Newsletter December 22, 2021

Vă dorim un Crăciun Fericit și un An Nou sănătos și reușit!!!!

Of course we wish you a pleasant Christmas and a healthy and successful 2022! They seem like well-intentioned wishes, but they have a certain jadedness. However, it is precisely in these days that “healthy” and “successful” take on a deeper meaning. I would like to add “wisdom” for the journal, because I I am amazed every day that they assume that a minister, economist or virologist can indicate the exact date when the virus has disappeared. Or approach politicians in an accusing tone as to whether they could not have done this or that better. That is “wisdom afterwards, from which we really don’t get any wiser. No one can have a consistent policy based on daily rates

I am amazed every day that they assume that a minister, economist or virologist can indicate the exact date when the virus has disappeared. Or approach politicians in an accusing tone as to whether they could not have done this or that better. That is “wisdom afterwards, from which we really don’t get any wiser. No one can have a consistent policy based on daily rates

Because the erratic Corona crisis has taught us something that you can hardly tailor a policy to that.

It compares well with chess. A chess player cannot predict what the opponent – in this case the Corona pandemic – will do. But he or she can take into account the possible moves, including the unlikely ones, and those who think further ahead have better chances. If you think about the worst-case scenario, you can also do things that prevent it from happening or at least come to a draw. However, you must be a grandmaster to win on multiple boards. And just like with In the game of chess, the rules (measures) are the grip with which you have a chance of winning, so let’s follow them as much as possible. So we wish the Covid-19 a checkmate together with you.

In the game of chess, the rules (measures) are the grip with which you have a chance of winning, so let’s follow them as much as possible. So we wish the Covid-19 a checkmate together with you.

And this: We attach great value to the power of personal meetings (see elsewhere in this newsletter) and due to the Coronavirus from November 25th, we had to postpone our Romanian Business Day to Thursday February 10, 2022, but in view of the developments and measures We do not dare to give a guarantee for the last few weeks, but trust that we will be able to give you a definitive answer about this around mid-January.

DRN welcomes new member Cerasus Grup from Cotnari(Judet Iași)

The company currently operating under the Panere brand produces a range of fruits such as cherries, strawberries, blueberries, tomatoes, walnuts, apricots and plums and now supplies the major Romanian retailers.

The plan has now been drawn up to export to the Netherlands and an initial meeting with the DRN has taken place at the Freshpark in Venlo.

The plan has now been drawn up to export to the Netherlands and an initial meeting with the DRN has taken place at the Freshpark in Venlo.

Preparations for an incoming trade mission will start in January. Due to the ongoing Coronavirus, this trade mission will take place later in the spring. It may be called quite unique that a Romanian company from this sector takes up the challenge of exporting.

You can find them on the provisional website www.panere.ro but they are in the process of designing a new website.

Departing and coming trade council Romanian Embassy

After an extra long period of five years, the Romanian trade council Cristian Mateescu has ended its activities in our country. And when he left, his service to the business community was praised in particular.

After an extra long period of five years, the Romanian trade council Cristian Mateescu has ended its activities in our country. And when he left, his service to the business community was praised in particular.

His successor who has not yet arrived is Mircea Borza (see photo) and who is known to have gained many years of experience in Argentina in the same position.

The DRN wishes both good luck with the new challenge!

IT Sector

Post-Craiova: the power of face-to-face meetings

Because the Dutch Romanian Network is a network organization pur sang, our new board member Han in ‘t Veld shared his perception and experience about the current situation. In daily life he is CEO of Netrom with offices in Romania and the Netherlands. We think many of you will recognize this and that is why by organizing Romanian Business Day we want to realize the power of personal meetings despite the fact that it makes us more dependent on the Corona restrictions. We let him speak below.

Because the Dutch Romanian Network is a network organization pur sang, our new board member Han in ‘t Veld shared his perception and experience about the current situation. In daily life he is CEO of Netrom with offices in Romania and the Netherlands. We think many of you will recognize this and that is why by organizing Romanian Business Day we want to realize the power of personal meetings despite the fact that it makes us more dependent on the Corona restrictions. We let him speak below.

With the outbreak of the coronavirus, remote working suddenly became the new normal. Many companies found it difficult to switch to this new way of working (together). It was different for NetRom: after all, we’ve been doing it for almost twenty years.

I can still remember what it was like fifteen years ago. We had just started our delivery center in Romania, and had to make do with a telephone line to send and receive data. We were already very happy when we reached 40 kilobytes per second. Uploading software sometimes took hours, but we didn’t mind at all. You discussed via e-mail and telephone – of course there was no video connection yet. Yet it worked.

Then and now

At that time, when I came to companies to talk about outsourcing, I had to use all my persuasiveness to explain its benefits. Certainly because it was about a relatively unknown country like Romania, it was all far from their bed. This has gradually changed and more and more organizations have realized its added value. The corona situation has really accelerated. Distance has become unimportant – whether you work remotely from Amsterdam with a team in Zwolle or Craiova, it no longer matters.

Companies have now gained more experience with remote working, which has increased the incentive to further digitize. A reinforcing effect is the growing shortage on the labor market. I don’t know of any software organization that doesn’t have a shortage of good IT staff. Everyone struggles to hire and retain the people with the right skillset. Then you can no longer ignore nearshoring. The knowledge base we have with 400 active software developers is so much larger than that of the average internal IT department.

Now when I visit companies to talk about NetRom, I mainly explain that our idea of nearshoring is different from what they have in mind. Many organizations that offer software outsourcing are actually disguised secondments. A developer is assigned to the customer and gets to work there. Or a medley of people is crammed into a team that is remotely controlled by a customer. We don’t like that: we set up dedicated teams that are specifically composed for what an organization needs in terms of software and skills. With its own project manager. We remain responsible for the process and the results – is something going wrong? Please ring the bell and we will solve it.

The power of face-to-face meetings

In the past we often sent people from Romania to the Netherlands, now we turn it around: it is good if a customer travels to Craiova once or twice a year to consult with the team. To see the roadmap together, from the details to the bigger picture. Now that those visits are becoming possible again, I notice what a feast of recognition it is to sit together in a room to talk. That is and remains more effective, more efficient and more productive than a conversation via Teams or Zoom. I notice that clients get really excited to be immersed in their software projects for a day or two. No matter how small the world has become, I’ll stay

In the past we often sent people from Romania to the Netherlands, now we turn it around: it is good if a customer travels to Craiova once or twice a year to consult with the team. To see the roadmap together, from the details to the bigger picture. Now that those visits are becoming possible again, I notice what a feast of recognition it is to sit together in a room to talk. That is and remains more effective, more efficient and more productive than a conversation via Teams or Zoom. I notice that clients get really excited to be immersed in their software projects for a day or two. No matter how small the world has become, I’ll stay

therefore believe in the power of face-to-face meetings.

A remote TEAM is different from an individual working from home.

The synergy benefits of a team in the combination of different talents, hard-and-soft skills, complementary character traits, team spirit, knowledge sharing, peer pressure are present in a remote team (working in a remote but common office location) and much less in a remote team where individual team members each work at their own location

Energy Sector

Romania to extract natural gas from the Black Sea by 2026

Romania could almost become energy independent if Romgaz and OMV Petrom start extracting the first quantities of natural gas from the Black Sea, said Energy Minister Virgil Popescu.

Romania could almost become energy independent if Romgaz and OMV Petrom start extracting the first quantities of natural gas from the Black Sea, said Energy Minister Virgil Popescu.

While no final investment decision has been made yet, Virgil Popescu is optimistic that in five years’ time, natural gas will be extracted from the Black Sea, with a capacity of 10 billion cubic meters per year.” If the investment decision is taken next year, as I would want, judging by the talks we’ve had with Romgaz and OMV Petrom, the investments would last 4-5 years and we’ll start extracting gas in 2026,” said Virgil Popescu.

Romgaz recently announced that its shareholders have approved the acquisition of the ExxonMobil group’s stake in the Neptun Deep perimeter, which is estimated to contain gas reserves of approximately 100 billion cubic meters. The transaction has the approval from the Supreme Council of National Defense and the National Agency for Mineral Resources, but Virgil Popescu hopes it will be approved in the early months of 2022.

approval from the Supreme Council of National Defense and the National Agency for Mineral Resources, but Virgil Popescu hopes it will be approved in the early months of 2022.

A week ago, OMV Petrom CEO Christina Verchere said that passing changes to the offshore law by the end of the year is vital for the extraction of Neptune Deep gas.

“If the law is not changed before the end of the year, it will delay the final investment decision for 2023,” said Christina Verchere.

Referring to the EU taxonomy on green investments, Virgil Popescu said he was optimistic that both nuclear power and natural gas would be included in the list of green investments, but added that a negative decision would not affect Romania’s plans to invest in natural gas. would change.

