Newsletter July 2022

Agricover announces new appointments in the management of Agricover Credit IFN SA

Given Robert Rekkers’ connection to the DRN Task Force Agri & Food Romania and his participation in the Committee of Recommendation, and that he was awarded the Romanian Business Award in 2017, we place the following message under DRN News.

Given Robert Rekkers’ connection to the DRN Task Force Agri & Food Romania and his participation in the Committee of Recommendation, and that he was awarded the Romanian Business Award in 2017, we place the following message under DRN News.

We also know Robert Rekkers as a banker at ABN Amro for which his activities included Latin America and North America and later in Romania he was appointed CEO of Banca Transilvania. He is known as someone who is always looking for new challenges and hence his joining Agricover.

We also know Robert Rekkers as a banker at ABN Amro for which his activities included Latin America and North America and later in Romania he was appointed CEO of Banca Transilvania. He is known as someone who is always looking for new challenges and hence his joining Agricover.

Agricover, the leader of the agribusiness market in Romania, announces the appointment of Mr. Robert Rekkers (pictured) as Chairman of the Board of Directors of Agricover Credit IFN SA and the appointment of Mr. Serhan Hacisuleyman as Managing Director of Agricover Credit IFN. Confirmation of the appointments will be finalized pending the necessary formalities.

Mr. Jabbar Kanani, Chairman of the Board of Directors of Agricover Holding said:

“Fifteen years ago, we made the decision to make financing simple and accessible to all Romanian farmers, convinced that the success of Romanian agriculture is closely linked to investment, technology and sustainable development.

During this period, Romanian farmers have demonstrated their ability to rapidly reduce the productivity gap with the best performing farmers in the European Union and I believe that we, Agricover, have also made an important contribution to this great leap through the innovative business model we have developed to meet the real needs of farmers.

I would like to thank Mr. Rekkers for bringing Agricover Credit IFN to a leading position in agricultural finance. We are pleased that we can count on his support in the future to continue building successful strategies

I would like to thank Mr. Rekkers for bringing Agricover Credit IFN to a leading position in agricultural finance. We are pleased that we can count on his support in the future to continue building successful strategies

to as many farmers as possible, especially small and medium farmers.”

Mr. Robert Rekkers, Chairman of the Board of Directors of Agricover Credit IFN said, ” In 2012, I happily accepted the challenge to join Agricover and over the years we have managed to build a rock-solid business. With a total financing of more than RON 2,6 billion, Agricover Credit IFN is today one of the leading agricultural financiers and a trusted partner for more than 4500 farmers. This success would not have been possible without the people on the team, whom I would like to thank for believing with me in the enormous potential of Romanian agriculture and in the importance of our commitment to providing farmers with the financing they need in a simple and fast way. I am honored to be able to contribute to the development of the strategy to ensure continued healthy growth from my new position as Chairman of the Board. ”

About Agricover

Agricover is the leader in the Romanian agribusiness market, a generator of innovative solutions that transform agriculture and farmers’ lives for the long term, creating progress and prosperity on a social scale.

Agricover Group has a total enterprise value of more than RON 3.5 billion and serves a total portfolio of 9,200 professional farmer customers, cultivating more than 2.6 million hectares of arable land nationwide. By the end of 2021, the subsidiaries of Agricover Holding employed 470 people.

Agricover Holding SA manages Agricover Distribution SA – specializing in the distribution of agricultural technologies and inputs, Agricover Credit IFN SA – a non-bank financial institution specializing in agricultural finance and Agricover Technology SRL through which the Group gives farmers access to the latest innovations in global digital agriculture.Agricover Credit IFN recorded outstanding loans and advances of RON 2.02 billion as of December 31, 2021, 18% higher than at the end of last year. Profit before tax posted accelerated growth of 35% due to strict risk management costs and higher net commission income.

Agricover Holding SA manages Agricover Distribution SA – specializing in the distribution of agricultural technologies and inputs, Agricover Credit IFN SA – a non-bank financial institution specializing in agricultural finance and Agricover Technology SRL through which the Group gives farmers access to the latest innovations in global digital agriculture.Agricover Credit IFN recorded outstanding loans and advances of RON 2.02 billion as of December 31, 2021, 18% higher than at the end of last year. Profit before tax posted accelerated growth of 35% due to strict risk management costs and higher net commission income.

Innovative products like Instant Credit, Diesel Pay on Harvest, Hectare Plus, Advance Forward Credit, Septel Plus Credit, Irrigation Credit were just some of the innovative financing solutions under the name Agricover Credit that the company launched year after year and appreciated by farmers. The latest innovation is the launch earlier this year of the Farmer Card – the first business credit card designed specifically for farmers, giving them quick access to financing with payment at harvest and 0% interest on the purchase of agricultural commodities in Agricover’s online store.

The company’s diverse product portfolio caters to micro and small farmers, as well as medium and large farms. The synergy with the Agricover group and the deep understanding of the needs of farmers and the industry are key assets in building the most appropriate financing solutions and efficient risk management.

To secure the necessary funds to finance farmers, the company has maintained strong partnerships with local banks as well as established international partners such as the European Bank for Reconstruction and Development, International Finance Corporation, European Investment Bank, European Investment Fund, Black Sea Trade and Development Bank, European Fund for Southeast Europe, ResponsAbility .

The shareholders of Agricover Holding SA are Mr. Jabbar Kanani (87.269%), the European Bank for Reconstruction and Development (EBRD) (12.727%) and the list shareholders. Adama Agriculture BV, part of the Syngenta Group, one of the world’s largest producers of crop protection products and certified seeds, holds 10% of the shares in Agricover Distribution SA.

Dutch embassy office in Moldova becomes full embassy

Foreign Minister Wopke Hoekstra informed the Council of Ministers on July 15 of the decision to upgrade the embassy office in Chisinau, Moldova to a full embassy. The embassy officein Chisinau now vt under the ambassador in Bucharest, Romania.

This decision was taken to intensify the good relationship with Moldova. The Netherlands supports Moldova’s EU candidate membership and has good ties with the pro-European Moldovan government. Also, the war in their neighboring country of Ukraine leads the Netherlands to want to be present with a stronger representation. By the way in the past Moldova belonged to the Dutch Embassy in Kiev.This means that there will be an ambassador and more people working there.

This decision was taken to intensify the good relationship with Moldova. The Netherlands supports Moldova’s EU candidate membership and has good ties with the pro-European Moldovan government. Also, the war in their neighboring country of Ukraine leads the Netherlands to want to be present with a stronger representation. By the way in the past Moldova belonged to the Dutch Embassy in Kiev.This means that there will be an ambassador and more people working there.

