Newsletter April / May 2022

Romanian Business Day – A new impetus!

For the Dutch Romanian Network it was the first physical meeting after the Corona period and almost all participants preferred this to the video meetings. The reasonably relaxed atmosphere made individual contacts possible again, which are limited during video meetings. A new impetus arose spontaneously in this atmosphere.

Also special was the presence of a substantial part of our Romanian contacts, including the Romanian Member of Parliament Viorel Băltărețu, who is chairman of the Romanian Parliamentary Friendship Group with the Netherlands and who comes from the business community.

Also special was the presence of a substantial part of our Romanian contacts, including the Romanian Member of Parliament Viorel Băltărețu, who is chairman of the Romanian Parliamentary Friendship Group with the Netherlands and who comes from the business community.

With verve, Decebal Popescu of the Romanian Transport Academy highlighted the opportunities of the logistics sector, including the much-discussed Mobility Package. The well-attended Round Table session of the DRN Task Force Agri & Food also attracted attention. It is not the intention to report extensively here, but we would like to point out that the Whitepaper “Romanian entities administrative processing in the Netherlands” can now be downloaded from www.dutchromaniannetwork.nl, where it is included in the Knowledge Base. (click here)

The geopolitical circumstances were only discussed indirectly. Or would Romania, often referred to as a Latin island in a Slavic sea, have an influence? In this newsletter we will come back to each situation.

The new impetus for the DRN will translate into more activities for the members, an increase in services and company visits in the coming period. And of course a renewed package will be put together for our sponsors. So you’ll be hearing from us!

Sector Logistics and Transport

Romania: Green license plates for zero-emission vehicles

The new regulation for the allocation of license plates in green letters and numbers has been published in the Government Gazette.

For example, according to the joint decision of the Ministers of the Environment, Water and Forests (Tánczos Barna), the Minister of the Interior (Lucian Bode) and the Minister of Transport and Infrastructure (Sorin Grindeanu), (free) number plates with green letters and numbers are exclusively awarded to zero-emission vehicles (pure electric or hydrogen fuel cell cars).

“Clean car registration numbers will act as a green passport for this type of vehicle. By clearly and visibly identifying clean vehicles in traffic, we are creating the framework to provide facilities to those who use them: whether we are talking about free parking , permitted access in low-emission areas, tax cuts, local facilities which are a very useful policy tool especially those in the large urban agglomerations,” said Minister Tánczos Barna.

“Clean car registration numbers will act as a green passport for this type of vehicle. By clearly and visibly identifying clean vehicles in traffic, we are creating the framework to provide facilities to those who use them: whether we are talking about free parking , permitted access in low-emission areas, tax cuts, local facilities which are a very useful policy tool especially those in the large urban agglomerations,” said Minister Tánczos Barna.

The new measures will come into effect 60 days after the publication of the decision in the Government Gazette. In the case of already registered cars that meet the criteria for assigning “green numbers”, they can be changed on request free of charge after the entry into force (June 2022) of the provisions of the normative law.

RO e-Transport System

Governments around the world are introducing continuous transaction control (CTC) systems to improve and amplify VAT collection while also combating tax evasion. Romania, with the largest VAT gap in the EU (34.9% in 2019), is one of the fastest moving countries when it comes to adopting CTCs. In December 2021, the country announced the mandatory use of the RO e-Factura system for high-tax risk products in B2B transactions from July 1, 2022, and are already taking the next step.

On April 11, the Ministry of Finance published a draft Emergency Ordinance (Ordinance) introducing a mandatory e-transport system for the supervision of certain goods on the national territory from July 1, 2022. The RO e-Transport system will be linked to existing IT systems at the level of the Ministry of Finance, the National Agency for Fiscal Administration (ANAF) or the Romanian Customs Authority. According to the draft regulation, the transport of high-tax risk products is limited to a maximum of three calendar days before commencement of the transport indicated in the e-transport system, prior to the movement of goods from one location to another.

The statement will contain the following:

- Sender and beneficiary data

- The name, characteristics, quantities and value of the transported goods

- Placing loading and unloading

- Details of the means of transport

The system generates a unique code (ITU code) after the declaration. This code must accompany the goods being transported, in physical or electronic format with the transport document. The competent authorities check the declaration and the goods on the transport routes.

Which transports fall under the scope?

The RO e-Transport system has been set up to monitor the transport of high-risk goods within the national territory. This includes the following:

- Intra-Community takeovers

- Intra-Community supplies

- Import and Export

- Domestic transport between different economic operators

- Domestic transport between two locations of the same economic operator

- Transport of goods subject to intra-Community transactions in transit through Romania

The transport of goods destined for diplomatic missions, consular posts, international organizations, the armed forces of foreign NATO member states or as a result of the execution of contracts is not covered by the RO e-Transport system.

What happens now?

As mentioned, the draft regulation was published in the Government Gazette on 11 April. After publication, the Ministry of Finance will prepare follow-up orders to define the categories of road vehicles and the list of high-tax risk products for the RO e-Transport system. In addition, as of 1 July 2022, the use of the RO e-Transport system will be mandatory for the transport of high-tax risk products.

Failure to comply with the rules regarding the e-Transport system leads to a fine of LEI 50,000 (approximately EUR 10,000) for private individuals and LEI 100,000 (approximately EUR 20,000) for legal entities. In addition, the value of undeclared goods is confiscated.

Summary conclusion DRN

The Romanian government wants to set up this digital platform to better monitor the control over goods with a high value or high risk of fraud.

To this end, they want carriers who transport goods that meet those fraud risks (based on a list of recorded commodity codes) to enter the data digitally 3 days before loading (loading, unloading address, goods description, car number, route, etc.).

The pilot started on April 11, 2022 and everyone should use this system from July 1, 2022. Fines for non-compliance are very high (ranging from RON 5000-100,000)

In particular, the extra workload and certainly the 3 days before loading are a problem. Many details are not yet known 3 days before loading or are subject to change. In practice this is not feasible.

E. van Wijk Logistics: “Keep supporting the Ukrainians right now”

The logistics service provider’s business premises in Lviv

Economy

With four international locations, more than 350 trucks and about 800 employees, E. van Wijk Logistics from Giessen is one of the larger logistics service providers in the Netherlands. Director Ewout van Wijk has a special bond with Ukraine.

