but the 19% increase in consumption does not fully justify the 14.7 point decrease in supply.

Poultry, beef and mutton

When calculating the consumption of meat, meat products and edible organs, irrespective of species, the self-sufficiency rate in 2020 was 72.1% compared to 79% in 2015, under which the need for poultry meat consumption is covered in from 90 .4% and the need for beef is satisfied with a percentage of 82.9%. They have a surplus of mutton.

When calculating the consumption of meat, meat products and edible organs, irrespective of species, the self-sufficiency rate in 2020 was 72.1% compared to 79% in 2015, under which the need for poultry meat consumption is covered in from 90 .4% and the need for beef is satisfied with a percentage of 82.9%. They have a surplus of mutton.

Even bigger problems with sugar self-sufficiency

Another major problem in Romania is sugar and sugar products. According to INS data, only 34.9% of consumption needs were covered by local production in 2020, compared to 100.6% in 2015, for example in the context of flat consumption of 25 kilograms per inhabitant. The problem is that Romania has only two production units: the Austrian Agrana plants in Roman and Buzau. †

Another major problem in Romania is sugar and sugar products. According to INS data, only 34.9% of consumption needs were covered by local production in 2020, compared to 100.6% in 2015, for example in the context of flat consumption of 25 kilograms per inhabitant. The problem is that Romania has only two production units: the Austrian Agrana plants in Roman and Buzau. †

Dairy products

The trend is also negative for dairy products (milk and milk products, equal to 3.5% fat milk, excluding butter), partly due to the increase in consumption from 250.7 kg per capita in 2015 to 260.2 kg in 2020. Local factories came in to cover only 86.4% of the need, compared to 93.1% five years ago.

The trend is also negative for dairy products (milk and milk products, equal to 3.5% fat milk, excluding butter), partly due to the increase in consumption from 250.7 kg per capita in 2015 to 260.2 kg in 2020. Local factories came in to cover only 86.4% of the need, compared to 93.1% five years ago.

As for eggs, consumption needs are almost completely covered by local production (96.8% self-sufficiency), but the trend is negative. In 2019, the self-sufficiency rate was 97.5% and in 2015 they produced more than they consumed (102.5% self-sufficiency rate). Over the years, consumption has fallen from 13.1 kilograms per capita to 11.8 kilograms per capita.

Last but not least, local production covers about 84% of the need for vegetable oils and 44.8% of the need for butter.

Local vegetable growers provide 82% of what is needed

From vegetables and legumes Romania produces:

- 70.4% for tomatoes versus 73.9% in 2015

- 79.65 for dried onions vs. 82.5% in 2015

- 70.5% for carrots versus 73.7% in 2015

- 77.2% for various vegetables vs. 85.2% in 2015

- 90.9% in melons vs. 95.1% in 2015

- 75.8% for legumes versus 80% for legumes

It shows a downward trend, noting that the climatic conditions in 2020 made it a particularly weak agricultural year.

Fruit – local producers provide 68.5% of the necessary consumption needs

With regard to fruit, the local production has an apple shortage, while in the other categories the production is quite close to the consumption requirement. For cherries and sour cherries, for example, they had a surplus in 2015.

In 2020, self-sufficiency in fruit was as follows:

- 68.5% for fruit and fruit products in general

- 86.8% for apples

- 92.7% for grapes

- 97.2% for plums

- 92.6% for cherries and sour cherries

- 18% peaches and nectarines

Because more and more Dutch livestock, agricultural and horticultural companies are looking “over the border” and Romania has long ceased to be a “far-from-bed show”, self-sufficiency will also play an increasingly important role and it certainly offers opportunities.

Because more and more Dutch livestock, agricultural and horticultural companies are looking “over the border” and Romania has long ceased to be a “far-from-bed show”, self-sufficiency will also play an increasingly important role and it certainly offers opportunities.

The DRN Task Force Agri & Food Romania can assist you with this.

*See link: https://www.dutchromaniannetwork.nl/drn-task-force-agri-food-romania/

Sector Logistics and Transport

Obligations of road hauliers after the Posting of Workers Directive entered into force on 2 February

Romanian road hauliers performing international road transport in the European Union (EU) and the United Kingdom (crossing and cabotage) must comply with the provisions of the Posting of Workers Directive 1057/2020 since February 2, 2022, announces the National Union of Romanian Road Transporters (UNTRR) ).

The directive stipulates that professional road and cabotage drivers in the EU and the United Kingdom must be registered on the platform launched by the European Commission – IMI, and that they will receive valid secondment certificates for up to 6 months, which are in electronic or paper form. must be on board the vehicles.

Excluded from the provisions of the Posting of Workers Directive, which will enter into force on 2 February 2022, bilateral transport operations, transit operations and up to 2 cross-border road transport operations are performed in addition to the initial bilateral operations.

To help Romanian road transport companies to comply with the provisions of the Posting of Workers Directive, UNTRR has launched the platform www.detasaretransport.ro, where road hauliers can benefit from the management of posting certificates.