An ambassador on the ground has better access to the government of Moldova and ensures that the Netherlands is better informed about developments in Moldova and the spillover effects of the war in Ukraine.Also, an ambassador can help better represent Dutch interests in Moldova and support the Moldovan government with the reform agenda. This upgrading will take effect once an ambassador is appointed. The Netherlands looks forward to continuing and strengthening the excellent cooperation with Moldova in the coming years.

Environment and climate sector

The uncertain future of Romania’s forests

The DRN has been campaigning against illegal deforestation in Romania since its inception, and despite efforts by the various Romanian governments, illegal deforestation continues. It has even become a significant economic factor, with CO2 emissions also playing an important role.

In large parts of the Carpathians, soil erosion may be observed, causing flooding in wet periods or desertification in some southern parts.

Less than 2% of the European landmass is still in its original state: untouched by human activity. It is not only tropical forests that are cut down or burned for human consumption. The same is happening at an alarming rate to the last primeval forests and adjacent forest areas in Central and Eastern Europe concentrated mainly in the Romanian Carpathians. Corruption, organized crime behind the destruction of forests, and the billion-dollar industry that profits from illegal logging provide the framework for large timber companies to increase their profits.

On July 9, a summit was held in Iasi where several organizations expressed their concerns about the ongoing deforestation and where pressure from the European Commission also played a role. Notable was the statement of Austrian MEP Thomas Waitz who spoke about the Romanian logging mafia, but apparently knowingly forgot to mention Austria’s role. He probably doesn’t know the distinction between cause and effect! Because it is precisely Austria that is the major contributor to illegal logging and could rather be accused of mafia-like practices. A reference to Austrian companies including the infamous Schweighofer(now changing its name to HS Timber Group. They have since lost their FSC registration. Kronospan and Egger.

On July 9, a summit was held in Iasi where several organizations expressed their concerns about the ongoing deforestation and where pressure from the European Commission also played a role. Notable was the statement of Austrian MEP Thomas Waitz who spoke about the Romanian logging mafia, but apparently knowingly forgot to mention Austria’s role. He probably doesn’t know the distinction between cause and effect! Because it is precisely Austria that is the major contributor to illegal logging and could rather be accused of mafia-like practices. A reference to Austrian companies including the infamous Schweighofer(now changing its name to HS Timber Group. They have since lost their FSC registration. Kronospan and Egger.  The latter two are wood processing companies that assemble and transport IKEA furniture throughout Europe. Ikea itself owns forests and is the largest private forest owner in Romania(33,000 hectares of forest). It is worth mentioning that the previously mentioned company Kronospan from Sebeș formaldehyde with which it glues chipboard. The World Health Organization the gas as carcinogenic above a certain concentration.

The latter two are wood processing companies that assemble and transport IKEA furniture throughout Europe. Ikea itself owns forests and is the largest private forest owner in Romania(33,000 hectares of forest). It is worth mentioning that the previously mentioned company Kronospan from Sebeș formaldehyde with which it glues chipboard. The World Health Organization the gas as carcinogenic above a certain concentration.

We do have to contradict that the Romanian government does not recognize the problem, because recently in the port of Constanta the customs seized timber worth 800,000, a cargo of Holzindustrie Schweighofer, destined for export to Japan, Saudi Arabia and Kuwait. Schweighofer exports the rest of the Romanian wood, in the form of pellets for biofuels, to 21 European Union member states, including Belgium. Especially stores in Austria, Slovenia, Bulgaria, the Czech Republic and Italy are among their largest customers. Also, Romsilva the Romanian equivalent of the State Forestry Administration plays a role in illegal deforestation. The director of Romsilva informed that he recorded 16 cases of aggression against forest guards in 2019. Since 2014, six Romanian foresters have been killed and 184 attacked.

We do have to contradict that the Romanian government does not recognize the problem, because recently in the port of Constanta the customs seized timber worth 800,000, a cargo of Holzindustrie Schweighofer, destined for export to Japan, Saudi Arabia and Kuwait. Schweighofer exports the rest of the Romanian wood, in the form of pellets for biofuels, to 21 European Union member states, including Belgium. Especially stores in Austria, Slovenia, Bulgaria, the Czech Republic and Italy are among their largest customers. Also, Romsilva the Romanian equivalent of the State Forestry Administration plays a role in illegal deforestation. The director of Romsilva informed that he recorded 16 cases of aggression against forest guards in 2019. Since 2014, six Romanian foresters have been killed and 184 attacked.

This, of course, does not help: The stories about the so-called illegal logging in Romania are not true, said the Minister of Environment, Water and Forests, Barna Tanczos, during the debate on a simple motion against him in the Chamber of Deputies. He argued that no one could show him a case of illegal massive deforestation that took place in 2021 or 2022, Agerpres said.

Furthermore, the minister underlined that “although there is illegal logging in Romania, I can state that it is not the kind of deforestation that is being discussed at the European level.” However, no insight was given into issued permits, which means there is window dressing or a way to circumvent or invalidate the accusations. However, several research and investigation projects conducted by the local publication Recorder.ro show the enormous scale of illegal logging in Romania over the past 30 years. As a constant phenomenon in Romania, illegal logging over the past three decades is estimated at 270 million cubic meters.

See also https://www.youtube.com/watch?v=_TOlDtgg0bE

Following a series of complaints from environmental organizations, the European Commission initiated infringement proceedings against the Romanian state in 2020.

Because the Romanian state failed to act, the European Commission issued a reasoned opinion later that same year – a final call for the Romanian state to address the problem. This was accompanied by a warning to send the case to the Court of Justice of the European Union (ECJ) if Romania does not take immediate action within four weeks. However, as the new report clearly shows, almost two years have passed and Romania has still not met the Commission’s requirement.

Real Estate Sector

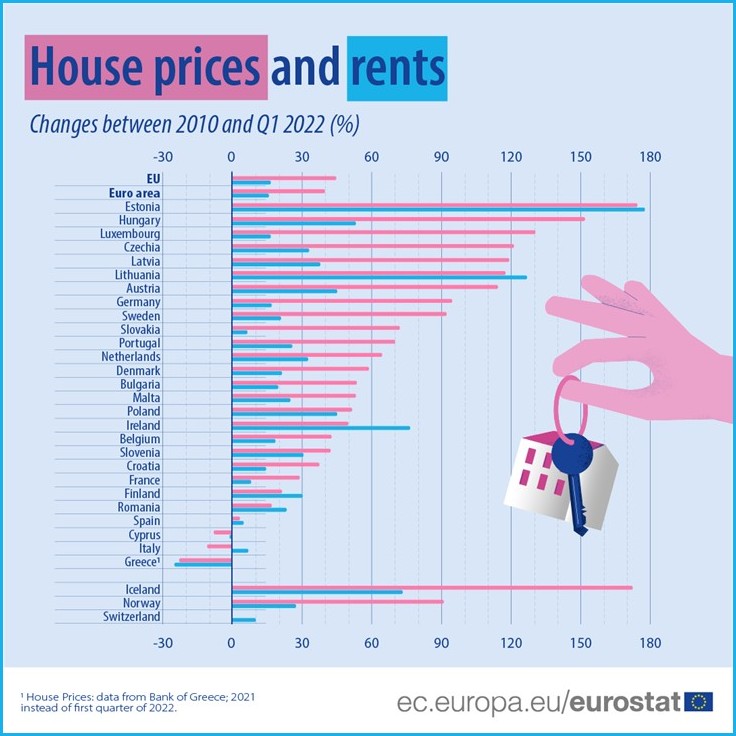

Eurostat: Since 2010, rental prices in the EU have increased by 17% and owner-occupied housing by 45%

What about Romania?