E. van Wijk Logistics has been active in Eastern Europe since the 1990s, says 35-year-old Van Wijk. That started after the fall of the Romanian dictator Ceausescu. “A pastor then asked my father, who was then still a director, to help deliver relief supplies there. Our business activities in Eastern Europe grew out of these relief efforts.”

Van Wijk also transports goods to and from Ukraine; especially medicines and products related to arable farming. Van Wijk: “We do not transport grain, but we do transport agricultural machinery and pesticides, for example. After all, the country is known as the breadbasket of Europe.”

In addition to two branches in the Netherlands, two in Romania and one in Poland, E. van Wijk has also had a business location in Lviv, Ukraine, since 2004. With a storage area of about 2,500 square meters, this is the company’s smallest location.

Ewout van Wijk

The building in Lviv mainly serves as a warehouse and storage place for customers, says Van Wijk. “Some companies based in Kiev use our warehouse to supply Western Ukraine from there. But there are also companies that arrange their distribution to other European countries from Lviv.”

The night before the Russian invasion, Van Wijk still thought to himself: That will never happen. He was therefore quite shocked when he woke up the next morning and saw messages from acquaintances from Ukraine on his phone that this had happened. “Since 2004 I have been coming to Ukraine regularly. I know quite a few people in Kiev and Lviv. It felt very surreal, especially with all the chaos and panic that followed the raid.”

dacha

The twenty employees of the logistics service provider in Lviv, five of whom were drivers, fled to family and friends in the countryside. Most of them are still there at the moment, Van Wijk knows. “In every family someone has a dacha: a house that people keep, even after they have moved to the city. One employee has fled to acquaintances abroad.”

Most commercial activities in Ukraine are still at a standstill. Many companies that have their storage in Kiev wanted to move it to E. van Wijk’s warehouse in Lviv. “It is now bulging,” says Van Wijk. “We don’t just have storage activities there; our drivers also drive up and down to pick up and deliver medicines and relief supplies.”

The trucks of logistics service provider E. van Wijk, more than 350 in total, drive through both Western and Eastern Europe. image E. van Wijk Logistics

The trucks of logistics service provider E. van Wijk, more than 350 in total, drive through both Western and Eastern Europe. image E. van Wijk Logistics

Van Wijk’s Ukrainian drivers do not have to serve as soldiers, he explains. “Relief supplies and foodstuffs will still have to come into the country. The Ukrainian government also sees transporting these goods as serving the country. That is why our drivers are allowed to continue driving.”

Impact

The Lviv facility accounts for 2 percent of the company’s total turnover. “Last year we had a turnover of 100 million euros, so even if all activities in Lviv disappear, this will not have a major impact on business. I think it is especially bad for our employees there if that happens: they will then have nothing.”

Van Wijk still has daily contact with employees of the Lviv branch by video calling. At the beginning of the war this was still almost every hour. “I walked around with a knot in my stomach for two weeks. I now notice that everyone, including the people in Ukraine, is slowly returning to the order of the day.”

According to Van Wijk, there is also a danger in this. “In the beginning, many aid campaigns started in the Netherlands. I can now see that the enthusiasm is waning a bit. But right now, when supplies in Ukraine are really starting to run out, the people there need our help more than ever. So I want to call on the Dutch to continue to support the people in Ukraine.”

Source: Reformatorisch Dagblad – Photos E.van Wijk Logistics

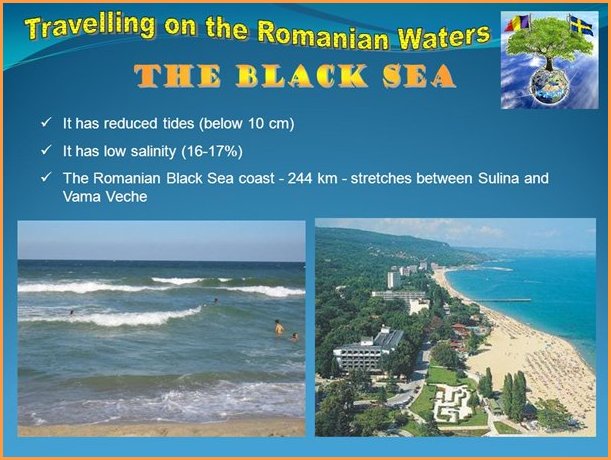

Sector Tourism

Agencies bringing foreign tourists to Romania receive project grants

Travel agencies that will bring foreign tourists to Romania can receive grants through a de minimis scheme that is currently in the final stages of the debate, National Association of Travel Agencies (ANAT) President Dumitru Luca said on Thursday. April 14, announced.

He added that with the recent amendment of Law 346 on Export Promotion, inbound tourism was recognized as an export of services, after many years of industry demanding authorities to do so.

He added that with the recent amendment of Law 346 on Export Promotion, inbound tourism was recognized as an export of services, after many years of industry demanding authorities to do so.

“After two years of speaking to deaf ears, a substantially better dialogue with the current Minister of Entrepreneurship and Tourism (Constantin-Daniel Cadariu) has emerged.” However, a swallow does not make a summer. We also need people behind him to have technical discussions and with whom to conduct them. One of his soul projects, which he has been fighting for several years and which is now about to be realized, is the recognition of inbound tourism as an export of services. Even though we were all taught in school that it is ultimately an export because the consumer of the product is a non-resident, but it is also the easiest form of export. That consumer comes here, we don’t take the goods where he is. This thing has been misunderstood over time, but it’s finally clear.

He underlined that a draft normative law providing for the granting of subsidies to agencies bringing foreign tourists to Romania is also in the final stages of debate. “We hope that the other absolutely natural measures that should boost the influx will come. A draft normative law is already in the final stages of the debate, which will provide some subsidies to the agencies that bring foreign tourists to Romania. is a de minimis scheme, requiring a minimum of four nights’ accommodation in Romania and for each additional night something is added. It’s not a lot of money, but it’s an incentive. (…) There is a legal framework, we also have the approval from the European Commission, and other countries are doing this, we didn’t invent it. I hope it will become a reality, even if it’s something symbolic, it’s a start,” said Luca.

Another project mentioned by the head of ANAT refers to the amendment of the Tax Code so that the incoming person will also benefit from a zero VAT rate.