However, Romania insists on including natural gas and nuclear energy in the list of green investments to ensure the necessary investments, Virgil Popescu said. “It would be a signal to the market that natural gas can still be financed, just like natural gas mixed with hydrogen. It is a signal to investors that they can continue investing in this segment,” the Minister of Energy appreciated. The European Commission could unveil its plan on December 22 on whether or not to include natural gas and nuclear projects on the list of “green” investments.

European gas prices fell sharply after Russia reserved pipeline capacity

Reference prices for natural gas in Europe fell Friday after Russia at the last minute reserved capacity to transport natural gas through pipelines, Bloomberg reports.

Futures on the Dutch hub fell to 16% on Friday, after Russia announced it had allayed some of its gas supply concerns, lowering fears and estimates that more liquefied natural gas cargoes will reach Europe. In addition, the weather forecast also shows that a cold snap that starts next week will not last as long as previously estimated.

Futures on the Dutch hub fell to 16% on Friday, after Russia announced it had allayed some of its gas supply concerns, lowering fears and estimates that more liquefied natural gas cargoes will reach Europe. In addition, the weather forecast also shows that a cold snap that starts next week will not last as long as previously estimated.

Russian giant Gazprom PJSC has set aside about 30 percent of its pipeline space to deliver natural gas from Russia to Germany via Poland at nighttime auctions. In response to this, the gas prices for next month’s delivery on the Amsterdam Stock Exchange fell to 120.60 euros for a megawatt hour.

“Whatever the reason for this last-minute capacity reserve, it clearly highlights the rapidly dwindling inventories facing Europe,” said Ole Hansen, analyst at Saxo Bank A/S.

On Monday, traders will closely monitor the monthly tender for transit capacity, which will give an indication of Gazprom’s plans for next month’s deliveries. If Russia finally decides to turn on the tap after limiting its exports to the quantities it has fixed in the long-term contracts, the gze quotations on the Dutch stock market can quickly fall to a level of almost 80 euros per megawatt hour, says Ole Hansen.

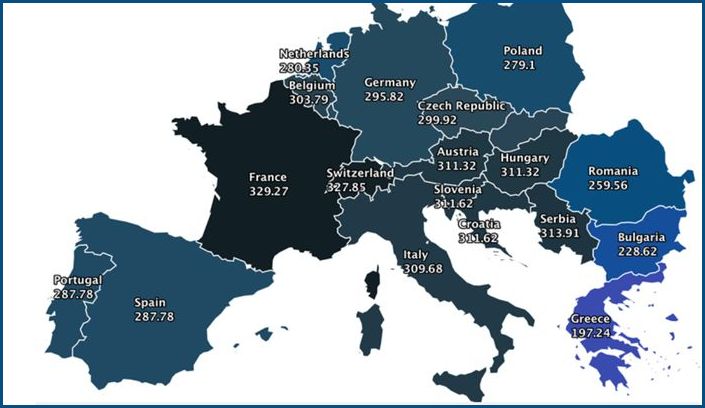

Geopolitics focuses on electricity prices in Europe. Romania, one of the cheapest markets

Electricity prices in Europe have reached new highs amid fears of fueling the former continent’s gas supply as a result of the escalating Russo-Ukrainian conflict, as well as the explosion in the price of carbon certificates, which exceeded EUR 90 per tonne .

So if in France the price of one MWh with next day delivery increased by 329 euros / MWh, Romania was at the other extreme, the market with the third lowest energy price in Europe. On Monday, no fewer than 10 European countries noted energy prices for the next day of more than 300 euros/MWh. The price of DAM in Romania, at 259.5 euros/MWh, even though it was almost 36 euros above the month-to-date average of 223.5 euros/MWh, was one of the lowest in the old continent. Only Greece, with a price of 197.2 euros/MWh, and Bulgaria, with a price of 228.6 euros/MWh, achieved lower prices than those on OPCOM. The price on OPCOM’s DAM platform is important because it represents only less than 40% of the local consumption. On Monday, December 13, both the European gas and electricity markets reacted to this. Especially on the statement of the new German Chancellor, Olof Scholz, who started the conversation about the need to resume the transport of Russian gas through Ukraine and not through Nord Stream 2. Germany’s new Foreign Minister Annalena Baerbock has threatened to freeze the Nord Stream 2 project if the Russian-Ukrainian conflict escalates. Electricity production in many European countries is based on natural gas. The prices of emission certificates have risen by 90 euros per tonne of CO2 this week. Analysts estimate that they will exceed the level of 100 euros by the end of the year. The value of EU allowances has tripled since the beginning of the year when they traded at €32/ton.

Automotive Sector

Dacia Spring, the third best-selling electric model in Europe in October

More than 5,000 Europeans registered a Dacia Spring model in October, taking the model to 3rd place in the electric car sales ranking.

Vehicle registrations in Europe and October decreased by 30% compared to the same month in 2020, to 790,652 units. The semiconductor crisis and component supply chain problems have had a strong impact on the automotive market.

“The shortage of semiconductors appears to be just as severe as the effects of last year’s pandemic. We have seen factories shut down across the continent and the industry is currently seeking a solution to the supply chain crisis,” said Felipe Munoz, analyst at the market research firm JATO Dynamics.

In this context, the sale of electric vehicles is taking an increasing share of the market. In October, a total of 181,300 BEV (100% electric) and PHEV (plug-in hybrids) units were registered.

In the 100% electric vehicle segment, the sales ranking for the tenth month of the year is led by Renault Zoe, a model with 6,438 registered units, while Volkswagen ID.3 with 5,539 units is in second place.

Surprisingly to many, the third position in the Summit last month went to the Dacia Spring model, which was registered by 5,277 Europeans.

The model of the Romanian brand, part of the Renault group, produced in China, surpassed much more famous vehicles such as Skoda Eniaq (5,166 units), Volkswagen ID.4 (4,847 units), Fiat 500 Electric (4,344 units), Kia e – Niro (4,237 units), Peugeot e-208 (4,117 units), Hyundai Ioniq 5 (3,286 units) or smart ForTwo (3,235 units). It is important to note that no fewer than five models in the Top 10 are completely new and this appear on the market year after year.

Commodities (Precious Metals) Sector

Canadian dubious prospectors continue to lust for Romanian gold

For more than a decade, Canadian prospectors have been trying to reproachfully (euphemistically put it) to obtain operating licenses for Romanian gold mines, most of which are located in the beautiful Apuseni Mountains.

For more than a decade, Canadian prospectors have been trying to reproachfully (euphemistically put it) to obtain operating licenses for Romanian gold mines, most of which are located in the beautiful Apuseni Mountains.

For the well-known gold mining project Rosia Montana, the Romanian government has succeeded in blocking it and now the Canadians are focusing on the nearby project in Rovina.

The opponents of these reprehensible practices are united in Mining Watch Romania and are once again trying to draw attention to it, because the gold miners keep using different names to lead authorities astray, but almost most of the names can be traced back to the Canadian city of Toronto and are listed there on the Toronto Stock Exchange as well as the London Stock Exchange. It is well known that: Rovina’s gold deposit, the second largest in Europe, contains measured and declared sources of 204 tons of gold and more than 635,000 tons of copper

Agricultural sector

Average price of Romanian agricultural land € 4700 per hectare

The aforementioned price applies to 2021 and has been corrected by a one-off large transaction, which would otherwise cause the average price to amount to € 10,000 per hectare and give a distorted picture.

The fields with areas of more than 30 hectares were sold this year with prices between 1,400 lei (285 euros) – in Suceava and 28.5 million lei (5.8 million euros) in Iasi, according to an analysis made by Economica based on data from the Ministry of Agriculture, which is obliged to publish transactions with agricultural land larger than 30 hectares. Given the 22 transactions that have been carried out since the beginning of the year, the hectare of agricultural land in plots of over 30 hectares has been sold for an average of about 10,000 euros . However, the average drops to around 4,700 euros, if we remove the value of the most expensive land traded this year from the calculation – 570,720 lei per hectare or 28.5 million lei in total (about 116,470 euros ha). The value of this farmland is explained by the fact that it is located outside the town of Iasi, consisting of plots of vines, arable land, hay and roads.

Where the cheapest and most expensive land was sold

Apart from the land outside Iași, MADR data (Romanian Ministry of Agriculture) shows that one of the most expensive land was traded in Timiș County, where MADR reported two transactions in the same place, at a price of 34,000 lei per hectare, i.e. about 7,000 euros per hectare. Each of the two lots has 45 hectares.

Three transactions involving land larger than 30 hectares were reported in the Dolj district. The most expensive – located in Segarcea (sw of Craiova) – has 65 hectares and costs a total of 2.4 million lei or 7,655 euros per hectare. The second in value in the province cost a total of about 1 million lei, about 40 hectares sold at 27,000 lei per hectare (5,500 euros), and the third in value was 292,000 lei for 50 hectares, or about 1,200 euros per hectare.