Rents and house prices in the European Union (EU) continued to rise steadily in the first quarter of 2022, by 1.4% and 10.5% respectively compared to the first quarter of 2021, according to the latest Eurostat survey.

Between 2010 and the second quarter of 2011, house prices and rents in the EU followed similar paths, but since the second quarter of 2011 those paths have diverged significantly. While rents rose steadily in the period up to the first quarter of 2022, house prices fluctuated significantly.

After falling sharply between the second quarter of 2011 and the first quarter of 2013, house prices remained more or less stable between 2013 and 2014. Then there was a rapid rise in early 2015, when house prices rose much faster than rents.

After falling sharply between the second quarter of 2011 and the first quarter of 2013, house prices remained more or less stable between 2013 and 2014. Then there was a rapid rise in early 2015, when house prices rose much faster than rents.

Over the period 2010 to the first quarter of 2022, rents increased by 17% and house prices by 45%.Since 2010, house prices have more than doubled in Estonia, Hungary, Luxembourg, the Czech Republic, Latvia, Lithuania and Austria

Comparing the first quarter of 2022 with 2010, house prices rose more than rents in 19 EU member states.

House prices rose in 24 EU member states and fell in three, with the highest increases in Estonia (+174%), Hungary (+152%) and Luxembourg (+131%). Declines were observed in Greece (-23%, ), Italy (-10%) and Cyprus (-8%). In Romania, the increase was over 10%.

Comparing the first quarter of 2022 with 2010 for rents, prices increased in 25 EU member states and decreased in two, with the highest increases in Estonia (+177%), Lithuania (+127%) and Ireland (+77%). Declines were recorded in Greece (-25%) and Cyprus (-1%). In Romania, there was an increase of over 20%.

Sector Investment Climate

The number of newly created foreign capital companies in Romania increased by 35%

The data centralized by the National Office of the Trade Register (ONRC) shows that the number of companies with new foreign capital established in Romania increased by 35.1% in the first five months of 2022 compared to the similar period of 2021 to 2,838 units .

The 2,838 new companies had an issued share capital totaling $17,231 million, 20.2% lower than that of companies registered in January-May 2021, of $21,595 million.

As of May 2022, 652 companies with foreign equity participation had been registered. Depending on the overall sector classification, most registrations were recorded in professional, administrative, scientific and technical activities (23.16%), wholesale and retail trade, auto and motor repair (22.7% of the total) and transportation, storage and communication (16.87%).

At the end of May 2022, there were 239,685 companies in Romania with a foreign shareholding. The value of the issued capital was $66.424 billion.

The largest number of companies with foreign participation was among investors from Italy, 51,060 respectively (issued capital of $3.974 billion), but the highest value of share capital was from Dutch companies, $12.357 billion respectively, in 5,769 companies.

Sector Logistics and Transport

H.Essers’ view on rising energy and commodity prices

As previously discussed by Transport COO Christopher Van den Daele, our industry faces another challenging period. While the global economy is picking up, it is certainly not going smoothly. The impact of the Covid-19 pandemic on supply chains is far from over.  Commodity shortages and the war in Ukraine are causing great macroeconomic instability in the market, resulting in a huge increase in energy prices. Transport COO Christopher van den Daele and Warehousing COO Carlo Theunissen are happy to elaborate on this and explain how H.Essers deals with it.

Commodity shortages and the war in Ukraine are causing great macroeconomic instability in the market, resulting in a huge increase in energy prices. Transport COO Christopher van den Daele and Warehousing COO Carlo Theunissen are happy to elaborate on this and explain how H.Essers deals with it.

“The huge increase in energy prices we’re seeing now translates into other costs as well,” Christopher says. ‘One example: road and rail transport has become more expensive due to direct energy consumption and associated price increases, such as the raw materials required to make new containers, trailers, etc. Some energy prices increased by as much as 70% and material costs by as much as 25%. That applies to everything, including our warehouses,” he concludes.

‘Our warehouses are also seeing a huge increase in both gas and electricity costs, despite them being relatively stable in the past,’ Carlo adds. ‘That means agreeing new pricing systems with our customers. The labor market is still extremely tight and sharp price increases are being applied in all aspects of construction, rolling stock, packaging materials and so on.’

The impact is unprecedented. ‘In Romania, for example, more than 5,000 out of 180,000 tractors were issued in the first quarter,’ Christopher says. ‘In the same period, more than 200 transport companies went bankrupt in Belgium.

Although these are often smaller companies, the numbers are alarming. Moreover, the loss of these players puts further pressure on the current staffing shortage. Add to that the implementation of the mobility package. This impact of the Return Home Vehicle and the adjusted remuneration model for Eastern European capacity is causing both direct and indirect price increases.’

Continuous investment

‘Doing nothing and waiting makes no sense,’ says Christopher. ‘After all, no one can say for sure how prices will develop in the coming period. So we are forced to shift up a gear and go along with the increases.

Although the diesel clauses in our contracts provided for an increase, the clause now seems outdated. And we are forced to sit down with our customers to reassess the impact on transportation rates and modified energy clauses,’ he concludes.’It is imperative to discuss rising direct costs with our customers in order to  keep our operations financially sound,” adds Carlo. ‘We are still incurring a lot of additional costs to achieve our growth in the current labor market. Just think of the recruiting efforts and training required to do so,” he continued. “At the same time, as an asset-based company, we continue to invest in our own fleet and warehouses to give our customers the capacity guarantee they need, and we are constantly thinking about ways to consolidate loads and optimize synchromodal routes to reduce the impact on our customers. In addition, we are focusing even more on renewable energy to ensure that we are even better prepared for these market fluctuations in the future.In Romania, H.Essers has sites in Bolotin-Deal, Roman, Curtici, Oradea and Bucharest.

keep our operations financially sound,” adds Carlo. ‘We are still incurring a lot of additional costs to achieve our growth in the current labor market. Just think of the recruiting efforts and training required to do so,” he continued. “At the same time, as an asset-based company, we continue to invest in our own fleet and warehouses to give our customers the capacity guarantee they need, and we are constantly thinking about ways to consolidate loads and optimize synchromodal routes to reduce the impact on our customers. In addition, we are focusing even more on renewable energy to ensure that we are even better prepared for these market fluctuations in the future.In Romania, H.Essers has sites in Bolotin-Deal, Roman, Curtici, Oradea and Bucharest.