“And another project that I care about very much and that I hope to realize in the coming period concerns the amendment of the tax code, because I know

“And another project that I care about very much and that I hope to realize in the coming period concerns the amendment of the tax code, because I know that all exports benefit from a zero VAT rate. Inbound is practically the only export where we don’t even have a reduced quota, we have a standard quota of 19%. We are also focusing on this issue, we are also in talks with the Ministry of Finance and with the political decision-makers, but the first step has already been taken with that amendment to Law 346,” added ANAT President Dumitru Luca .

that all exports benefit from a zero VAT rate. Inbound is practically the only export where we don’t even have a reduced quota, we have a standard quota of 19%. We are also focusing on this issue, we are also in talks with the Ministry of Finance and with the political decision-makers, but the first step has already been taken with that amendment to Law 346,” added ANAT President Dumitru Luca .

Opinion DRN

We hope that this minister will support the ANAT, because for decades various Romanian governments, including their foreign representations, have not been able to put Romania in the spotlight from a touristic point of view. Despite the fact that the country has all the ingredients to quickly grow into a tourist destination of European stature.

For the time being, we say first see than believe, so get on with it now. And as DRN we will be happy to support these developments!

IT Sector

certSIGN supplies SSL certificates worth 250,000 euros in the Netherlands

certSIGN is a Romanian technology company that provides reliable services in accordance with the requirements of the eIDAS Regulation, as well as cryptographic, digital identity and cybersecurity solutions. CertSIGN solutions are fully developed in Romania and specially designed for the specific needs of the business environment and to ensure the security of personal data.

certSIGN, a reliable service provider based on qualified digital certificates accredited at European level according to the eIDAS regulation, has signed an agreement for the sale of its own SSL certificates in the Netherlands.

certSIGN, a reliable service provider based on qualified digital certificates accredited at European level according to the eIDAS regulation, has signed an agreement for the sale of its own SSL certificates in the Netherlands.

CertSIGN currently has projects in 21 countries such as Finland, Denmark, Norway, Belgium, Serbia, Portugal, UK, Bulgaria, Cyprus, and this year focuses on developing partnerships for the sale and implementation of its solutions in other European countries.

The first eligible market is the Netherlands, where certSIGN has signed a partnership for the sale and implementation of 250,000 euros website authentication certificates (SSL certificates).

The SSL certificates that certSIGN will bring to the market will provide a high level of website security and will also be used by companies providing services where the security of users’ personal data is of paramount importance, such as internet banking or online payment services.

“CertSIGN has managed to build a relevant position in the local IT&C landscape and has successfully gained access to external markets based on the developed skills and solutions. Past experience has taught us that our solutions are stable and efficient, so this year we decided to focus on strategic partnerships with key players in the IT sector in several European countries, with the first step being this collaboration in the Netherlands. The services delivered within this partnership meet the security needs of the sites needed to comply with GDPR requirements, and the SSL certificates sold are compatible and recognized by all web browsers,” said Adrian Floarea, CEO of certSIGN.

“CertSIGN has managed to build a relevant position in the local IT&C landscape and has successfully gained access to external markets based on the developed skills and solutions. Past experience has taught us that our solutions are stable and efficient, so this year we decided to focus on strategic partnerships with key players in the IT sector in several European countries, with the first step being this collaboration in the Netherlands. The services delivered within this partnership meet the security needs of the sites needed to comply with GDPR requirements, and the SSL certificates sold are compatible and recognized by all web browsers,” said Adrian Floarea, CEO of certSIGN.

certSIGN had a turnover of approximately 14 million euros last year. Projects implemented in foreign markets for the implementation of reliable services, digital identity solutions and cybersecurity accounted for 18% of the company’s turnover.

Energy Sector

Romania is also becoming an energy independent country due to the location of the first small modular reactor (SMR) in Europe

Energy Minister Virgil Popescu announces that US company NuScale Power and Romanian National Nuclear Power Company have agreed to work together to build a power plant with SMR reactors. Thus, says the minister, Romania will become an energy-independent country by installing the first small modular reactor (SMR) in Europe.

“Romania is also becoming an energy independent country by installing the first small modular reactor (SMR) in Europe! The US company NuScale Power and the Romanian National Nuclear Power Company have agreed to work together to build a plant with SMR reactors post,” Popescu wrote on Facebook.

The minister points out that NuScale has announced that the process to manufacture reactor components will start this year.

Doosan Enerbility will begin production of NuScale Modular Small Reactor (SMR) core equipment, under an agreement signed these days. I welcome the establishment of this new partnership, which will implicitly also ensure Romania’s energy security,” Virgil Popescu also wrote.

Romania could become a “Blue Hydrogen Valley” in the EU

Romania could become a “Blue Hydrogen Valley” in the European Union as it has gas resources, carbon storage capacity and a diverse industry that can utilize this resource, Ionut Ciubotaru, Vice President for Business Development, OMV Petrom, said in a profile conference.

“We are currently the second largest gas producer in the EU after the Netherlands and we have a great opportunity to become the largest natural gas producer in the European Union, if we get access to the gas resources of the Black Sea, with all the benefits that this investment in terms of jobs, revenues for the state budget and Romania’s independence from imports.If we do not have access to these sources, Price Waterhouse Coopers predicted that 50% of the required gas consumption by 2030 will come from imports, “said Ciubotaru, in the conference ” Hydrogen Project – the first steps in Romania “, organized by Energynomics.ro .

In addition, Romania can store carbon dioxide in empty oil and gas tanks.

“Obviously there is a need for testing and changes to the legislation, but there is an opportunity. We need to consider and keep in mind that we can become one of the largest storage depots of carbon dioxide in the EU,” he said. OMV Petrom official.

At the same time, our country has a diverse industry in which hydrogen can be used.

“Romania has a very good industrial diversity, which leads us to the idea that in the future we will probably have local hydrogen consumers. I use all these three arguments to highlight a concept that we are trying to promote, which is that Romania could become a ‘Blue Hydrogen Valley’ in the EU,” Ciubotaru added.

“Romania has a very good industrial diversity, which leads us to the idea that in the future we will probably have local hydrogen consumers. I use all these three arguments to highlight a concept that we are trying to promote, which is that Romania could become a ‘Blue Hydrogen Valley’ in the EU,” Ciubotaru added.