More than 30,000 lei (about 61,000 euros) per hectare costs on average the large plots of land in the Teleorman district. This year, three transactions took place in the district, from 5,000 euros per hectare to 7,000 euros per hectare.

In contrast, in the Suceava district, the cheapest large plot of land sold for 1,420 lei per hectare – about 290 euros per hectare.

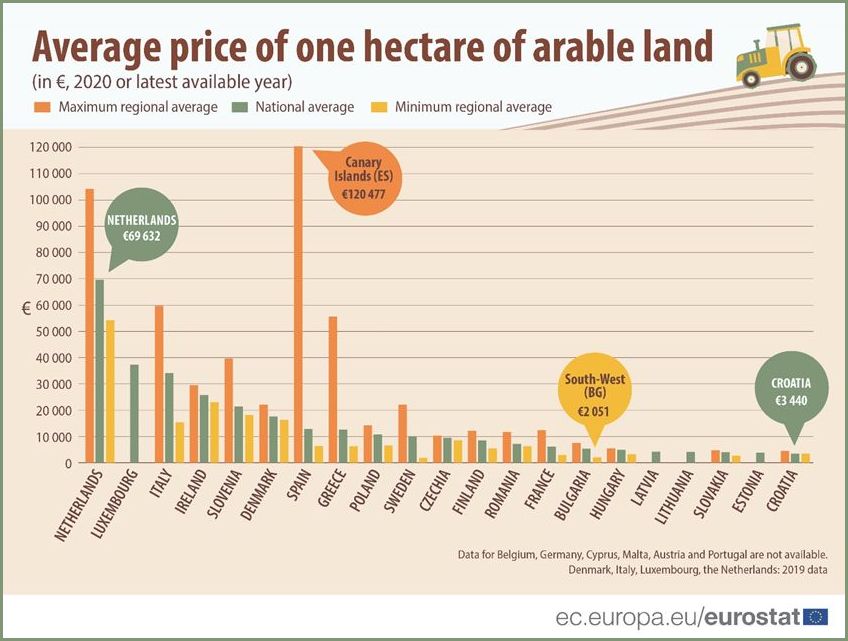

What the official statistics look like

European statistics have recently launched a study on the prices of agricultural land in the EU, according to which the average network of one hectare of arable land in Romania last year was 7,163 euros, in France it was 6,000 euros and in Hungary 4,893 euros.

Of the EU Member States, the highest prices for arable land were in the Netherlands (average €69,632 per hectare in 2019), while Croatia on the other side cost an average of €3,440 hectares of agricultural land in 2020.

Agricultural land prices: huge variation within the EU

Of the EU Member States, the Netherlands recorded the highest purchase price for one hectare of agricultural land in the EU (average €69 632 in 2019). The price of agricultural land in all regions of the Netherlands was above all other available national averages in the EU. However, of the EU regions for which data is available, the highest agricultural land prices were in the Spanish region of the Canary Islands (average EUR 120 477 per hectare in 2020). cost €3 440. At the regional level, one hectare of agricultural land cost the least in the southwestern region (Yugozapaden) of Bulgaria (average € 2,051).

The level of land prices depends on a number of factors, be it national (laws), regional (climate, proximity to networks) and local productivity factors (soil quality, slope, drainage, etc.), as well as the market forces of supply and demand (including the influence of foreign property rules).

In all EU regions for which data is available, buying agricultural land was more expensive than buying permanent pasture (up to 20 times more expensive in the Greek islands of the North Aegean Sea (Voreio Aigaio) and in the Spanish region of Murcia). Similarly, in almost all regions, buying irrigable farmland was more expensive than non-irrigable farmland (in the Spanish region of Murcia, it was almost six times more expensive).

Agricover launches Crop360 digital agricultural platform

Agricover, the leader in the Romanian agribusiness market, recently announced that it is launching the specialized Crop360 platform, which provides digital farming services to farming partners, as an additional support in growing profitable businesses.

“Crop360 is an integrated digital farming platform, built to give farmers quick access to services and information specific to day-to-day farming operations, enabling them to make real-time decisions. For example, the My Farm module allows farmers to remotely monitor crop developments by processing satellite images and determining a range of vegetation indices. The platform also has weather alerts or disease and pest alerts, as well as field access information. For the construction of the platform, we chose Microsoft as a technology partner, combining their technological expertise with that of our group’s agriculture, resulting in a product that we are proud of,” said Liviu Dobre, General Manager of Agricover holding.

“Agriculture is one of the most important economic sectors and, like any other area, is undergoing an accelerated process of digital transformation. We at Microsoft are delighted to have the opportunity to contribute to the sustainable development of the agricultural sector in Romania, and everywhere, through the partnerships we have with companies in this sector. Our aim is to support Romanian farmers in the context where the challenges they have to solve are becoming increasingly important. Through our partnership with Agricover, we aim to provide them with cloud solutions, tools and platforms, such as Crop360, which simplifies farmers’ work and helps them manage their crops as easily as possible and maximize production. while streamlining the use of resources”. said Bogdan Putinica, Country General Manager of Microsoft Romania.

By accessing the Crop360 platform, the farmer gains access to a range of digital tools specially designed for optimal management of agricultural activities. Once the farmer has imported his plots from APIA, he can monitor the plants’ growth stage and health via satellite imagery. He can plan his work in the field and assign tasks to farm workers, he is warned if there is a risk of disease in the crop or if there is a chance of extreme weather.

By accessing the Crop360 platform, the farmer gains access to a range of digital tools specially designed for optimal management of agricultural activities. Once the farmer has imported his plots from APIA, he can monitor the plants’ growth stage and health via satellite imagery. He can plan his work in the field and assign tasks to farm workers, he is warned if there is a risk of disease in the crop or if there is a chance of extreme weather.

It can also locate farm implements at any time and access the history of the route they traveled. Other important facilities for farmers are the efficient organization of leases, the management of stocks of controlled substances and reporting to the authorities.

At the same time, Agricover partner farmers have insight into the trade relationship. They can quickly buy the necessary inputs through the online store, have access to information about the financial situation, loan maturities, withdrawals and repayments, as well as the ability to use the funds with a click.

About Agricover

Since its inception, the Agricover Group has set itself the goal of serving Romanian farmers and offering them innovative solutions tailored to their needs, enabling them to sustainably consolidate their productivity through international access to high-quality agricultural technologies and solutions. the agricultural sector.

Since its inception, the Agricover Group has set itself the goal of serving Romanian farmers and offering them innovative solutions tailored to their needs, enabling them to sustainably consolidate their productivity through international access to high-quality agricultural technologies and solutions. the agricultural sector.

Agricover Holding SA brings together Agricover SA (specialized in the distribution of agricultural technologies), Agricover Credit IFN SA (non-bank financial institution specialized in financing farmers) and Agricover Technology SRL.Robert Rekkers, General Manager of Agricover Credit IFN SA is part from the DRN Task Force Agri & Food Romania.

Founded in 2020, Agricover Technology SRL – the new operating company – is the company through which the Group provides farmers with access to the latest innovations in global digital agriculture, facilitating the transformation of their way of working.

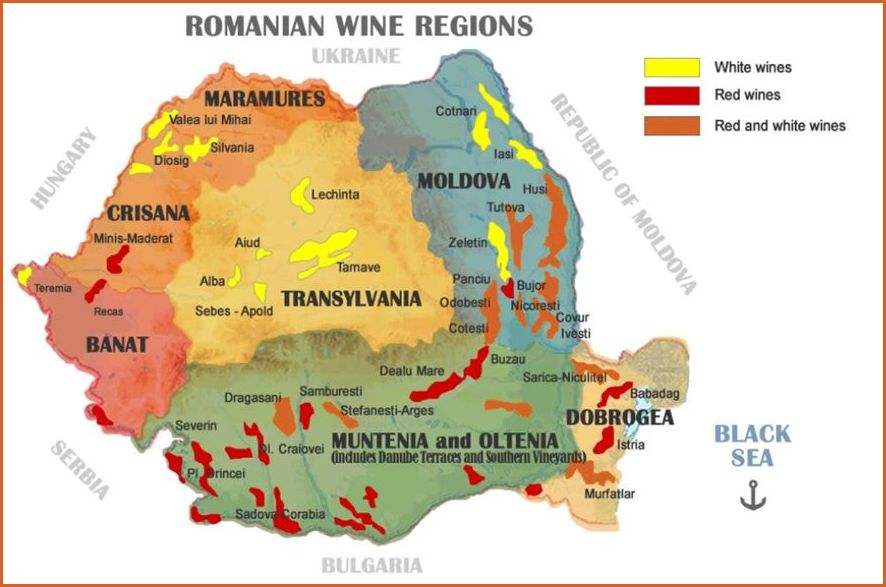

International wine press praises the quality of Romanian wines

Romania is the largest wine country in Southeastern Europe. And yet quite unknown.