For further information see newsletter HEssentials, email gert.bervoets.essers@essers.com

Maersk: The rise in shipping costs will not slow down in the short term

AP Moller Maersk A/S, the world’s largest shipping company, warned that since the start of the pandemic, shipping costs have risen by 25-30% due to inflationary pressures, and says it is unlikely that this increase will abate over time. short term, reports Reuters.

Maersk is considered an indicator of world trade because it transports goods to major retailers and companies, from Walmart to Nike to Unilever.

Maersk is considered an indicator of world trade because it transports goods to major retailers and companies, from Walmart to Nike to Unilever.

Higher supply chain costs have impacted retail and packaged goods since the beginning of the pandemic, especially in the last year as economies began to recover, with frequent congestion at major ports where containers of products are unloaded.

“I think we will face higher inflation in the coming years. Logistics requires a lot of energy and manpower, and these are two segments of the economy that are facing significant inflationary pressures,” Vincent Clerc, managing director at Maersk, said in an interview at a conference in Dublin.

Although congestion is less pronounced in some parts of the world, it becomes more pronounced in others, such as the east coast of the United States and northern Europe, Clerc added.

“We’re talking about the availability of truck drivers, the available capacity to move goods over land infrastructure.” Since the onset of “trade tensions” with China, international companies have increasingly reduced their share of the materials and goods they export from the country, hoping to diversify their operations, the Maersk official said.

He concluded, “We are definitely seeing a trend toward diversification of distribution and a decrease in reliance on one or two specific areas.”

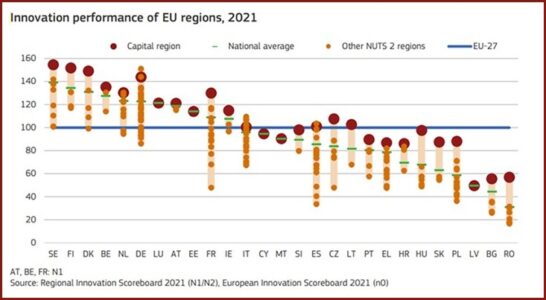

ICT Sector

EU report: Dutch aged 65-74 have better digital knowledge than Romanians aged 25-34

In an increasingly digitized world, new types of jobs are emerging and routine jobs are beginning to disappear. Digital skills are thereby essential to enable people to participate in the labor market, in the economy and in society. However, Romania has been in last place in the European Union for years in terms of basic digital skills. Moreover, a new EU report shows that Dutch people in the 65-74 age group have better digital knowledge than people in the 25-34 age group in Romania, Bulgaria and Italy.

“It is important that digital skills are not only used in the ICT sectors, but are increasingly needed in different professions, and that all citizens need at least basic digital skills to participate in society. Digital technologies can also be used to drive the green transition, for example, to digitize energy systems, to implement sustainable mobility solutions in urban and rural areas, and to promote participatory approaches to engage people in shaping the transition . Innovation Performance Report , which analyzes the EU’s innovation performance in a global context.

“It is important that digital skills are not only used in the ICT sectors, but are increasingly needed in different professions, and that all citizens need at least basic digital skills to participate in society. Digital technologies can also be used to drive the green transition, for example, to digitize energy systems, to implement sustainable mobility solutions in urban and rural areas, and to promote participatory approaches to engage people in shaping the transition . Innovation Performance Report , which analyzes the EU’s innovation performance in a global context.

On average, only 56% of the EU population aged 16-74 had at least a basic level of digital skills in 2019 (see Figure 4.3-9), up from only 54% in 2015.

Skill levels vary by gender, age, skill level, and professional status: of women, 54% have at least basic skills, compared to 58% of men. Among young people (25-34 years old), 74% have at least basic skills, compared to only 24% for older people (65-74 years old)

Among the low-skilled, only 32% have at least basic digital skills, compared to 54% of those with average skills and up to 84% with tertiary skills. Among the unemployed, only 44% of them in the European Union have at least basic digital skills.

The countries of Northern Europe top the ranking, with very high levels of overall use of digital technologies and software programming skills. “In 2019, the proportion of adults with a basic level of digital knowledge ranged from 79% in the Netherlands to 29% in Bulgaria. Even among young people, the difference remains large: in the Netherlands, 89% of people between 25 and 34 have at least basic digital skills, compared to 44% in Bulgaria. In addition, Dutch people in the 65-74 age group have better digital knowledge than people in the 25-34 age group in Romania, Bulgaria and Italy.” , the report also shows.

People living in cities have higher levels of digital literacy than those living in small towns, suburbs and rural areas.

Of those living in EU cities, 37% have digital skills above the basic level. The proportion is lower for those living in smaller cities and suburbs (29%) and for those living in rural areas (24%).

“In some countries, such as Bulgaria and Romania, the differences between rural and urban areas are particularly pronounced , while in others the differences are much smaller. In Belgium, people in rural areas are better equipped with digital skills than people in urban areas. (…) These geographic inequalities must be addressed by policymakers to promote favorable increases in inclusion and social resilience,” the cited paper also states.

Given the growing importance of digital skills in the workplace, more and more companies are training their staff in ICT skills. Between 2012 and 2019, the percentage of EU companies that provided ICT training to their employees increased by 5 percentage points, from 18% to 23%, representing a growth rate of 28%.

The country that has trained its employees the most of the countries analyzed is Norway, where about 44% of companies provided ICT training, followed by Finland, Belgium, Austria and the United Kingdom. According to the report, Romania was the country least involved in providing vocational training. Only 6% of companies have updated employees’ ICT skills.

The rise of ICT has not only required retraining of workers, but has also changed the tasks they perform and the number of people who handle computers and software. In the EU, 8% of people say they have changed jobs because of new software or equipment. This statistic is very high in countries like Iceland (22%), Norway (21%), the Netherlands (15%), Denmark (16%) and Finland (13%), while it is very low in countries like Romania (3%) , Bulgaria (3%) and Greece (3%).

“In the digital economy, technical and digital skills increasingly need to be complemented by social and communication skills and the ability to adapt to changing circumstances. Formal and non-formal education and training programs must respond to the needs of the digital age, taking into account the complementarity between technical and social skills. The stronger the core competencies that individuals have, the easier it will be for them to improve and retrain and adapt to changing labor market conditions,” EU officials said in the report.But even when it comes to very basic digital skills, the skills gap remains: 44% of EU adults do not have even the most basic digital skills. Unfortunately, the countries with the largest skills gaps tend to also be those with the lowest adult participation in learning. Only 1% of Romania’s adult population is involved in various forms of learning.