For his part, Ioan Iordache, executive director of the Hydrogen Energy Association, said hydrogen can be stored in salt mines for the long term.

“It’s about storing hydrogen in underground salt caverns. We are talking about long-term, seasonal storage in large quantities. In Romania we have this potential and we are one of the first to study it and we put it on paper,” Iordache said at the same conference.

What will happen to the gas from the Black Sea if Russia annexes Snake Island?

Will Future Neptune Deep Gas Exploration Be Affected If Snake Island Becomes “Russian Land”? The Minister of Energy gave an answer.

Will Future Neptune Deep Gas Exploration Be Affected If Snake Island Becomes “Russian Land”? The Minister of Energy gave an answer.

A possible annexation of Snake Island by Russia could reopen the dispute over the area, which the International Court of Justice (ICJ) closed in The Hague in 2009. The ICJ then granted our country almost 80% of the continental shelf area and economic zone excluding dispute with Ukraine.

But the Kremlin does not recognize the decisions of this Court. Thus, it will not automatically recognize the boundary line established by the ICJ in the Black Sea, which means that a dispute on this issue will be inevitable. Resources are estimated at 70 billion cubic meters of natural gas and 12 million tons of oil.

The perimeter of Neptune Diep is not part of the continental area that Romania gained in the Hague process with Ukraine. It has been in Romanian territorial waters since the beginning. Now we see, better than ever, what a security umbrella of the North Atlantic Alliance means,” Energy Secretary Virgil Popescu wrote on Facebook.

On this occasion, the official also announced that in the coming days the contract between Romgaz and Exxon will be signed, to acquire the 50% US stake in the Neptun Deep perimeter. The remaining 50% is held by OMV Petrom.

Agri & Food Sector

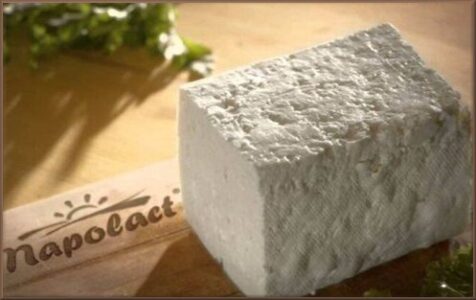

FrieslandCampina invests in new cheese production line

Friesland Campina has invested 3 million euros in this production line at its factory in Cluj Napoca. They will produce more than 3000 tons of cheese per year there, in addition to telemea, bellows cheese, melted cheese, butter and milk. It is sold under the Napolact brand, according to a company statement.

The new production line has an annual capacity of more than 3000 tons and allows the producer to produce slices and blocks of cheese in Cluj, both in the conventional and ecological version. Our products will be available in all channels – in modern commerce, in traditional commerce, in online trading platforms and the hospitality industry.

The new production line has an annual capacity of more than 3000 tons and allows the producer to produce slices and blocks of cheese in Cluj, both in the conventional and ecological version. Our products will be available in all channels – in modern commerce, in traditional commerce, in online trading platforms and the hospitality industry.

“Today we are taking another step in our strategic journey to create a cheese expertise center in Cluj, which started operating the new facilities for Telemea in 2017. The cheese production line, which is coming into operation, has an annual capacity of more over 3000 tons and increase the number of jobs in cheese production for the inhabitants of Cluj by 40%.We are committed to creating value for Romania in the lives of consumers, workers, partners, farmers, but also for the local community “says Ferenc Szecskó, general manager of FrieslandCampina Romania.

Napolact cheese completes the range of products made in Cluj: three types of telemea, bellow cheese, melted cheese, butter and milk.

The production capacity of the cheese center of excellence in Cluj is 8,000 tons of cheese and butter per year and up to 35,000 tons of milk in carton packaging.

FrieslandCampina Romania is part of the Dutch company Royal FrieslandCampina, one of the largest dairy producers in the world.

FrieslandCampina is present on the Romanian market with the Napolact, Campina, Oke and Dots brands and offers a wide range of products: drinking milk, yoghurt, cheese, butter and milk-based snacks.

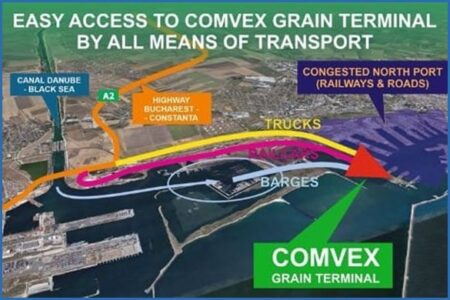

Romanian Port of Constanta helps with Ukrainian exports

The ship Lady Dimine, a 160-meter long grain vessel with a capacity of 26,000 tons, is the second ship to prepare to leave the port of Constanta in the past five days, loaded with grain from Ukraine, the Romanian port on the Black Sea becomes one of the few exits for Ukrainian agricultural products.

The stakes are high for many countries that depend on grain supplies from Ukraine, which before the war exported up to 4.5 million tons of agricultural products per month by sea, or 12% wheat, 15% maize and 50% sunflower oil. from anywhere in the world.

Currently, the blockade of Ukrainian ports is complete, from those in the Sea of Azov to the port of Odessa on the Black Sea, which in normal times was responsible for 60% of Ukrainian port activity.

Of the possible solutions, Romania is the ideal candidate. NATO’s safe haven is also the second largest exporter of wheat in the European Union, after France, and has an adequate infrastructure.

“The departure of the third vessel is expected in six days and we hope to accelerate the pace,” said Viorel Panait, CEO of Comvex, the first grain operator in Constanta. “Given the unfortunate situation our Ukrainian neighbors are going through, we need to help them as best we can,” added Viorel Panait.

But before cereals from Ukraine reach the port of Constanta, there is still a long way to go. First, they are loaded onto trains, trucks or barges in the small Danube ports of Reni and Izmail, on Ukraine’s border with Romania.

To fill a ship with a capacity of 70,000 tons, such as the one that first departed from Constanta last week, loaded with maize from Ukraine, would require 49 trains and as many barges or several thousand trucks, with the risk of a huge traffic jam on the roads in Constanta, Viorel Panait said. “A lot of hassle”, says the director of the port of Constanţa, Florin Goidea.