By registering on the platform www.detasaretransport.ro, road hauliers have access to the management of posting declarations, alerts on their expiry and in case of control by the authorities of the Member States and communication with the competent authorities of the Member State where the posting took place . †

At the same time, road transport companies will benefit from up-to-date information on posting requirements in each Member State.

While the EC has stated that the new rules for posting declarations aim to reduce the administrative burden for operators and simplify the process of submitting posting declarations through a single EU portal, linking national websites in EU Member States such as SIPSI, MILOG, LIMOSA, MELDLOKET, UTIK, LSDB – however, the new EU procedures remain complex and burdensome for road hauliers, especially for small businesses that have to deploy additional staff to deal with the large volume of posting declarations that the EU for every driver and for every country.

At the European level, Romania is the 8th largest market for road transport in the European Union and ranks 3rd in the EU in cross-trade (10.5%) and cabotage (8.2%) international road transport.

Representatives of the UNTRR recall that they have challenged the discriminatory provisions of the Mobility Package 1 before the Court of Justice of the European Union, which severely restricts the activities of Romanian airlines in the EU, and legal action is ongoing and supported by the Romanian government.

Representatives of the UNTRR recall that they have challenged the discriminatory provisions of the Mobility Package 1 before the Court of Justice of the European Union, which severely restricts the activities of Romanian airlines in the EU, and legal action is ongoing and supported by the Romanian government.

UNTRR encourages road haulage companies that want to use second-hand certificate management services to partner with those on their side as it provides both benefits and support to national and international authorities.

Energy Sector

Azerbaijani gas supplies cheap replacement for Russian gas

Romania is ready to participate in the development efforts of the Southern Gas Corridor project, a strategic gas transport infrastructure necessary for the stability of Europe’s energy security.

The Southern Gas Corridor is one of the most complex energy projects, involving seven countries and 11 energy companies, resulting in a 3,500 kilometer gas transportation system that has opened a new gas supply route for Europe.

Romanian Energy Minister Virgil Popescu proposed to include Romania in the plan to extend the Southern Gas Corridor to the Balkans and Central Europe, the ministry said in a press release.

Romania reiterates its concrete proposal to include the transport infrastructure of the BRUA gas pipeline (Bulgaria, Romania, Hungary, Austria) in the plan to extend the Southern Gas Corridor to the Balkans and Central Europe.

As Europe faces the specter of dwindling Russian gas in the event of a conflict with Ukraine, the EU leadership is concerned about finding alternative sources of supply. Baku’s EU Energy Commissioner, Kadri Simson, was also in Baku for the first time and announced that Brussels wants to increase imports through the Southern Corridor, making this corridor a strategic alternative source of Europe’s energy supply. An Underrated Resource It is interesting to note that Azerbaijani gas, while cheaper than Russian gas, was not a priority for Europe, at least not in the first year of operation of the TAP pipeline, which was the terminus of the Southern Corridor mega project. .

The Trans Anatolian Pipeline (TANAP) begins at the Shah Deniz field in Azerbaijan, runs through Georgia and Turkey, and joins the Greek border with the TAP pipeline, which carries Azerbaijani natural gas to Europe via Albania and Italy. According to official data, from 12.12.2020, the date of commissioning, to 31.12.2021, only 8.1 billion cubic meters of gas was transported by TAP, although the pipeline’s capacity reaches 10 billion cubic meters. Since the beginning of February, another 1 billion cubic meters has been added. In Baku, several proposals were heard to connect other Balkan pipelines to the TAP pipeline and scenarios for its extension were also presented. More precisely: – On January 18, TAP, Snam Rete Gas and DESFA published for public consultation the Project Proposal Plan, outlining all pipeline expansion scenarios. The third and most crucial step, the mandatory market test, will follow in July of this year, which will highlight the interest of users. The extension of the TAP to 20 billion cubic meters does not require the construction of a new pipeline, but will be achieved by consolidating the compressor stations in Kipoi-Evros and Serres, as well as the corresponding points in Albania and Italy.

The Western Balkans (Bosnia and Herzegovina, Montenegro, Croatia) are interested in connecting the Ionian Adriatic Pipeline (IAP) to the TAP, which is under construction. The connection would be made at the border with Albania. It should be noted that the Western Balkans are completely dependent on Russian gas, which is why countries in the region are looking for a new supply route. These developments prompted President Aliiev of Azerbaijan to say with satisfaction: “The Southern Gas Corridor has been completed, but our work continues. European markets will see more gas from Azerbaijan in 2022.”

Editorial DRN Newsletter: Romania has room to supply other countries with gas due to its own energy supply. The Romanian government chooses to supply the countries Ukraine and Moldova so that they are more independent from Russian gas. Transport to Moldova is already underway and has a capacity of 1.5 billion cubic meters of gas. Negotiations are currently underway with Ukraine’s Ukrtransgaz for the supply of two billion cubic meters of gas.

High Tech Sector

Alke Heating Technology invests heavily in Romania

Alke bv has been a producer and market leader of gas – fired infrared heating since 1974 . The wide range of these applications is so comprehensive that consulting their websites is a must. As an example, we cite the many industrial applications, whereby the focus on the agricultural sector – especially in the poultry and pig sub-sectors – should not go unmentioned.

