Newsletter August 2022

Justice for Honorary President DRN!

The connection between Ralph Hamers and the Dutch Romanian Network dates back to the founding period(2007) of the latter organization. His knowledge and experience about Romania had been gained as

ING General Manager during the period 1999-2002. Among other things, he brought about the cooperation between DRN and the Romanian Chamber of the (former) Netherlands Center for Trade Promotion(NCH). For a long period of time, he and Ben Jager pulled “the DRN cart.”

ING General Manager during the period 1999-2002. Among other things, he brought about the cooperation between DRN and the Romanian Chamber of the (former) Netherlands Center for Trade Promotion(NCH). For a long period of time, he and Ben Jager pulled “the DRN cart.”

The reason for posting this message is the fact that recently the Board for Discipline in Banking ruled in favor of the former ING top and that Ralph Hamers in his (former) capacity as chairman of the board and CEO of the ING Group also got off scot-free.

Below is a brief account recently published in the Financieele Dagblad.

In Brief

The Supervisory Board of ING severely underestimated the social resistance to Hamers’ salary increase, judged Tuchtrecht Banken. That was awkward, but not wrong, according to the ruling published Monday.

With that, ING goes free again in a case surrounding the 2018 money laundering debate.

Former ceo Ralph Hamers’ salary increase in 2018, when a money-laundering case was playing out at ING, did not contribute to confidence in the banking sector, but was not wrong. The Disciplinary Committee on Banks disagrees with complainants that the former supervisory board violated the banking oath and rules that the complaints are unfounded.

Ralph Hamers, when the money laundering settlement – which would eventually cost the bank €775 mln – was discussed, received a 50% salary increase, to just over €3 mln per year. Even before the decision could be presented to the shareholders, ING renounced it under great political and social pressure.

The prosecutor still hinted at possible violations of the banking oath in September 2021, but Monday’s anonymized ruling shows that the disciplinary committee sees no reason for that. The complaints were declared unfounded. ING said in a response it was pleased with the decision.

No professional ban for Supervisory Board

The prosecutor stepped in after complaints from angry stakeholders, who argued that then-President Jeroen van der Veer and his fellow supervisors had not made the moral-ethical consideration required by the banking oath. The prosecutor asked for a two-year professional ban for two of the commissioners and a one-year conditional professional ban for the third.

The prosecutor stepped in after complaints from angry stakeholders, who argued that then-President Jeroen van der Veer and his fellow supervisors had not made the moral-ethical consideration required by the banking oath. The prosecutor asked for a two-year professional ban for two of the commissioners and a one-year conditional professional ban for the third.

However, the Disciplinary Committee sees this differently: ‘It is first and foremost up to the bank to determine an appropriate remuneration.’ There is also no reason, according to the investigators, to conduct further investigations into Hamers. ‘All involved performed their duties with integrity and care.’

Balance of Interests

The Disciplinary Committee does go along with part of the prosecutor’s criticism, which is that the commissioners underestimated social resistance and made “a major error of judgment. ING’s supervisory board felt pressure in 2018 to bring Hamers’ pay more in line with that of his colleagues in other countries. In doing so, according to the ruling, it was “recognized and taken into account” that the salary proposal would “cause a public outcry,” but the bank’s interest outweighed it. In doing so, the commissioners “reinforced the perception that their own remuneration dominates the actions of bankers.

Bart de Man, lawyer for the former directors, says: ‘The ruling confirms that those involved acted with integrity and that the salary decision was taken with care.

This is not the first time ING has gone scot-free before the Disciplinary Committee. Although all times the body was critical of the bank’s lack of social feelers. May 2021, a case was dismissed against three ING employees. They allegedly refused to provide documents on top executive Ralph Hamers, thereby deliberately delaying the investigation. Later, the bank still provided the documents.

In September that year, prosecutors ruled that Hamers had made no culpable mistakes in the money laundering case. This drew a line under the claim of leeuwonwaardig.nl, an initiative that called for reporting possible abuses at the major bank. Ralph Hamers has been CEO of Swiss investment bank UBS since July 2020.

Sources: FD,Tuchtrecht Banken and DRN

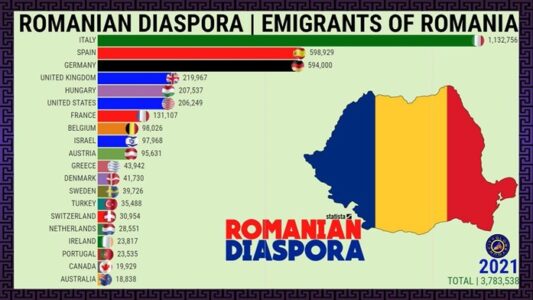

Romanian government wants Romanian diaspora to return to their homeland

Romanians from the diaspora who want to return to the country and invest in a business can get funding of up to 200,000 lei through the Start-Up Nation program, now in its third edition, according to a press release from the Ministry of Entrepreneurship and Tourism .

The press release addressed to the Romanian diaspora reads as follows:

“Romania is home! Here we can build together a more prosperous present and future, both for us and for our children. There are many opportunities to take advantage of. One of them is the Start-Up Nation program, which for the first time has a pillar dedicated to the diaspora. In particular, you will have access to non-refundable financing of up to 200,000 lei to open your own business in the country. Romania is waiting for you!”, stated the Minister of Entrepreneurship and Tourism, Constantin-Daniel Cadariu.

The maximum amount, worth 200,000 lei, can be obtained if at least two full-time jobs are created through the project. Applicants who instead assume the creation of a single job can receive up to 100,000 lei. In addition, the beneficiary company must come up with a co-financing percentage of at least 5% of the eligible value of the project.

To gain entry into the program, Romanians from the diaspora, in addition to the standard conditions imposed by the procedure, must provide proof of residence or stay abroad within the last 12 years up to the time of enrollment by means of a residence permit/proof of establishment, residence visa/long stay or residence certificates.

To gain entry into the program, Romanians from the diaspora, in addition to the standard conditions imposed by the procedure, must provide proof of residence or stay abroad within the last 12 years up to the time of enrollment by means of a residence permit/proof of establishment, residence visa/long stay or residence certificates.

Registrations are done exclusively online, on the granturi.imm.gov.ro platform, until September 1. Interested parties also have access to a manual, which contains the necessary steps to sign up within the program.

The total budget for Pillar II Start-up Nation Diaspora is 20,031,000 lei. The objective of the Ministry of Entrepreneurship and Tourism (MAT), the institution that manages and implements the program, is to fund 1,000 beneficiaries.

Those wanting more information can call the MAT call center number: 021 90 59.

Philips Romania will plant thousands of trees in southern Romania (Dolj district) which is in danger of turning into a desert

In the campaign “Plant together” or “Plantăm împreună”, a tree is planted for every order of more than 250 lei ca.€ 51.

In the campaign “Plant together” or “Plantăm împreună”, a tree is planted for every order of more than 250 lei ca.€ 51.

In the first 4 months since the campaign started, the stated goal was reached by more than 75%, with over 6,000 orders registered.

“We are pleased with the positive response we have received from consumers and we assure them that we are just at the beginning of a series of programs that focus on sustainability and actions to increase social responsibility. Innovation, responsibility for the planet and society are part of the Philips DNA, and when these elements work together, the best results appear!” said Daciana Tulpan, leader of Philips’ personal care division.

The program is implemented by Philips Romania , together with the Viitor Plus Association, runs until September 30, 2022 and Philips expects to contribute to the afforestation of an area of over 1.5 hectares, in southern Romania, with approximately 8,000 trees.