Pressured by the need to modernize an aging rail network, the government in Bucharest has found a solution: the restoration of 95 rail lines dating back to the communist era and blocked by rusty wagons for hundreds of years.

“It is a project worth 200 million lei, which is extremely important as it will unblock road traffic in the port and increase managed stocks,” emphasized Florin Goidea.

“The war in Ukraine is a challenge, but also an opportunity,” says the director of the port of Constanta, adding that Constanta became the European hub of grain exports in 2021, ahead of the French port of Le Havre. This year Florin Goidea hopes that last year’s record traffic of 67.5 million tons will be exceeded

Automotive Sector

More than a third of Ford’s cars sold in Europe were produced in Romania

A Data Force report from AutomotiveNews Europe shows Ford sold 142,482 cars in the first quarter in Europe.

American company Ford Motor Co. sold 142,482 cars in the first three months of this year in Europe, down from 166,943 in the same period last year.

The most sought-after Ford vehicle among European customers remains the Puma model, which sold 38,857 units during the said period, up from 39,714 a year ago.

In second place in Ford sales in Europe is the Kuga SUV (29,577 units) and in third place Focus (21,943 units). The Fiesta model was sold in 16,157 units and EcoSport in 10,169 units.

Since both Puma and EcoSport are produced at Ford’s Craiova plant, Romania occupies a leading position among the US company’s production units. In addition, taking into account the total of 49,026 Puma and EcoSport units sold in the first quarter of 2022, the production of the Bănie plant (nwvan Craiova) represents no less than 34.41% of the total sales of the Ford brand. in Europe.

Despite declining sales in the first quarter of the year, Ford reported financial results that exceeded expectations. According to John Lawler, the company’s chief financial officer, Ford reported a net profit of $207 million (about $197 million) in Europe.

At the same time, Ford’s European division posted sales of $6.9 billion, up from $7.1 billion a year ago.

Registrations of 100% electric cars in Romania, the biggest increase in Europe

As in the case of the overall car market, Romania ranks first in the European Union in increasing the registration of electric cars in the first quarter of 2022.

The Association of European Automobile Manufacturers (ACEA) report on the type of car powertrains registered for the first time in the European Union between January and March shows that Romania registered the highest increase in 100% electric cars, 408%, compared to the comparable period from 2021.

The Association of European Automobile Manufacturers (ACEA) report on the type of car powertrains registered for the first time in the European Union between January and March shows that Romania registered the highest increase in 100% electric cars, 408%, compared to the comparable period from 2021.

In the first three months of this year, sales of battery electric cars in the European Union (EU) increased 53.4% to 224,145 units. Many European markets posted a triple-digit percentage increase (over 100%), but Romania had the strongest percentage increase (408%) as 2,108 electric cars were sold in the first quarter of this year, compared to 415 units in the same period. period last year.

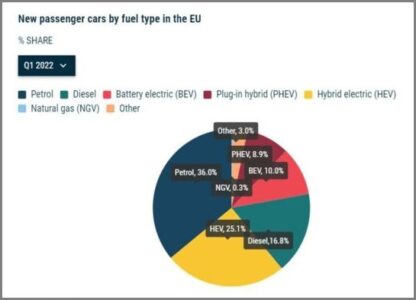

Currently, fully electric cars account for 10% of the EU car market, doubling its share in the first quarter of last year, surpassing plug-in hybrids with a market share of 8.9%.

After conquering the main car markets on the continent, such as Germany or France, sales of electric cars started to explode in Spain, Romania and Poland. Only in Italy did sales of electric cars fall, pending the introduction of a new purchase premium.

At the same time, between January and March 2022, registrations of diesel cars fell by 33.2% to 378,000 units, with the market share of these cars falling by 5.3 percentage points to 16.8%. Diesel car sales fell significantly in all EU car markets, including Romania (minus 19%).

Also in the first quarter, sales of plug-in hybrid cars in the European Union fell at 199,107 registered cars, 5.3% less than in the first quarter of last year. However, the market share of plug-in hybrid cars rose to 8.9% as a result of a sharp drop in sales of petrol and diesel cars.

Also in the first quarter, sales of plug-in hybrid cars in the European Union fell at 199,107 registered cars, 5.3% less than in the first quarter of last year. However, the market share of plug-in hybrid cars rose to 8.9% as a result of a sharp drop in sales of petrol and diesel cars.

On the other hand, sales of light hybrid cars increased by 5.3% year-on-year to 563,000 vehicles, now accounting for a quarter of the total car market, up from 20% at the beginning of 2021. Petrol cars continue to dominate sales in the EU market with 808,000 units sold and 36% of the market in the first quarter. However, year-over-year sales of petrol cars fell by 22.6% and their market share from 40.8% to 36%.

According to ACEA data, cars with petrol and diesel engines continue to dominate the automotive market in the European Union, with a combined market share of 52.8%.

Socio-Economic Developments

Romania and Bulgaria, the lowest hourly labor costs in the EU – Eurostat

Average hourly labor costs across the economy (excluding agriculture and public administration) in 2021 are estimated at €29.1 in the 27 Member States of the European Union and €32.8 in the eurozone, compared to €28. EU and 32.4 euros in the eurozone respectively in 2020, according to data released Monday by the European Statistical Office (Eurostat).

Average hourly labor costs mask significant differences between EU Member States, with the lowest hourly labor costs recorded last year in Bulgaria (EUR 7) and Romania (EUR 8.5), and the highest in Denmark (EUR 46.9) , Luxembourg (43 euros). ) and Belgium (41.6 euros

In 2021, average hourly labor costs in industry were €29.1 in the EU and €35.1 in the euro area, while in construction it was €26 in the EU and €29.3 in the euro area. the EU and 31.6 in the eurozone.

Hourly labor costs include payroll and non-wage costs, as well as Social Security contributions paid by employers. The share of non-wage labor costs in total labor costs in the economy as a whole was 24.6% in the EU and 25.1% in the euro area. The lowest share of indirect costs was in Lithuania (3.7%), Romania (4.9%) and Ireland (8.7%) and the highest in Sweden (32%), France (31%), 9% ) and Italy. (28.3%). In 2021, hourly labor costs in the economy as a whole, expressed in euros, rose by 1.7% in the EU and by 1.2% in the eurozone.