Alke bv has been a producer and market leader of gas – fired infrared heating since 1974 . The wide range of these applications is so comprehensive that consulting their websites is a must. As an example, we cite the many industrial applications, whereby the focus on the agricultural sector – especially in the poultry and pig sub-sectors – should not go unmentioned.

Alke BV, with their head office in Scherpenzeel, is a producer and market leader of gas-fired infrared heating since 1974. Sales take place in 106 countries.

In 2007 Alke started a company Alke Total Confort SRL in the Romanian city of Brasov with its own production facility of 5300 m2. In view of the prosperous state of affairs, in recent years their investments (via AK Production & Manufacturing SRL) amounted to 1 .2 million euros expanded their machinery enormously. In terms of manufacturing industry, a good example for both countries, so for both the Netherlands and Romania.

For more information: https://www.alke.nl

Retail Sector

“The Netherlands threatens to be out of step in Europe with new rules regarding production guarantees”

That is what VNO-NCW and MKB-Nederland say. They call on the House of Representatives to introduce the bill just like the other EU countries instead of again with all kinds of extra ‘bells and whistles’.

The new rules are the result of European directives that aim to equalize warranty periods throughout the EU. This gives European consumers and businesses the same rights everywhere and everyone knows where they stand. However, instead of the Netherlands adopting the new term, just like its neighboring countries in Europe, it chooses to continue to use a different warranty term; a term that depends on the expected life of a product. Nobody knows what that lifespan is. This uncertainty means that no one knows where he stands. ‘So just take over the EU term,’ say VNO-NCW and MKB-Nederland.

The new rules are the result of European directives that aim to equalize warranty periods throughout the EU. This gives European consumers and businesses the same rights everywhere and everyone knows where they stand. However, instead of the Netherlands adopting the new term, just like its neighboring countries in Europe, it chooses to continue to use a different warranty term; a term that depends on the expected life of a product. Nobody knows what that lifespan is. This uncertainty means that no one knows where he stands. ‘So just take over the EU term,’ say VNO-NCW and MKB-Nederland.

User fee

The usage fee, which we have known for years in the Netherlands when people return after years of use with a non-functioning product and receive a new one, will also disappear. ‘While it is precisely this system that leads to great satisfaction with both customers and sellers’. If the EU term is adopted, this problem will also be solved immediately.

Update obligation

The bill threatens to cause problems on several fronts if it is not amended. For example, stores are obliged to inform customers about updates to software that is in telephones, laptops, smart TVs, smart washing machines, etc. and to deliver the updates. Even years later. How should the seller do this? This is going to cause hassle at the counter, the business organizations fear.

don’t deviate

The business organizations ask the MPs not to adopt a different position as the Netherlands, but to opt for the European guarantee period that all our neighboring countries also use. The user fee must also at least be possible from 2 years after purchase or sale. Furthermore, the update obligation must be designed as simply as possible for retailers without a whole paperwork and unworkable systems.

*DRN Newsletter editors: In addition, it should be mentioned that it can also have a negative effect on the Dutch export position

Cultural sector

Waiting for the West” is well worth reading

The book was recently published and written by Nausica Marbe. She is a Dutch writer, columnist and journalist of Romanian descent. She is the author of, among others: Mândraga , for which she received the Charlotte Köhler Stipendium and Smeergeld, which was awarded the Diamanten Kogel. She was a columnist for De Volkskrant for seven years and has been writing a weekly column for De Telegraaf since 2013.

The book was recently published and written by Nausica Marbe. She is a Dutch writer, columnist and journalist of Romanian descent. She is the author of, among others: Mândraga , for which she received the Charlotte Köhler Stipendium and Smeergeld, which was awarded the Diamanten Kogel. She was a columnist for De Volkskrant for seven years and has been writing a weekly column for De Telegraaf since 2013.

Empty shelves in the supermarket. Queues for the shops. Borders closed. Forbidden gatherings in the house and people who keep their distance from you, as if you were suspicious. The beginning of the corona crisis, when life changed radically, became uncertain and oppressive, felt eerily familiar to Nausicaa Marbe. The feeling of being locked up, the thought that time stands still, that real life will take place later, in a better world, she had experienced before. The lockdown took her right back to her childhood in communist Romania.

*Editorial DRN Newsletter: Highly recommended on a topical and palpable theme that draws an enlarged parallel with Romania before 1989.