“This is likely to perpetuate and exacerbate existing inequalities and risks that worsen social cohesion in the EU. Political decision-makers must step up their efforts to address these gaps, with broad support from the EU, and to address inequalities across age groups, countries and regions, in order to successfully build a resilient, competitive society. fair European competitive and equitable,” the study also states.

In terms of contribution to GDP, the EU countries with a high share of ICT were Malta (7.5%), Luxembourg (7%) and Sweden (6.3%). Eastern European countries, such as Romania, Hungary and Latvia, also reported a large contribution of the ICT sector to their GDP, with a share of about 5%.

The ICT sector in the EU employed more than 6 million people by 2020, continuing the upward trend that began in the 2000s. The ICT services subsector (excluding telecommunications) accounted for the largest share of ICT employment in 2020, at about 4 million. 7 million employees.

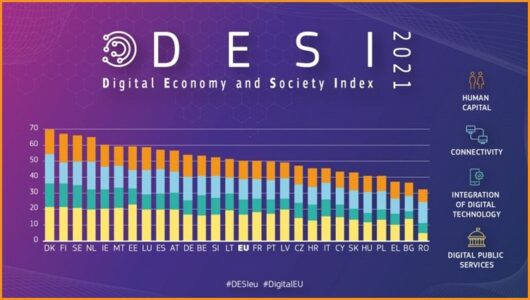

Why digitization can be an important part of a country’s economic recovery

It is no longer a secret that digitalization should be one of the main objectives of a country and one of the main components of the strategy for economic recovery, after 2 and a half years characterized by crises. The progress of the digitization process and the various indicators of EU Member States’ digital performance are assessed at the European level by the Digital Economy and Society Index (DESI) conducted by the European Commission. The DESI index focuses on five dimensions, including the degree of integration of digital technology in business.

DESI rankings for 2021Photo: European Commission

Romania ranks 27th out of 27 EU member states in the 2021 edition of the Digital Economy and Society Index (DESI), published by the European Commission. One of the aspects mentioned in the report is that “Romanian companies do not fully benefit from digital technologies (electronic information exchange, social communication platforms, big data and cloud), except artificial intelligence. In terms of digital public services, Romania ranks last in terms of key indicators, such as digital public services for citizens and businesses, users of e-government services and pre-filled forms ”

Electronic signature and the European legal framework

One of the digital technologies that can be easily integrated into daily business operations is the electronic signature, especially since its use as a tool that promotes digital transformation is included in Romania’s Resilience and Economic Recovery Plan, which includes measures that are fully or partially related to digital competencies or the realization of major government digitization projects, the implementation of which would contribute to a stable improvement in Romania’s performance in all dimensions of DESI.

Electronic signatures are regulated at EU level by Regulation No 910/2014 (eIDAS Regulation) . Thus, unlike an EU directive, which must be transposed by law in each country, a regulation, the eIDAS regulation is also directly applicable to all member states and does not need to be transposed into national law. However, each country must define some elements at the national level:

- Regulatory bodies responsible for monitoring trusted service providers and publishing secure lists of qualified trusted service providers;

- How to identify the individuals to whom qualified digital certificates are issued;

- Penalties for violating the eIDAS regulation.

But why is eIDAS important?

For the creation of the European internal market and because eIDAS clearly establishes in practice that the qualified electronic signature is the only one that has the legal effect of the handwritten signature.

For the creation of the European internal market and because eIDAS clearly establishes in practice that the qualified electronic signature is the only one that has the legal effect of the handwritten signature.

eIDAS aims to provide an interoperability framework and comparable conditions for the provision of services in all EU Member States. The most commonly used service is the issuance of qualified certificates to create a qualified electronic signature. In practice, eIDAS clearly establishes that the qualified electronic signature is the only one that has the legal effect of the handwritten signature and implements, through secure lists, a centralized mechanism by which each qualified signature can be automatically validated.

Automotive Sector

Dacia keeps Renault group’s decline in Europe under control and becomes the volume brand with the biggest increase

In a sharply shrinking car market, the only major group that has reported growth is Hyundai – Kia, while Dacia is aiming higher and higher.

In a sharply shrinking car market, the only major group that has reported growth is Hyundai – Kia, while Dacia is aiming higher and higher.

The Association of European Automobile Manufacturers (ACEA) report on new car registrations in Europe in the first half of 2022 shows a sharp decline , down 13.7% to 5,597,656 units.

Surprising to many, but quite logical in difficult times when those who buy cars and don’t want to spend much, the Dacia brand goes against the grain and reports an 18.2% increase to 226,160 units.

This rise of the Romanian brand in the Renault group not only boosts its market share, which thus rises from 2.9% last year to 4% by 2022, but is the largest of any volume brand.

Despite Dacia’s growth, the Renault group continues to experience difficult times. ACEA data for the period January – June 2022 shows total registrations at 522,315 units, a 7% decrease.

Renault Group sales fell by just 8.1% in the first half of the year, thanks to a 16% increase in Dacia car sales, with 210,526 units registered in Europe in the first six months of the year

Aviation Sector

New Romanian airline launched

At a time when the airline industry is in a state of flux around the world, some of which are having to downsize, they have dared to set up a new airline under the name AirConnect. In addition to the existing Romanian airlines Tarom and Blue Air, it is believed that regional flights may be considered a niche in the market. The focus is on charter flights in the tourism sector. In this context, charter flights to Greece, Bulgaria, Turkey and Egypt will start this month.

The flights will be operated ATR 72-600 aircraft, with a configuration of 68 seats. It is a so-called twin-engine turboprop passenger aircraft.

The company has already signed contracts with tour operators such as Carpathian Turism, Dertour, Cocktail Holidays and AeroVacanțe.

The company’s fleet will be expanded with another ATR 72-600 in August 2022 and two more aircraft next year. In the fall, AirConnect will launch domestic flights, connecting regional airports with nearby hubs. The first cities in Romania are Bucharest, Oradea, Arad, Timisoara, Craiova, Targu Mures, Sibiu and Baia Mare.

AirConnect’s founders relied on ATR 72-600 aircraft because they are the most efficient regional solution in terms of fuel consumption, due to their lightweight structure, optimized speed and engine designed for short sectors. These features lead to lower operating costs, but also to lower CO2 emissions. The aircraft offers passengers optimum comfort, with low noise levels inside, a pleasant flight pressure and a width of almost 50 cm between the armrests. AirConnect’s executive management consists of Dorin Ivașcu, Chairman of the Board of Directors, Tudor Constantinescu, General Manager and Florin Necula, Operations Manager.

About the company

AirConnect is a Romanian airline, founded in 2022, with the aim of operating domestic flights and charter flights. Flora AirConnect will include two ATR 72-600 aircraft in the first year of activity and four by 2023. The company aims to become the market leader in the regional flights segment.