In the euro area, hourly labor costs increased in all Member States except Italy (minus 1.6%) and Spain (minus 0.3%). The main progress was in Lithuania (12.5%), Estonia (6.5%), Cyprus and Slovenia (6.2% each) and Latvia (6.1%). In the case of countries outside the euro area, the Hourly labor costs, expressed in national currency, increased last year in all Member States, with the most significant increases being Bulgaria (9.1%), Poland (8.2%) and Hungary (7.3%). ), and the lowest increase in Sweden and Croatia (each 3%).

In 2021, most EU Member States extended the validity of support schemes introduced in 2020 to mitigate the impact of the pandemic on employers and workers.

The unemployment rate in the European Union fell to 6.2%, according to data from Eurostat

The unemployment rate in the European Union fell to 6.2% in March from 6.3% in the previous month and 7.5% in the same period in 2021, according to data released Tuesday by the European Statistical Office ( Eurostat). With an unemployment rate of 5.7% in March, Romania is one of the EU Member States with low unemployment.

In the euro area, the unemployment rate fell to 6.8% in March from 6.9% the previous month and 8.2% in the same period in 2021.

Eurostat estimates that 13.374 million people in the EU, of which 11.274 million in the eurozone, were unemployed in March. Compared to February 2022, the number of unemployed in the EU fell by 85,000 and in the euro area by 76,000. Compared to March 2021, the number of unemployed fell by 2.359 million in the EU and 1.931 million in the euro area.

In March, 2,579 million young people (under 25) were unemployed in the EU, of which 2,098 million were in the euro area. Youth unemployment stood at 13.9% in March in the EU and the euro area, up from 14% in both regions the previous month.

Among women, the unemployment rate in the EU stood at 6.6% in March, stable compared to the previous month, while among men it was 5.9%, down from 6% in February. Among the EU Member States, the lowest unemployment rates were in March in the Czech Republic (2.3%), Germany (2.9%), Poland and Malta (both with 3%). On the other hand, the highest unemployment rates were in Spain (13.5%) and Greece (12.9%).

Macro-Economic Outlook

Positive ratings from Standard&Poor’s, Fitch and Oxford Economics maintain stable outlook

The Ministry of Finance announced today that on Friday, April 15 this year, the Standard & Poor’s agency reconfirmed the sovereign rating of Romania’s sovereign debt to BBB-/A-3 for its long-term and short-term debt in local currency as well as the stable outlook.

Standard&Poor’s

Standard & Poor’s believes that Romania’s rating is supported by its membership of the European Union and its solid access to financing in the international capital markets. The risks posed by the conflict in Ukraine are also mitigated by the prospect of absorbing a significant volume of European funds (Romania is one of the main beneficiaries of the Structural Funds in the EU Multiannual Framework and the Recovery and Resilience Facility) and energy dependence on our country compared to the natural gas and oil in Russia.

Standard & Poor’s believes that Romania’s rating is supported by its membership of the European Union and its solid access to financing in the international capital markets. The risks posed by the conflict in Ukraine are also mitigated by the prospect of absorbing a significant volume of European funds (Romania is one of the main beneficiaries of the Structural Funds in the EU Multiannual Framework and the Recovery and Resilience Facility) and energy dependence on our country compared to the natural gas and oil in Russia.

Finance Minister Adrian Câciu wrote on his Facebook page, in response to Standard & Poor’s announcement, that the agency’s decision to reaffirm Romania’s sovereign rating and maintain a stable outlook is further evidence that the government’s policy to economy was correct.” The fact that Standard & Poor’s reaffirms Romania’s sovereign rating and maintains a stable outlook is further proof that our government policy to finance the economy has been fair.

It is an extremely important signal that the current government’s solutions to counter the effects of the energy crisis and the war in Ukraine are giving investors reasons to trust that the Romanian economy will survive this complicated period that is going through all of Europe.

It is an extremely important signal that the current government’s solutions to counter the effects of the energy crisis and the war in Ukraine are giving investors reasons to trust that the Romanian economy will survive this complicated period that is going through all of Europe.

For me and my colleagues at the Ministry of Finance, the signal from Standard & Poor’s is a confirmation that the efforts to launch new support programs for Romanian companies are appreciated.

Therefore, after the launch of the “Support to Romania” program, we will continue to work to finalize the full financial support framework for local businesses as soon as possible. We are financing the economy to support the whole of Romania!” said Câciu.

Standard & Poor’s decision comes a week after the Fitch agency decision, in which it maintained Romania’s rating at “BBB minus” with a negative outlook, which is the latest step in the “investment-grade” category.

fitch

The Fitch assessment released a week ago was based on our country’s EU membership and access to European capital flows that support investment and macro stability, and GDP per capita, indicators of governance and human development, which above those of other countries. “BBB” rating.

The Fitch assessment released a week ago was based on our country’s EU membership and access to European capital flows that support investment and macro stability, and GDP per capita, indicators of governance and human development, which above those of other countries. “BBB” rating.

“The Romanian government is implementing effective measures to counter the effects of the energy crisis and the war in Ukraine. We are not the only ones saying this, says Standard & Poor’s, reflecting the country’s rating and high level of security for investors confirms, and maintains a stable outlook,” underlined Adrian Câciu in the communiqué published by the Ministry of Finance.

The Standard & Poor’s Agency claims that the registration of sustainable economic growth, cumulated with the reduction of the government deficit, could lead to the consolidation of the production capacity of the Romanian economy and therefore to a possible action to upgrade our country’s sovereign rating. improve .

Oxford Economics and the Banks

In a note in March, Oxford Economics wrote that Central and Eastern European countries are among the most exposed to the economic impact of the Russian invasion of Ukraine, with the region’s gross domestic product (GDP) expected to fall by an average of 1. percentage points. in 2022 and 0.5 in 2023.

economic impact of the Russian invasion of Ukraine, with the region’s gross domestic product (GDP) expected to fall by an average of 1. percentage points. in 2022 and 0.5 in 2023.

At the beginning of April, the Romanian authorities entered into talks with the European Commission about a comprehensive aid package, estimated at €3.5 billion, most of which will go to social measures targeting low-income families.