“Of all the wine regions around the Black Sea and in the Balkans, Romania is THE country from which we can expect the greatest potential”, writes Hugh Johnson in his famous ‘Wine Atlas’.

Romania has a very old wine-growing tradition. According to some legends, there were already so many vineyards on the Romanian east coast far before our era that the Greek wine god Dyonisos must have been born here. It is certain that a wine culture already existed before our era and that in the time of the Romans the area was famous for the richness of viticulture. This is not surprising because the soil and climate conditions are very suitable for the grapes to reach an ideal ripeness. After all, the subsoil consists of Chernozem or black earth that develops in loess and produces very fertile soil.

In the Middle Ages, Saxon peoples (including what we then called the Southern Netherlands) emigrated to central Romania. They brought their own grape varieties, which are grown in this region to this day.

Later in the 17th century, Romanian viticulture reached a peak. Romanian wines were well known in the European courts and in ecclesiastical circles. The Austrian emperor even had his own vineyards there. After all, a large part of present-day Romania was then part of the Austro-Hungarian Empire.

And in the 19th century, Romania maintained close ties with France. French winemakers introduced French vines and shared their secrets with the local winegrowers. After the grape aphid largely destroyed the European vineyards, the Romanian vineyards were therefore largely replanted with French vines such as Pinot Noir, Cabernet Sauvignon, Merlot, Chardonnay and Sauvignon Blanc.

Currently, Romania is one of the 10 largest wine producers in the world. However, if you take a tour of the Dutch sommeliers, oenologists, vinologists and wine buyers, there is still a world to gain for them in terms of knowledge of Romanian wines.

The Romanian digital information carrier Profit selects selected Romanian top wines almost daily and we would like to mention the wine below as a recent example: The iconic Prince Matei is the most famous Romanian Merlot. The strength and elegance of this Merlot van is reminiscent of the personality of the great voivode Matei Basarab, whose name it bears. This “patron” of culture and Orthodoxy with whom the use of the Romanian language in official, civil and religious life is connected for the first time. The 2013 edition of Prince Matei wraps the glass in a ruby red cloak with purple reflections. The bouquet is complex, with hints of berries, black pepper, chocolate, coffee and vanilla. The taste is dry, intense, full-bodied, with soft tannins and delicate astringency and a long finish. The ideal serving temperature is 18 C and we recommend that you taste it with red meat dishes, game with sauces, Romanian cuisine or aged cheeses, with an intense flavour. The wine can be aged in glass (10-15 years), in cellar conditions, giving a velvety texture. As of 2019, the company that owns Vitica Sarica Niculițel acquired the Villa Zorilor Winery in Zorești from Vinarte and created a new company, Domeniile Prince Matei.

The Romanian digital information carrier Profit selects selected Romanian top wines almost daily and we would like to mention the wine below as a recent example: The iconic Prince Matei is the most famous Romanian Merlot. The strength and elegance of this Merlot van is reminiscent of the personality of the great voivode Matei Basarab, whose name it bears. This “patron” of culture and Orthodoxy with whom the use of the Romanian language in official, civil and religious life is connected for the first time. The 2013 edition of Prince Matei wraps the glass in a ruby red cloak with purple reflections. The bouquet is complex, with hints of berries, black pepper, chocolate, coffee and vanilla. The taste is dry, intense, full-bodied, with soft tannins and delicate astringency and a long finish. The ideal serving temperature is 18 C and we recommend that you taste it with red meat dishes, game with sauces, Romanian cuisine or aged cheeses, with an intense flavour. The wine can be aged in glass (10-15 years), in cellar conditions, giving a velvety texture. As of 2019, the company that owns Vitica Sarica Niculițel acquired the Villa Zorilor Winery in Zorești from Vinarte and created a new company, Domeniile Prince Matei.

In the Netherlands, you can buy or order Romanian wines at https://roemwijn.nl (The Hague) and www.cassdegoudensmaak.nl (Groningen and Haren).

Financial sector

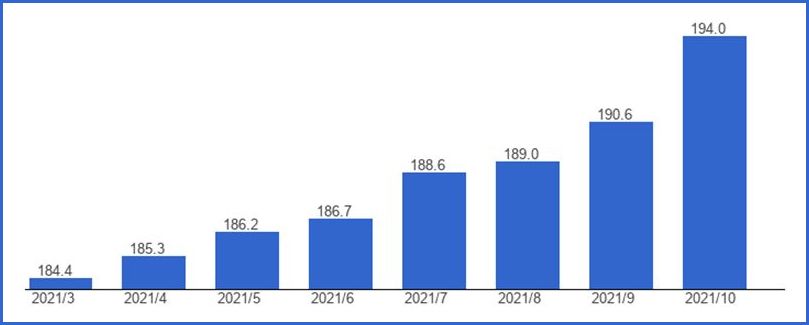

ING Bank Romania posted a net profit of 42% in the third quarter

ING Bank Romania recorded a net profit of 630 million lei in the 3rd quarter of this year, an increase of 42% compared to the same period in 2020.

Income

Total revenues reached 1.7 billion lei, an increase of 9%, while the deposits attracted amounted to 48.6 billion lei (+13%) and the loan portfolio reached more than 32 billion lei (+15%).

New loans private individuals

New loan production in the retail segment exceeded the levels recorded in the same period last year by 54%, while loans for personal needs showed a more accentuated dynamic. At the same time, the bank maintained a non-performing loan rate in line with the market average of 3.7%.” Lending accelerated in the third quarter. In the retail segment, our customers took out 54% more loans than last year. At the same time, they maintained a non-performing loan rate in line with the market average of 3.7%, reflecting a healthy portfolio, which they have built thanks to ING’s responsible lending policy.

SME Invest

For SME Invest, they have reached the ceiling allocated in 2021 (1.1 billion lei). As a result, we received an additional allocation of 400 million lei, available to their customers until the end of the year. It was a good quarter, with positive developments for financial indicators on the one hand, but also many product introductions and costs and optimization on the other. The evolution of lending and in particular the lower cost of risk provisions has resulted in an increase in profitability compared to the same period of 2020.

Digital products and services

They have added Home’Bank’s 100% online health insurance to their portfolio of digital products and services. , payments by phone number using the AliasPay service and, last but not least, virtual cards.

Green loan for private individuals

At the same time, we launched the first green loan for individuals, encouraging responsible decisions among those who want a more environmentally friendly vehicle,” said Mihaela Bîtu – CEO of ING Bank Romania.

Large companies

In the large corporate segment, ING continues to support the local business environment and has been involved in several key financings during this period. These include: participation as Principal Arranger in providing an additional 500 million lei facility to RCS & RDS; participation as Principal Arranger in the EUR 324 million transaction awarded to the Ameropa Group by a consortium of banks to fund operations in Romania; providing a loan of 15.5 million euros to Gersim Impex – the largest distributor of mobile phones and tablets in the local market, to diversify the company’s portfolio.

Bucharest Community Foundation

ING Bank and the Bucharest Community Foundation have announced the first three projects funded in the Bucharest Environmental Platform, part of a larger program to be implemented in the coming years. The three projects that received a total funding of 300,000 lei support air quality and green spaces in Bucharest. They aim to develop an ecological corridor between Văcăreşti Natural Park and Dâmboviţa exit from the city; expansion of the air quality measurement network, aerlive.ro, with 20 sensors; the creation of two educational gardens, at a secondary school in sector 1 and one in Buftea.

ING Bank and the Bucharest Community Foundation have announced the first three projects funded in the Bucharest Environmental Platform, part of a larger program to be implemented in the coming years. The three projects that received a total funding of 300,000 lei support air quality and green spaces in Bucharest. They aim to develop an ecological corridor between Văcăreşti Natural Park and Dâmboviţa exit from the city; expansion of the air quality measurement network, aerlive.ro, with 20 sensors; the creation of two educational gardens, at a secondary school in sector 1 and one in Buftea.

ING Group

ING Bank Romania is part of ING Group, a global international financial institution, providing banking services to more than 38.8 million individual customers, companies or institutions in more than 40 countries.

Founded in 1994, ING Bank Romania is the fourth bank in the top 10 of local banks measured by assets, and the only bank with organic growth, with no customer portfolio or other bank acquisitions. ING Bank Romania is a universal bank with more than 1.6 million customers from three business segments: retail (retail), SMEs and Wholesale Banking.

Romanian annual inflation fell slightly to 7.8% in November

Year-on-year inflation fell to 7.8% in November 2021, from 7.9% in October, while non-food prices rose 10.49%, food prices rose 6.10% and services rose 4.09%, according to the report. data released Monday by the National Institute. of Statistics (INS).