The trees will be planted in the municipality of Apele Vii, in the distrct of Dolj, on lands that are currently undergoing a process of desertification. The land is owned by the municipality and the forest will be established for the benefit of the community to support local climate regulation, reduce pollution and increase resilience to extreme weather events.  According to pedology specialists(soil scientists), more than 1,000 hectares of fertile soil in the southern part of the country are turning into sand every year due to the negative anthropogenic impact(such as deforestation, burning of fossil fuels and due to large-scale agriculture, the concentration of some substances in the atmosphere has changed significantly, including greenhouse gases. Reforestation of land is a natural and sustainable measure to combat desertification and erosion, as trees have the ability to reverse land degradation, thereby converting sandy, infertile soil into healthy, biodiverse soil. Planting will take place in the fall of this year, during the period of vegetative dormancy. In the years following planting, maintenance work is carried out for a period of 3 to 7 years, until the forest reaches the mature stage.

According to pedology specialists(soil scientists), more than 1,000 hectares of fertile soil in the southern part of the country are turning into sand every year due to the negative anthropogenic impact(such as deforestation, burning of fossil fuels and due to large-scale agriculture, the concentration of some substances in the atmosphere has changed significantly, including greenhouse gases. Reforestation of land is a natural and sustainable measure to combat desertification and erosion, as trees have the ability to reverse land degradation, thereby converting sandy, infertile soil into healthy, biodiverse soil. Planting will take place in the fall of this year, during the period of vegetative dormancy. In the years following planting, maintenance work is carried out for a period of 3 to 7 years, until the forest reaches the mature stage.

“We can say that on average, a tree absorbs 22 kilograms of 1CO2/year and filters 100 kilograms of dust/year. Thus, the more than 6,000 trees resulting from the first months of the campaign will absorb more than 134 tons of CO2/year and filter more than 612 tons of dust/year,” says Teia Ciulacu, founder and president of the Viitor Plus Association.

Philips’ initiative is very commendable and perhaps an example for others especially in a time period where illegal deforestation is still taking place.

The Romanian state can certainly contribute because irrigation is possible because at the southern border of desertification is the Danube River basin. If that fails, southern Romania will be swallowed up by a desert. See also elsewhere in this newsletter the article by De Friese arable farmer Minne Lettiinga, CEO and shareholder of the Frizon Group

Agri & Food Sector

Dairy prices in the EU hit record levels

In Romania, the price increase is 36% on the farm

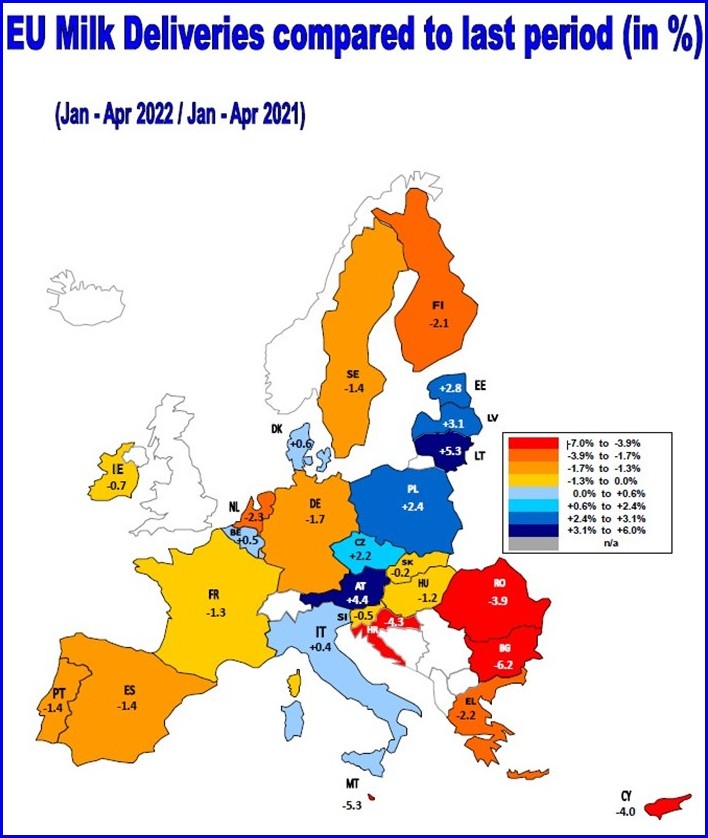

Dairy prices in the European Union have reached record levels and forecasts for the end of the year are far from favorable. Farmers’ raw milk deliveries are declining and their margins are severely affected by rising costs. In Romania, farmers delivered 3.9% less than the same period last year only through April, the second largest drop in the EU after Bulgaria, and average farm prices are more than 36% higher than last year.

While prices for SMP (skimmed milk powder – used to make yogurt, milk desserts, ice cream) and WMP (whole milk powder) remain relatively stable but high, and prices for whey are falling, other dairy products continue to rise in price, according to the latest analysis from the European Commission presented at the Agri Fish Council this week. These developments support EU raw milk prices at record levels. In May 2022, 100 kg of milk cost an average of 47.6 euros in the EU, 33.2% more than in the same period last year and 3.6% compared to the previous month. Also in June, the average price had risen again to 48.5 euros/100 kilograms.In Romania, where the average price was 42.4 euros/100 kilograms, the increase is about 36% compared to the same period last year. But there are countries where it is 68% more expensive (Lithuania). The lowest increase in the analyzed period was reported at 0.5% in Cyprus.

Production in Romania declines even more, champion in decline

Nevertheless, it draws attention to the fact that agricultural margins remain small due to high production costs. In addition, dry and warm weather conditions in the spring, as well as the use of smaller quantities of feed, due to high costs, are expected to reduce EU milk production more than expected earlier this year (0.4%).

As the number of dairy cows is also lower (-1%), EU milk deliveries are therefore expected to decline by 0.6% in 2022. In Romania, in January-April, farmers’ milk deliveries of crude oil already fell by 3.9% , the second largest drop after Bulgaria (minus 6.2%).

“Lower grass quality and feed utilization due to availability and high cost are also likely to reduce milk fat and protein content, further reducing the availability of milk solids for processing.

Cheese and cream production in the EU could continue to increase and reduce the availability of milk fat for butter and WMP production. Cheese exports are expected to increase and domestic consumption of dairy products could rise slightly (0.3%) in 2022, assuming a continued recovery in retail and catering services and limited transfer of high producer prices along the chain to consumers. “, the Commission’s analysis also shows.

Romania: ‘fresh’ news on food consumption

Bread and bakery products

Although the consumption of bread and bakery products is declining in Romania, it remains high compared to other European countries. Consumption of other product categories increases slightly. Bread and bakery products were part of the basic food basket in 2021 with an average monthly per capita consumption of 7.38 kg, compared to 7.60 kg in the previous year; this represents an annual per capita consumption of 88.57 kg (91.19 kg per capita in 2020), data centralized by the National Institute of Statistics (INS) show.

Although the consumption of bread and bakery products is declining in Romania, it remains high compared to other European countries. Consumption of other product categories increases slightly. Bread and bakery products were part of the basic food basket in 2021 with an average monthly per capita consumption of 7.38 kg, compared to 7.60 kg in the previous year; this represents an annual per capita consumption of 88.57 kg (91.19 kg per capita in 2020), data centralized by the National Institute of Statistics (INS) show.