The Romanian economy grew by 5.9% in 2021, according to revised preliminary data from the National Institute of Statistics, after contracting by 3.7% in 2020. In the fourth quarter of 2021, the economy grew by 2.4%, with industrial production growing at 5% in 2021, with imports up 13.7% and exports 11.1%. In contrast, the agricultural sector registered an annual decline of 13.5%.

At the end of March, the European Bank for Reconstruction and Development (EBRD) lowered its forecast for Romania’s economic growth from 4.4% to 2.8% for 2022, a sharp drop, partly due to cross-border fighting in the north.

In 2023, Romania’s GDP is expected to grow by 4.2%

But other forecasts are less rosy. The World Bank estimates that the Romanian economy will grow by just 1.9% in 2022. Then Fitch Ratings writes in an April updated note that Romanian GDP growth will slow to 2.1% in 2022, according to the BBB- credit rating with a negative outlook.

The war in Ukraine – the main effects

According to Valentin Tataru, chief economist at ING Bank Romania, the negative impact of the conflict between Ukraine and Russia on Romania’s trade balance is marginal due to Romania’s weak direct trade relations with Russia and Ukraine, which account for about 3% of the total volume. of the country’s trade, compared to 70% of trade with the EU.

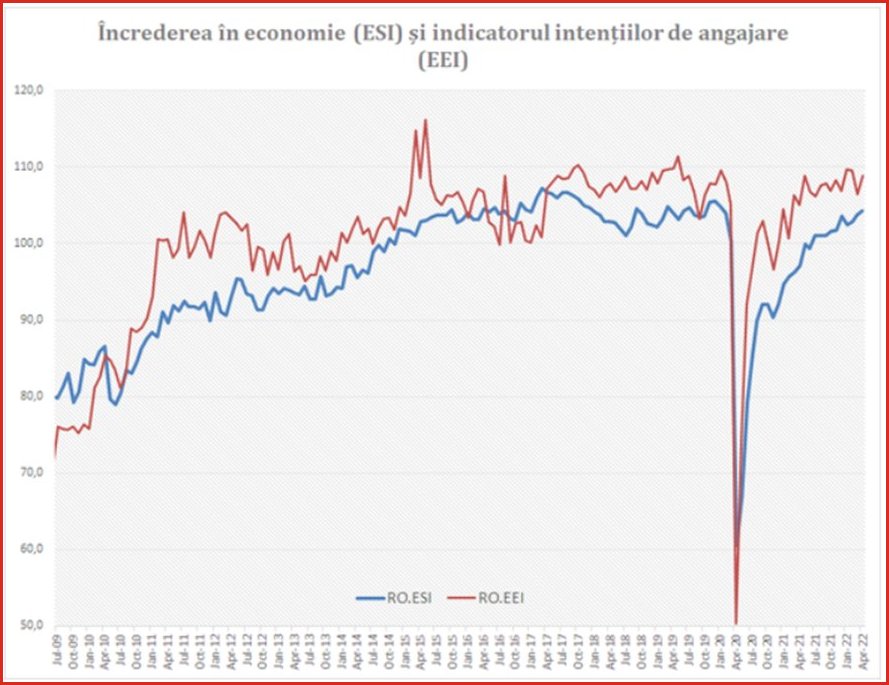

Instead, Mr Tataru suggests that most of the impact of the war on the Romanian economy will be a confidence effect. “This is because both consumers and businesses feel the need to postpone or re-prioritize current spending and investments,” he said. “Another important indirect effect is the rise in global energy and commodity prices. Although Romania is the least dependent country in the EU on Russian gas, it has no control over the movements of these prices on the world market.”

According to Mr Tataru, ING Bank has lowered its 2022 GDP forecast for Romania from 3.2% to 2.3%, with inflation expected to rise by 9.3% in 2022, with upside risks. This could have far-reaching implications for the Romanian public budget.

“The government budget was based on economic growth of more than 4% of GDP,” said Daniel Dăianu, president of the Romanian Fiscal Council.

“I think we should be happy if we close the year with something between 2% and 3%. Supply chain disruptions will continue and will be exacerbated by the war and the crisis in the commodity markets.”

“I think we should be happy if we close the year with something between 2% and 3%. Supply chain disruptions will continue and will be exacerbated by the war and the crisis in the commodity markets.”

In 2020, the Romanian deficit reached 9.2% of GDP, partly due to the impact of the pandemic. And the share of debt in GDP rose from 35.3% at the end of 2019 to 50.6% at the end of February, a worrying trend.

Fitch also writes that, in his base case, Romania’s government debt-to-GDP ratio will increase to 55.2% by 2023, with government debt dynamics remaining vulnerable to possible changes in market sentiment. The rating agency also pointed to persistent macro imbalances, including the large external deficit, which could limit Romania’s response in volatility, adding that it expects a budget deficit of 7.1% in 2022 and 5.8% in 2022. GDP in 2023, which is one of the largest deficits among BBB-rated countries.

However, Mr Dăianu says: “I continue to believe that Romania is underestimated. It is true that it has a very large budget deficit and its mission to cut it in three[of] four years is very ambitious, but there is also the potential to significantly increase tax revenues.”

Rising interest rates and inflation

In April, Romania’s central bank, the National Bank of Romania (BNR), raised its benchmark rate by 50 basis points (bps) to 3% – the fifth consecutive rate hike. These are unlikely to be the last increases in 2022.

“We believe a deteriorating inflation outlook means yields will rise above 5% this year,” Liam Peach, an economist at Capital Economics, wrote in a note to clients shortly after the announcement. the NBR.

According to the NBR , annual inflation rose from 7.80% in November to 8.19% in December 2021. Since then, inflation has steadily risen. Consumer prices in Romania rose by 10.2% in March and food prices by 11.2%. The last time Romania reported double-digit inflation was in 2004.

“We are concerned about inflation,” said Ionut Dumitru, chief economist at Raiffeisen Bank Romania , one of the country’s largest banks. “Food prices are rising, but this is a trend that applies all over the world. This is the new ‘game’ that will be in vogue in the coming years: higher energy prices, higher food prices and quite high inflation. The central bank has already raised interest rates and will continue to increase it.”

In the meantime, the government has imposed a ceiling on electricity and gas prices for households and a number of companies, a ceiling that will run until at least April 2023. This is possible because many of the Romanian energy suppliers are still companies.