Agri & Food sector

Romanian pig farmers have been making no profit for a year and a half and slaughtering is at an all-time low due to African Swine Fever

The price of pork at the gate of Romanian farms has reached a record high, more than 31% higher than in the same period last year. Yet farmers who do not have integrated production systems cannot cover their costs, which have increased by more than 40%. In addition, as a result of African swine fever affecting the sector since 2017, a minimum threshold for weekly slaughter has been reached, falling by more than 30%. Some small farmers have already closed their businesses or are operating as service providers for older players, and imports continue to grow, with statistics already reporting a 22% increase in the first quarter of the year compared to the same period last year.

The price of pork at the gate of Romanian farms has reached a record high, more than 31% higher than in the same period last year. Yet farmers who do not have integrated production systems cannot cover their costs, which have increased by more than 40%. In addition, as a result of African swine fever affecting the sector since 2017, a minimum threshold for weekly slaughter has been reached, falling by more than 30%. Some small farmers have already closed their businesses or are operating as service providers for older players, and imports continue to grow, with statistics already reporting a 22% increase in the first quarter of the year compared to the same period last year.

“We don’t have more than 14-16 months in Romania,” Ioan Ladoși, president of the Association of Romanian Pork Producers (APCPR), describes the situation of Romanian pig farmers, who are experiencing both the effects of the war in Ukraine and African swine fever that has decimated herds since 2017.

Over the past year, the cost of fattening pigs (grains, energy, piglets, labor) has increased by more than 40%, an increase that farmers have not been able to incorporate into the final price. According to the latest data from the European Commission, in the week since June 13, 100 kilograms of type S pig carcasses cost an average of 206.7 euros at the farm, 11% more than a week ago, 21, 6% more than the previous month and 31.7% above the level reported in the same period last year. It is a maximum this year, since in January the 100 kilogram carcass cost 144.7 euros. “I do not know how and if these losses will be made up. The manufacturer cannot increase the price overnight, because we are part of a global market that we have to take into account. (…) Europe still has overproduction of pork, and imports from China (from the EU ed.) have fallen by more than 50%, so processors can always tell Romanian breeders that they don’t like the price and that they are cheaper to import,” explains Ladoși.

Romania does not have the highest prices at the farm, but the average of 206 euros is above the European, of 196 euros 100 kilograms carcass type S. In Hungary, for example, the average price is 185 euros 100 kilograms, in Germany it reaches 191.70, while in Poland farmers sell 100 kilograms for 189 euros. The most expensive is in Estonia – 231.7 euros 100 kilograms.

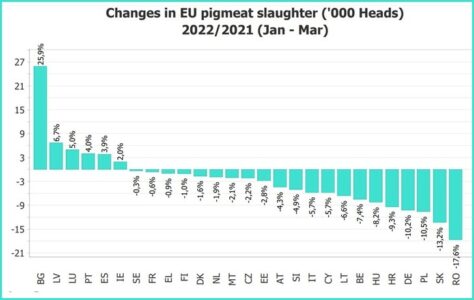

20% higher imports in the first quarter of the year. Negative record for slaughter. Imports can also be justified by the fact that there are cheaper goods on the European market, but mainly because domestic production only covers about 20% of consumption needs. Between January and March 2022, Romania reported the largest decline in slaughtering (minus 17.6%) in the EU.

“The year 2021 was the most disastrous for commercial farms from the perspective of African swine fever. 30 of the more than 200 farms were affected, resulting in the liquidation of livestock. They were breeding farms, which brought the whole flow to a standstill, affecting this year’s production. Now 30-40% less is sacrificed every week than last year, which means we have a negative record in terms of weekly slaughter,” says Ladoși.

The situation is already reflected in the imports.

According to data from the National Institute of Statistics, Romania imported pork worth 148.9 million euros in the first three months of the year, 22.3% more than in the same period last year.

According to Ladoși, the small ones are the most affected breeders, with a capacity of about 2,000 seats and productions of 4-5,000 pigs per year. Generally, they do not have integrated production upstream (grain production) or downstream (processing, distribution), which means they cannot afford to lower their costs or balance their supply.

According to the president’s estimates, only about 40% of APCRP member companies have some degree of integration.

“Small farms have been decapitated. The big problem is that many of them were built or refurbished with European funds and still have to pay instalments (to banks – n.ed). So some owners either sold to bigger producers, rented the space or started providing services for other companies (space rental, labor – n.ed.) “, the manager explains.

Energy Sector

Photon Energy Dutchmen build new solar power plant in Romania

Photon Energy Group, a renewable energy company registered in the Netherlands, has begun construction of a new photovoltaic plant in Romania, with a capacity of 4.7 MW and an estimated annual production of 6.8 GWh. The plant, located near Aiud, in Alba County, will occupy 6.6 acres of undeveloped land and will be equipped with approximately 8,700 solar panels. It is the second power plant built by Photon Energy in Romania. Last month, the company launched the construction of a 5.7 MW photovoltaic plant near the municipality of Șiria, in Arad province, with plans to build plants with a total capacity of about 32 MW by the end of the year.

The new plant will be owned and operated by Holloway Solar SRL, a special purpose company wholly owned by Photon Energy. The plant is scheduled to become operational in the last quarter of the year. “The Aiud plant marks another important step in our efforts to commission a total capacity of about 32 MWp in Romania by the end of 2022. Only these new assets will expand our portfolio as a PPI (independent power producer) to more than 120 MWp by the end of the year,” the company said. Photon Energy, founded in 2008 by entrepreneurs Georg Hotar and Michael Gartner, entered the Romanian market in 2015, when it signed maintenance contracts for three solar power plants in the northwest of the country, with a total capacity of 11 MW.

Based in Amsterdam and listed on the Warsaw, Prague and Frankfurt stock exchanges, the company is controlled by the two founders, with a cumulative stake of approximately 71%. Photon Energy’s portfolio includes photovoltaic plants built with a combined capacity of nearly 92 MW in Australia, the Czech Republic, Hungary and Slovakia, as well as developing projects with additional capacity of more than 790 MW in Australia, Hungary, Poland and Romania. The Dutch company recently raised 10 million euros from the sale of bonds to finance the expansion of its portfolio.

Currently, the company is developing photovoltaic projects in Romania with a total capacity of 236 MW, of which 115 MW are at an advanced stage of development. “The remaining development projects in Romania are expected to be built and commissioned in 2023 and 2024, and therefore the Romanian market will contribute significantly to the company’s goal of expanding its IPP (independent power producer) portfolio by at least. 600 MWp worldwide by the end of 2024,” the company said.