Social Economic Figures & Trends

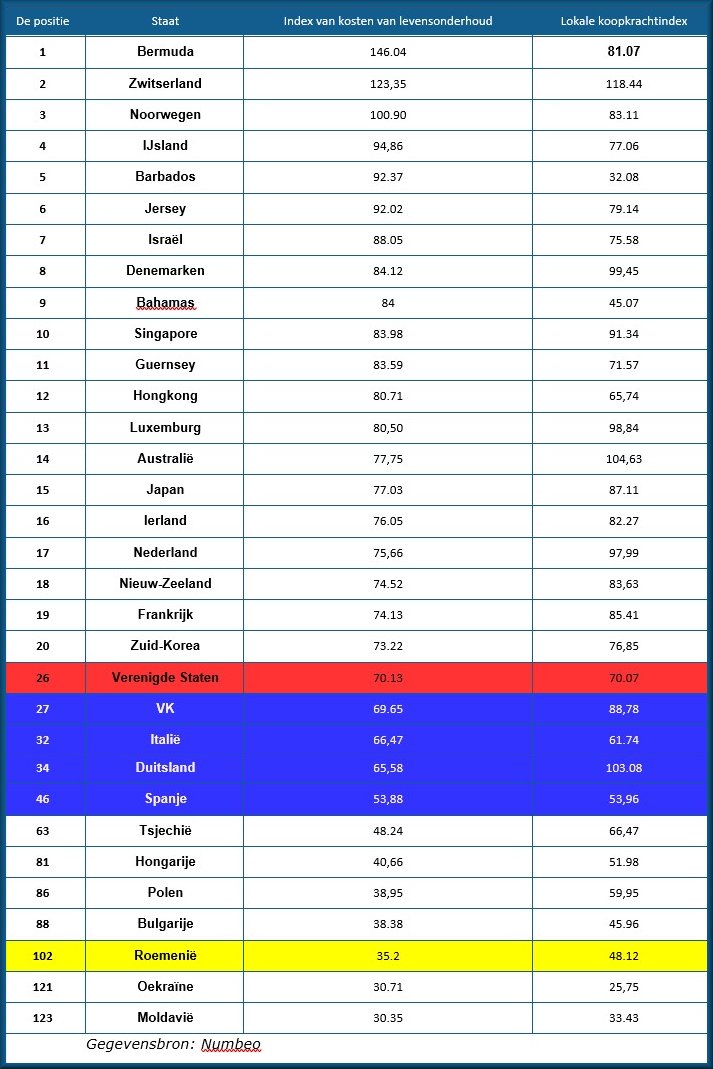

Top countries where life is most expensive

Switzerland, Norway, Israel and Denmark are in the top 10 most expensive countries in the world, according to the cost of living index, according to the calculations and estimates of the Numbeo platform for 2022, which lists 139 countries around the world .

Taking into account the cost of living only in the countries of the European Union, Romania is the cheapest, ranking 102nd in the top with a coefficient of 35.2, below Bulgaria , with a coefficient of 38.3 and on the 88th place in the list, Poland (38.9 – 86th place) and Hungary (40.6 – 81st place).

Globally, Bermuda has a cost of living of 146.04 and is followed by Switzerland (123.35), Norway (100.90), Iceland (94.86), Barbados (92, 37), Jersey (92.02) and Israel (88.05). Luxembourg (position 13), Australia (position 14), Japan (position 15), the Netherlands (position 17) and France (position 19) are also in the top 20 most expensive countries.

The other major western powers follow immediately after the top 20: US (position 26), Great Britain (position 27), Italy (position 32), Germany (position 34), Spain (position 46).

Since the level of the cost of living index is calculated on the basis of the cost of living in New York (which thus has an absolute value of 100), Romania’s coefficient of 35.2 represents the fact that living in the country is 64.8% cheaper than in New York.

The last place in the EU in terms of cost of living for our country is only a glass half empty/full, because with this indicator one must always take into account the purchasing power of the local income (net wage). In other words, a country’s population is not necessarily so favored by the low cost of living in its territory, if incomes (wages, pensions, social benefits, etc.) are also among the lowest.

This is illustrated by the fact that Romania, although it has a lower housing coefficient than all neighboring EU countries, also has a lower purchasing power coefficient than these countries, except for Bulgaria (48.12 Romania vs. 45.96 Bulgaria).

The best living countries are those where the purchasing power index far exceeds the cost of living index. In the European Union, the best examples are Germany (with a positive difference of 37.5 ), Sweden (a positive difference of 26.4 ) and the Netherlands (a positive difference of 22.33 ).

The cost of living coefficient is calculated based on the New York level. This means that for New York City, each index must be 100. For example, if a city/country has an index of 120, it means that the cost of living is 20% higher in that city/country than in New York. If the index is 80, the cost of living is 20% lower than in New York. It should be noted that the cost of living in the shopping cart compiled by Numbeo does not include the cost of rent or mortgage installments.

The cost of living coefficient works according to the same calculation scheme in which New York has an absolute value of 100 and is based on the size of the local net wage. For example, for a country that scores 40 on this index, its people can buy 60% less goods and services than New Yorkers with a net salary.