Year-on-year inflation fell to 7.8% in November 2021, from 7.9% in October, while non-food prices rose 10.49%, food prices rose 6.10% and services rose 4.09%, according to the report. data released Monday by the National Institute. of Statistics (INS).

“The consumer price index in November 2021 compared to October 2021 is 100.00%. The inflation at the beginning of the year (November 2021 to December 2020) is 7.4%. The annual inflation rate in November 2021 compared to November 2020 is 7.8%.The average rate of consumer prices in the last 12 months (December 2020 – November 2021) compared to the previous 12 months (December 2019 – November 2020) is 4.5%,” the INS statement reads. communique.

According to the quoted source, the harmonized index of consumer prices in November 2021 compared to October 2021 is 100.26%

The INS notes that annual inflation in November 2021 compared to November 2020 calculated on the basis of the Harmonized Index of Consumer Prices (HICP) is 6.7%. The average rate of consumer prices in the last 12 months (December 2020 – November 2021) compared to the previous 12 months (December 2019 – November 2020) determined on the basis of the HICP is 3.7%.

Annual CPI inflation is projected to reach 7.5% in December 2021 and is expected to ease to 5.9% by the end of next year, according to the National Bank of Romania’s inflation report.

Annual CPI inflation is projected to be 7.5% in December 2021, after a temporary slowdown from the recent upward trend, amid the entry into force of measures to compensate domestic consumers of electricity and natural gas, which they will also reflect on the CPI inflation during the application of these provisions (November 2021 – March 2022). Then, in April 2022, after the expiry of these measures, the annual CPI inflation rate will reflect significant increases, reaching 8.6% in the second quarter of 2022, a maximum in the forecast range. Thereafter, CPI inflation is expected to moderate to 5.9% by the end of next year and 3.3% at the start, respectively,” the November report said.

Annual CPI inflation is projected to be 7.5% in December 2021, after a temporary slowdown from the recent upward trend, amid the entry into force of measures to compensate domestic consumers of electricity and natural gas, which they will also reflect on the CPI inflation during the application of these provisions (November 2021 – March 2022). Then, in April 2022, after the expiry of these measures, the annual CPI inflation rate will reflect significant increases, reaching 8.6% in the second quarter of 2022, a maximum in the forecast range. Thereafter, CPI inflation is expected to moderate to 5.9% by the end of next year and 3.3% at the start, respectively,” the November report said.

The NBR found that compared to the August report, the new estimate is 1.9 percentage points higher at the end of this year and 2.5 percentage points higher at the end of next year. An overwhelming part of these revisions is explained by the growing contribution of components of the consumer package beyond the control of monetary policy.

Economical developments

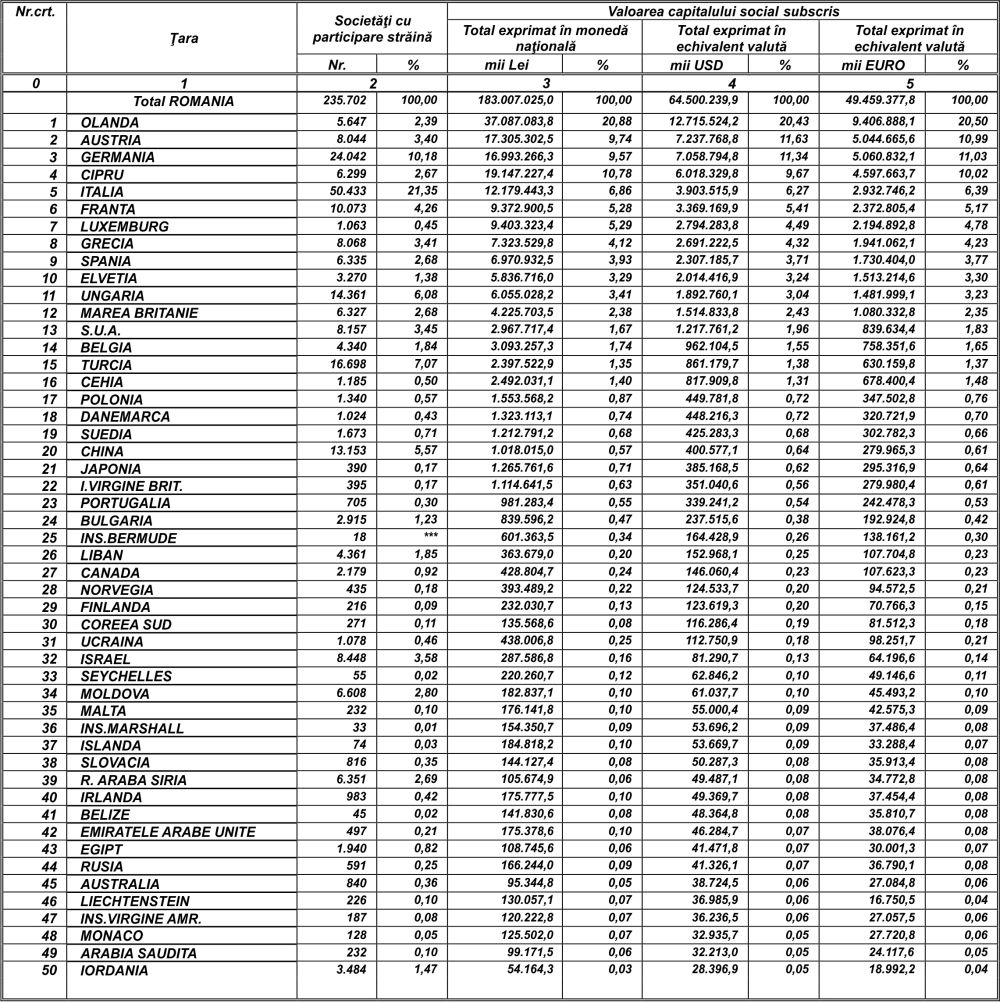

The Netherlands still the largest investor in Romania

The number of newly established foreign limited liability companies in Romania increased by 43.6% in the first ten months of 2021 compared to the same period in 2020 of 4,726 units, according to data centralized by the National Trade Register Office (ONRC). The 4,726 new companies had issued share capital totaling $36.028 million, 91.6% higher than the January-October 2020 registered companies of $18.808 million.

The number of newly established foreign limited liability companies in Romania increased by 43.6% in the first ten months of 2021 compared to the same period in 2020 of 4,726 units, according to data centralized by the National Trade Register Office (ONRC). The 4,726 new companies had issued share capital totaling $36.028 million, 91.6% higher than the January-October 2020 registered companies of $18.808 million.

By October 2021, 562 companies with foreign participation were registered in the capital. By region, most registrations were registered in professional, administrative, scientific and technical activities (26.33%), wholesale and retail trade, car and motorcycle repair (25.27% of the total) and construction (13, 7%). At the end of October 2021, there were 235,702 companies with a foreign shareholding in Romania. The value of the subscribed capital was $64.5 billion.

The largest number of companies with foreign participation was with investors from Italy, respectively 50,433 (issued capital of 3.903 billion dollars), but the highest share capital value is of Dutch companies, respectively 12.715 billion dollars, in 5,647 companies.

Clasamentul* pe ţări de rezidenţă a investitorilor în societăţi cu participare străină la capitalul social – la data de 31 Octombrie 2021

*) includes a selection of countries, relative to the size of the total issued share capital in USD equivalent, in descending order (column 4)

Note: col.2 shows the number of registrations made so far. The data relating to the subscribed share capital includes the capital subscriptions at the time of incorporation of companies from the reference period to which the capital increases were added and the share capital subscribed by the companies deregistered from the commercial register decreased during the reference period.