Currently, the company is developing photovoltaic projects in Romania with a total capacity of 236 MW, of which 115 MW are at an advanced stage of development. “The remaining development projects in Romania are expected to be built and commissioned in 2023 and 2024, and therefore the Romanian market will contribute significantly to the company’s goal of expanding its IPP (independent power producer) portfolio by at least. 600 MWp worldwide by the end of 2024,” the company said.

Furthermore, Photon Water offers water treatment and management solutions that ensure that clean water is accessible in any environment. Photon Water’s services include well and other resource management and utilize state-of-the-art technology, including a unique nanosanitation solution to combat the growing problem of PFAS contamination in groundwater.

For more information see:

www.photonenergy.com

Water Sector

How is Romania in the area of public utilities? Places without sewage and drinking water

Romania is not doing very well in terms of public services, especially in rural areas, in a context where only a third of municipalities have sewers. The drinking water distribution network expanded nationwide in 2017 compared to 2016, mainly due to the expansion of the central supply system in rural areas by some 1,800 kilometers, according to a report by the National Institute of Statistics (INS).

Wastewater

Last year, of the 320 cities and towns in Romania, 314 had sewers and of the 2,861small municipalities(approx.2,000 inhabitants), only 937 had sewers. “In 2017, the activity of wastewater discharge from households and economic and social units took place in 314 municipalities and cities and in 937 in small municipalities,” the INS report shows.

Last year, of the 320 cities and towns in Romania, 314 had sewers and of the 2,861small municipalities(approx.2,000 inhabitants), only 937 had sewers. “In 2017, the activity of wastewater discharge from households and economic and social units took place in 314 municipalities and cities and in 937 in small municipalities,” the INS report shows.

According to the INS, the Romanian population connected to sewerage systems accounted for more than half of the resident population in 2017, while residents connected to sewers with sewage treatment plants accounted for 49.4% of the total resident population.Thus, 9.98 million residents had their homes connected to sewers, representing 50.8% of the Romanian population, with 276,147 more people than in 2016.

At the level of developing regions, the largest proportion of the population connected to sewers, in the total population, was recorded in the Bucharest-Ilfov region (84.4%), followed by the Centre (62.9%) and West (57.8% ) regions. The lowest degree of connection to sewerage was recorded in South Muntenia (35.0%), North East (35.4%) and North West (50.2%).

In other words, according to the statistics, in 2017 in the urban area the population connected to sewerage was 9.2 million people, representing 87.7% of the urban population of Romania, and in the rural area about 745,000 people benefited from sewerage services , representing 8.2% of the Romanian rural population.

Drinking Water

At the end of last year, the length of the drinking water distribution network was 82,000 km, in the country more than 2,400 km longer than in the situation at the end of 2016.

The rural drinking water distribution network expanded in 2017 compared to 2016, mainly due to the expansion of the central supply in rural areas by about 1,800 kilometers.In municipalities and cities, the proportion of street lengths with drinking water distribution networks compared to the total length of streets was about 80% at the end of 2017.

Is Romania out of the picture?

The Dutch water sector with its many specialties has built an excellent reputation in Romania and was involved in many diverse projects. While there are numerous opportunities for water sector entrepreneurs, the sector is remarkably quiet. Perhaps a wake-up call is necessary for the various organizations, such as the Netherlands Water Partnership, Foundation Dutch Water Sector or companies such as Nijhuis Saur Industries and others?

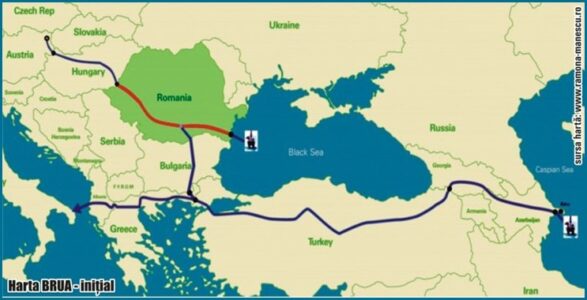

Gas interconnetor between Bulgaria and Greece operational and connection BRUA pipeline(Bulgaria, Romania, Hungary and Austria)optional.

It concerns gas imports from Azerbaijan(Caspian Sea).

The construction of this 182-kilometer pipeline was supposed to be completed in April 2021, but in the meantime, due to the pandemic and technical problems, the deadline has been extended to December 31, 2021. Subsequently, the company responsible for this project granted the Greek contractor another six months’ extension, until June 2022.

At a conference in Athens on Greek Energy Minister Kostas Skrekas said construction work had been completed and that he would travel to Komotini on Friday to inaugurate the project with Greek Prime Minister Kyriakos Mitsotakis.

The Bulgaria-Greece gas interconnector project is overseen by ICGB, which is 50% owned by Bulgarian energy company BEH, and the rest of the shares are held by Greek company DEPA and Italian group Edison.

With an initial capacity of three billion cubic meters per year, the Bulgaria-Greece gas interconnector is an important part of European plans to reduce dependence on Russian natural gas. The IGB pipeline would be connected to the Trans Adriatic Pipeline (TAP), the terminus of the Southern Gas Corridor, a $40 billion project covering 3,500 kilometers and connecting the Shah field. Deniz II of the Caspian Sea and Italy, passing through Georgia, Turkey, Greece, Albania and the Adriatic Sea.

In addition to the gas interconnector, the authorities of Athens and Sofia are currently building a floating liquefied gas terminal in Alexandroupolis, in northeastern Greece. The U.S.-backed project is intended to increase diversification of energy supplies in Southeastern Europe, a region largely dependent on Russian natural gas.

The future floating terminal would allow for the transit of 5.5 billion cubic meters of natural gas per year. From Alexandroupolis, the new gas interconnector allowed natural gas to be transported to Central Europe via Bulgaria.

A project desired by Romania

Romanian officials over time have expressed their desire that this project, which is very late, can be completed, because it could give us a diversification of gas sources. In this regard, Romanian Energy Minister Virgil Popescu had talks with officials from Azerbaijan, one of the largest gas producers in the Caspian region.

“The gas from Azerbaijan is one of the possible solutions for us, we hope to reach an agreement with the Azerbaijani government. If possible, we want to import all the gas we need from Azerbaijan. We are in negotiations and when we are ready, we will announce it. But we are on the right track,” Virgil Popescu said recently in an interview for the Azerbaijani press.

The minister spoke about the different ways to access Azerbaijani gas.

“Two years ago, we thought we had no chance with energy sources other than Russia and developed the Transverse Balkan Corridor Flow Project, which was built to supply gas from Russia, Ukraine, Romania, Bulgaria and Turkey. Last year we completed the counterflow changes and now we have a corridor that can bring in and take out Romanian gas from Turkey, Bulgaria and Ukraine.