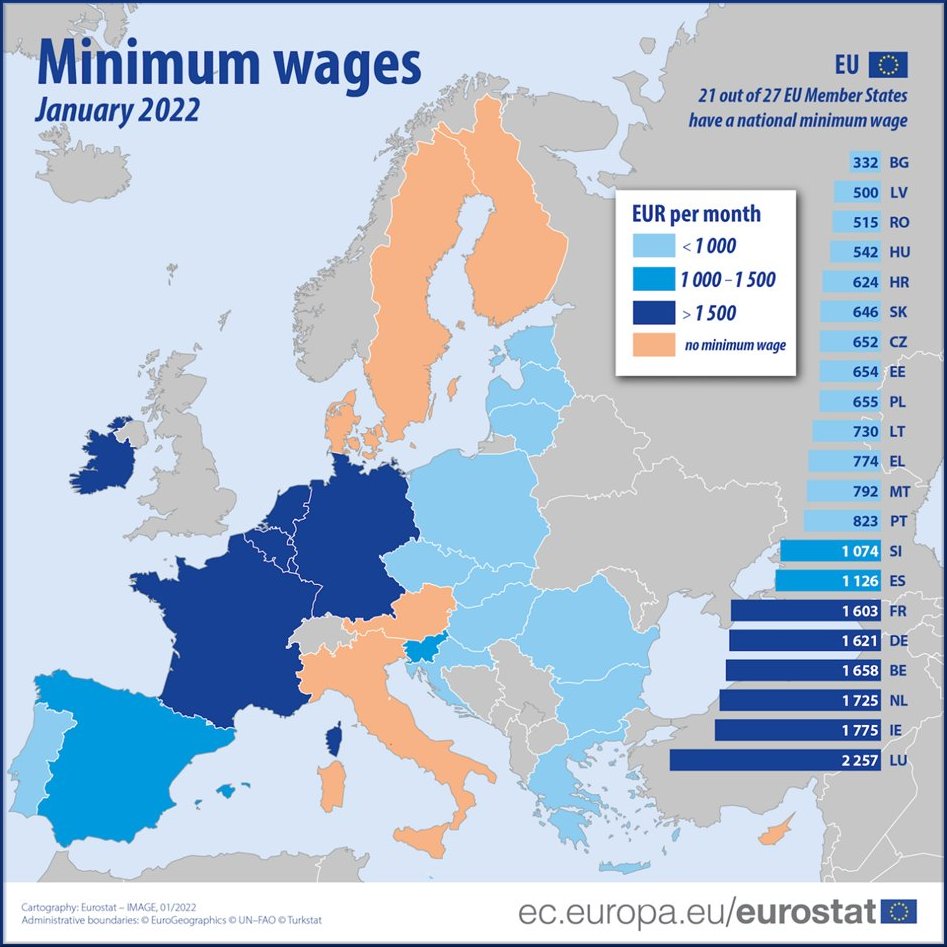

Bulgaria, Latvia and Romania, lowest minimum wage in the EU

More than two thirds of the EU Member States (21 out of 27 Member States) had a minimum wage in the economy on 1 January 2022, with 13 EU Member States having a minimum wage of less than €1,000 per month, in two countries just over € 1,000 and six others had minimum wages of more than €1,500 a month, according to data released recently by the European Statistical Office (Eurostat).

The minimum wage in the 21 Member States of the European Union can be divided into three main groups, based on the level in euros.

At the beginning of this year, for example, 13 EU Member States in the east and south of the EU had a minimum wage of less than EUR 1,000 per month: Bulgaria (EUR 332), Latvia (EUR 500), Romania (EUR 515), Hungary (EUR 542). , Croatia (624 euros), Slovakia (646 euros), Czech Republic (652 euros), Estonia (654 euros), Poland (655 euros), Lithuania (730 euros), Greece (774 euros), Malta (792 euros) and Portugal (823 euros)).

In Slovenia (1,074 euros) and Spain (1,126 euros) the minimum wage is slightly higher than 1,000 euros per month, and the other six EU Member States, all in the northwestern part of the EU bloc, had minimum wages of more than 1,500 euros per month : France (€ 1,603), Germany (€ 1,621), Belgium (€ 1,658), the Netherlands (€ 1,725), Ireland (€ 1,775) and Luxembourg (€ 2,257).

By comparison, the US federal minimum wage was 1,110 euros per month in January 2022.

The only Member States that do not yet have a minimum wage in the economy are: Denmark, Italy, Cyprus, Austria, Finland and Sweden.

In the 21 Member States of the European Union, the highest minimum wage is almost seven times higher than the lowest. However, the differences are considerably smaller after eliminating the effect of price differences. The minimum wage in the European Union ranges from 604 PPS (standard purchasing power parity) per month in Bulgaria to 1,707 PPS in Luxembourg, meaning that the highest minimum wage in the EU is almost three times higher than the highest.

Based on the PPS, there are two main groups: one with a minimum national salary above 1,000 PPS and another with a minimum national salary below 1,000 PPS. The first group includes: Luxembourg, Germany, Netherlands, Belgium, France, Ireland, Slovenia, Spain, Poland and Lithuania, where the national minimum wage ranges from 1,038 PPS in Lithuania to 1,707 PPS in Luxembourg.

The second group includes Romania, Portugal, Malta, Croatia, Greece, Hungary, Czech Republic, Estonia, Slovakia, Latvia and Bulgaria, where the national minimum wage ranges from 604 PPS in Bulgaria to 949 PPS in Romania.

The OECD has started accession negotiations with Romania

The government based in Bucharest welcomes the decision of the Council of the Organization for Economic Co-operation and Development regarding the start of accession negotiations with Romania, stressing in a press release that this decision will bring the country significantly closer to achieving one of its strategic goals. foreign policy. Goals are shared and continuously adopted at the highest level of the state: to obtain OECD membership.