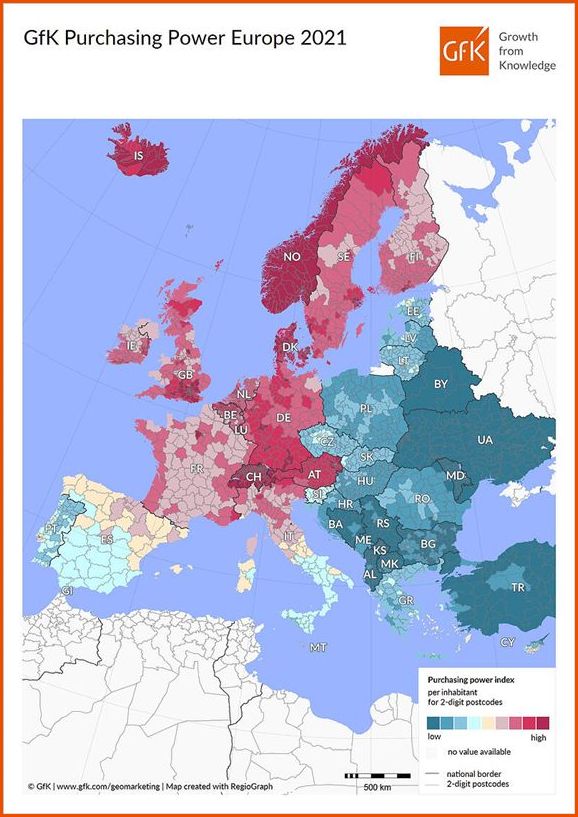

The purchasing power of Romanians: where are we and which countries are the best at European level

The average purchasing power per capita in Europe in 2021 is 15,055 euros. However, the average net disposable income per capita for each of the 42 countries included in the study varies considerably: Liechtenstein, Switzerland and Luxembourg have the highest average net disposable income, while Kosovo, Moldova and Ukraine have the lowest values. . . Liechtensteiners thus have an average of 34 times more money available for spending and saving than Ukrainians. These are some of the results of the “GfK Purchasing Power Europe 2021” survey.

In total, Europeans will have around €10.2 trillion to spend on food, housing, services, energy costs, private pensions, insurance, holidays, mobility and consumer purchases by 2021. This corresponds to an average purchasing power per head of EUR 15,055. Purchasing power per capita will rise in nominal terms by 1.9% in 2021. The amount consumers have available to spend and save varies significantly from country to country, as shown by the analysis of the top 10 countries.

The Netherlands is not in the top 10

Like last year, Liechtenstein is again in first place, with an average purchasing power per capita of EUR 64,629. This is 4.3 times higher than the European average. Just like last year, Switzerland and Luxembourg complete the top three in the purchasing power ranking. The Swiss have EUR 40,739 per capita – 2.7 times the European average – while the Luxembourgers have a purchasing power per capita of EUR 35,096, which is more than 2.3 times the European average.

| Position 2021 (last year) | The country | Population | 2021 purchasing power

per capita |

Purchasing Power Index

Europe * |

| 1 (1) | Liechtenstein | 38.747 | 64.629 | 429,3 |

| 2 (2) | Switzerland | 8.606.033 | 40.739 | 270.6 |

| 3 (3) | Luxembourg | 634.730 | 35.096 | 233.1 |

| 4 (4) | Iceland | 368.792 | 29.510 | 196,0 |

| 5 (5) | Norway | 5.391.369 | 29.252 | 194.3 |

| 6 (6) | Denmark | 5.840.045 | 27.621 | 183.5 |

| 7 (7) | Austria | 8.901.064 | 24,232 | 161.0 |

| 8 (8) | Germany | 83.166.711 | 23.637 | 157,0 |

| 9 (10) | Sweden | 10.379.295 | 23.557 | 156.5 |

| 10 (12) | United Kingdom | 67.081.234 | 23,438 | 155,7 |

| Europe (Total) | 678.426.283 | 15.055 | 100.0 | |

* index per capita: European average = 100

All the other Top 10 countries also have very high purchasing power per capita – at least 55% higher than the European average.

In total, 16 of the 42 countries surveyed are above the European average. This is in contrast to 26 countries where purchasing power per capita is below average – including Spain which is slightly below the European average at 14,709 euros per capita. Ukraine ranks last among the countries included in the survey, with the lowest purchasing power, Ukrainians have only 1,892 euros per capita, which is less than 13% of the European average.

Filip Vojtech, an expert in GfK geomarketing solutions, explains: “After purchasing power stagnated last year due to the Coronavirus pandemic, this year people can at least partially offset the rise in inflation through nominal purchasing power gains. This means that in 2021 Europe will have more money available for consumer spending, services, holidays and more. However, purchasing power does not develop in the same way in every European country: while the UK rises two places in the purchasing power ranking, partly due to a stronger pound, neighboring Ireland drops three places down in the top. And there have also been some changes within countries, such as in France, where the purchasing power gap is widening.”

Below is a detailed assessment of the purchasing power distribution in the Netherlands, France, Italy, Spain, Czech Republic, Poland, Hungary and Romania. A comparison of these countries provides relevant perspectives on the regional distribution of the spending potential in those countries.

| The place in 2021

(last year) |

The country | Population | 2021 purchasing power

per capita |

Purchasing Power Index

Europe * |

| 14 (14) | The Netherlands | 17.407.585 | 21,510 | 142,9 |

| 15 (15) | French | 64.844.037 | 20,662 | 137,2 |

| 16 (16) | Italy | 59,257,566 | 17,242 | 114,5 |

| 17 (17) | Spain | 47.450.795 | 14.709 | 97,7 |

| 24 (25) | Czech Republic | 10.701.777 | 10,667 | 70.9 |

| 28 (28) | Poland | 38.265.013 | 8,294 | 55.1 |

| 30 (30) | Hungary | 9.730.772 | 7.643 | 50.8 |

| 31 (31) | Romania | 19,328,838 | 7,453 | 49.5 |

* index per capita: European average = 100

Comparison between regions

Bucharest ranks by far in the ranking of purchasing power

Romania ranks 31st out of 42 countries included in the European ranking. With an average purchasing power per capita of 7,453 euros, Romanians have a purchasing power that is 50% lower than the European average.

Like France and Poland, Romania has a significant gap between rich and poor. The capital Bucharest is the leader in the top 10. This year, Bucharest residents have an average purchasing power per capita that is almost 86% above the national average, but still 8% below the European average. Bucharest residents have more than three times more purchasing power compared to residents of the least wealthy province, Vaslui, where net disposable income is about 56% of the national average and just under 28% of the European average.

In 2021 there were several changes in the top ten: Sibiu and Brașov move to fifth and sixth place, while Alba Prahova passes and reaches ninth place. All provinces in the Top 10 have an average purchasing power per capita that is significantly above the national average. Constanța, in 11th place, with purchasing power per capita at about the same level as the national average, while all other provinces have purchasing power below average.

For Romania, purchasing power data is available in detail down to city level for each of the following categories: food, non-alcoholic beverages, alcoholic beverages, tobacco products, health and hygiene products, clothing, footwear and leather products, furniture , household products; glass, porcelain; home appliances, consumer electronics, IT&C, photography, watches and jewelry, books and supplies, sporting goods, hobbies and recreation, home renovation items.

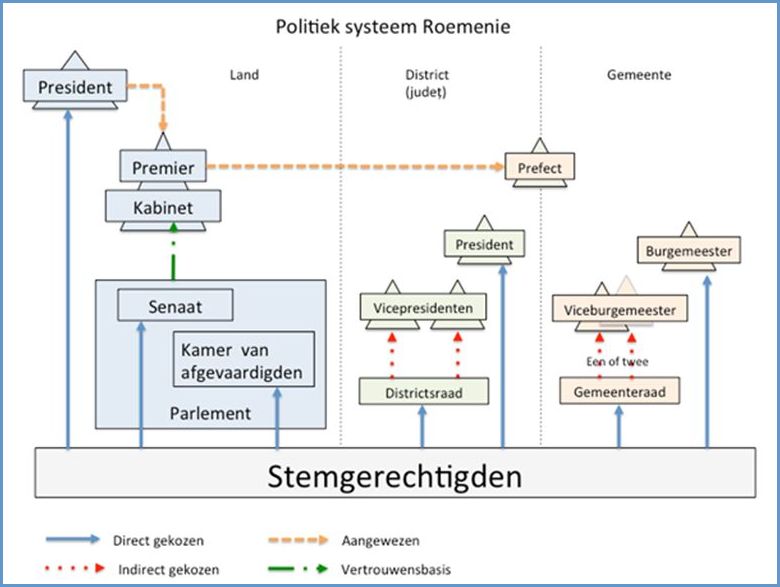

Political developments

Towards political stability

Fortunately, we have been able to establish in the last month that new majority coalitions have been formed in three countries, so Romania, Germany and the Netherlands. In view of the strong economic ties that these three countries have with each other and reports in the Dutch media are scarce, we give you a brief overview below of the Romanian balance of power and their constitution.

Romania is a semi-presidential republic with a president (currently President Klaus Johannis) as head of state. The government is headed by a prime minister (currently: Nicolae Ciuca – PNL), appointed by the president.

The currently formed coalition (sworn in on November 25, 2021) has 20 ministers excluding the prime minister. The coalition consists of the liberal (Christian-democratic signature) PNL(8 ministers + prime minister), PSD (socialists, 9 ministers) and 3 of the UDMR/RMDSZ (party of the Hungarian minority).

President of the Chamber of Deputies is Marcel Ciolacu (PSD) and President of the Senate Florin Citu (PNL)

The deputy prime ministers are Sorin Grindeanu (PSD) and Kelemen Hunor (UDMR/RMDSZ). The two opposition parties are the USRPLUS (liberals) and the AUR (ultra conservative, nationalist).