Meat and meat products

According to statistics, the consumption of meat and meat products in Romania was relatively lower compared to patterns in more developed countries. The average monthly per capita consumption of fresh meat was 3.88 kg in 2021. If meat preparations are included, the amount becomes 5.37 kg per capita, an increase of 0.31 kg from the previous year; the annual consumption of fresh meat and meat preparations was 64.38 kg per capita. Consumption of fresh meat and meat products is highest in single-person households – monthly 5.57 kg per capita for fresh meat and 7.69 kg per capita for fresh meat and meat preparations, reports INS.

more developed countries. The average monthly per capita consumption of fresh meat was 3.88 kg in 2021. If meat preparations are included, the amount becomes 5.37 kg per capita, an increase of 0.31 kg from the previous year; the annual consumption of fresh meat and meat preparations was 64.38 kg per capita. Consumption of fresh meat and meat products is highest in single-person households – monthly 5.57 kg per capita for fresh meat and 7.69 kg per capita for fresh meat and meat preparations, reports INS.

Dairy Products

Average monthly milk consumption in 2021 was 5.45 liters per capita (5.33 liters in 2020). The highest level was recorded in retired households (5.81 liters per capita in 2020 and 5.95 liters per capita in 2021), and the lowest in unemployed households (4.58 liters per capita in 2020 and 4.03 liters per capita in 2021). There is a small difference of 0.003 liters per capita between rural and urban households (5.445 liters of milk per capita for the former and 5.448 liters per capita for the latter). Single-person households had the highest milk consumption (7.50 liters per capita per month), a situation that can also be explained by the fact that these are predominantly older households, according to INS. Consumption rates for cheese and cream were higher in retired households (1.77 kg per capita per month) and lower for unemployed households (1.25 kg per capita per month). Single-person households stand out with a monthly per capita consumption of 2.40 kg).

Average monthly milk consumption in 2021 was 5.45 liters per capita (5.33 liters in 2020). The highest level was recorded in retired households (5.81 liters per capita in 2020 and 5.95 liters per capita in 2021), and the lowest in unemployed households (4.58 liters per capita in 2020 and 4.03 liters per capita in 2021). There is a small difference of 0.003 liters per capita between rural and urban households (5.445 liters of milk per capita for the former and 5.448 liters per capita for the latter). Single-person households had the highest milk consumption (7.50 liters per capita per month), a situation that can also be explained by the fact that these are predominantly older households, according to INS. Consumption rates for cheese and cream were higher in retired households (1.77 kg per capita per month) and lower for unemployed households (1.25 kg per capita per month). Single-person households stand out with a monthly per capita consumption of 2.40 kg).

Vegetables

Potato consumption was relatively uniform across all household categories, with the national monthly average in 2021 of 3.02 kg per capita. Pensioners were above average with a per capita consumption of 3.26 kg, while the figures for employee households were the lowest. Last year, the average monthly consumption of vegetables and canned vegetables was 8.46 kg per capita, up 0.46 kg from the previous year. The highest consumption was recorded in single-person households (12.89 kg per capita) and in childless households (9.97 kg per capita), and the lowest in households with 4 or more children (5.66 kg per capita) or households of 6 or more people (6.27 kg per capita).

Potato consumption was relatively uniform across all household categories, with the national monthly average in 2021 of 3.02 kg per capita. Pensioners were above average with a per capita consumption of 3.26 kg, while the figures for employee households were the lowest. Last year, the average monthly consumption of vegetables and canned vegetables was 8.46 kg per capita, up 0.46 kg from the previous year. The highest consumption was recorded in single-person households (12.89 kg per capita) and in childless households (9.97 kg per capita), and the lowest in households with 4 or more children (5.66 kg per capita) or households of 6 or more people (6.27 kg per capita).

Fruit

In terms of fruit consumption, it was relatively low across all households, with a monthly average of 4.29 kg per capita in 2021 and 4.06 kg in 2020, with single-person households consuming 6.40 kg per capita per month (6.08 kg in 2020), more than double the average consumption of households of 6 and more, which were 2.84 kg per capita in 2021 and 2.64 kg per capita in 2020.

In terms of fruit consumption, it was relatively low across all households, with a monthly average of 4.29 kg per capita in 2021 and 4.06 kg in 2020, with single-person households consuming 6.40 kg per capita per month (6.08 kg in 2020), more than double the average consumption of households of 6 and more, which were 2.84 kg per capita in 2021 and 2.64 kg per capita in 2020.

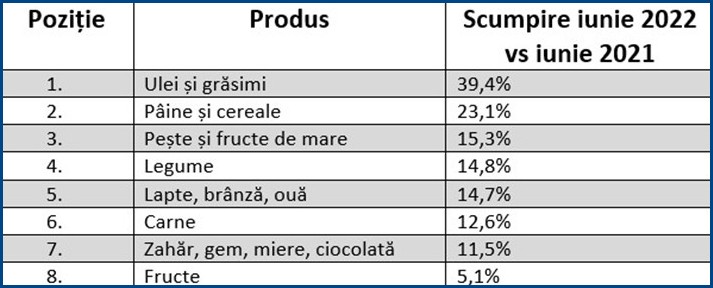

Romania vs. Europe on the price of food. Which states are suffering the most?

With annual price increases of more than 39% for some food products, Romania is among the member states with moderate price increases for the most important food products. In June compared to the same period last year, the largest price increases for all basic food products combined occurred in Lithuania, at 28.6%, and the lowest in France, where food increased by an average of 6.4%. In Romania, basic products are 15.5% more expensive.

With an average price increase of basic food products of 15.5% in June compared to the same period last year, Romania is one of the member states with an average response to the current macroeconomic and geopolitical conditions. So none of the commodities monitored by the European Commission are in one of the extremes – the highest or lowest growth in the EU, according to the latest data published by the European Commission.

Romania thus reported significant price increases of 39.4% for oil and fats , a market hit hard by the war in Ukraine, the largest European supplier of such products. However, it is not one of the largest increases in the EU, as prices rose by 47.2% in Slovakia, 42.6% in Portugal and 42.2% in the Czech Republic. Oil rose the least in Luxembourg, by 13.3% compared to June 2021.

Bread and cereals increased in price by 23.1% in Romania during the analyzed period, while in Bulgaria the increase was 35.4%, in Hungary 29.9% and in Lithuania 29.7%. The lowest price increase was reported by France – 6.6%.

In June, fish and seafood were on average 15.3% more expensive in Romanian stores than in the same period last year. However, consumers in Estonia had 36.2% higher price increases and in Finland the price increase was 27.3%. In Greece, fish costs 4.4% more, the least significant increase in the EU.

As for the average price of vegetables , it was 14.8% higher in June 2022 than in June 2021 in Romania. However, in Lithuania the average price increase was 37.4%, while in Ireland the increase was only 2.4%. Almost as much as vegetables, milk, cheese and eggs increased in price (14.7%). In contrast, in Lithuania these products are 42.6% more expensive and in Cyprus the price increase was only 5.7%.

Meat became more expensive by an average of 12.6% in Romania, in contrast to Hungary where 22.9% was added to the price. France reported the lowest price increase at 7.1%.

Sugar is 11.5% more expensive in Romania, while in Cyprus we are talking about price increases of 22.8%. In Estonia, however, the price increase was only 1.6%.

Last but not least, according to the European Commission data, the most insignificant price increases in Romania took place in fruits, of 5.1%, while in Spain the average price increase was 17.1%, and in Luxembourg and Cyprus the fruits became cheaper by 1.4 and 1.3% respectively.