Membership in the OECD (OECD) will enhance Romania’s international profile and provide access to the expertise of an international body valued for the quality of economic studies and public policy evaluations. It also offers the opportunity to participate directly with other members in the development of international regulations in the field of good economic governance.

The opening of the accession negotiations is the culmination of the consistent efforts of Romanian diplomacy and the entire institutional spectrum over the past decades to bring Romania closer to the OECD standards and practices, which are recognized worldwide as a standard for good governance in developed economies.

The main advantage of OECD membership is that it does not require an army of experts to reform corporate tax, for example. From now on, it will sit at the table with the countries that together account for 64 percent of the global added value. National investment agency Cinde hopes membership will further boost foreign investors’ confidence as OECD decisions are binding

The Organization for Economic Cooperation and Development (OECD), or Organization for Economic Cooperation and Development (OECD), is an intergovernmental organization dedicated to promoting economic development and world trade. The partnership consists of 38 countries and provides a platform to study and coordinate social and economic policies. The member countries try to pursue a joint policy in order to stimulate sustainable economic growth, promote employment, guarantee financial stability and support economic developments in other countries. The OECD now has 38 countries that subscribe to the principles of the market economy, the rule of law and respect for human rights

ING Romania: The state can decide to lower the VAT. We see an average inflation rate of 8.8% and GDP growth of 3.2%

After an announced economic growth of 5.6% and an annual inflation of 8.4%, ING Bank changes its forecasts for 2022 below. For example, Valentin Tătaru, ING Bank’s chief economist, forecasts for economic growth to fall to 4.5% to 3.2% for 2022, while forecasts for average inflation in 2022 increase to 8.8%. To counter an average annual inflation of more than 10%, ING Bank sees the VAT reduction as a short-term solution.

After an announced economic growth of 5.6% and an annual inflation of 8.4%, ING Bank changes its forecasts for 2022 below. For example, Valentin Tătaru, ING Bank’s chief economist, forecasts for economic growth to fall to 4.5% to 3.2% for 2022, while forecasts for average inflation in 2022 increase to 8.8%. To counter an average annual inflation of more than 10%, ING Bank sees the VAT reduction as a short-term solution.

The latest figures from INSSE, economic growth in 2021 of 5.6% (below expectations) and inflation (8.4% in January 2022 compared to January 2021 – above expectations), are gradually pushing the expectations of the chief economists of the major commercial banks to fall down.  Forecasts for 2022 begin to fall without taking into account the health crisis or the escalation of the conflict between Russia and Ukraine. In addition, the chief economists are starting to look for solutions to ensure that double-digit inflation, which is so difficult to eradicate in Romania, does not appear again in the statistical figures, and that it is just a normal phenomenon – March, April , when the NBR said it was over 11% inflation

Forecasts for 2022 begin to fall without taking into account the health crisis or the escalation of the conflict between Russia and Ukraine. In addition, the chief economists are starting to look for solutions to ensure that double-digit inflation, which is so difficult to eradicate in Romania, does not appear again in the statistical figures, and that it is just a normal phenomenon – March, April , when the NBR said it was over 11% inflation For example, Valentin Tătaru, chief economist of ING Bank, said: “We are revising our GDP growth forecast to 3.2% in 2022 and maintaining it at 4.5% for 2023.” Since the details of economic growth in 2021 will not be available until March 8, Valentin Tataru concludes that with suppressed demand, inflation swallowing wage increases and the energy crisis that will never end, only the public investment plan, which amounts to 6 .7% of GDP could save the day.

For example, Valentin Tătaru, chief economist of ING Bank, said: “We are revising our GDP growth forecast to 3.2% in 2022 and maintaining it at 4.5% for 2023.” Since the details of economic growth in 2021 will not be available until March 8, Valentin Tataru concludes that with suppressed demand, inflation swallowing wage increases and the energy crisis that will never end, only the public investment plan, which amounts to 6 .7% of GDP could save the day.

In terms of inflation, ING Bank’s chief economist is even sharper.

In this regard, ING Bank’s daily report says to investors: “The key to the future inflation trajectory will be the already discussed administrative measures to cut energy prices in particular. The latest official statements suggest that decision-makers this year will try to take the necessary steps to avoid double-digit inflation. In the short term, a VAT cut (targeted or comprehensive) would be most effective, but the action plan will likely be more complex than that.”

In this regard, ING Bank’s daily report says to investors: “The key to the future inflation trajectory will be the already discussed administrative measures to cut energy prices in particular. The latest official statements suggest that decision-makers this year will try to take the necessary steps to avoid double-digit inflation. In the short term, a VAT cut (targeted or comprehensive) would be most effective, but the action plan will likely be more complex than that.”

In this regard, ING Bank predicts that “general inflation will return to the NBR target range of 1.5%-3.5% by mid-2024”. year-end interest rate at 8.0%, while for 2023 an average inflation rate of 5.5% and the year-end interest rate at 4.5% is expected. Despite higher forecasts, the response from the central bank is likely to be quite limited. Maintaining a near-flat EUR/RON exchange rate for the rest of the year is likely to be the top priority.