Romania’s average net wage increased by 8.9% to EUR 748 per month in January 2022 / January 2021, and real wages (adjusted for inflation) increased by 0.5%.

Some positive things to note

In September, Romania approved the Recovery and Resilience Plan, so that it will receive €14.2 billion in grants and €14.9 billion in loans over the next five years, which together will account for 13.7% of Romania’s GDP in 2020 . More than half of the money is allocated to “green transition” initiatives, including investments in rail infrastructure and charging stations for electric vehicles.

According to government estimates, NextGenerationEU (NGEU) funds are expected to contribute 3.4% – 5.4% to real GDP growth between 2021 and 2026.

“NGEU is our chance to come out stronger and reshape our economy,” said Sergiu Manea, Executive Director of Banca Comerciala Romana (BCR). “Romania needs investment in major modernization projects and PNRR can be used to transform the Romanian economy at all levels.”

Money also enters Romania through other channels. By 2027, the country is expected to receive more than €80 billion in funding from various EU initiatives, according to Fitch estimates, the equivalent of 37% of annual GDP.

“EU funds allocated to Romania – €80 billion over 5-8 years – offer the country the opportunity to develop its infrastructure and energy sector in a sustainable way,” said Mihaela Bitu, executive director of ING Bank Romania, that the current geopolitical context could also trigger a wave of relocations (nearshoring), allowing Romania to benefit from increased foreign investment.

Confidence in the Romanian economy rose for the third month in a row in April, according to a European Commission poll, despite the war in Ukraine. The evolution is taking place amid the expansion of industry and services, while the signal from retail and construction is waning. The Economic Sentiment Indicator (ESI) rose 1.6 points to 104.3 points in April, the third consecutive month of expansion, as March and April were marked by the international war.

Confidence in the Romanian economy rose for the third month in a row in April, according to a European Commission poll, despite the war in Ukraine. The evolution is taking place amid the expansion of industry and services, while the signal from retail and construction is waning. The Economic Sentiment Indicator (ESI) rose 1.6 points to 104.3 points in April, the third consecutive month of expansion, as March and April were marked by the international war.

Political trends

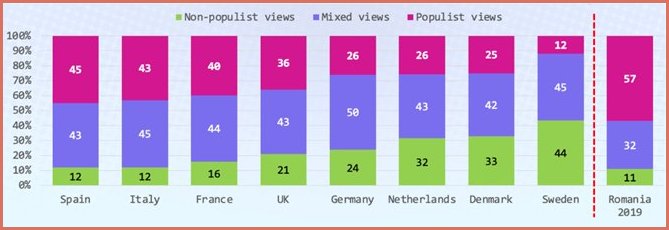

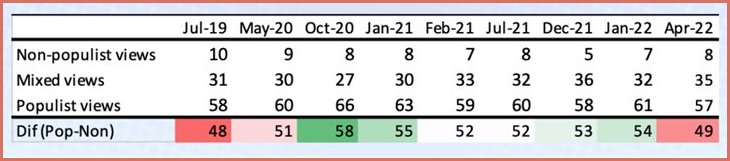

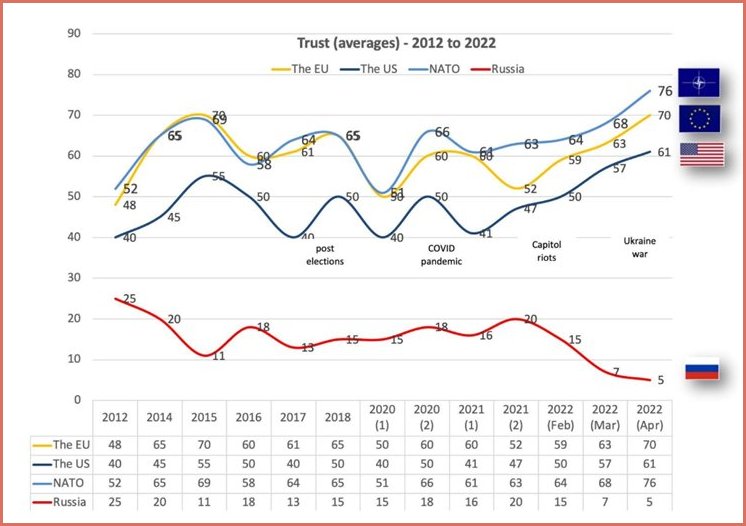

Romania has a much higher proportion of the population with populist orientations, compared to European countries (study)

Romania has a much larger share of the populist-oriented public compared to European countries measured in sociological research, according to a study on the rise of populism in Romania presented Monday afternoon at Harvard University by Dan Sultanescu, research director of the Center for Promoting Participation and Democracy (SNSPA).

The event was hosted by former Secretary of the Treasury Ioana Petrescu, a senior fellow at Harvard and the director of the Faculty of Management’s Center for Leadership and Innovation (SNSPA).

Dan Sultănescu presented the method used by CPD SNSPA to measure populist attitudes among the Romanian public, as well as the results of several opinion polls (9 surveys conducted by CPD in 2019-2022). Romania has a much higher proportion of the public with populist orientations, compared to European countries measured in sociological research.

Dan Sultănescu presented the method used by CPD SNSPA to measure populist attitudes among the Romanian public, as well as the results of several opinion polls (9 surveys conducted by CPD in 2019-2022). Romania has a much higher proportion of the public with populist orientations, compared to European countries measured in sociological research.

According to CPD studies, the populist orientations of the Romanian public have seen an increase in the context where the pandemic – economically, socially and culturally – has affected broad categories of vulnerable audiences. Low-income, low-education, and poor-media people are most likely to adopt this type of attitude, as they are directly affected by the economic effects of complicated periods.

Survey figures show that the populist public had the highest share during the election campaign (October 2020), with other growth moments in the second half of 2021. Later, however, the share of the populist public declined again.

Survey figures show that the populist public had the highest share during the election campaign (October 2020), with other growth moments in the second half of 2021. Later, however, the share of the populist public declined again.

Disclaimer

The newsletter of the Dutch Romanian Network is compiled with great care. The Dutch Romanian Network cannot accept any liability for a possible inaccuracy and/or incompleteness of the information provided herein, nor can any rights be derived from the content of the newsletter. The articles do not necessarily reflect the opinion of the board.