Top of the biggest food price increases in Romania

As other analyses show , the European Commission data (see chart) also indicate a fairly large discrepancy between the increase in production costs in the food industry and the price at which those products are sold to the final consumer.

Food store prices reflect far from the increase in food prices observed in the last 18 months, the situation is observed in all EU countries, including Romania, data from Allianz Trade shows. In Romania, although food product inflation exceeded 14.5% in June 2022 compared to June 2021, it is just over 80% of the price increase of non-food products, with still growth potential. It can therefore be said that even at the local level, upstream price increases have not yet been fully transferred to the final beneficiary.

“As causes of this slower evolution we could consider the impact of agricultural products, but this should be felt more in the months of July-August. Also, the power of large retail chains remains overwhelming, with the ability to influence the intensity of price adjustments to a certain extent. Drought and disruptions, delays in supply chains, this time in the middle of the grain shipping channel, will continue to put pressure on food prices. In this context, for companies in the field, we expect higher sales driven by inflation, not volumes, and declining profits in an effort to maintain traded volumes,” explains Mihai Chipirliu, CFA – Risk Director – Allianz Trade.

Romania hit hard by this summer’s drought

Frisian arable farmer Minne Lettinga is involved in a large farm in the country’s granary and sees how irrigation is the key to yield security.

Irrigationis the key to good yields in drought-stricken Romania. So says Minne Lettinga, CEO and shareholder of Frizon Group, a Dutch partnership that operates a large arable farm in eastern Romania. Plots with water are achieving excellent yields this year, plots without water have very low to no yield, he sees around him.

Of Frizon Group’s current 4,300 hectares, over 1,000 hectares are irrigated with water from a river that fortunately still has enough water, and unlike the Danube, also remains available for agriculture. The Danube has a ban on withdrawals to prevent shipping from stopping.

Exceptional drought

Lettinga has been active in Romania since 2008. Drought was something he saw more often, but now the situation is exceptional, right in the granary of the country. It is less dry in the West, but that is a less important production area. Romania is a major producer and exporter of wheat, corn and sunflowers. Last year, corn exports amounted to 4.3 million tons. The country accounts for 10% of EU wheat production and normally over 6 million tons go on export.

Harvest forecasts for the entire country have been dramatically revised downward. From 14 million tons of grain corn at the beginning of the year to 8 million according to the latest official estimate and according to Lettinga, it could be even less. The wheat harvest will be a quarter less than last year, over 9 million tons, according to Romanian media.

This growing season already had a false start for winter crops, Lettinga says. Until January it was bone dry. “In January and February, rain did come, after which the crop still developed well. In March it even seemed very good. Only the root system was poorly developed, so the crop could not withstand the drought afterwards.” Plots without irrigation will not achieve a ton of wheat per hectare this year, he says. Normal here is 4 to 6 tons. If there is irrigation, then 6 to 7 tons come into the picture.

Less corn

Due to market expectations and the availability of nitrogen fertilizer, the farm opted for a different crop plan than usual this year, with much more sunflowers (3,000 acres) and much less corn (1,000 acres). Corn needs more nitrogen. This turned out to be a good choice in retrospect because corn is more sensitive to drought. “In corn plots without irrigation, the yield is zero.” Plots with water achieve yields of 13 to 14 tons of grain corn per acre.

The – irrigated – soy on the farm is doing great this year, Lettinga says. He expects a yield of 4 tons of soy per hectare. Good plots of sunflowers also achieve about 4 tons per hectare, but poor plots are already distressed by the drought and do not get beyond 1 ton. Many other plots also remain below 2 tons due to the drought.

The company is located in the granary of Romania. But the harvest is now so meager in the area that grain is actually needed. “Only about 6 percent of the land is irrigated. The rest is now lying dead.” Not only does this leave arable farmers without income, there is also little for transporters to earn, and landlords – landowners are mostly private individuals with few hectares – may not get their leases. This is usually paid in kind: a share of the harvest.

Import from Ukraine needed

Poultry farms in particular have a problem; they cannot get enough corn and other feed commodities. It leads to grain prices in this production area now being higher than at export ports. The upside-down world. Poultry farmers are looking across the border out of necessity. Little by little, grain is coming in via Moldova from Ukraine.

The Frizon Group can play a role in this. It has contacts with poultry farms, as it has been purchasing poultry manure for several years. “Those poultry farmers are now asking if we can use our transport capacity to get corn and grain from Ukraine.” There was already a line with the largest private grain trader in that country. But the war put a crimp in the plan. “The owner and his wife were recently killed by a Russian bomb.”

Rural climate with extremes

In 2020, Romania was also hit hard by drought. The intervening 2021 was good, though it ended in a torrid autumn. Still, Lettinga doesn’t really want to call the drought structural yet. “I’ve seen all kinds of things pass by here since we started operating here in 2008: both wet and dry. We’ve also had a lot of snow very late in the spring that has disrupted everything. That’s what you get with such a continental climate.”

Of one thing, the entrepreneur is convinced: “The only way to tackle that land climate is irrigation.” There is still a lot to be gained in that area, he notes. Follow-up question is whether there is enough river water available if everyone wants to use it. Lettinga: “That is true. But if you can give the crop something in the spring alone, that already makes a huge difference in yield security.”

Sources: Frizon Group, The Farm

Shipbuilding sector

Damen Shipyards wins Romanian (ISU) tender for multi-role vessels for use in the Black Sea and the Mediterranean

The Romanian General Inspectorate for Emergency Situations is a public structure subordinate to the Ministry of the Interior, created on December 15, 2004 by merging the Civil Protection Command with the General Inspectorate of the Military Fire Corps. (IGSU) received only one bid in the tender for multi-role vessels, with an estimated value of 187 million lei. To be precise, the bid was submitted by the Dutchmen of Damen Shipyards Gorinchem BV, the owners of Damen Shipyards Galați (former Galați Naval Shipyard).

The Romanian General Inspectorate for Emergency Situations is a public structure subordinate to the Ministry of the Interior, created on December 15, 2004 by merging the Civil Protection Command with the General Inspectorate of the Military Fire Corps. (IGSU) received only one bid in the tender for multi-role vessels, with an estimated value of 187 million lei. To be precise, the bid was submitted by the Dutchmen of Damen Shipyards Gorinchem BV, the owners of Damen Shipyards Galați (former Galați Naval Shipyard).

The auction, launched on July 3, 2022, is divided into two lots:

1-Multifunctional fire engine

2-Multifunctional search and rescue (SAR) vessel

The purpose of the purchase is to diversify the technical resources available to professional emergency services to cover as many types of risks as possible. The acquisition aims to increase intervention capacity at sea, which will lead to an increase in the number of lives saved, assets recovered and the reduction of the negative impact on the environment during emergencies.

The existence of multipurpose vessels moored in the port of Constanța will allow compliance with the international obligations undertaken by Romania (the IMO, SOLAS and SAR conventions and the Black Sea SAR Convention), according to the tender announcement .

The new ships would be deployed in the Black Sea, but also in the Mediterranean, according to information in the specifications:

The purchase is being financed through the Large Infrastructure Operational Program – POIM, with a 14-month deadline for delivery of the vessels. The Dutch from Damen own the former Galați Naval Shipyard in Romania. With an area of 55 hectares and 1,700 employees, Damen Shipyards Galati is one of the largest shipyards in the Dutch group.