In conclusion, a fixed exchange rate, however, based on a super controlled depreciation, an inflation full of unknowns, interest rates up to 4%, etc. A future full of surprises.

Geopolitical developments

Special agenda French visit to Romania

As is well known, France will hold the presidency of the European Council this six months, in which the heads of government are the participants. It should not be confused with the Council of Europe of which the Russian Federation is also a member .

Romania: de-escalation

French Minister of European and Foreign Affairs Jean-Yves Le Drian recently visited his Romanian counterpart Bogdan Aurescu who informed Jean-Yves Le Drian that France wanted to send 4,000 troops to deter the clash of arms from the Russian Federation. However, its Romanian counterpart brushed it off as it could be seen to further challenge the adversary and both Romania and Ukraine are clearly opting for the path of de-escalation over confrontation.

Corvette order

Following on from this, the French Minister for Europe and Foreign Affairs, Jean-Yves Le Drian, mentioned that the talks between the French shipbuilder Naval Group and the Constanta Shipyard had stalled over the construction of corvettes, adding that hopefully a agreement had to be reached. However, the reality is that the French state-owned company cannot meet its obligations and the cause of this must be sought entirely from the French side and the possibility arises that this contract will be awarded to Damen Shipyards.

Romanian accession to Schengen

With reference to the French presidency of the European Council, it was indicated in diplomatic terms that France can positively decide on Romania’s accession to Schengen. And to think that France and also the Netherlands prevented this accession.

Romanian trade deficit with the Russian Federation

The year just ended marked a new negative record in Romania’s trade relationship with the Russian Federation. The trade deficit well passed the EUR 1 billion threshold in ten months, reaching values found, for example, in 2013.

According to the latest available data, the trade deficit with Russia was about 1.6 billion euros in the first 10 months of the year, amid a 34% increase in imports between January and October 2021 compared to 2020. 839.8 million euros. In previous years, the deficit remained below the EUR 1 billion threshold. In 2013, high levels of the deficit were recorded, exceeding €1 billion. In 2020, Romania had a trade deficit with the Russian Federation of 992.7 million euros, with imports totaling over 1.8 billion euros.

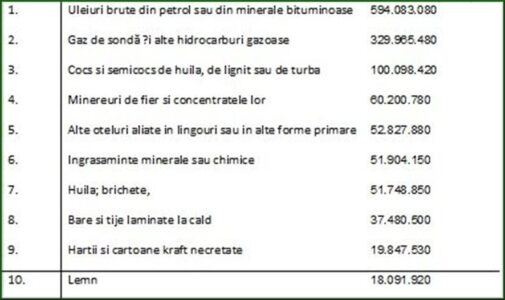

What Romania buys from Russia

As for the goods they get from Russia, they were at about the same level both in 2020 and the first ten months of 2021.

This is the top ten most imported products from the Russian Federation, in the first 10 months of 2021, according to INS. Oil and gas are at the top, followed by ores and steel products.

Source: INS

Instead, they export parts and accessories for tractors (217.5 million euros), medicines (54.4 million euros) and pneumatic, hydraulic or power tools (40.8 million euros).

Romania does not have a large trade in the agri-food segment.

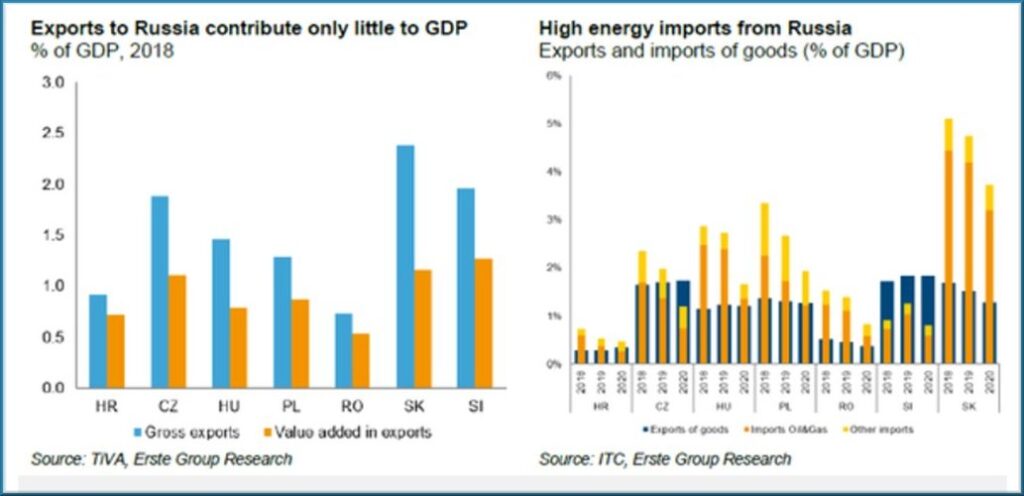

Which EU countries depend on Russia

For Romania, Russia is no longer such an important trading partner – it ranks 15th among the top importers – but it is for the EU. According to the latest data from Eurostat, in 2020 Russia was the fifth largest partner for the export of goods from the EU (4.1%) and also the fifth partner for the import of goods from the EU (5.6%). Russia mainly sells oil, gas, coal and aluminum in the EU and receives medicines and motor vehicles.