We can bring gas from Turkey, from Azerbaijan and from liquefied natural gas (LNG) terminals. So we have an inter-Balkan Corridor. The Vertical Corridor, which was due for completion six years ago, is expected to be completed this summer. The Greece-Bulgaria (IGB) interconnector, scheduled for completion in July, will give Romania access to the Trans-Anatolian Natural Gas Pipeline (TANAP), the Trans-Adriatic Pipeline (TAP). The BRUA pipeline (Bulgaria, Romania, Hungary and Austria) is another corridor that can bring gas from the Southern Gas Corridor, the Vertical Corridor to Romania, Moldova and the rest of Europe,” Popescu added.

Tax development VAT and bank guarantee

Romania violates EU law by not issuing VAT refund despite bank guarantee

The EU Court of Justice rules that Romania is in violation of EU law by providing less favorable procedural rules for VAT refund claims. For other levies, refunds are possible if a bank guarantee has been provided.

The EU Court of Justice rules that Romania is in violation of EU law by providing less favorable procedural rules for VAT refund claims. For other levies, refunds are possible if a bank guarantee has been provided.

Philips Orăştie SRL disagrees with a tax assessment in which the Romanian Tax Administration demands that Philips pay VAT and additional tax obligations. Philips therefore objects and submits a bank guarantee statement.  The Tax Office rejects the objection. Philips then argues that the Tax Procedure Code grants suspensive effect to the performance of tax obligations imposed in tax assessments that have been appealed and for which a bank guarantee statement has been submitted. Therefore, this rule should also apply when those payment obligations relate to a VAT post-payment. The Romanian court asks a preliminary question in this case.

The Tax Office rejects the objection. Philips then argues that the Tax Procedure Code grants suspensive effect to the performance of tax obligations imposed in tax assessments that have been appealed and for which a bank guarantee statement has been submitted. Therefore, this rule should also apply when those payment obligations relate to a VAT post-payment. The Romanian court asks a preliminary question in this case.

The Court of Justice of the EU rules that Romania is in violation of EU law by providing less favorable procedural rules for VAT refund claims based on violations of the common VAT system. More favorable rules apply to similar claims based on taxes and levies other than VAT. In fact, if a bank guarantee is provided, a refund can be obtained in such cases.

Sector Culture

From the Rhine to the Danube and back

With a certain poetic license, one would assume with this headline that it is about the long-held desire to connect the ports of Constanta and Rotterdam. However, it is Romanian autobiography of the well-known Jan Willem Bos translator and promoter of Romanian culture in the Netherlands.

With a certain poetic license, one would assume with this headline that it is about the long-held desire to connect the ports of Constanta and Rotterdam. However, it is Romanian autobiography of the well-known Jan Willem Bos translator and promoter of Romanian culture in the Netherlands.

He studied in Romania during the darkest era of the communist dictatorship, he knew many writers and cultural people, but also simple people from all walks of life, for whom he creates memorable portraits. He was pursued by the Securitate and compiled a dossier of several hundred pages. He had the time, with great subtlety, to fully learn the hidden faces of the Romanian language, which he speaks perfectly, without accent, with idiomatic expressions that not many Romanians know, so that no one would suspect that he is not a native speaker. This knowledge, as well as that of Romanian culture and civilization, was used in the translation work of many Romanian writers at prestigious Dutch publishing houses. The book reads like a novel in which dozens of characters live, speak and act with great naturalness, but also as testimony to a turbulent period in Romania’s history.

The final chapter places the two peoples, the Dutch and the Romanians, face to face, with their similarities and differences laced with great psychological finesse. An autobiography-romance essay in which Jan Willem Bos, his family and Romanian and Dutch friends appear before our eyes with great naturalness, convincing and truthful as in a genre painting by a Dutch master.”

Perhaps needless to say, it is only available in the Romanian language.

Maritime Sector

DRN endorses: Involve Dutch industry in procurement of new defense equipment

Dutch industry should be involved as much as possible in the procurement of new defense equipment, especially in (niche) areas where the Netherlands currently has a lot of high-quality knowledge and expertise. This is what NIDV, NMT and FME and VNO-NCW said in a joint appeal on June 24. In the current tender process for the new submarines, for example, there is no requirement for Dutch industry to be involved in the construction. This creates the risk that Dutch companies will soon be left out,’ said the four entrepreneurs’ organizations, which have asked politicians for guarantees in a letter.

Submarine maintenance

‘Submarines are very complex’ says Bas Ort, NMT chairman, ‘it is very difficult to be able to maintain and improve them if you have never been involved in their construction. The crucial knowledge and expertise of Dutch maritime companies must be retained for construction and maintenance. This can only be done by involving the Dutch industry in the order’. In addition, maintenance is not expected to take place until 2040. Dutch companies would have to hold on to their knowledge and skills until then without being able to use it immediately. For SMEs in particular, this is a major challenge.

Strategic autonomy and innovativeness

Furthermore, because of the disconnection, the foreign shipyard that eventually wins the tender actually no longer has any reason to involve Dutch industry in the high-tech systems in the submarine. ‘While a role in these systems is precisely essential for Dutch strategic autonomy and innovative strength. Innovation keeps our equipment modern and makes us an important partner for companies from EU and NATO countries’ says the FME chairman, Theo Henrar.

The Netherlands has expertise in house

The current Dutch Walrus-class submarines can sail much longer thanks to recent life-extending maintenance – carried out by the Dutch maritime manufacturing industry. ‘This shows the expertise that the Netherlands currently has’. Says Hans Hillen, NIDV president. United in the Dutch Underwater Knowledge Centre, the Dutch industry has also offered its expertise to the candidate yards’.

Importance of healthy defense sector

Defense, industry and knowledge institutions work together extensively and successfully in the Netherlands. This makes a major contribution to Dutch security and strategic autonomy. Ingrid Thijssen, VNO-NCW president: ‘The innovations that come out of this cooperation often have spill-over effects on the rest of the economy. In addition, the Netherlands has an enormous knowledge base in the maritime field that we must cherish and with which we can distinguish ourselves in the EU when building all the new defense capacity that is currently taking place.

The letter writers ask the House of Representatives to ensure the involvement of Dutch industry in the procurement and construction of equipment.

Click

here

to view this letter

Editorial Comment DRN Newsletter: In connection with the unstable situation in Europe in combination with the NATO membership that entails obligations it is desirable that the Dutch government takes a decision . All the arguments have been exchanged and to move on again is a lack of decisiveness with all the possible dangers that this entails.

Furthermore, we would like to refer to European regulations, where Article 346 of the Lisbon Treaty defines that it is permissible for military orders not to have to be tendered internationally.

Disclaimer

The newsletter of the Dutch Romanian Network is compiled with great care. The Dutch Romanian Network cannot accept any liability for a possible inaccuracy and/or incompleteness of the information provided herein, nor can any rights be derived from the content of the newsletter. The articles do not necessarily reflect the opinion of the board.