Shipbuilder Damen Shipyards writes black figures again after three years of losses

According to the family business, the well-filled order book underscores the good starting position for the future. It is still unclear how the conflict in Ukraine and the sanctions will affect the company.

Damen Shipyards, the largest shipbuilder in the Netherlands, returned to black figures in 2021 after three consecutive years of losses. This is evident from the 2021 corporate figures filed this week.

Damen posted a positive gross operating profit (ebitda) of €81.5 mln, compared to a negative €87.5 mln in 2020. At the bottom line, the Gorinchem-based family business was left with over a million euros, after mega losses of €161.5 mln and €287 mln in 2020 and 2019, respectively. With the favorable results for 2021, it should be noted that for Damen the consequences of the war in Ukraine are not yet clear. In an accompanying press release, Damen says that the shipbuilder faces “a number of uncertainties” for 2022.

Order book very well filled

In any case, the order book of the shipbuilder (35 shipyards worldwide, 12,000 employees) is well filled. By the end of 2021, it had risen to an operating record of €8.8bn, up from around €8bn a year earlier. The order book includes a billion-dollar order for the construction of four frigates (there may also be more) for the German Navy, a large number of yachts, tugs and ferries, and ship repair. Damen Yachting, the yacht branch of the Gorinchem shipbuilding group, recorded a “record of orders.

Ceo Arnout Damen calls 2021 a “good year,” also in terms of sustainability and innovation. The shipbuilder says it built the world’s first all-electric harbor tug for an Australian customer and ferries with full-electric hybrid or lng propulsion for Canadian customers. With the electric powered water buses delivered to the city of Copenhagen, Damen won an important maritime award in the Netherlands.

Ukraine

According to Damen, the crisis in Ukraine is having a “big impact” on the company, first of all in humanitarian terms. Before the war broke out on February 24, 214 people worked for Damen Shipyards in the cities of Cherson and Mykolajiv. Relatives of people who worked at Damen in Ukraine or at Ukrainian suppliers were received in Flushing and Amsterdam. Others were housed at Damen yards in Romania and Poland. One employee did not survive the war.

In response to the Russian invasion, the South Holland family-owned company decided to suspend the delivery of ordered ships and the conclusion of new contracts with Russian and Belarusian clients. Sanctions taken by the Dutch government against Russia made deliveries and order fulfillment completely impossible shortly thereafter.

On the chain

The shipbuilder says it is not yet able to indicate the business impact of these developments, a Damen spokesman said in an explanation. ‘Numerous legal proceedings are still ongoing around those orders and the ships under construction. Vessels may be able to be sold to other clients by mutual agreement. Then the damage is limited. In other cases, the damage can be much more substantial.

Damen would not say how many ships are involved. It is also said to be one or more superyachts for Russian oligarchs, but the shipbuilding group would not confirm this. However, in recent months the Dutch government has chained up a large number of superyachts owned by Russian oligarchs in the Netherlands.

Sector (inland) shipping

Shortage of barges looming on the Rhine

An acute capacity problem is looming on the Rhine. This is due to additional demand for ships to transport coal to German power stations.’But the ship supply has actually shrunk: ships have been sold to transport Ukrainian grain on the Danube. Of course, the current low water level of the Rhine exacerbates the bottlenecks.

Sector organization Royal Barge Netherlands (KBN)

KBN is very concerned about a shortage of shipping capacity on the Rhine. A lot of capacity is needed for the transport of coal,’ says Maira van Helvoirt of KBN. This is at the expense of other cargoes, which she believes can lead to major problems in logistics chains. Less capacity is available for containers and dry cargo other than coal, such as grain, ores and agricultural products such as animal feed, while there is a great demand for transport. For coal transport, the tightness has led to a doubling of prices in recent weeks.

KBN is very concerned about a shortage of shipping capacity on the Rhine. A lot of capacity is needed for the transport of coal,’ says Maira van Helvoirt of KBN. This is at the expense of other cargoes, which she believes can lead to major problems in logistics chains. Less capacity is available for containers and dry cargo other than coal, such as grain, ores and agricultural products such as animal feed, while there is a great demand for transport. For coal transport, the tightness has led to a doubling of prices in recent weeks.

‘Some inland shipping companies have to cancel sailings in container transport because the capacity is not there,’ says Van Helvoirt. Since the financial crisis in 2008, dry cargo transport has barely added capacity.

Low water level

The low water level on the Rhine exacerbates the problems. As a result, only one-third to one-half of the normal amount of cargo can be transported per ship. This increases the logistical pressure on inland shipping.In the summer months, there is normally much less transport of coal to Germany, because the coal-fired power plants are running at lower capacity. Patrick le Cessie, director of inland shipping company Gebroeders De Korte, speaks of an “extreme demand for shipping space. De Korte transports coal for three German coal-fired power plants. German coal-fired power plants are running at full capacity to reduce dependence on Russian gas. But for the supply of the coal they are largely dependent on Dutch inland navigation. The bulk of the coal goes from the ports of Rotterdam, Amsterdam and Antwerp to Germany.

Ships to Danube region

Capacity problems are made all the more acute by the fact that in the first half of the year several dozen barges were sold to companies in the Danube region to transport grain from Ukraine to the Romanian port of Constanța. This eliminates capacity on the Rhine, even though it is currently so needed.

Coal transport relies primarily on large 135-meter vessels. Of these, according to Van Helvoirt, around 150 are in the Dutch fleet and fifteen have gone to the Danube region. ‘So then you’re already talking about 10% less capacity in that segment.’

Van Helvoirt speaks of a combination of bottlenecks leading to a “worrying situation” in inland shipping. In addition to shortage of ship space, there is a lack of personnel on the ships. ‘And there is overdue maintenance in the infrastructure,’ she adds. A lock near Weurt in Gelderland is closed, forcing ships to detour via Grave, in North Brabant. ‘This leads to waiting times and reduces efficiency.’

Favourable for brokers

For shipbrokers, the bottlenecks in capacity are actually favourable. ‘I’ve been doing this for fifteen years now and I haven’t experienced this before,’ says Twan de Goeij of Rensen-Driessen, shipbroker and shipbuilder. He speaks of a “perfect storm” in the barge market. His industry colleague Paul Cornet of Concordia Damen confirms this picture. ‘The demand for ships is high.’

For shipbrokers, the bottlenecks in capacity are actually favourable. ‘I’ve been doing this for fifteen years now and I haven’t experienced this before,’ says Twan de Goeij of Rensen-Driessen, shipbroker and shipbuilder. He speaks of a “perfect storm” in the barge market. His industry colleague Paul Cornet of Concordia Damen confirms this picture. ‘The demand for ships is high.’

Paul Cornet of ship brokerage Concordia Damen assumes that sales of barges will double this year. ‘I estimate that we will end up with between three hundred and four hundred ships against around two hundred in other years.’

Transport of relief goods

One of the foreign parties that has purchased Dutch barges is the Romanian transport company Trading Line. Owner Paul Ivanov: ‘I have bought fourteen ships in the last few months. Only big ships.’

Among other things, he plans to use the ships to transport agricultural products from Ukraine and aid supplies across the Danube to Ukraine. This is done within the framework of European programs for the creation of transport corridors (solidarity lanes). Romanian banks are financing the purchase of the ships, according to Ivanov.

Sector Logistics and Transport

Heisterkamp a beautiful company with a total concept

Heisterkamp Transportation Solutions offers a total package for the transportation industry.