Ten Member States have a trade surplus with Russia. The largest surplus was held by Germany (EUR 3,601 million), followed by the Czech Republic (EUR 1,801 million) and Lithuania (EUR 1,196 million).

Another 17 member states have a trade deficit with Russia. The largest deficit was recorded in the Netherlands (EUR 6,733 million), followed by Poland (EUR 2,828 million) and Greece (EUR 2,753 million).

The three largest exporters to Russia from the EU were Germany (€23,155 million), Poland (€7,136 million) and Italy (€7,101 million), while the largest Russian importers were Germany (€19,554 million), the Netherlands (€13,417 million). ) and Poland (EUR 9964 million).

Public health sector

When could Romania also give up restrictions?

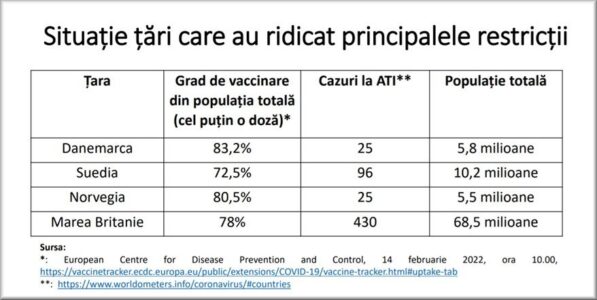

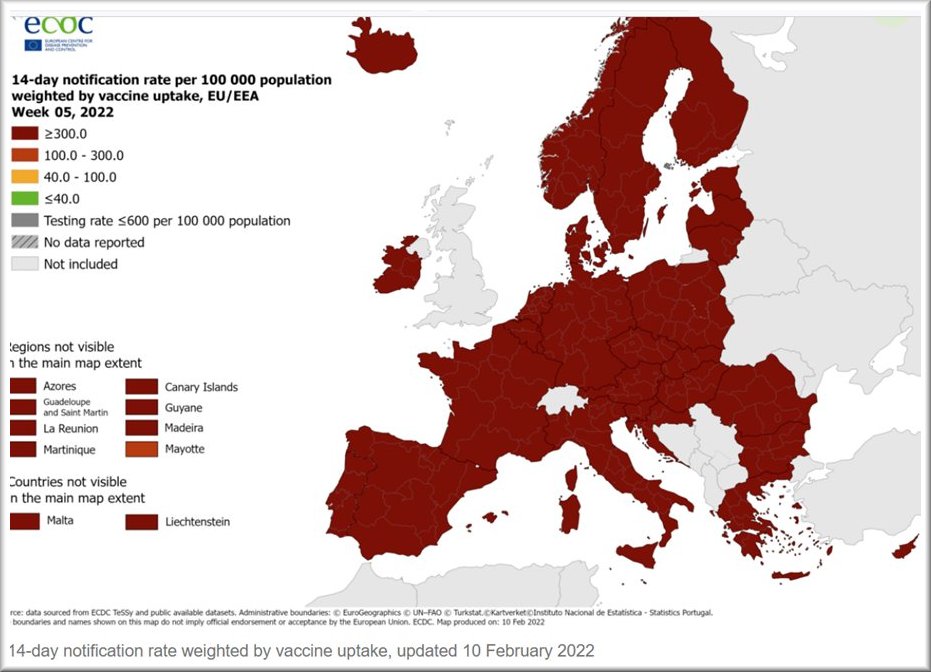

So far, four European countries have lifted the main restrictions against COVID-19: Denmark, Sweden, Norway and the United Kingdom, after writing this newsletter, also the Netherlands. The main restrictions are the wearing of a mask, the lifting of a ban on non-vaccinators and the recommendation to work from home where possible. At the very least, judging by the vaccination rate and the number of cases admitted to intensive care in these 4 countries, Romania seems a long way from that.

But what is the vaccination coverage and the number of patients admitted to the Intensive Care Unit (ATI) in these countries?

- Denmark has a vaccination rate of 83.2% and 25 COVID-19 patients are included in ATI for a total population of 5.8 million.

- Sweden has a vaccination rate of 72.5% and 96 COVID-19 patients are included in ATI for a total population of 10.2 million.

- Norway has a vaccination rate of 80.5% and 25 COVID-19 patients are hospitalized in ATI for a total population of 5.5 million.

- The UK has a vaccination rate of 78% and 430 COVID-19 patients admitted to ATI for a total population of 68.5 million.

Romania has a vaccination rate of only 42% of the total population and 1,155 COVID-19 patients currently admitted to the ICU, 974 of whom are unvaccinated.

Generally speaking, the conditions are now changing in several European countries. We strongly recommend that you consult the website www.nederlandwereldwijd.nl before your trip.

Generally speaking, the conditions are now changing in several European countries. We strongly recommend that you consult the website www.nederlandwereldwijd.nl before your trip.

Disclaimer

The newsletter of the Dutch Romanian Network is compiled with great care. The Dutch Romanian Network cannot accept any liability for a possible inaccuracy and/or incompleteness of the information provided herein, nor can any rights be derived from the content of the newsletter. The articles do not necessarily reflect the opinion of the board.