In accordance with the Romanian Constitution, 18 seats are reserved for ethnic minorities in Romania. The Romanian Constitution (Article 62), under the conditions imposed by the electoral law, provides for seats in the Chamber of Deputies for the party and cultural association of ethnic minorities in Romania (with the restriction that each national minority must be represented by one organization only ). Minority parties and associations are exempt from the electoral threshold(5%) and are guaranteed a seat as long as they obtain at least 10% of the votes needed for the last party eligible to win a seat over the threshold. Traditionally, these groups support the government in power.

In accordance with the Romanian Constitution, 18 seats are reserved for ethnic minorities in Romania. The Romanian Constitution (Article 62), under the conditions imposed by the electoral law, provides for seats in the Chamber of Deputies for the party and cultural association of ethnic minorities in Romania (with the restriction that each national minority must be represented by one organization only ). Minority parties and associations are exempt from the electoral threshold(5%) and are guaranteed a seat as long as they obtain at least 10% of the votes needed for the last party eligible to win a seat over the threshold. Traditionally, these groups support the government in power.

As in the Netherlands , Romania has a bicameral system . The House of Representatives in Romania is called the Chamber of Deputies (Camera Deputaţilor) and has 332 seats. The Senate becomes the Senate and has 137 seats.

For detailed information see the English and Romanian language website www.gov.ro

Laura Kovesi: Eastern and Western Europe are equal in corruption.

“No country in Europe is clean. None!” Under this title, the Swiss newspaper “Neue Zurcher Zeitung” published an extensive interview with the head of the European Public Prosecutor’s Office, Laura Kovesi, Deutsche Welle reports, Sega writes, quoted by Rador . The author of the interview, Daniel Steinfort, stated that Kovesi, who received him in a modest room in Luxembourg, did not want to talk much – she also spoke directly on the subject.

Kovesi warned from the outset of the high risk that the European money in the package to overcome the effects of the pandemic would not reach its destination. “No difference between Member States” “At the moment there is a lot of money going to the health sector and the risk of fraud is high. Governments do not announce public tenders. There is not enough control, there is no transparency,” said the head of the European Public Prosecutor’s Office , from Romania .

Kovesi warned from the outset of the high risk that the European money in the package to overcome the effects of the pandemic would not reach its destination. “No difference between Member States” “At the moment there is a lot of money going to the health sector and the risk of fraud is high. Governments do not announce public tenders. There is not enough control, there is no transparency,” said the head of the European Public Prosecutor’s Office , from Romania .

She stated that in the case of public tenders, the Public Prosecution Service is constantly dealing with bribes and personal gain. Laura Kovesi reiterated her belief that prosecutors delegated to the European Public Prosecutor’s Office by the various states must be completely independent in order to do their job. She thinks the money for the European Public Prosecutor’s Office is too little and gives an example: EUR 30.2 million was initially earmarked for its construction, which corresponds to the budget of a regional prosecutor’s office in Romania.

“When it comes to fraud and the rule of law, the finger is often pointed at Eastern Europe. Is this correct?” asks journalist Daniel Steinfort. Kovesi has a clear view on the matter: “No. No country in Europe is clean.

No. See, for example, statistics showing that the EU has a trade surplus of more than €300 billion. This is theoretically impossible. Within the EU, exports and imports must be in balance. The explanation is one: massive VAT fraud. These figures do not show any difference between Member States. Also, the cases we handle do not show that there is more corruption in Eastern Europe than in Western Europe.”

“We cannot divide Europe into East and West” Towards the end of the extended interview, the reporter returns to the same topic and asks Kovesi if she is not concerned about the different attitudes to the rule of law in the two parts of the continent. The head of the European Public Prosecutor’s Office replies: “I am not a politician, that is not my field. I will not go into the political aspect. However, as a prosecutor I can tell you that we cannot divide Europe into East and West or North and South. Every Member State has problems to solve. We have seen attacks on justice in all parts of the continent.”

Public health sector

No predictions, but acting according to the situation.

The virus in all its variants is global and situations can differ and therefore also the measures that are taken. The Dutch situation and the associated measures as well, so we limit ourselves to the situation in Romania because the readers of this newsletter maintain contact with it. However, keep in mind that developments are taking place at a rapid pace and this message is therefore a snapshot.

The virus in all its variants is global and situations can differ and therefore also the measures that are taken. The Dutch situation and the associated measures as well, so we limit ourselves to the situation in Romania because the readers of this newsletter maintain contact with it. However, keep in mind that developments are taking place at a rapid pace and this message is therefore a snapshot.

Passengers Location Form for all people entering Romania

On Wednesday 8 December, the Romanian government approved the Passenger Location Form (PLF), a document that will come into effect from 20 December. The form must be completed by all people entering Romania. The form has already been used in 18 EU countries.

The document will make epidemiological research more efficient. “From December 20, people coming to Romania will have to fill in the digital entry form. The new Omicronstrain and the Covid epidemiological situation in the country require the most effective protection measures in Romania, especially as the holiday season approaches. The form is necessary to protect our health and the health of our loved ones,” the prime minister argued.

The Passenger Location Form makes epidemiological research more efficient, so that public health authorities can more easily come into contact with people who have come into contact with an infected citizen during the trip.

The form has been developed by the Romanian Special Telecommunications Service (STS) and is to be completed by all people entering Romania and traveling by air, train, means of transport for persons by road or sea.

The form can be completed electronically via the website plf.gov.ro , and will be completed at the entrance of the country and presented to the authorized persons from the border crossing points.

The data entered will only be accessible to authorized public health personnel and will be used only for conducting epidemiological research

Health Minister Alexandru Rafila, in turn, said that the Passenger Location Form (PLF) must be completed 24 hours before entering Romania.

“Romania joins the EC’s decision to set up a digital passenger tracking system. This document does not impede traffic, but it helps us locate an infected person and allows health authorities to quickly conduct epidemiological investigations and take the necessary measures to test or isolate infected people. It is a procedure to quickly identify the contacts of infected persons. This certificate is not difficult to complete. If they don’t, they can go home and have to finish it within 24 hours, but if they don’t keep to this interval, they risk fines,” said Alexandru Rafila.

Validity period of Covid certificates limited to 9 months

EU countries have agreed to limit the validity of Covid certificates. EU countries are expected to limit the duration of COVID-19 travel certificates to nine months after the first vaccination, while discussions on travel restrictions outside the EU bloc continue. In November, the European pandemic severely affected health care funding and economic productivity. The effects will weigh on If the new rules come into force, EU citizens who want to travel freely within the EU bloc next summer will need a booster dose. But some countries with lower vaccination rates were concerned about the impact this could have on travel.

EU governments have repeatedly said that a common approach is needed to avoid further disruption to the tourism sector. However, they have introduced different rules. France set a seven-month limit on the day the Commission proposed it to be nine months. The French rule will apply from January 15, while the Commission has proposed to set the start date as January 10. In Cyprus, the certificate should be valid for seven months, while in Greece it would expire after six months for the elderly. EU officials said both countries were ready to join a common EU border.

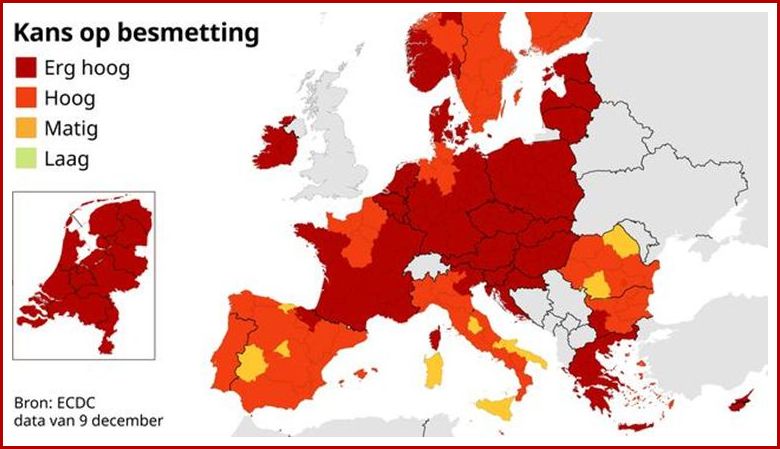

Limburg is currently one of the largest corona fires in Europe

But 5 of the 211 European districts register more positive corona tests than Limburg, according to figures from the European health service ECDC. Of every 75 inhabitants, 2 were found to have the virus in the past two calendar weeks.

The ECDC makes a corona map every week. This is based on the number of positive tests in the past two calendar weeks. For Thursday’s card, this is the period from November 22 to December 5. Limburg had 29,766 positive tests in those weeks. Converted that is 2,664 cases for every 100,000 Limburgers.