Originally from Ootmarsum, the company celebrated its centenary last year and now consists of three divisions with 1500 employees: the Transport division with 750 trucks, Equipment with a rental fleet of more than 200 trucks and 4,000 trailers and Service.

In addition to the new truck workshop, the Service division also includes a workshop for trailers and a damage repair department with paint shop in Oldenzaal, a Breakdown Service for 24/7 breakdown assistance in Europe and a truck and trailer workshop in Travemünde (D). In 2019, the family business celebrated its 100th anniversary.

Heisterkamp also has a presence in Romania in the cities of Cluj and Iasi.

Further information:www.heisterkamp.eu

Financial sector

ING Bank Romania launched an instant credit with repayment in installments for SMEs, without material guarantees

ING Bank Romania comes to the aid of entrepreneurs with a new loan with repayment in equal capital installments – Credit Util, which they can get on the spot at an ING branch. The verification of the companies’ situation is carried out automatically by the bank, without the need for financial documents or material guarantees, for the immediate approval of the loan. Entrepreneurs can borrow up to 500,000 lei, for all types of expenses needed for the business, for a period of up to 5 years.

ING Bank Romania comes to the aid of entrepreneurs with a new loan with repayment in equal capital installments – Credit Util, which they can get on the spot at an ING branch. The verification of the companies’ situation is carried out automatically by the bank, without the need for financial documents or material guarantees, for the immediate approval of the loan. Entrepreneurs can borrow up to 500,000 lei, for all types of expenses needed for the business, for a period of up to 5 years.

At the same time, ING Credit Util confirms the bank’s strategy of offering our customers relevant products and services that are as easy and quick to access as possible. For example, ING customers can access the loan without financial documents and material guarantees, and the approval is done immediately. We want ING to be a reliable partner for current and future clients, providing them with predictability and the right tools for their business,” said Luana Sorescu, Head of Clients in the Business Banking division within ING Bank Romania.

Who has access to the ING Util loan?

ING Credit Util was created for micro and small companies with a turnover between 100,000 lei and 9,000,000 lei in the previous financial year.

Companies must be registered SRLs and have been operating for at least 2 years. In order to sign the credit documentation, administrators and majority shareholders must present themselves at an ING branch with their proof of identity.For those who are not yet an ING customer, they must first open a current account. They can get credit approval on the spot, but have access to the requested amount once the relationship establishment application is completed.

Advantageous costs for ING Credit Util

The costs are advantageous, adjusted to the profile of the company.

Monthly, on the due date (chosen at the beginning), the payment amount is automatically debited from the company’s current account.

ING Credit Util, aimed at growth opportunities for companies

According to a 2021 BNR report, small business loans accounted for 21% of total loans. To grow, small businesses need the confidence to rely on banking partners that provide them with predictability, stability and meet their needs as quickly as possible.

ING Credit Util supports entrepreneurs and small businesses in optimizing their business in a fast, useful and convenient way for any type of expense.

Economical developments

Romania, one of the countries with the highest economic growth in the EU in the second quarter of 2022 – Eurostat

The Gross Domestic Product of the European Union and the Eurozone recorded an increase of 0.6% in the second quarter of 2022 compared to the previous three months, with the Netherlands and Romania making the biggest progress, preliminary data published Wednesday by European Statistical Office (Eurostat) show.

During the same period, U.S. gross domestic product declined 0.2%. On an annual basis, the U.S. economy grew by 1.6% between April and June 2022

In the first quarter of 2022, compared to the previous three months, Gross Domestic Product registered an increase of 0.5% in the Eurozone and 0.6% in the EU.

Among the EU member states for which data are available, the largest advance in the economy in the second quarter of 2022, compared to the previous three months, was recorded in the Netherlands (2.6%), Romania (2.1%) , Sweden ( 1.4%), Spain, Hungary and Bulgaria (all by 1.1%). Declines were recorded in Poland (minus 2.3%), Latvia (minus 1.4%), Lithuania (minus 0.4%) and Portugal (minus 0.2%).

Compared to the second quarter of last year, GDP rose 3.9% in the euro area and 4% in the European Union between April and June 2022, with all EU member states for which data are available reporting increases.

Romania and Bulgaria, the lowest hourly labor costs in the EU – Eurostat

Average hourly labor costs across the economy (excluding agriculture and public administration) in 2021 are estimated at €29.1 in the 27 member states of the European Union and €32.8 in the euro area, compared with €28.6 in the EU and €32.4 in the euro area, respectively, in 2020, data published Monday by the European Statistical Office (Eurostat) show.

Average labor costs per hour mask significant differences among European Union member states, the lowest labor costs per hour last year were recorded in Bulgaria (seven euros) and Romania (8.5 euros), and the highest in Denmark (46.9 euros), Luxembourg (43 euros) and Belgium (41.6 euros),

In 2021, the average hourly labor cost in manufacturing was €29.1 in the EU and €35.1 in the euro area, while in construction it was €26 in the EU and €29.3 in the euro area, and in services €28.8 in the EU and €31.6 in the euro area.

Hourly labor costs include salary costs and non-salary costs, such as social security contributions paid by employers. The share of non-salary costs in total labor costs in the whole economy was 24.6% in the EU and 25.1% in the euro area. The lowest proportion of non-salary costs was in Lithuania (3.7%), Romania (4.9%) and Ireland (8.7%) and the highest in Sweden (32%), France (31.9%) and Italy (28.3% ).

In 2021, hourly labour costs in the whole economy expressed in euros increased by 1.7% in the EU and by 1.2% in the euro area compared to 2020.In the euro area, hourly labour costs increased in all member states except Italy (minus 1.6%) and Spain (minus 0.3%). The most significant advances were in Lithuania (12.5%), Estonia (6.5%), Cyprus and Slovenia (6.2% each) and Latvia (6.1%).

In the case of non-eurozone countries, hourly labor costs expressed in national currency increased last year in all member states, with the most significant increases in Bulgaria (9.1%), Poland (8.2%) and Hungary (7.3%). and the lowest growth in Sweden and Croatia (3% each).

In 2021, most EU member states extended the validity of support schemes introduced in 2020 to mitigate the impact of the pandemic on employers and workers.

Europe goes into full recession as Russia cuts off gas completely-Analysis ING

In any case, the energy crisis will plunge Europe into recession, the question is how bad it will be. ING expects the Eurozone economy to contract by 1-3% in the event of a total halt in gas supplies from Russia. European countries have begun to significantly reduce natural gas consumption in the face of sharp price increases. Germany reduced its consumption in the second quarter of this year by 10-15% compared to the average of the past 10 years, while in the Netherlands the decline was 30% compared to the average of the years 2019-2021, according to an economic analysis by ING.

In any case, the energy crisis will plunge Europe into recession, the question is how bad it will be. ING expects the Eurozone economy to contract by 1-3% in the event of a total halt in gas supplies from Russia. European countries have begun to significantly reduce natural gas consumption in the face of sharp price increases. Germany reduced its consumption in the second quarter of this year by 10-15% compared to the average of the past 10 years, while in the Netherlands the decline was 30% compared to the average of the years 2019-2021, according to an economic analysis by ING.

Gas deliveries from Russia have fallen sharply in the past two quarters from the average of the past five years to about half and recently as much as a third. Russia recently closed up to 20% of the capacity of the Nord Stream 1 valve to Germany. The decline in gas imports from Russia represents 15% for Q1 and 25% for Q2, respectively, of Europe’s historical consumption, as 40-45% of the gas consumed comes from the East. “We think the negative impact of a total embargo of Russian gas on the Eurozone economy from now on will be between 1% and 3% of GDP in the short term,” say ING analysts, who caution, however, that the actual figure is difficult to estimate, given the experience of recent years on how macro models work in a crisis with far-reaching consequences such as COVID. In any case, the decline in GDP comes over the expected recession that is also caused by the ongoing energy crisis.? “After a substantial impact and with a difference from country to country, and given that we already expect a mild recession, this development would be enough to lead to a full recession. It is very clear that a full gas freeze will hurt Europe. It is crucial to avoid it by having a credible plan to reduce consumption,” say ING analysts.

Some of Russia’s imports were supplemented by imports by sea of liquefied natural gas (LNG) and other pipeline imports, while more coal or even oil was used for power generation.

Some of Russia’s imports were supplemented by imports by sea of liquefied natural gas (LNG) and other pipeline imports, while more coal or even oil was used for power generation.

The European Commission estimates that 60% of Russian gas could be replaced from other sources within a year. ING considers the percentage achievable, given that substitution is already high, more LNG terminals are being built and more solar and wind generation capacity is being installed. “We have also seen that the debate over fuel switching evolves rapidly over time.

The reopening of coal plants is now acceptable and extending the life of nuclear plants is no longer considered taboo in Germany,” according to ING’s analysis. Moreover, the reopening of the Groningen deposit, the largest in Western Europe, could be considered by the Dutch authorities in light of the accelerated rise in bills and the potential for high profitability, respectively. European countries have agreed to a voluntary 15% reduction in gas consumption, which would replace imports of Russian gas Gas traded in Romania, a quarter cheaper – 50 euros/MWh – than traded in Austria “Ironically, Russia’s decision to reduce the flow of gas through Nord Stream 1 again to 20% will help governments reach the goal. It leads to a price level where the market automatically cuts off your demand. Thus, the likelihood of government rationalization of consumption decreased. Industrial players will decide whether they are still willing to pay the price. As long as they are, they will probably get the gas. The rest of the world is likely to be much less willing to pay the same price as long as they have alternatives like coal available to them,” says ING. One discussion that remains open is related to the regulations that focus on the price the population pays. A price ceiling that is too low would still stimulate consumption – i.e., the temperature in homes does not fall, but high demand would put pressure on market prices (prices that ultimately have to be paid by someone) and industrial consumers – while that a ceiling of too high a price or on the market would severely depress household incomes, especially the poorest. Gas-intensive sectors, excluding energy, generate 6% of the EU’s gross domestic product. Because many of these sectors underlie supply lines, a drop in production has a variety of second-round effects that lead to higher prices in

other sectors and supply issues, ING says. Some companies have already reduced or stopped industrial production and others will take similar measures. A decline in semi-finished or finished products will lead to higher imports as long as there is demand, such as agricultural fertilizers. Other sectors, especially consumer-oriented sectors, will be affected by lower purchasing power due to a drop in demand. “The longer high energy prices in Europe persist, the more the pressure on European competitiveness increases. The current situation provides an incentive for investment in energy-intensive industrial production in regions such as North America or the Middle East.”

The impact varies from country to country. The Netherlands, in particular, is experiencing second-round effects: in normal weather, consumption would drop by a quarter this winter, allowing Germany to supply gas as well. Germany, on the other hand, is the largest consumer of Russian gas, gas that goes not only to industry  , but also for heating the population in proportion of 30%, since half of the apartments use this energy source.

, but also for heating the population in proportion of 30%, since half of the apartments use this energy source.

Italy has reduced its Russian gas imports by a third and is looking at additional alternatives(e.g. Azerbaijan), mainly LNG and restarting coal plants.

Hungary, one of the countries most dependent on Gazprom, has agreed on a new supply deal with Russia and would be supplied through Serbia if the pipelines to the west are empty.

Romania has the lowest dependence in the Central and Eastern Europe region , thanks to domestic production (which covered 80% of consumption in 2020), but it still needs imports to cover consumption. This winter, domestic production and warehouses could only provide for the consumption of the population and entities of paramount importance, according to some estimates .

Sector Geopolitical developments

Hungarian Prime Minister Viktor Orban causes international scandal

In both Europe and the U.S., there has been much commotion about the mixing of races which has led to a relationship with World War II. Orban did it during a Summer School in the Romanian town of Băile Tușnad a town in the Romanian district of Harghita in Szeklerland. This Summerschool was organized by the UDMR or RMDSZ and is the Democratic Union of Hungarians in Romania. Romanian President Klaus Johannis condemns racist remarks by Hungarian prime minister “It is a big mistake and it is inadmissible for a European dignitary to make such statements based on the theory of race, a theory that led to the most terrible catastrophe of the 20th century, World War II,” Iohannis said, quoted by News.ro

In both Europe and the U.S., there has been much commotion about the mixing of races which has led to a relationship with World War II. Orban did it during a Summer School in the Romanian town of Băile Tușnad a town in the Romanian district of Harghita in Szeklerland. This Summerschool was organized by the UDMR or RMDSZ and is the Democratic Union of Hungarians in Romania. Romanian President Klaus Johannis condemns racist remarks by Hungarian prime minister “It is a big mistake and it is inadmissible for a European dignitary to make such statements based on the theory of race, a theory that led to the most terrible catastrophe of the 20th century, World War II,” Iohannis said, quoted by News.ro

At the annual meeting in Tușnad, Transylvania, Hungarian Prime Minister Viktor Orban argued against the “mixing” of European and non-European races. Orbán argued that Hungarians were racially pure and wanted to remain so. Orbán’s speech drew numerous condemnations in response. In Hungary, Zsuzsa Hegedüs, one of Viktor Orbán’s longest-serving advisers and special envoy for social integration, resigned in protest. Several Romanian politicians also noted that such speech could not be accepted.  Romania’s Hungarian minority party UDMR under pressure after Orban’s anti-EU rhetoric Nearly 800 ethnic Hungarian intellectuals in Transylvania also signed an online petition to distance themselves from Orbán’s speech. “The ideas that emerged in Orban’s speech this year, ideas rooted in racial prejudice and a long-abandoned ‘race’ theory, are alarming,” the petition says. “We distance ourselves from this speech. There are no human ‘races’, we are all part of one unitary species: Homo sapiens. Orbán’s ideas, which foreshadow the decline of the West, an evolution caused by racial mixing, in contrast to the vitality of the non-racially mixed nation-states of Central and Eastern Europe, are reminiscent of the racist rhetoric that led to World War II and the Holocaust,” the signatories added. However, Orbán also found defenders in Romania. Kelemen Hunor, leader of UDMR, the party representing ethnic Hungarians in Romania, said that “Orbán has no racism in him.” UDMR is part of the governing coalition in Romania, together with the Social Democrats and the National Liberal Party.

Romania’s Hungarian minority party UDMR under pressure after Orban’s anti-EU rhetoric Nearly 800 ethnic Hungarian intellectuals in Transylvania also signed an online petition to distance themselves from Orbán’s speech. “The ideas that emerged in Orban’s speech this year, ideas rooted in racial prejudice and a long-abandoned ‘race’ theory, are alarming,” the petition says. “We distance ourselves from this speech. There are no human ‘races’, we are all part of one unitary species: Homo sapiens. Orbán’s ideas, which foreshadow the decline of the West, an evolution caused by racial mixing, in contrast to the vitality of the non-racially mixed nation-states of Central and Eastern Europe, are reminiscent of the racist rhetoric that led to World War II and the Holocaust,” the signatories added. However, Orbán also found defenders in Romania. Kelemen Hunor, leader of UDMR, the party representing ethnic Hungarians in Romania, said that “Orbán has no racism in him.” UDMR is part of the governing coalition in Romania, together with the Social Democrats and the National Liberal Party.