Compared to the previous map, the number of cases in Limburg rose slightly: by 1.8 percent. Nevertheless, the province climbed from twelfth to sixth place in the European ranking. This is because the number of cases in other fires is falling rapidly, especially in Austria. In the state of Upper Austria, the number of cases fell by 34 percent in a week and by 32 percent in Salzburg.

Netherlands dark red for fourth week in a row

Some Dutch provinces are also seeing a cautious decline, for the first time since the start of the current wave. In Gelderland, the number of positive tests is almost 4 percent lower than last week. The number of corona cases is also falling in Overijssel, Flevoland and North Holland. Still, for the fourth week in a row, the entire country remains in dark red, the highest risk level.

The map of Europe is redder than last week. In total, 132 regions are now in dark red, compared to 119 last week. The ‘light’ spots on the map are in Italy, Spain and Romania.

Map of anti-COVID vaccination in Romania / Only five counties have a vaccination rate of more than 50% / The city with the lowest vaccination rate / Top locations – December 13, 2021

Almost a year after the start of the anti-COVID vaccination campaign in Romania, only 46.3% of the eligible population (over 12 years old) has been vaccinated. Suceava, the first red county in Romania at the start of the pandemic, maintains its last position, with just over 29% of individuals over 12 years of age vaccinated against COVID-19. Suceava is also the city with the lowest vaccination rate – 7.70% in Vicovu de Sus. In Bucharest, the percentage of the vaccinated population is more than 66%, and five provinces have a vaccination rate of more than 50%, according to data from HotNews.ro.

Provinces by vaccination rate

Vaccine coverage in Romania:

- 40.5% general population

- 46.3% Eligible Population (over 12 years old)

- 48.5% adult population (over 18 years old)

Vaccination rate:

- nationwide: 25.05%;

- urban: 40.53%;

- municipalities: 42.33%.

Progress of Romanian vaccination process

The city in Romania with the highest vaccination rate – 54.58% is Otopeni from Ilfov, while on the other side is Vicovu de Sus from Suceava, with 7.70%.

The places in Romania with the highest vaccination coverage , according to the December 5 data published by the Vaccination Steering Committee:

- 62.91% – Dumbrăvița Municipality, Timiș County;

- 61.21% – Municipality of Salva, Bistrița-Năsăud County;

- 58.84% – Municipality of Cârcea, Province of Dolj;

- 58.5% – Municipality of Valea Lupului, Iași Province;

- 57.26% – municipality of Rimetea, province of Alba;

- 56.71% – Municipality of Giroc, Timiș County;

- 56.07% – Municipality of Sfântu Gheorghe, Province of Tulcea;

- 55.65% – Municipality of Izvoru Crișului, Province of Cluj;

- 55.08% – Municipality of Chiajna, Ilfov Province;

- 54.58% – city of Otopeni, province of Ilfov;

- 54% – Municipality of Cluj-Napoca, Province of Cluj.

The places in Romania with the lowest vaccination coverage:

- Valea Moldovei (Suceava) – 3.80%, Cojasca (Dâmbovița) – 4.78%, Augustin (Brașov) – 5.35%, Brăhășești (Galați) – 5.84%, Pietroasa (Timiș) – 5.85% , Burla (Suceava) – 6.02%, Repedea (Maramureș) – 6.09%, Moldova-Sulița (Suceava) – 6.23%, Cămârzana (Satu Mare) – 6.27%,

- Jina (Sibiu) – 6.86%, Horgești (Bacău) – 6.91%, Ripiceni (Botoșani) – 7.03%, Corbasca (Bacău) – 7.19%, Vicovu de Sus (Suceava) – 7.70 %,

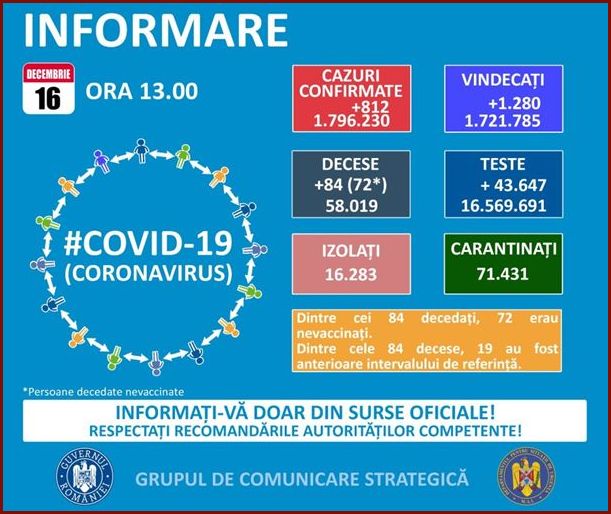

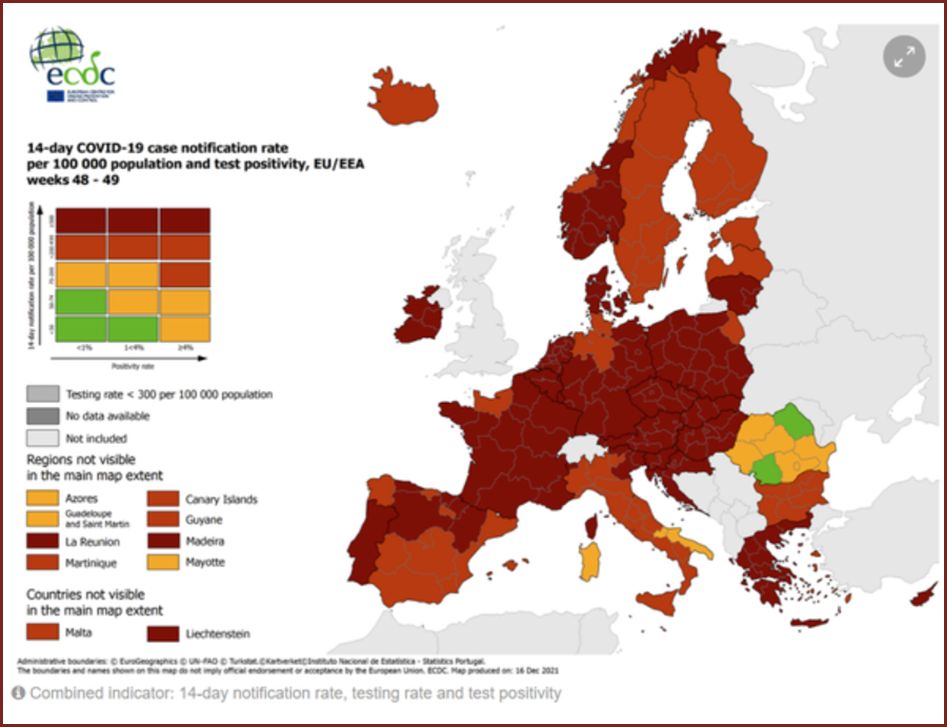

Romania became the standard of contradictions in Europe on Thursday 16 December

Although it is barely more than 40% of the population that has been vaccinated against Covid with at least one dose, slightly better than Bulgaria, it is the state with the lowest rates of Covid infection, respectively test positive. Two regions in Romania are the only green spots and actually the safest in Europe, according to the color system drawn up by the European Center for Disease Control and Prevention (ECDC) to express concern.

ECDC has identified 4 degrees of epidemic concern, from dark red (which is the most worrisome grade and the 14-day infection rate per 100,000 population is over 500), red, orange and green (where the infection rate is 14 days per 100,000 population). is less than 50 and the positive rate is less than 4% or the infection rate at 14 days per 100,000 population is less than less than 75, but the positive rate is less than 1%).

According to ECDC, Romania has managed to provide the only green spots on this epidemiological map. This, although at the level of vaccination, Romania is in the penultimate place with 40.8% of the population vaccinated with at least one dose and 39.6% of the population vaccinated with two doses, after Bulgaria, which has only 27.8 % of the population vaccinated with at least one dose and 26.6% with two doses.

France, where 77.7% of the population has been vaccinated against Covid with at least one dose, reported 60,866 cases of coronavirus on Thursday.

The UK, where nearly 90% of the population has been vaccinated with at least one dose and more than 80% with the second dose, set a new record for daily Covid cases on Thursday, respectively 88,376, after the daily balance was on Wednesday. 78,610.

UK health authorities are increasing the number of cases to such an extent that the spread of the Omicron variant, which is so far more widespread than any coronavirus variant, and which at least partially escapes the protective effect of the vaccine or the passage previous through cure of the corona virus..

Disclaimer

The newsletter of the Dutch Romanian Network is compiled with great care. The Dutch Romanian Network cannot accept any liability for a possible inaccuracy and/or incompleteness of the information provided herein, nor can any rights be derived from the content of the newsletter. The articles do not necessarily reflect the opinion of the board.