Asked if UDMR should leave the coalition, President Iohannis said that clarifications are needed from their side. “They applauded the speech and the person. There must be an explanation,” Iohannis said. However, the president insisted that the situation must not lead to a crisis for the current governing coalition.

Asked if UDMR should leave the coalition, President Iohannis said that clarifications are needed from their side. “They applauded the speech and the person. There must be an explanation,” Iohannis said. However, the president insisted that the situation must not lead to a crisis for the current governing coalition.

Viktor Orbán wants Hungarian guardianship on Romanian territory. The German newspaper Die Welt writes that Orbán cannot undo Trianon, but he and his government are doing everything they can to connect the area to the motherland and incorporate it into the former great Hungarian empire.

Viktor Orban caused a veritable tsunami with his racist and anti-EU speech in Tușnad, Romania. Internal and external reactions followed, President Iohannis asked for explanations, UDMR coalition partners asked for explanations , there was even talk of UDMR being removed from the government, but UDMR leaders refused explanations. Union leadership was with Viktor Orban in Tușnad and applauded the already infamous speech, even though some Hungarian leaders in Romania may not agree with the Budapest autocrat’s ideas.

Why are the heads of the UDMR silent? Simple: for many years Viktor Orban has been pumping hundreds of millions of euros from government funds into a huge network of foundations and individuals in Transylvania.

Azerbaijan launched military operation “Revenge” in Nagorno-Karabakh

Azerbaijan announced Wednesday that its army had taken positions and destroyed Armenian targets in the enclave of Nagorno-Karabakh, in a military operation it called “Revenge” that raised fears of a resumption of an Azerbaijani-Armenian war in this Azerbaijani-Armenian enclave with a majority Armenian population.

The Azerbaijani army “has gained control of several high positions,” including hills, the Azerbaijani Defense Ministry reported, quoted by AFP, adding that Azerbaijani forces are reinforcing their occupied positions.The two camps had earlier announced the deaths of at least two Armenian fighters and an Azerbaijani soldier in this resurgence of violence.

Russia, which mediated the ceasefire that ended the 2020 war and deployed a peacekeeping force in Nagorno-Karabakh, accused Azerbaijan of violating the ceasefire in the Saribaba region.

Moscow is taking “measures to stabilize the situation,” which is deteriorating in the region, the Russian Defense Ministry said.According to the Azerbaijani Defense Ministry’s version, its troops were the target of gunfire in the Latcin district, a buffer zone between the Armenian border and Nagorno-Karabakh, so it launched a retaliatory operation, hence the name “Revenge” it gave it.Armenia and Azerbaijan have been disputing the Azeri province of Nagorno-Karabakh with a majority Armenian population since the 1990s. Their last war, fought in the fall of 2020, resulted in about 6,500 deaths and was halted by the ceasefire negotiated by Russia in the face of an impending defeat of Armenian forces.According to the agreement reached at the time, Armenia was to cede to Azerbaijan part of this province and the Azeri territories around it that it controlled after the war in the early 1990s.

Armenia has traditionally had close relations with Russia, including through its membership in the Collective Security Treaty Organization (CSTO). During the Nagorno-Karabakh conflict in the fall of 2020, Prime Minister Nikol Pashinian asked Moscow for CSTO intervention, as Armenian forces were outmatched by the capabilities of the Azeri army, which was backed by Turkey.The Kremlin-which considers Pashinian a pro-Western politician who came to power after a “color revolution”-refused at the time, arguing that the Nagorno-Karabakh region is not Armenia’s territory, a fact that is internationally recognized.

Considering the pipeline for European gas supply coming from Azerbaijan and passing through Turkey, “touching” the borders of Armenia and South Ossetia which is a secessionist republic of Georgia under strong influence of the Russian Federation implies that these disputed areas could strengthen the position of the Russians.

New concepts to promote Europe’s unity and cohesion

Often, European cooperation is hampered by the figurative meaning of a watershed, that is, in the sense of a substantial difference in methods of action, culture and mentality. With many Western European countries adopting a rather wait-and-see attitude, the two largest countries in Central and Eastern Europe, Poland and Romania, undertook initiatives to break this undesirable status quo.

The first initiative the “Three Seas Initiative” was taken in August 2016 by Polish President Andrzej Duda in the Croatian city of Dubrovnik.

The cooperating partners were the 12 countries located between the Adriatic Sea, the Baltic Sea and the Black Sea, thus the three seas of Central Europe. Their focus is particularly on regional economic cooperation in the areas of energy and transport and communications infrastructure.

Related to the Three Seas Initiative, Romanian President Klaus Johannis established B9(Bucharest 9) in November 2015.

Related to the Three Seas Initiative, Romanian President Klaus Johannis established B9(Bucharest 9) in November 2015.

The Bucharest Group 9 is an action project to ensure the unity and participation of the interests of the Eastern European countries, created as a joint response to Russia in its rule over Crimea and its claims in Eastern Ukraine and the Black Sea. These nine countries that make up the B9 were part of the Soviet Union or participated in the Warsaw Pact. The past of socialist unity brings Russia’s historical interest in making progress in these countries. Then, following the model of the Three Seas Initiative, Bucharest Group 9 seeks increased investment by the European Union in more active participation in the security of these countries, with military support from NATO.

As a condensed group, Bucharest 9 became a key NATO and EU player on Europe’s eastern flank, especially in conflicts with Russia and the advance in Ukraine. It is primarily an action of demonstration of strength and unity. NATO alliances guarantee military security for several countries, preventing any attack on one of its members. But it is not only a unity for NATO, but also for the European Union and the countries furthest from the Western core. The goal here is to demonstrate a single block of political and military participation. So Russia’s implicit attacks on the eastern territory, which in the past was part of the USSR or at the same time were “satellite” countries, have a geopolitical barrier involving several actors, mainly the EU and the US. This causes the interests of the West to manifest as a united front of action, with different territories subscribing to its bases. Partly due to B9’s efforts, a great deal of European unity has now been created in relation to the Russian Federation and their annexation of Crimea and brutal invasion of Ukraine

As a condensed group, Bucharest 9 became a key NATO and EU player on Europe’s eastern flank, especially in conflicts with Russia and the advance in Ukraine. It is primarily an action of demonstration of strength and unity. NATO alliances guarantee military security for several countries, preventing any attack on one of its members. But it is not only a unity for NATO, but also for the European Union and the countries furthest from the Western core. The goal here is to demonstrate a single block of political and military participation. So Russia’s implicit attacks on the eastern territory, which in the past was part of the USSR or at the same time were “satellite” countries, have a geopolitical barrier involving several actors, mainly the EU and the US. This causes the interests of the West to manifest as a united front of action, with different territories subscribing to its bases. Partly due to B9’s efforts, a great deal of European unity has now been created in relation to the Russian Federation and their annexation of Crimea and brutal invasion of Ukraine

Disclaimer

The newsletter of the Dutch Romanian Network is compiled with great care. The Dutch Romanian Network cannot accept any liability for a possible inaccuracy and/or incompleteness of the information provided herein, nor can any rights be derived from the content of the newsletter. The articles do not necessarily reflect the opinion of the board.